Table of Contents

- What is Nifty BeES?

- Key Features:

- Nifty BeES Share Price Target for 2025 and 2030

- Why Nifty BeES is a Timeless Investment Choice

- Nifty BeES vs Mutual Funds: A Timeless Comparison

- Timeless Investment Strategy: How to Maximise Returns with Nifty BeES

- FAQs: Timeless Insights

- Final Thoughts: Why Nifty BeES is a Timeless Investment Choice

Nifty BeES: A Timeless Guide to India’s Leading Index ETF

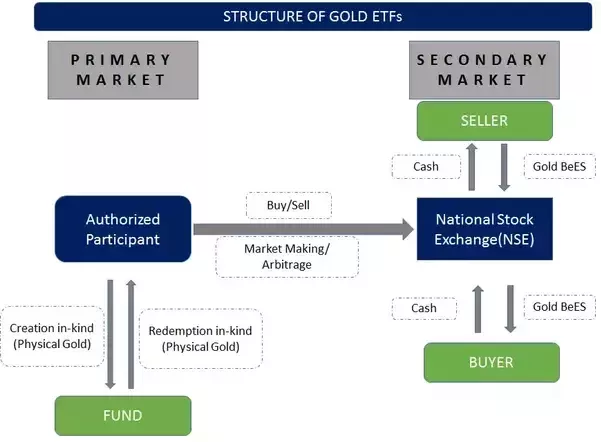

In the dynamic world of Investing, certain instruments stand the test of time. One such example is Nifty BeES, a low-cost, passive investment vehicle that tracks the Nifty 50 index, representing the 50 largest and most liquid stocks on the National Stock Exchange (NSE). Nifty BeES offers investors an easy, efficient, and cost-effective way to gain exposure to India’s top-performing companies. Whether you're just starting your investment journey or looking to diversify your Portfolio, Nifty BeES provides long-term growth potential with minimal effort.

What is Nifty BeES?

Nifty BeES (Benchmark Exchange Traded Scheme) is a type of Exchange Traded Fund (ETF). Launched in 2002 by Nippon India Mutual Fund (formerly Reliance Mutual Fund), it mirrors the performance of the Nifty 50 Index. With an expense ratio of just 0.05%, Nifty BeES is considered one of the most affordable ways to invest in the Indian stock Market.

Quick Insight: The term NSE NiftyBeES is commonly used to refer to this ETF being listed and traded on the NSE, providing liquidity and flexibility for investors.

Key Features:

- Passive Investment: Tracks Nifty 50 without active management.

- Liquidity: Traded like a stock, ensuring ease of buying and selling.

- Diversification: Exposure to 50 top companies in various sectors.

- Low Cost: Minimal expense ratio (approximately 0.05%).

Nifty BeES Share Price Target for 2025 and 2030

Looking at the Nifty BeES price trend and future growth prospects, here's an overview of potential price targets:

Nifty BeES Share Price Target 2025: ₹270 – ₹285 (assuming 9–10% annual growth)

Nifty BeES Share Price in 2030: ₹400 – ₹450+ (projected 10–12% annual growth)

These targets reflect a long-term investment horizon, driven by India’s Economic Growth and the strong performance of Nifty 50 companies.

Timeless Tip: Investing in Nifty BeES is about consistency over time. Short-term market movements are unpredictable, but the long-term growth of India’s Economy and top businesses offers investors substantial wealth creation opportunities.

Talk to our investment specialist

Why Nifty BeES is a Timeless Investment Choice

While market trends can change, the core principles of Passive Investing remain unchanged. Nifty BeES aligns perfectly with these principles, and here’s why it’s a timeless choice for investors:

1. Exposure to the Indian Economy’s Growth

Nifty BeES gives you access to India’s economic growth, represented by blue-chip companies across various sectors. From IT and banking to consumer goods and pharmaceuticals, the ETF mirrors the health of the broader economy.

2. Compounding Over Time

With its low expense ratio and dividend reinvestment option, Nifty BeES is an ideal choice for long-term investors. The Power of Compounding plays a critical role, turning small investments into significant returns over years.

3. Consistent Performance

Historically, Nifty BeES has closely tracked the performance of the Nifty 50 Index, which has delivered steady returns over the long term, making it a reliable investment choice for wealth-building.

4. Diversification

By investing in 50 large-cap companies, Nifty BeES ensures diversification, reducing the risk associated with investing in individual stocks.

Nifty BeES vs Mutual Funds: A Timeless Comparison

| Feature | Nifty BeES | Mutual Funds |

|---|---|---|

| Management | Passive (Index Fund) | Active (Fund Manager) |

| Cost | Low (0.05% expense ratio) | High (1–2% expense ratio) |

| Liquidity | High (Traded on NSE/BSE) | Low (NAV-based, end of day) |

| Returns | Aligned with Nifty 50 | Can outperform or Underperform Nifty 50 |

| Investment Horizon | Long-Term | Short-Term or Long-Term |

Timeless Investment Strategy: How to Maximise Returns with Nifty BeES

Long-Term Perspective: Hold Nifty BeES for 5+ years to benefit from the growth of India's leading companies. Time in the market often trumps timing the market.

Systematic Investment plan (SIP): Regular monthly investments reduce the impact of market Volatility and allow you to buy more units during market corrections.

Reinvest Dividends: Automatically reinvesting dividends helps in compounding your returns over time.

Periodic Review: While the Nifty BeES is a passive investment, reviewing your portfolio annually ensures it aligns with your Financial goals.

Timeless Tip: Patience is key. The Nifty 50 index has a long history of recovering from short-term downturns and continuing its upward trajectory. Don’t be swayed by market fluctuations.

FAQs: Timeless Insights

1. How much can I expect to earn with Nifty BeES over the next 5 years?

A: Historically, Nifty BeES has delivered an average 12%–14% annual return over the long term, but this can vary depending on the broader market conditions.

2. Is Nifty BeES a safe investment?

A: While Nifty BeES offers diversification and is linked to the Nifty 50, it is still an equity investment and can be subject to market risk. For long-term investors, it remains a solid, low-cost option for wealth generation.

3. Can I buy Nifty BeES if I don’t have a Demat account?

A: You need a Demat and Trading Account to buy and sell Nifty BeES. Many brokers and mutual fund platforms offer easy account opening procedures.

Final Thoughts: Why Nifty BeES is a Timeless Investment Choice

Nifty BeES is an evergreen investment that offers low-cost exposure to India's top-performing companies. Whether you're a beginner or an experienced investor, Nifty BeES helps you build wealth passively over time. It combines the best features of low cost, liquidity, and diversification, making it a cornerstone of many long-term investment strategies.

🔔 Reminder: Investing in Nifty BeES requires patience and a long-term mindset. It’s not about quick wins but about consistently building wealth over time.

Ready to start your journey with Nifty BeES? Open a Demat account and start investing today. Remember, the best time to plant a tree was 20 years ago; the second-best time is now.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like