Table of Contents

Tax Saving FD

Tax saving fixed deposits or tax saving FD can be a good solution for investors looking for safe and convenient tax saving schemes. It is an easy and secure tax saving instrument which will help you in your Tax Planning. tax saver FD is a financial avenue where you can invest and save tax under the Section 80C of the income tax Act.

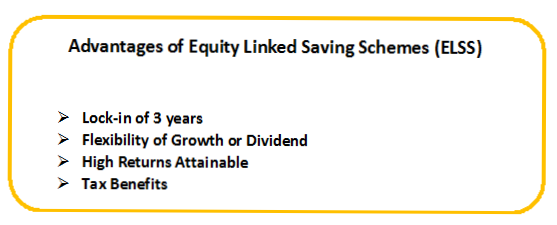

Tax saving FD is a type of debt investment and is safer than the equity-based tax saving instruments like ELSS schemes. Also, the returns of the tax saver FD are guaranteed (up to INR 1 lakh) contractually by the Post Office or Bank depending on where you invest. These returns are fixed for the duration of the FD. The tax saving FD Interest Rates vary from lender to lender (banks and post office). SBI Tax Saving Scheme 2006, HDFC Bank Tax Saver FD, Axis Bank Tax Saver Fixed Deposit etc. are among the popular tax saver deposit schemes in the Market.

Highlights of Tax Saver FD

Let us look at the key highlights of the tax saver FD -

- Only individuals and members of hindu undivided family (HUF) can invest in the tax saving FD scheme

- The minimum investment amount of the tax saver FD varies from bank to bank

- The lock-in period of the tax saving FD is five years

- You can get tax deductions up to INR 1,50,000

- There is no provision for premature withdrawal

- You cannot apply for loan against these tax saver FD

- Investment in these tax saver FDs can be done in any private or public sector bank (except co-operative and rural banks)

- Investment made in Post Office Time Deposit for the period of over five years also qualifies as tax saving FD

- You can transfer the Post Office FD from one Post Office to another

- The interest earned from this type of FD is taxable and will be deducted from the source

- Tax saving deposit account can be opened individually as well as jointly.

- In case of a joint account, the tax benefit will be enjoyed by the first holder of the joint account

Tax Saver FD Interest Rates

Presently, the banks are Offering the interest rates in the Range of 6.75% to 6.90% p.a. for the general public. On the other hand, the Post Office tax saving FD interest rate is around 7.8% p.a. As you can observe, Post Office offer higher interest rates than banks but these rates will be reviewed by the Government from 1st April 2017.

Talk to our investment specialist

Benefits of Tax Saving Fixed Deposit

- You save Income tax under the Section 80C of the Income Tax Act

- You can start Investing even with a small amount of INR 100 and then build up on your savings

- Your returns will be protected

- Nomination Facility is available for tax saving FD and you can name someone to avail the deposits in the unfortunate event of your death

Top 5 Banks Offering Tax Savings FD in India

- ICICI Bank

- Axis Bank

- State Bank of India (SBI)

- HDFC Bank

- IDBI Bank

Tax Saving FD Interest Rate Comparison

Let us look at the interest rates offered by the above-mentioned banks in case of tax saving FD

| Bank | Tax Saving FD Scheme | General Rate of Interest | Rate of Interest for Senior Citizen |

|---|---|---|---|

| ICICI Bank | ICICI Bank Tax Saver Fixed Deposit | 7.00% per annum | 7.50% per annum |

| Axis Bank | Axis Bank Tax Saver Fixed Deposit | 7.00% per annum | 7.75% per annum |

| State Bank of India (SBI) | SBI Tax Saving Scheme 2006 | 6.50% per annum | 7.50% per annum |

| IDBI Bank | Suvidha Tax Saving Fixed Deposit Scheme | 6.50% per annum | 7.00% per annum |

Other Alternatives for Saving Tax

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Tata India Tax Savings Fund Growth ₹40.7798

↑ 1.12 ₹4,053 -3.8 -11.2 7 12.8 23.2 19.5 L&T Tax Advantage Fund Growth ₹121.819

↑ 3.57 ₹3,604 -4.5 -12.7 9.2 15.4 23.8 33 Principal Tax Savings Fund Growth ₹470.581

↑ 10.16 ₹1,212 -0.3 -7.8 5.8 12.5 24.1 15.8 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 1.2 15.4 35.5 20.6 17.4 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 9.7 15.1 16.9 20.8 10 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 15 Apr 25

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.