Table of Contents

ELSS vs Tax Saving FD

Equity Linked Savings Scheme (ELSS)

ELSS is the only Mutual Fund eligible for 80C deductions. It is a diversified equity mutual fund that offers tax deductions up to Rs. 1.5 lakhs annually under Section 80C of income tax Act (IT Act 1961).

Prior to the introduction of Feburary Budget 2018, its returns were completely tax-free. However, now it is subject to 10% long-term Capital gains tax if your Capital Gains exceed Rs. 1 lakh after one year. Even after the 10% tax cut, ELSS has the potential to deliver superior returns compared to other tax-saving instruments. The perks of ELSS investments are not limited to the Taxes saved. The Power of Compounding ensures that your investment is doubled if you invest for, say, 5 years (tenure of tax-saving FD). To add to that, the minimum lock-in period is only 3 years.

Tax Saving Fixed Deposits

Investing money in Fixed Deposits with banks allows individuals and HUFs to claim a tax Deduction of up to Rs. 1,50,000 in a financial year. These deposits have a lock-in period of 5 years. You, however, cannot withdraw this deposit prematurely. But you can avail loans against your FDs at competitive rates. The interest earned on these deposits, however, is taxable marginal rate of tax (as per the tax bracket) of the individual.

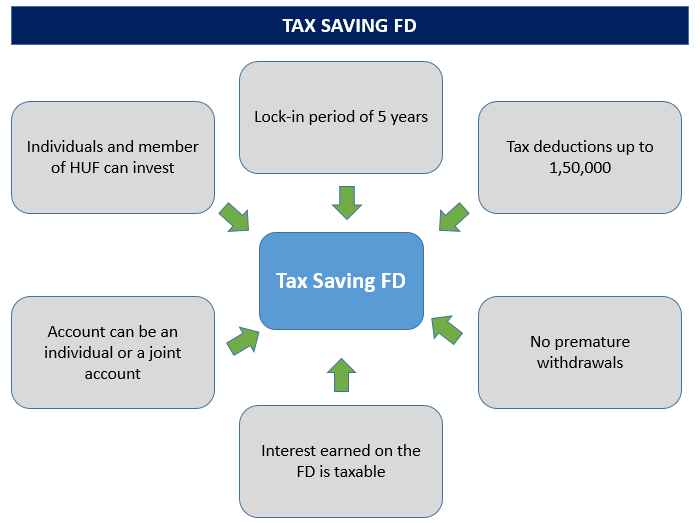

Highlights of Tax Saver FD

Let us look at the key highlights of the tax saver FD -

- Only individuals and members of hindu undivided family (HUF) can invest in the tax saving FD scheme

- The minimum investment amount of the tax saver FD varies from Bank to bank

- The lock-in period of the tax saving FD is five years

- You can get tax deductions up to Rs. 1,50,000

- There is no provision for premature withdrawal

- You cannot apply for loan against these tax saver FD

- Investment in these tax saver FDs can be done in any private or public sector bank (except co-operative and rural banks)

- Investment made in Post Office Time Deposit for the period of over five years also qualifies as tax saving FD

- You can transfer the Post Office FD from one Post Office to another

- The interest earned from this type of FD is taxable and will be deducted from the source

- Tax saving deposit account can be opened individually as well as jointly.

- In case of a joint account, the tax benefit will be enjoyed by the first holder of the joint account

Talk to our investment specialist

ELSS vs FD - Comparison

Here is a quick overview of the of the differences between ELSS and Tax Saving FDs over various parameters:

| Parameter | FD | ELSS |

|---|---|---|

| Tenure | 5 Years Lock-in | 3 Years Lock-in |

| Returns | 7.00 - 8.00 % (Compounded Annually) | No Assured Divividend / Return as it Market linked generally around 16 - 17% per annum |

| Min. Investment | Rs. 1000 | Rs. 500 |

| Max. Investment | No Upper Limit | No Upper Limit |

| Amount Eligible for Deduction under 80c | Rs. 1.5 Lakhs | Rs. 1.5 Lakhs |

| Taxation for Interest/return | Interest Taxable | Gains up to Rs. 1 lakh are free of tax. Tax at 10% applies to gains above Rs. 1 lakh |

| Safety/Ratings | Safe | Bit Risky |

| liquidity | You cannot withdraw tax saving FD before 5 years | You may exit or withdraw ELSS after 3 years. |

| Online option | Not all banks offer an online Facility to open an FD | One can start an ELSS online – as a lump sum or SIP |

Top ELSS Mutual Funds FY 25 - 26

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Motilal Oswal Long Term Equity Fund Growth ₹45.8314

↑ 0.29 ₹3,817 -10 -16.6 9 21.3 25.6 47.7 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 9.7 15.1 16.9 20.8 10 Franklin India Taxshield Growth ₹1,402.25

↑ 19.66 ₹6,359 0.5 -6.3 10.3 17.2 26.6 22.4 JM Tax Gain Fund Growth ₹45.0852

↑ 0.41 ₹184 -3.7 -11.6 9.5 17 26 29 Baroda Pioneer ELSS 96 Growth ₹68.6676

↑ 0.33 ₹210 -6.1 -3.5 17.6 16.7 11.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

*Below is the list of funds having AUM between 100 - 15000 Crore & having fund age of 3 Years of above. Based on 3 Year Performance.

(Erstwhile Motilal Oswal MOSt Focused Long Term Fund) The investment objective of the Scheme is to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related instruments. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Motilal Oswal Long Term Equity Fund is a Equity - ELSS fund was launched on 21 Jan 15. It is a fund with Moderately High risk and has given a Below is the key information for Motilal Oswal Long Term Equity Fund Returns up to 1 year are on The Scheme will seek to invest predominantly in a diversified portfolio of equity and equity related instruments with the objective to provide investors with opportunities for capital appreciation and income along with the benefit of income-tax deduction(under section 80C of the Income-tax Act, 1961) on their investments. Investments in this scheme would be subject to a statutory lock-in of 3 years from the date of allotment to be eligible for income-tax benefits under Section 80C. There can be no assurance that the investment objective under the scheme will be realized. IDBI Equity Advantage Fund is a Equity - ELSS fund was launched on 10 Sep 13. It is a fund with Moderately High risk and has given a Below is the key information for IDBI Equity Advantage Fund Returns up to 1 year are on The primary objective for Franklin IndiaTaxshield is to provide medium to long term growth of capital along with income tax rebate Franklin India Taxshield is a Equity - ELSS fund was launched on 10 Apr 99. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Taxshield Returns up to 1 year are on The investment objective is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities and to enable investors a deduction from total income, as permitted under the Income Tax Act, 1961 from time to time. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns. JM Tax Gain Fund is a Equity - ELSS fund was launched on 31 Mar 08. It is a fund with Moderately High risk and has given a Below is the key information for JM Tax Gain Fund Returns up to 1 year are on The main objective of the scheme is to provide the investor long term capital growth as also tax benefit under section 80C of the Income Tax Act, 1961. Baroda Pioneer ELSS 96 is a Equity - ELSS fund was launched on 2 Mar 15. It is a fund with Moderately High risk and has given a Below is the key information for Baroda Pioneer ELSS 96 Returns up to 1 year are on 1. Motilal Oswal Long Term Equity Fund

CAGR/Annualized return of 16% since its launch. Return for 2024 was 47.7% , 2023 was 37% and 2022 was 1.8% . Motilal Oswal Long Term Equity Fund

Growth Launch Date 21 Jan 15 NAV (17 Apr 25) ₹45.8314 ↑ 0.29 (0.64 %) Net Assets (Cr) ₹3,817 on 31 Mar 25 Category Equity - ELSS AMC Motilal Oswal Asset Management Co. Ltd Rating Risk Moderately High Expense Ratio 0.74 Sharpe Ratio 0.26 Information Ratio 0.83 Alpha Ratio 5.9 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,396 31 Mar 22 ₹18,690 31 Mar 23 ₹19,798 31 Mar 24 ₹30,510 31 Mar 25 ₹33,744 Returns for Motilal Oswal Long Term Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 8% 3 Month -10% 6 Month -16.6% 1 Year 9% 3 Year 21.3% 5 Year 25.6% 10 Year 15 Year Since launch 16% Historical performance (Yearly) on absolute basis

Year Returns 2024 47.7% 2023 37% 2022 1.8% 2021 32.1% 2020 8.8% 2019 13.2% 2018 -8.7% 2017 44% 2016 12.5% 2015 Fund Manager information for Motilal Oswal Long Term Equity Fund

Name Since Tenure Ajay Khandelwal 11 Dec 23 1.22 Yr. Rakesh Shetty 22 Nov 22 2.27 Yr. Atul Mehra 1 Oct 24 0.41 Yr. Data below for Motilal Oswal Long Term Equity Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 30.18% Consumer Cyclical 22.76% Financial Services 17.97% Technology 12.09% Real Estate 6.8% Basic Materials 6.36% Health Care 2.01% Asset Allocation

Asset Class Value Cash 1.83% Equity 98.17% Top Securities Holdings / Portfolio

Name Holding Value Quantity Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | 5433206% ₹220 Cr 9,923,692 Trent Ltd (Consumer Cyclical)

Equity, Since 31 Aug 22 | 5002516% ₹206 Cr 425,260 Gujarat Fluorochemicals Ltd Ordinary Shares (Basic Materials)

Equity, Since 28 Feb 23 | FLUOROCHEM4% ₹147 Cr 408,886 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | KALYANKJIL4% ₹145 Cr 3,134,622 Amber Enterprises India Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Mar 24 | AMBER4% ₹132 Cr 235,044 Coforge Ltd (Technology)

Equity, Since 31 Jul 24 | COFORGE4% ₹124 Cr 168,355 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Jun 23 | KAYNES4% ₹123 Cr 297,751 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 18 | ICICIBANK4% ₹120 Cr 995,689 Suzlon Energy Ltd (Industrials)

Equity, Since 31 Jan 24 | SUZLON4% ₹120 Cr 24,068,813 Inox Wind Ltd (Industrials)

Equity, Since 31 Dec 23 | INOXWIND4% ₹119 Cr 7,946,960 2. IDBI Equity Advantage Fund

CAGR/Annualized return of 16% since its launch. Ranked 21 in ELSS category. . IDBI Equity Advantage Fund

Growth Launch Date 10 Sep 13 NAV (28 Jul 23) ₹43.39 ↑ 0.04 (0.09 %) Net Assets (Cr) ₹485 on 30 Jun 23 Category Equity - ELSS AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.39 Sharpe Ratio 1.21 Information Ratio -1.13 Alpha Ratio 1.78 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,407 31 Mar 22 ₹17,362 31 Mar 23 ₹17,326 Returns for IDBI Equity Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 3.1% 3 Month 9.7% 6 Month 15.1% 1 Year 16.9% 3 Year 20.8% 5 Year 10% 10 Year 15 Year Since launch 16% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for IDBI Equity Advantage Fund

Name Since Tenure Data below for IDBI Equity Advantage Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. Franklin India Taxshield

CAGR/Annualized return of 20.9% since its launch. Ranked 28 in ELSS category. Return for 2024 was 22.4% , 2023 was 31.2% and 2022 was 5.4% . Franklin India Taxshield

Growth Launch Date 10 Apr 99 NAV (17 Apr 25) ₹1,402.25 ↑ 19.66 (1.42 %) Net Assets (Cr) ₹6,359 on 31 Mar 25 Category Equity - ELSS AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆ Risk Moderately High Expense Ratio 1.83 Sharpe Ratio 0.19 Information Ratio 1.32 Alpha Ratio 2.32 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,793 31 Mar 22 ₹21,613 31 Mar 23 ₹22,171 31 Mar 24 ₹32,145 31 Mar 25 ₹35,012 Returns for Franklin India Taxshield

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 6.9% 3 Month 0.5% 6 Month -6.3% 1 Year 10.3% 3 Year 17.2% 5 Year 26.6% 10 Year 15 Year Since launch 20.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 22.4% 2023 31.2% 2022 5.4% 2021 36.7% 2020 9.8% 2019 5.1% 2018 -3% 2017 29.1% 2016 4.7% 2015 4% Fund Manager information for Franklin India Taxshield

Name Since Tenure R. Janakiraman 2 May 16 8.84 Yr. Rajasa Kakulavarapu 1 Dec 23 1.25 Yr. Data below for Franklin India Taxshield as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 30.86% Consumer Cyclical 13.13% Technology 10.95% Industrials 9.83% Health Care 6.41% Communication Services 5.59% Consumer Defensive 5.31% Basic Materials 4.65% Utility 4.03% Energy 3.03% Real Estate 1.63% Asset Allocation

Asset Class Value Cash 3.86% Equity 96.14% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 07 | HDFCBANK9% ₹565 Cr 3,260,417 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK9% ₹547 Cr 4,546,914 Infosys Ltd (Technology)

Equity, Since 29 Feb 12 | INFY5% ₹325 Cr 1,922,741 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 07 | BHARTIARTL5% ₹308 Cr 1,963,637

↓ -250,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 19 | LT5% ₹280 Cr 883,853 HCL Technologies Ltd (Technology)

Equity, Since 31 Oct 21 | HCLTECH4% ₹230 Cr 1,462,587 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 14 | 5322154% ₹229 Cr 2,252,948 Zomato Ltd (Consumer Cyclical)

Equity, Since 30 Nov 21 | 5433203% ₹167 Cr 7,500,000 United Spirits Ltd (Consumer Defensive)

Equity, Since 31 Oct 18 | UNITDSPR3% ₹164 Cr 1,276,457

↓ -298,543 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Nov 17 | KOTAKBANK3% ₹161 Cr 843,530 4. JM Tax Gain Fund

CAGR/Annualized return of 9.2% since its launch. Ranked 18 in ELSS category. Return for 2024 was 29% , 2023 was 30.9% and 2022 was 0.5% . JM Tax Gain Fund

Growth Launch Date 31 Mar 08 NAV (17 Apr 25) ₹45.0852 ↑ 0.41 (0.92 %) Net Assets (Cr) ₹184 on 31 Mar 25 Category Equity - ELSS AMC JM Financial Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.4 Sharpe Ratio 0.26 Information Ratio 0.48 Alpha Ratio 4.69 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,396 31 Mar 22 ₹21,099 31 Mar 23 ₹20,935 31 Mar 24 ₹30,269 31 Mar 25 ₹33,442 Returns for JM Tax Gain Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 5.6% 3 Month -3.7% 6 Month -11.6% 1 Year 9.5% 3 Year 17% 5 Year 26% 10 Year 15 Year Since launch 9.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 29% 2023 30.9% 2022 0.5% 2021 32.2% 2020 18.3% 2019 14.9% 2018 -4.6% 2017 42.6% 2016 5.2% 2015 -0.6% Fund Manager information for JM Tax Gain Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 0.41 Yr. Asit Bhandarkar 31 Dec 21 3.17 Yr. Chaitanya Choksi 18 Jul 14 10.63 Yr. Ruchi Fozdar 4 Oct 24 0.41 Yr. Data below for JM Tax Gain Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 24.93% Consumer Cyclical 16.94% Basic Materials 12.3% Technology 11.78% Industrials 9.75% Health Care 9.45% Consumer Defensive 4.67% Communication Services 2.88% Utility 1.21% Asset Allocation

Asset Class Value Cash 4.75% Equity 95.25% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | ICICIBANK6% ₹9 Cr 77,975

↑ 20,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 11 | HDFCBANK6% ₹9 Cr 54,131 Infosys Ltd (Technology)

Equity, Since 31 Aug 18 | INFY5% ₹8 Cr 45,965

↓ -2,500 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Jan 25 | 5329784% ₹7 Cr 35,500

↑ 3,000 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | MARUTI3% ₹6 Cr 4,706 Bajaj Auto Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | 5329773% ₹5 Cr 6,550 State Bank of India (Financial Services)

Equity, Since 31 Aug 20 | SBIN3% ₹5 Cr 72,900 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 24 | BHARTIARTL3% ₹5 Cr 30,700 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 10 | LT3% ₹5 Cr 14,447 CreditAccess Grameen Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 24 | CREDITACC2% ₹4 Cr 43,600 5. Baroda Pioneer ELSS 96

CAGR/Annualized return of 8.4% since its launch. . Baroda Pioneer ELSS 96

Growth Launch Date 2 Mar 15 NAV (11 Mar 22) ₹68.6676 ↑ 0.33 (0.48 %) Net Assets (Cr) ₹210 on 31 Jan 22 Category Equity - ELSS AMC Baroda Pioneer Asset Management Co. Ltd. Rating Risk Moderately High Expense Ratio 2.55 Sharpe Ratio 2.51 Information Ratio -0.09 Alpha Ratio 5.69 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,937 Returns for Baroda Pioneer ELSS 96

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month -3.9% 3 Month -6.1% 6 Month -3.5% 1 Year 17.6% 3 Year 16.7% 5 Year 11.6% 10 Year 15 Year Since launch 8.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Baroda Pioneer ELSS 96

Name Since Tenure Data below for Baroda Pioneer ELSS 96 as on 31 Jan 22

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity

Should you Invest in ELSS or Tax saving FDs?

Before getting into new investment ventures, people consider a lot of things. Age, investment horizon and risk appetite are a few of the important factors. People who want dual benefits of wealth growth and tax benefits prefer ELSS. For instance, new investors with a long investment horizon and higher risk appetite find ELSS a sensible option. People nearing retirement can invest in tax saving FDs as they tend to have low risks and guaranteed returns over long term (5 year or above atleast).

How to Invest in ELSS Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.