Table of Contents

- What is the need for a will?

- Eligibility for making a will

- Important elements in a will

- Steps to writing an effective will

- The will enforcement

- Registration requirement

- The applicable law to wills

- Who is competent to create a will?

- The attestation of a will

- What is a digital will?

- What happens if there is no will?

- Conclusion

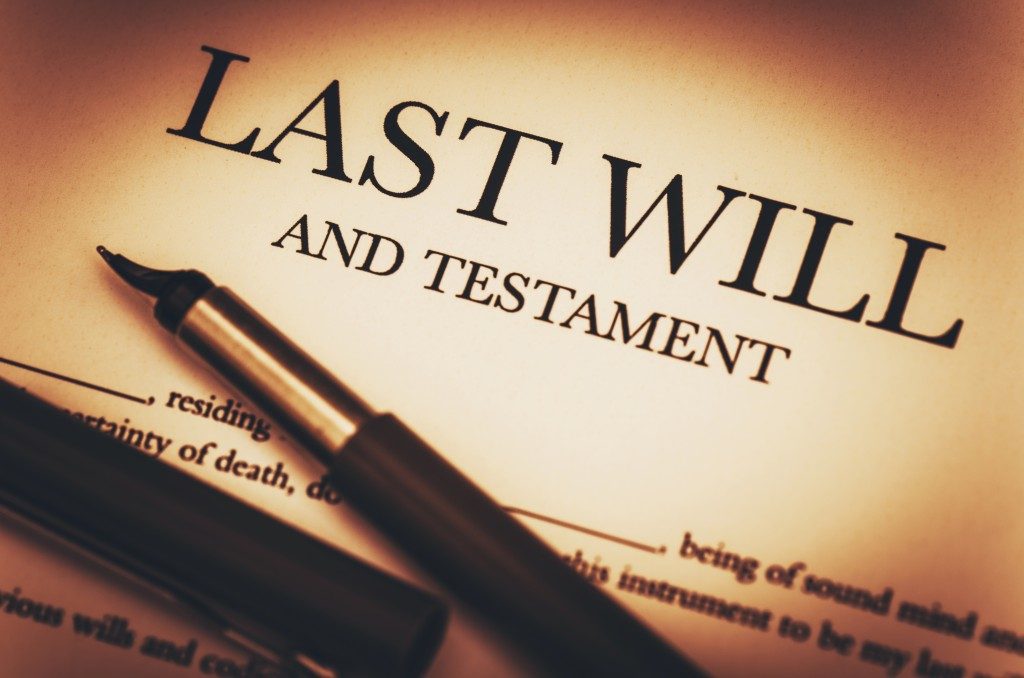

What is a Will? How to Create a Will?

A will, also known as a testament, is a legal declaration through which a testator (a person) names one or multiple people as the executor to Handle their estate and offer property transfer after the testator's death. However, the will can be created for only self-acquired properties. It cannot be created for ancestral properties. Moreover, future properties can be given, which accumulate to the testator once the will is executed. The will can be annulled only until the testator is alive and not after his death.

One of the things to be kept in mind here is that a testator cannot give their property to a charity in case their family is living in a state of poverty. The testator must give good grounds for this disinheritance that will have to be under the court of law's scrutiny.

What is the need for a will?

There are some advantages of executing a will, such as:

- A well-created will can help prevent family disputes about the testator's property. If a dispute comes into the picture, the property's beneficiary will have this document in favour

- The will ensures no false claims after the testator's death

- The will allows the testator to consider whether a family member should or should not inherit their property and in what proportion, which is not regarded by the law of Inheritance

- It is a standard legal need for transferring an interest in the business, stocks and shares, Bank deposits, and Real Estate

- A will ensures every type of property, moveable and immoveable, is distributed equally

Eligibility for making a will

Jotted down below is the required eligibility for creating a will:

- The testator must have a sound mind

- They must be completely aware of the will's content

- They should be free from coercion or influence

- The testator must act voluntarily

- People who are deaf, blind, or dumb and are not injured in making a will can proceed with this document if they understand the particulars

Talk to our investment specialist

Important elements in a will

Here is a checklist that helps to make sure a will is enforceable:

- The will must have the testator's details, like the address and name

- It can be created in any language. There are no technical words that should be there

- It should be signed by the testator and attested by at least two witnesses

- The need for making this document should be written along with the statement that the testator is doing it voluntarily with a sound mind and under no coercion

- The properties' schedule should be attached

- Explicit language should be used to bequeath the estate

- The name of the executor must be mentioned

Legal Declaration

A will is a legal declaration. This document purports to be a testament that the will is legal. This means that it should comply with the law and be administered by someone legally competent for its execution. The will should be signed and attested accordingly per the statute's requirements.

Disposition of Property

The declaration must be related to the assets' disposal of the testator making the will.

Revocability

The essence of will is that it can be revoked during the testator's lifetime.

Steps to writing an effective will

Now that you have basic details, let's start writing an effective will. Here is a step-by-step guide to assist you:

Step 1

Make sure your will begins with a name, the testator's description, and a declaration that they are writing the will without coercion and pressure and are of sound mind. It should also be declared that this is the testator's last will, and if any wills were written earlier, this one supersedes them all. An objective behind writing the will can also be defined.

Step 2

The next step is to appoint an executor. This person will carry powers to implement the testator's directions and administration of the property. If there is a minor child, a testamentary guardian can be appointed for them.

Step 3

In this step, mention all the legal heirs or beneficiaries with their date of birth or age and their relation with you. You must also pinpoint each family member even if you are not giving them anything.

Step 4

Next, you must list the details of your immovable and movable assets and liabilities. Make sure to describe them thoroughly. Mention the addresses of the property and the percentage of ownership. Make sure you add maximum details for the movable assets, such as account numbers, the weight of the jewellery, locker number, Bonds, Mutual Funds, business equity stakes, insurance policies, business partnerships, and more. If you have taken any advances or loans, you must also write them clearly here. Mention the amount and the asset that was pledged for the loan. Also, put the balance due, EMI payments, and other details.

Step 5

Now, bequest your assets to beneficiaries or heirs. It is recommended to mention every bequest in a different point or paragraph.

Step 6

In this step, declare whom you would want to pay your property Taxes and liabilities and how. You can also mention that after writing this will, if you acquire any assets or liabilities, how shall they be bequeathed?

Step 7

Sign your will in the presence of two witnesses. The sign and date should be mentioned on every page of the will. Make sure that the witnesses are not related to the beneficiaries or the executor in any way. Full addresses and names of the witnesses should be mentioned clearly as well.

The will enforcement

Once the testator has passed away, an executor or the Heir of the testator can enforce the will. They will be the safe-keeper of the beneficiaries' rights under the will. Under the will, the enforcement of rights, as per a provision of the Indian Succession Act, can be done only by a Probate.

A probate comes in the form of a copy of the will, which has been certified by the tribunal. It is treated as conclusive evidence of the truthfulness of the will. It simply means getting the will certified by a court of capable jurisdiction. However, it is not applicable to Indian Hindus, the only exception being the immovable property available in Chennai, Mumbai, or Kolkata.

The court will ask all the heirs whether they have objections to the will or not. In case they will not have an objection, the probate will be granted. If any objections come into the picture, a citation will be served, calling heirs to consent. Once the issue is resolved and the probate is granted, the will comes into effect.

Registration requirement

Although a will is not needed to be registered as per section 18 of the Registration Act and can be written on a simple paper, it is recommended to get it registered. You can get it registered with the Registrar of Assurances, where the testator is residing. It can be registered by the testator throughout their life. However, after their death, it can be done by a legatee or an executor. In case there have been any amendments afterward, they should be registered as well. By getting the will registered, you ensure that it cannot be tampered with; hence, its authenticity will get established.

Here is the procedure for getting the will registered:

- A will should be registered with the sub-registrar or the registrar by paying a small registration fee

- The testator should be present at the time of the registration, along with the witnesses

- The registrar's signature will be enough to prove the will's execution. In case the testator has passed away but they have affirmed the will's content by putting their thumb Impression or signature in the presence of the registrar or the sub-registrar, the latter can be regarded as the attesting witness

- A codicil or the will doesn't need a stamp

- The cover of the will must be superscribed by the name of the testator or their agent with a statement of the document's nature. Rs. 1,000 will have to be paid as a fee

- The deposited cover can be withdrawn by either the testator or their agent after paying Rs. 200 as the fee

The applicable law to wills

India comprises a well-developed system of laws related to wills that regulate the property of a person after their death. They apply specifically to wills and codicils that are made by Christians, Parsis, Jains, Sikhs, Buddhists, and Hindus. As far as Muslims are concerned, Muslim Personal Law regulates their matters.

The applicable laws are:

- The Indian Succession Act, 1925

- The Indian Registration Act, 1908

- Hindu Personal Laws

Who is competent to create a will?

According to Section 59 of the Indian Succession Act, anybody with a sound mind and a mature age is competent to create a will. However, it cannot be created by:

- Those who are mentally disturbed, insane, or lunatics

- Those who are minors, meaning below the age of 18 years

- Those who are coming out from intoxication or illness or a cause that leads to them not knowing what they are doing

The attestation of a will

Here is how a will can be attested:

- The testator must affix or sign or mark the will, or somebody else should do it in the testator's presence and with their direction

- The mark or signature of the testator should be clear and decipherable

- The will has to be attested by two or more witnesses; each of them must see the testator or the other person sign or mark the will

- Each of the witnesses should sign the will while the testator is present there

What is a digital will?

A well-written, signed as well as attested through an electronic medium is referred to as a digital will. It is also known as an e-will or an electronic will. Every bit of detail gets recorded digitally. However, the Indian legal system has not started recognising digital wills yet.

What happens if there is no will?

In case you die without creating a valid will, there is a chance of dispute occurring among the members of your family. However, in such a scenario, religion-specific laws are pretty much applicable when it comes to property division. However, this is only applicable if the dispute reaches the court.

There is the Hindu Succession Act that deals with making Sikhs, Jains, Buddhists, or Hindus:

- The property will get transferred to those relatives who are named in Class I

- If there is no Class I beneficiary, the property will be given to relatives in Class II

- In a scenario when there are no Class II beneficiaries, the property will go to agnates (the ones related through males by virtue of blood or adoption)

- If there are no agnates, the property will go to cognates (the ones related through adoption or blood but not males)

If there are female Sikhs, Jains, Buddhists, or Hindus:

- The property will be given to the husband and daughters (also including the children of a predeceased daughter or son) equally

- If the above heirs are absent, the property will be given to the heirs of the husband

- If there are no heirs from the side of the husband, the property will be given to the parents

- If the parents are not alive, the estate will go to the heirs of the father

- If there are no heirs from the father's side, the estate will be given to the heirs of the mother

In the case of a hindu undivided family (HUF):

- If the Karta dies, the estate will be given to the members of the four surviving generations

- Despite the beneficiaries being Hindus, the property will not be divided according to the Hindu Succession Act

- A female or male relative from Class I can claim a share in the property. In such a situation, the property will be given to them as per the Hindu Succession Act

In the case of Christians, according to the Indian Succession Act:

- The wife will get one-third of the estate, and the remaining will be divided equally among children (including the children of any predeceased daughter or son)

- If there is no wife, the estate will be divided among children equally

- If there are no children, the property will be divided among the relatives of the wife and the husband equally

- If there are no relatives, the property will be given to the parents of the deceased

In the case of Parsis, according to the Indian Succession Act:

- The wife gets half the property, and the children get the remaining

- If there is no wife, the estate gets divided among children equally

- If there are no children, the parents of the deceased get the property

In the case of Muslims, according to Shariat:

- The judge or Qazi will be undertaking the burial expenditure and listing down the assets to be distributed among children and wives. According to Shariat, the sons of the deceased get twice more than the daughters.

Conclusion

Through the information mentioned above, by now, you would have realised the importance of having a legally valid will to keep everything divided equally after your demise. Keep in mind that you ensure being of sound mind and under no compulsion while making the will, or else it will be nulled.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.