Tax Saving Schemes for Investment in 2026

The new financial year has started. There is one common question, for investors and non-investors alike. how to Save Tax? What are the best Tax Saving Scheme? Which is the best tax saving Mutual Funds to invest in? Should I be Investing in ELSS or in a tax saving FD (fixed deposit)? There are various tax saving options available such as ELSS, Public Provident Fund, National Pension Scheme, etc. It is a wise move to start your Tax Planning early and thus invest in tax saving schemes. We have compiled a list of best Tax Saving Investment options for you to choose from.

Deductions on Section 80C, 80CCC & 80CCD

Section 80C

Deductions on Investments

Under Section 80C, a deduction of Rs 1,50,000 can be claimed from your total income. In simple terms, you can reduce up to Rs 1,50,000 from your total taxable income through section 80C. This deduction is allowed to an Individual or a HUF. A maximum of Rs 1, 50,000 can be claimed for the FY 2018-19, 2017-18 and FY 2016-17 each.

If you have paid excess taxes, but have invested in LIC, PPF, Mediclaim, incurred towards Tuition Fees etc.and have missed claiming a deduction of the same under 80C, you can file your Income Tax Return, claim these deductions and get a refund of excess taxes paid

Fund Selection Methodology used to find 7 funds

Equity Linked Tax Saving Scheme (ELSS)

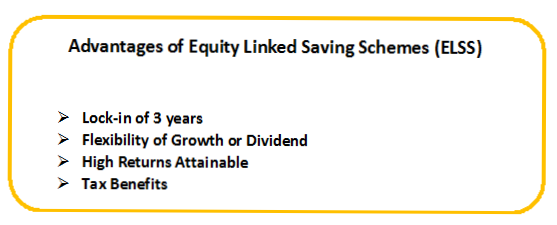

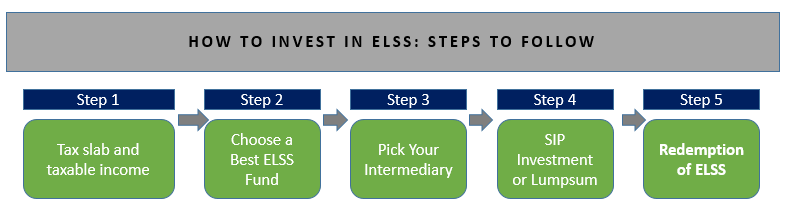

ELSS are one of the most common tax saving schemes available in the market. ELSS Mutual Funds are a type of equity-linked Mutual Funds which invest mainly in equity or stocks. These ELSS funds deliver good returns of around 14-16% p.a. over a long period of investment. ELSS schemes have a lock-in period of three years which is lowest among other tax saving schemes available for investment. Also, the returns from these ELSS Mutual Funds are tax-free.

You can invest in ELSS schemes in form of either a lump sum amount or SIP. Up to INR 1,50,000 can be saved under ELSS tax saving schemes. It is a good tax saving option for investors with a high holding period and an ability to take a risk in an investment. Some of the best ELSS schemes in the market are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata India Tax Savings Fund Growth ₹46.0015

↑ 0.21 ₹4,566 -0.9 4.4 14.8 16.6 14 4.9 Bandhan Tax Advantage (ELSS) Fund Growth ₹155.96

↑ 0.36 ₹7,060 -1.5 2.3 12.6 15.8 15.9 8 Aditya Birla Sun Life Tax Relief '96 Growth ₹61.68

↑ 0.15 ₹14,993 -1.9 0.4 15.5 15.8 9.6 9.3 DSP Tax Saver Fund Growth ₹144.271

↑ 0.40 ₹17,223 -0.1 4.1 14 20.6 17.1 7.5 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 1.2 15.4 35.5 20.6 17.4 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 9.7 15.1 16.9 20.8 10 Nippon India Tax Saver Fund (ELSS) Growth ₹130.585

↑ 0.25 ₹14,881 -1.6 0.6 14.6 18.2 16.1 6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 7 Funds showcased

Commentary Tata India Tax Savings Fund Bandhan Tax Advantage (ELSS) Fund Aditya Birla Sun Life Tax Relief '96 DSP Tax Saver Fund HDFC Long Term Advantage Fund IDBI Equity Advantage Fund Nippon India Tax Saver Fund (ELSS) Point 1 Lower mid AUM (₹4,566 Cr). Lower mid AUM (₹7,060 Cr). Upper mid AUM (₹14,993 Cr). Highest AUM (₹17,223 Cr). Bottom quartile AUM (₹1,318 Cr). Bottom quartile AUM (₹485 Cr). Upper mid AUM (₹14,881 Cr). Point 2 Established history (11+ yrs). Established history (17+ yrs). Established history (17+ yrs). Established history (19+ yrs). Oldest track record among peers (25 yrs). Established history (12+ yrs). Established history (20+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.01% (lower mid). 5Y return: 15.90% (lower mid). 5Y return: 9.58% (bottom quartile). 5Y return: 17.13% (upper mid). 5Y return: 17.39% (top quartile). 5Y return: 9.97% (bottom quartile). 5Y return: 16.07% (upper mid). Point 6 3Y return: 16.57% (lower mid). 3Y return: 15.76% (bottom quartile). 3Y return: 15.85% (bottom quartile). 3Y return: 20.57% (upper mid). 3Y return: 20.64% (upper mid). 3Y return: 20.84% (top quartile). 3Y return: 18.18% (lower mid). Point 7 1Y return: 14.79% (lower mid). 1Y return: 12.57% (bottom quartile). 1Y return: 15.46% (upper mid). 1Y return: 13.96% (bottom quartile). 1Y return: 35.51% (top quartile). 1Y return: 16.92% (upper mid). 1Y return: 14.57% (lower mid). Point 8 Alpha: -0.76 (bottom quartile). Alpha: 0.34 (bottom quartile). Alpha: 3.77 (top quartile). Alpha: 1.75 (upper mid). Alpha: 1.75 (lower mid). Alpha: 1.78 (upper mid). Alpha: 0.95 (lower mid). Point 9 Sharpe: 0.14 (bottom quartile). Sharpe: 0.21 (bottom quartile). Sharpe: 0.50 (upper mid). Sharpe: 0.33 (lower mid). Sharpe: 2.27 (top quartile). Sharpe: 1.21 (upper mid). Sharpe: 0.26 (lower mid). Point 10 Information ratio: -0.35 (lower mid). Information ratio: -0.30 (lower mid). Information ratio: -0.43 (bottom quartile). Information ratio: 0.93 (top quartile). Information ratio: -0.15 (upper mid). Information ratio: -1.13 (bottom quartile). Information ratio: 0.22 (upper mid). Tata India Tax Savings Fund

Bandhan Tax Advantage (ELSS) Fund

Aditya Birla Sun Life Tax Relief '96

DSP Tax Saver Fund

HDFC Long Term Advantage Fund

IDBI Equity Advantage Fund

Nippon India Tax Saver Fund (ELSS)

Section 80CCC

Deduction for Premium Paid for Annuity Plan of LIC or Other Insurer

This section provides a deduction to an individual for any amount paid or deposited in any annuity plan of LIC or any other insurer. The plan must be for receiving a pension from a fund referred to in Section 10(23AAB). Pension received from the annuity or amount received upon surrender of the annuity, including interest or bonus accrued on the annuity, is taxable in the year of receipt.

Talk to our investment specialist

Section 80CCD

Deduction for Contribution to Pension Account

a. Employee’s contribution – Section 80CCD (1) is allowed to an individual who makes deposits to his/her pension account. Maximum deduction allowed is 10% of salary (in case the taxpayer is an employee) or 20% of gross total income (in case the taxpayer being self-employed) or Rs 1, 50,000, whichever is less. FY 2016-17 and earlier years – In the case of a self-employed individual, maximum deduction allowed is 10% of gross total income.

b.Deduction for self-contribution to NPS – section 80CCD (1B) A new section 80CCD (1B) has been introduced for an additional deduction of up to Rs 50,000 for the amount deposited by a taxpayer to their NPS Account. Contributions to Atal Pension Yojana are also eligible.

c. Employer’s contribution to NPS – Section 80CCD (2) Additional deduction is allowed for employer’s contribution to employee’s pension account of up to 10% of the salary of the employee. There is no monetary ceiling on this deduction.

Section 80 TTA

Deduction from Gross Total Income for Interest on Savings Bank Account

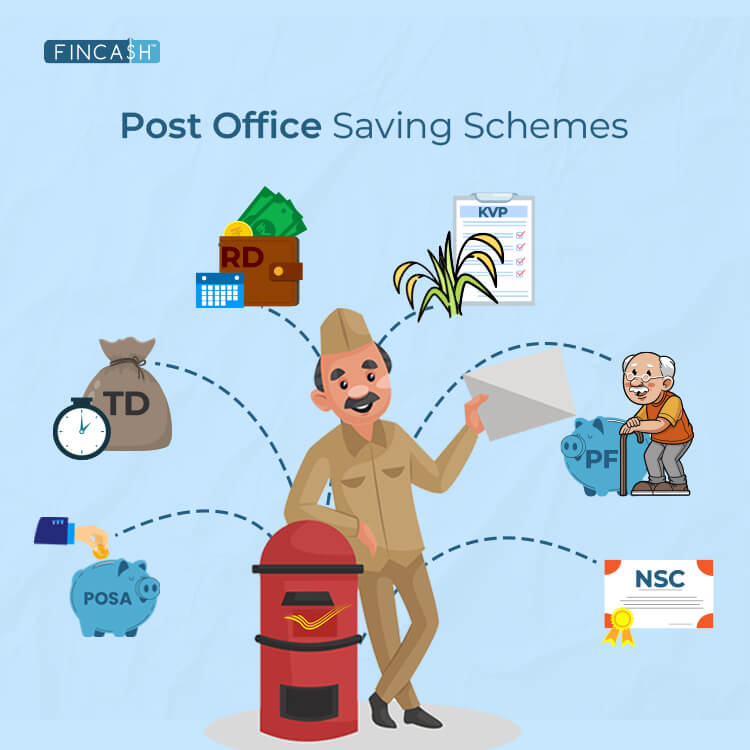

A deduction of maximum Rs 10,000 can be claimed against interest income from a savings Bank account. Interest from savings bank account should be first included in other income and deduction can be claimed of the total interest earned or Rs 10,000, whichever is less. This deduction is allowed to an individual or an HUF. It can be claimed for interest on deposits in Savings Account with a bank, co-operative society, or post office. Section 80TTA deduction is not available on interest income from fixed deposits, recurring deposits, or interest income from corporate Bonds.

Section 80GG

Deduction for House Rent Paid Where HRA is not Received

a. This deduction is available for rent paid when HRA is not received. The taxpayer, spouse or minor child should not own residential accommodation at the place of employment

b. The taxpayer should not have self-occupied residential property in any other place

c. The taxpayer must be living on rent and paying rent

d. The deduction is available to all individuals

Deduction available is the least of the following: a. Rent paid minus 10% of adjusted total income

b. Rs 5,000/- per month

c. 25% of adjusted total income*

*Adjusted Gross Total Income is arrived at after adjusting the Gross Total Income for certain deductions, exempt incomes, long-term capital gains and income relating to non-residents and foreign companies. An online e-filing software like that of ClearTax can be extremely easy as the limits are auto-calculated and you do not have to worry about making complex calculations. From FY 2016-17 available deduction has been raised to Rs 5,000 a month from Rs 2,000 per month.

Section 80E

Deduction for Interest on Education Loan for Higher Studies

A deduction is allowed to an individual for interest on loan taken for pursuing higher education. This loan may have been taken for the taxpayer, spouse or children or for a student for whom the taxpayer is a legal guardian. The deduction is available for a maximum of 8 years (beginning the year in which the interest starts getting repaid) or till the entire interest is repaid, whichever is earlier. There is no restriction on the amount that can be claimed.

Section 80EE

Deductions on Home Loan Interest for First Time Home Owners

FY 2017-18 and FY 2016-17 This deduction is available in FY 2017-18 if the loan has been taken in FY 2016-17. The deduction under this section is available only to an individual who is a first time home-owner. The value of the property purchased must be less than Rs 50 lakh and the Home Loan must be less than Rs 35 lakh. The loan must be taken from a financial institution and must have been sanctioned between 01 April 2016 to 31 March 2017. Through this section, an additional deduction of Rs 50,000 can be claimed on home loan interest. This is in addition to deduction of Rs 2,00,000 allowed under Section 24 of the income tax Act for a self-occupied house property.

FY 2013-14 and FY 2014-15 This section provides a deduction on the home loan interest paid. The deduction under this section is available only to individuals for the first house purchased where the value of the house is Rs 40 lakh or less and the loan taken for the house is Rs 25 lakh or less. The loan must be sanctioned between 01 April 2013 to 31 March 2014. The aggregate deduction allowed under this section cannot exceed Rs 1,00,000 and is allowed for FY 2013-14 and FY 2014-15.

Section 80CCG

Rajiv Gandhi Equity Saving Scheme (RGESS)

The deduction under this section is available to a resident individual. Investors whose gross total income is less than Rs. 12 lakhs. To avail the benefits under this section the following conditions should be met: a. The assessee should be a new retail investor as per the requirement specified under the notified scheme.

b. The investment should be made in such listed investor as per the requirement specified under the notified scheme.

c. The minimum lock in period in respect of such investment is three years from the date of acquisition in accordance with the notified scheme.

Upon fulfillment of the above conditions, a deduction, which is lower of the following is allowed. 50% of the amount invested in equity shares; or Rs 25,000 for three consecutive Assessment Years. Rajiv Gandhi Equity Scheme has been discontinued starting from 1 April 2017. Therefore, no deduction under section 80CCG will be allowed from FY 2017-18. However, if you have invested in the RGESS scheme in FY 2016-17, then you can claim deduction under Section 80CCG until FY 2018-19.

80D Tax Saving Schemes

Deduction for the premium paid for Medical Insurance

Deduction under this section is available to an individual or a HUF. A deduction of Rs. 25,000 can be claimed for insurance of self, spouse and dependent children. An additional deduction for insurance of parents is available to the extent of Rs 25,000 if they are less than 60 years of age or Rs 50,000 (has been increased in Budget 2018 from Rs 30,000) if parents are more than 60 years old. In case, a taxpayers age and parents age is 60 years or above, the maximum deduction available under this section is to the extent of Rs. 100,000. Example: Rohan’s age is 65 and his father’s age is 90. In this case, the maximum deduction Rohan can claim under section 80D is Rs. 100,000. From FY 2015-16 a cumulative additional deduction of Rs. 5,000 is allowed for the preventive health check up to individuals.

Section 80DD

Deduction for Rehabilitation of Handicapped Dependent Relative

This deduction is available to a resident individual or a HUF and is available on: a. Expenditure incurred on medical treatment (including nursing), training and rehabilitation of handicapped dependent relative

b. Payment or deposit to specified scheme for maintenance of dependent handicapped relative.

i. Where disability is 40% or more but less than 80% – fixed deduction of Rs 75,000.

ii. Where there is severe disability (disability is 80% or more) – fixed deduction of Rs 1,25,000.

To claim this deduction a certificate of disability is required from prescribed medical authority. From FY 2015-16 – The deduction limit of Rs 50,000 has been raised to Rs 75,000 and Rs 1,00,000 has been raised to Rs 1,25,000.

Section 80DDB

Deduction for Medical Expenditure on Self or Dependent Relative

This deduction is available to a resident individual or a HUF. The deduction that can be claimed is Rs 40,000. Such deduction, for an individual, is available in respect of any expenses incurred towards treatment of certain specified medical diseases or ailments for himself or any of his dependents. For a HUF, such deduction is available in respect of medical expenses incurred towards these prescribed ailments, for any of the members of the HUF. In case the individual on behalf of whom such expenses are incurred is a senior citizen, a deduction upto Rs 1 lakh can be claimed by the individual or HUF taxpayer. Earlier i.e. until FY 2017-18, the deduction that could be claimed for a senior citizen and a super senior citizen was Rs 60,000 and Rs 80,000 respectively. This otherwise means, now it is a common deduction available upto Rs 1 lakh for all senior citizens (including super senior citizens) unlike earlier. Any reimbursement of medical expenses by an insurer or employer shall be reduced from the quantum of deduction the taxpayer can claim under this section. Also remember that you need get a prescription for such medical treatment from the concerned specialist in order to be able to claim such deduction. Read our detailed article on Section 80DDB.

Section 80U

Deduction for Person suffering from Physical Disability

A deduction of Rs. 75,000 is available to a resident individual who suffers from a physical disability (including blindness) or mental retardation. In case of severe disability, deduction of Rs. 1,25,000 can be claimed. From FY 2015-16 – The deduction limit of Rs 50,000 has been raised to Rs 75,000 and Rs 1,00,000 has been raised to Rs 1,25,000.

Section 80G

Deduction for donations towards Social Causes

The various donations specified in u/s 80G are eligible for deduction up to either 100% or 50% with or without restriction as provided in Section 80G. From FY 2017-18 any donations made in cash exceeding Rs 2,000 will not be allowed as deduction. The donations above Rs 2000 should be made in any mode other than cash to qualify as deduction u/s 80G.

Section 80GGB

Deduction on contributions given by companies to Political Parties

Deduction is allowed to an Indian company for the amount contributed by it to any political party or an electoral trust. Deduction is allowed for contribution done by any way other than cash.

Section 80GGC

Deduction on contributions given by any person to Political Parties

Deduction under this section is allowed to a taxpayer except for a company, local authority and an artificial juridical person wholly or partly funded by the government, for any amount contributed to any political party or an electoral trust. The deduction is allowed for contribution done by any way other than cash.

Section 80RRB

Deduction with respect to any Income by way of Royalty of a Patent

Deduction for any income by way of royalty for a patent registered on or after 01.04.2003 under the Patents Act 1970 shall be available up to Rs. 3 lakhs or the income received, whichever is less. The taxpayer must be an individual resident of India who is a patentee. The taxpayer must furnish a certificate in the prescribed form duly signed by the prescribed authority.

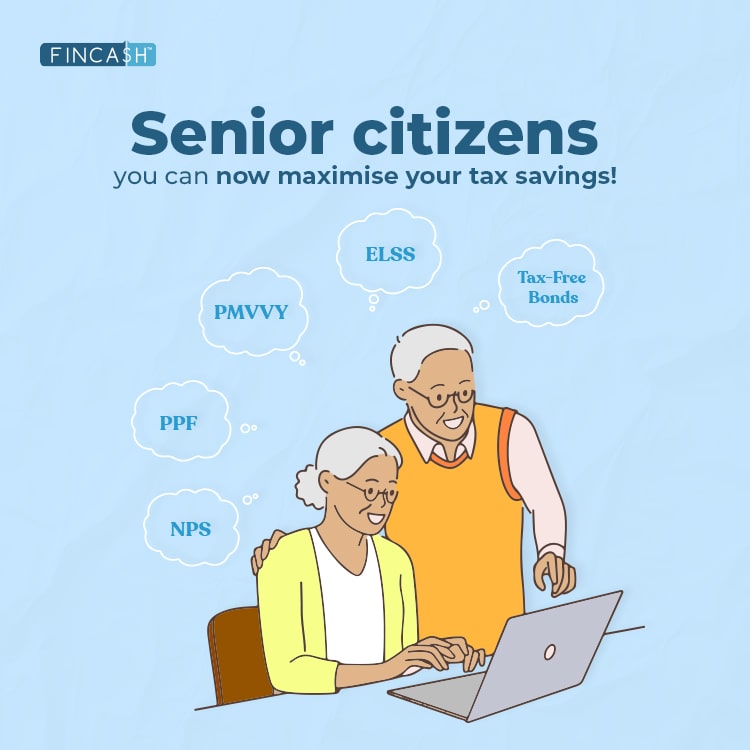

Section 80 TTB

Deduction of Interest on Deposits for Senior Citizens

A new section 80TTB has been inserted vide Budget 2018 wherein, a deduction in respect of interest income from deposits held by senior citizens will be allowed as a deduction from the total income The limit for this deduction is Rs. 50,000. Further, no deduction under section 80TTA shall be allowed. In addition to section 80 TTB, Section 194A of the Act will also be amended so as to increase the threshold limit for deduction of tax at source on interest income payable to senior citizens from the existing limit Rs 10,000 to Rs. 50,000.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.