Table of Contents

Ready to Verify Your Returns? Know These Ways to ITR Verification

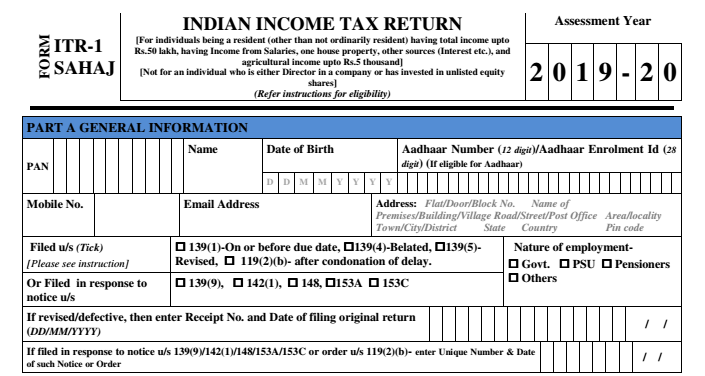

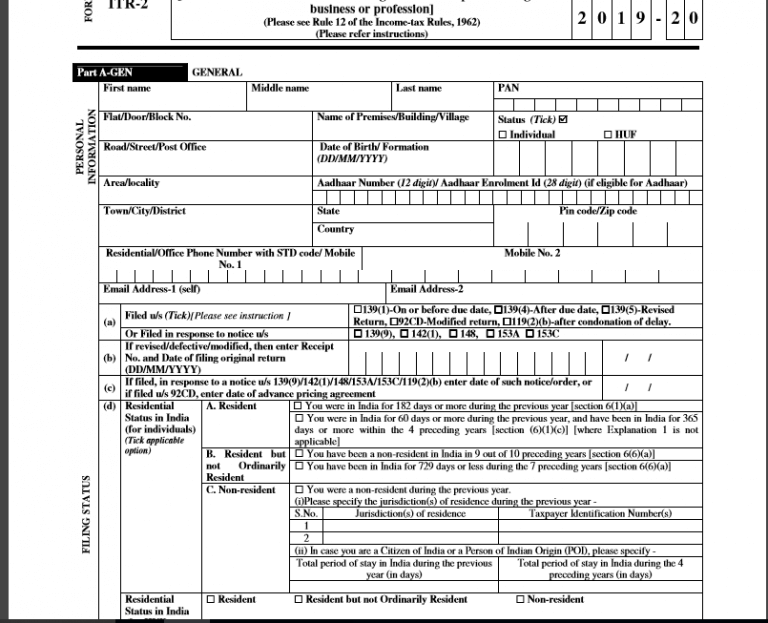

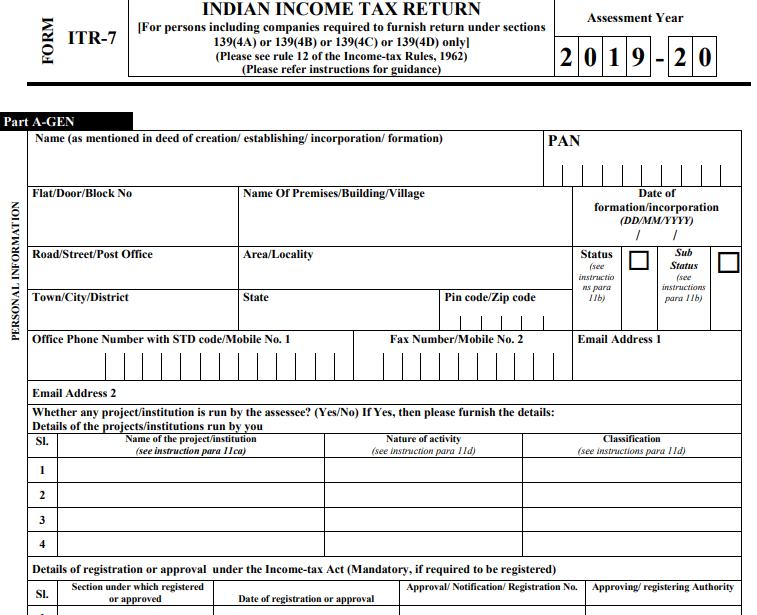

There are only a few scenarios where you, being an individual taxpayer in India, can choose to file your Income Tax Returns through the paper mode. For this mode, either you would have to be a senior citizen with 80 years or above age, or your annual Income should not be exceeding Rs. 5 lakhs and you must not expect any Tax Refund for a specific Fiscal Year.

And, for everyone else, filing tax returns has to be done electronically. However, your tax filing is not considered complete unless the income tax Department has acknowledged your form and you have verified the same.

The ITR verification process is necessary as it makes you aware of the fact that the Tax Return has been filed. So, how can you verify this? Read ahead and find out more in this post.

E-Verification of the Income Tax Return:

A few years back, the only method to verify the tax return was to get a printout of the acknowledgement form, sign it and send to the Centralized Processing Centre, situated in Bangalore. But, over the years, the income tax department has implemented an array of methods for e-verify ITR.

Considering that most of the ways are electronic, they help decrease manual work, which, in turn, can generate results quickly.

Thus, the following are the prevalent methods used for verifying the ITR and you can choose any one of them.

Generating EVC Through Net Banking

There are only a few banks in the country who have the authority to provide this service. If your Bank is covered in the list, you can verify your return by simply logging into the net banking account. And from there, you can create your Electronic Verification Code (EVC). To do so, follow these steps:

- Find out whether or not your bank is eligible for this purpose by visiting the official website

- Once you have found your bank listed, click on the name of your bank and log in

- Look for the option to login into the e-filing website and enter the portal

- Click on e-verify

- Click Continue to confirm the verification process

You will then get a confirmation message stating that your e-verification of ITR has been done.

Income Tax e-verify Using the Demat Account

The specific method is similar to verifying through the net banking option. However, for this one, you would have to pre-verify your Demat account number. Only after this, you would be able to generate the EVC. Follow these steps to verify the ITR:

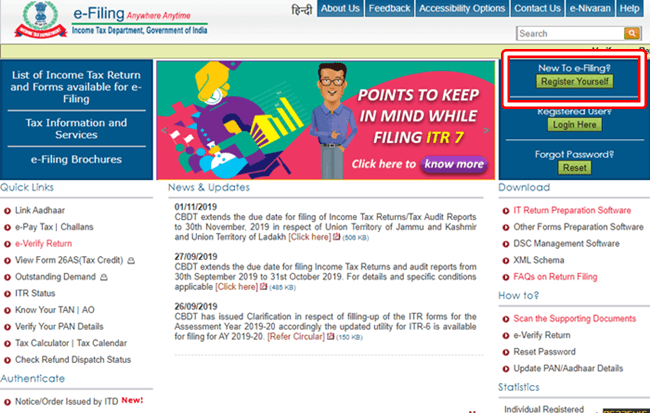

- Visit the e-filing portal

- Choose Pre validate your DEMAT account number

- Now, validate the account number and click on e-verify link

- Choose the option to verify with DEMAT account details

- Generate a One-Time-Password

- Now, enter the EVC number and verify

You will receive a confirmation message shortly regarding the success of your e-verify return.

Talk to our investment specialist

ITR Verify Through ATM

For ATM verification serve, the ITD has provided permission to only 6 major bank ATMs. If your associate is counted in the list, you can visit the ATM and use a PIN for e-filing option. This will help you generate your EVC. Follow the below-mentioned steps for the same:

- Swipe the ATM card and click on PIN option

- On your registered phone number, you will get an OTP

- Now, use that OTP to login to the e-filing portal and choose the option to e-verify return through bank ATM

- Enter the EVC on e-filing website and verify

You will soon get the confirmation message for the online ITR verification.

Talk to our investment specialist

Verifying through Aadhar Card

Another method to verify the Income Tax Return is by using the Aadhar card. This one seems to be an easy option as all you would have to do is:

- Visit the e-filing portal

- Generate One-Time-Password (OTP)

- Enter the received OTP

And, that is it. Your return has got verified.

Verifying through Email ID and Mobile Number

Lastly, you can also use your email ID and mobile number to verify your income tax returns. For that:

- Visit the official portal of the department

- From the top menu, choose Generate EVC available under My Account section

- Go to My Account and e-verify the return

- Once done, you will receive a confirmation message

One thing that you must keep in mind is that generated EVC is a unique number which is associated with your PAN. Hence, there can be only one EVC number. In case your return requires any revisions or modifications, you would have to generate a new EVC for your return.

Conclusion

Finally, above-mentioned are some of the preferable methods to e-verify income tax returns. Depending on the convenience, you can choose one from the list. Irrespective of what you select, always ensure that verifying returns is extremely essential. If not done, the department will not be processing your returns, and your tax will not be counted.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.