TDS Challan 281: Know How to File Challan 281

Back in the past, the income tax Department had its way of collecting income tax manually. However, the process used to have several errors popping up every now and then. To put a stop over silly mistakes, Online Tax Accounting System or OLTAS came into existence! Basically, OLTAS is liable for gathering, accounting, and reporting receipt and payments of direct taxes. In earlier times, three different copies of challan used to be issued. But, after OLTAS, a single copy is issued along with a tear-off strip, called challan 281.

What is Challan ITNS 281?

It was back in 2004 when an online tax accounting system replaced the manual tax collection process. The intention behind introducing this system was to decrease human intervention, thus, minimizing mistakes and facilitating online transmission of information regarding tax collected, submitted, refunded, and more.

With the single copy of challan that OLTAS issues, it becomes easier for taxpayers to track the status of e-challan or challan deposited in banks. There are three different types of challans that generally get issued:

- Income Tax Challan 280: It is precisely for depositing income tax

- Income Tax Challan 281: This one is for depositing Tax deducted at source and tax collected at source

- Income Tax Challan 282: This one is for depositing wealth tax, gift tax, securities, transaction tax, and other types of direct taxes

Compliance for Challan No 281

Challan 281 is issued when a taxpayer deposits- Tax Collected at Source (TCS) or Tax Deducted at Source (TDS). Hence, they would have to comply with the timelines mentioned for deducting as well as depositing tax. The last date for depositing the TDS payment generally is:

- TDS on payments (apart from the property purchase): 7th of the subsequent month

- TDS on the property purchase: 30th of the subsequent month

- TDS deducted in March: 30th April.

In case the tax deposit gets delayed, an interest of 1.5% will be charged per month from the date of deduction.

Talk to our investment specialist

How to File Challan 281?

There are two different and easy ways of filing challan 281:

1. The Online Process

If you are filing challan 281 online, follow the below-mentioned steps for a seamless process:

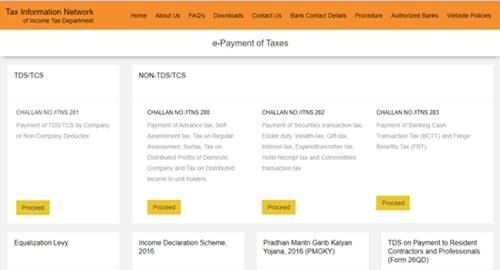

- Visit tin-nsdl website

- On the homepage, look for Challan No./ ITNS 281 and click proceed

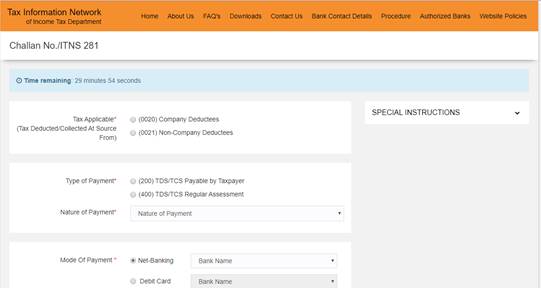

- The redirected window will open up a form that you have to fill up in 30 minutes

- Now choose the required options and fill up the columns with the appropriate information

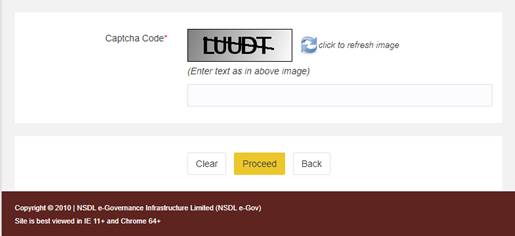

- Once you have filled up all of the details, enter Captcha click on ‘Proceed’; you will be then redirected to the Bank's portal for the payment process.

- Once the transaction gets successfully processed, a receipt will be displayed with the payment details, a CIN number, and the bank name through which you have made the e-payment.

2. The Offline Process

As far as the offline process is concerned, you would have to make the payment personally by visiting the bank and submitting your challan. If you are making the payment through cash or cheque, you should take note along.

Upon submitting the challan, the bank will be issuing a challan receipt with the stamp at the back as your submission proof.

How can you check TDS Challan status?

If you wish to keep a tab on your TDS Challan status, you can easily do that online.

Visit the TIN-NSDL site

Hover your cursor over the ‘Services menu’ and choose Challan Status Inquiry

- A new tab will open up where you can select either CIN Based View (Challan Based View) or TAN Based View

- If you are choosing CIN Based View, you would have to enter the details regarding your challan, available on the issued receipt

- And, if you are choosing TAN Based View, you would only have to enter the Collection Account Number (TAN) and date of deposit

FAQs

1. What is TDS and who collects TDS?

A: TDS is Tax Deducted at Source, and the Central Government collects it.

2. Who pays the TDS?

A: TDS is the tax paid by the individual or organization for rent, commission, salary, professional fees, salary, etc.

3. When is Challan ITNS 280 issued?

A: The ITNS Challan 280 is issued for the depositing of income tax. The Challan is applicable for self-assessment of tax, advance payment of tax, and tax on regular assessment.

4. What is Assessment Year for tax deduction?

A: Assessment Year or AY comes after the Financial Year or FY. The income earned during the FY is assessed and taxed. However, both AY and FY start on 1st April and end on 31st March. For example, FY 2019-20 and AY 2020-21 are the same.

5. What are the different types of payment?

Some of the sources of incomes that are liable to fall under TDS are as follows:

- Salary

- Interest on securities

- Prize money

- Contract payments

- insurance commission

- Brokerage commission

- Transfer of immovable property

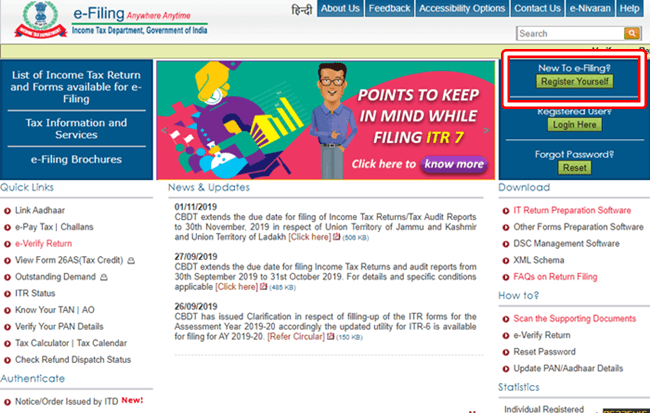

6. How to download a TDS paid Challan 281?

A: To check the status and download TDS paid Challan 281, you will have to log into the Income Tax Department website. After that, you will have to provide the TAN number, fill in the requisite details. Once you have provided the details, you can check the status of the Challan and download it.

7. What is the time limit to pay TDS?

A: The TDS has to be paid by the 7th of each month. For example, for April, May, and June, with the quarter ending on 30th June, the TDS has to be paid on 7th May, 7th June, and 7th July.

8. What is the difference between Challan 280 and 281?

A: The Challan 280 is generated for the payment of Income Tax. The Challan 281 is generated for the payment of Tax Deducted at Source.

9. Can I pay TDS in the offline mode?

A: Yes, you can pay TDS in the offline mode, but for that, you will have to get in touch with the bank where you have an account. After that, you will have to discuss the TDS payment method available with the bank.

10. How is TDS penalty calculated?

A: TDS penalty is calculated based on every tax you delay in paying. It is calculated until the penalty equals the amount you have to pay as tax.

11. Who files the TDS return?

A: The TDS return is filed by the employer or organization paying the TDS. Other than that, anyone who pays TDS has to file for TDS returns.

Concluding

Keep in mind that TDS challan 281 is a necessary receipt when you are ready to pay your taxes. So, whether you are choosing the offline method or the online, don’t forget to keep a tab on challan to track if your tax got accepted.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.