Table of Contents

Challan 280- Know How to Pay Challan 280 Online

Challan 280 a form that is used by individuals to pay income tax in the form of Advance Tax, self- assessment tax, tax on regular assessment, surcharge tax and so on. Other than this, you can also pay tax on distribution profits or tax on distributed Income.

Income tax can be paid online as well as through cash, cheque and Demand Draft. Whether you pay tax online or by visiting your Bank it is mandatory for the taxpayer to fill Challan 280.

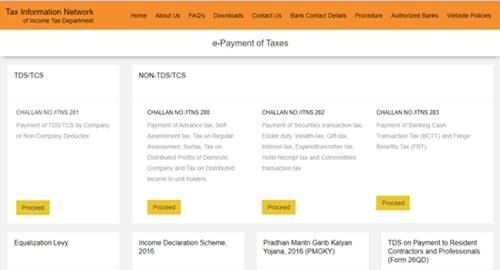

Step to Pay Challan 280/ITNS 280 Online

- Visit the TIN NSDL website

- Under ‘Services’ select the ‘e-payment: Pay Taxes Online’ option

- Click on ‘Challan 280 (Income Tax and Corporation Tax)’

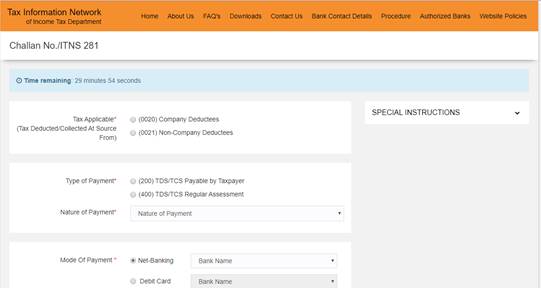

- Select the given options for which you have to pay tax

- Select the mode of payment, there are two modes of payments available- Net Banking and Debit Card

- Select the relevant Assessment Year. For the financial year 2019-2020, the assessment year will be 2020-2021

- Enter your complete address

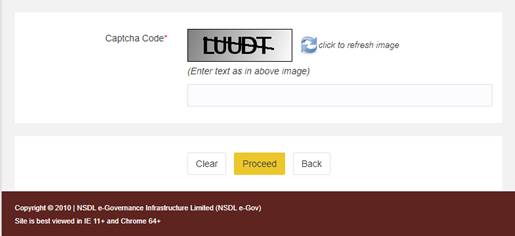

- Type given captcha and click on proceed

- Now, you will be redirected to your bank’s payment page

- After completing the payment you will get a tax Receipt on the screen where you can see the payment details. Here you can see the BSR code and Challan serial number on the right side of Challan

Note: Save the copy or take a screenshot of your BSR code and Challan copy you will have to enter in your Tax Return

When to Pay Advance Tax?

- If an individual has annual tax dues exceeding Rs. 10,000, then it is a must to pay income tax in advance.

- You are a salaried person and have a high income from interest or Capital gains or rental income.

- If you are a freelancer

- If you are running a business

How to Calculate and Pay Advance Tax?

Add income from all sources, including salary income, interest income, Capital Gains, etc. If you are a freelancer calculate your annual income from all clients and subtract your expenses from it.

Talk to our investment specialist

How to Calculate Tax Due on Total Income

Consider the latest income tax slab rates on your Taxable Income. To calculate your income tax due, reduce any TDS that may have been deducted from your full tax due.

Check the following table for due dates 2018-2019:

| Dates | For Individuals |

|---|---|

| Before 15th June | Up to 15% of advance tax |

| Before 15th September | Up to 45% of advance tax |

| Before 15th December | Up to 75% of advance tax |

| Before 15th March | Up to 100% of advance tax |

Self Assessment Tax

An individual cannot submit the ITR to the Income Tax Department unless you have paid full tax dues. Any balance tax paid by the taxpayer in the tax income after taking TDS at the time of filing your return is called Self-Assessment Tax.

The self-assessment tax you can pay online to ensure successful e-filing. In case you are paying tax after 31 March, you should also pay the interest under Section 234B and 234C with the tax due.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.