Table of Contents

- Services on Income Tax New Portal

- Features of the New Income Tax E-Filing 2.0

- E-Filing 2.0 Registration Process

- How to Use the E-Filing 2.0 Portal?

- Income Tax New Portal - Linking Identity Proofs

- E-Filing 2.0 - Logging In

- How to Access the Income Tax Portal via Net Banking?

- How to Access the Income Tax Portal via Aadhaar OTP?

- How to Access the Income Tax Portal via Mobile or Email?

- How to File Income Tax Returns on the New Income Tax Portal?

- Income Tax Mobile App - Aaykar Setu

- Installation of the Aaykar Setu App

- Conclusion

New Income Tax Portal – efiling 2.0

You would be familiar with an e-filing platform available to submit Income Tax Returns (ITR). The new income tax portal (e-filing 2.0) was launched on May 20, 2021, with a unique design that provides greater convenience for taxpayers.

It is the official web portal from the Income tax department, a part of India's finance ministry, and was developed as part of the national e-government plan. The purpose of this portal is to enable taxpayers and other stakeholders with a single point of access to income tax-related services such as requesting refunds, penalties, exemptions, appeals, and file complaints. This article will assist you in understanding the newly reformed portal profoundly.

Services on Income Tax New Portal

If you want to use the portal's services, first, you must complete the registration process. Once you've registered and logged in, the following services will be available to you.

- Filing the tax returns by filing the necessary forms

- Filing for refunds, reissues, and corrections

- Filing complaints

And a lot more.

Features of the New Income Tax E-Filing 2.0

The primary features and benefits of the new income tax portal are listed below:

Single Interface Interaction

In a single dashboard, you can see all interactions, uploads, and pending actions, along with the follow-up activity options.

Free ITR Software

ITR preparation software is accessible both online and offline. If you have no prior understanding of tax or pre-filing, you can seek assistance via the portal's interactive questions. ITR-1, ITR-4, and ITR-2 software are currently available online and offline, while ITR-3, ITR-5, ITR-6, and ITR-7 are yet to be released.

Prompt & Friendly Support

It is connected with a 'new Call center' to provide immediate assistance to customers. Your concerns are addressed through various resources such as comprehensive FAQs, how-to videos, and chatbots, live operators.

Mobile Application

There is a user-friendly, intuitive mobile application available to download. It can be effortlessly used to avail all the new portal's features at any time to file the ITR.

Faster ITR Processing

The new user-friendly platform will instantly process your Tax Return. Faster processing of tax returns means faster payouts.

Multitude Payment Methods

With the new portal, you now have the option of making a variety of payments. RTGS, NEFT, credit card, UPI, and net banking are just a few of the methods you can use to make a payment.

Talk to our investment specialist

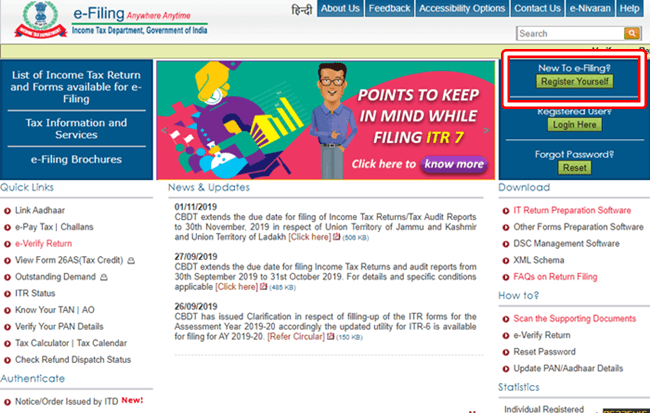

E-Filing 2.0 Registration Process

To file your ITR for the first time, you should register your account on the new tax filing portal. Here is a list of the required information and step-by-step instructions for registering and opening an account on the new income tax portal.

Registration Requirements

Before starting the registration process, ensure that the following conditions are met:

- You possess a valid and active PAN Card

- You have a mobile number and an email address

Here's a step-by-step explanation of how to sign up for the new income tax portal:

- Open the new income tax portal

- Click on 'Register’ on the top right corner of the web portal

- Select 'Taxpayer'

- Enter PAN

- Click on 'Validate'

- If your PAN is already registered or inactive, an error warning will popup

- Once the PAN has been successfully validated, click on ‘Continue’

- Next, input your name, first name, middle name, date of birth, gender, and residency status (Resident/Non-resident)

- Once completed, click 'Continue'

- On the next page, enter your primary mobile phone number and email address

- You have to specify whether the phone number and email address are yours or not

- Enter your communication address

- You will receive One Time Password (OTP) separately on your mobile and email address.

- Once the OTP have been entered, click on the 'Continue' button

- You will be prompted to validate all of the information you added in the previous tabs

- If you input any inaccurate information, you will be given the option to modify them in the last step

- Once the information has been reviewed, click 'Confirm'

- Now enter your selected password and confirm it

Note - Password should contain at least eight and no more than fourteen characters, should have both Capital and lowercase letters, at least one number, and one special character

- Enter the personalised message of up to 25 characters

Note - This personalised message is displayed each time you log into your new income tax portal account. Personalized message assists in determining whether or not you are logging into the legitimate website and not a fake one

- After entering the message, click 'Register'

You have been enrolled successfully on the new income tax portal website. You can now access your tax returns and other tax-related services by logging into your account

How to Use the E-Filing 2.0 Portal?

Here are a few helpful steps to use the e-filing 2.0 portal:

- Visit the officially revamped e-filing portal

- On the top of the web page, you'll find a menu with various categories having subgroups under it. Click the appropriate option to file your ITR, check your refunds, income tax forms, submit grievances, and a lot more.

- You can access services like rectification, refund reissue, download e-PAN, annual information statement, etc.

- Some tutorials on the main page under ‘Things to Know’ will assist you in understanding the portal better. Apart from that, you'll find documentation like how-to guides and frequently asked questions.

Income Tax New Portal - Linking Identity Proofs

The following is the procedure for linking your Permanent Account Number (PAN) and Aadhaar on the new income tax portal.

- Go to the *new income tax portal *

- Click on the 'Link Aadhaar' option under the home section on the left side panel

- A new window will open up where you’ll have to input your PAN, aadhaar number, name (as it appears on your aadhaar), and mobile number

- Click on 'Link Aadhaar'

- Your registered mobile phone will receive a One Time Password (OTP)

- Enter the OTP to complete the process

E-Filing 2.0 - Logging In

The tax department claims there are 14 ways to log into the portal. You can log in via Aadhaar OTP, Net Banking, a static password, and other methods. The methods and credentials necessary are listed in the table below.

| Method | Credentials |

|---|---|

| Aadhaar Number (Applicable for individual taxpayers) | User ID(Aadhaar) |

| Registered Mobile/Email OTP | User ID (PAN) and password |

| Aadhaar OTP (including the case where the E-Filing Vault option is enabled) | User ID (PAN) |

| Internet Banking (e-filing vault higher security enabled) | User ID and password |

| Internet Banking (e-filing vault higher security not enabled) | Net banking User ID and password |

| Static Password | User ID (PAN) and password |

| EVC Bank / Demat account (e-Filing Vault Higher Security enabled) | User ID (PAN) and password |

| DSC | User ID (PAN) and password |

| Mobile App - Scan QR Code | User ID (PAN) and password |

| Mobile App - Push Notification | User ID (PAN) and password |

| Mobile App-T-OTP | User ID (PAN) and password |

| Login with CA, TAN, ERI, or External Agency ID | User ID (PAN) and password |

| Login with ITDREIN User ID | User ID (PAN) and password |

| DSC login (when e-Filing Vault Higher Security is activated) — for CA, TAN User, ERI, and External Agency | User ID (PAN) and password |

How to Access the Income Tax Portal via Net Banking?

Below are the steps to access the new income tax portal using net banking:

- Click 'Login' on the e-Filing portal's home page

- Choose 'Net Banking' at the bottom of the login page

- Click ‘Continue’ after selecting your desired bank

- A popup window with a disclaimer appears; you must thoroughly read it

- Click on the 'Continue' button

- Your net banking page opens

- Log in with your net banking credentials

- After logging in, navigate to the bank's website and click on the link for the Electronic Filing portal

- Displays e-filing dashboard portal

How to Access the Income Tax Portal via Aadhaar OTP?

Here is the process to log in to the new income tax portal using aadhaar OTP. Before this, you must have ‘Aadhaar OTP Login' activated in your profile.

- On the home page of the e-Filing portal, click ‘Login’

- In the ‘Enter your User ID’ in the textbox and enter your PAN

- Select the secure access message check box

- Select ‘OTP on the mobile number registered with Aadhaar’ option

- Click ‘Continue’

- If you already have an OTP registered with Aadhaar enter it; if not, select the 'Generate OTP' option

- Select ‘I agree to validate my Aadhaar details’ checkbox

- Select ‘Generate Aadhaar OTP’

- Enter the 6-digit OTP received on your mobile phone and click ‘Login’

- Opens the e-filing dashboard

How to Access the Income Tax Portal via Mobile or Email?

Below are the steps to access the new income tax portal through an email address or mobile number:

- Go to the new income tax portal

- Click 'Login', which is on the top right of the web portal

- Login page opens

- In the ‘Enter your User ID’ textbox, enter your PAN

- Click 'Continue'

- Select the secure access message check box

- Enter your password

- Click 'Continue'

- Select whether the 6-digit OTP is delivered through voice call or SMS message to your primary mobile number

- Click on ‘Continue’

- Enter the 6-digit OTP issued to your registered mobile number or email address

- Click 'Login'

- After validation, the e-filing dashboard appears

How to File Income Tax Returns on the New Income Tax Portal?

Before filing ITR, make sure to calculate your Taxable Income according to the tax policy. Determine your category and choose an ITR form based on the definition provided by the income tax department for each ITR form. To e-file, your tax returns through the new income tax portal, follow the below steps.

- Visit the official e-filing website and click 'Login'

- Input your user ID

- Click 'Continue'

- Enter your password

- After logging in, select 'e-file'

- Click on 'File Income Tax Return'

- Select the tax year and click 'Continue'

- You will then be asked to file online or offline

- Select 'Online'

- Choose whether to file as an individual, hindu undivided family (HUF), or other

- Select 'Individual'

- Select the ITRs to file

Note - Individuals and HUFs who do not have a business or professional income can File ITR 2. Individuals can also pick between ITR1 and ITR4.

- Select 'ITR1' and click 'Proceed'

- Following that, you will be asked to explain why you are filing returns that are more than the basic exemption limit

- Select the appropriate option and click 'Next'

- Fill out the information about your bank account

- Make sure that your bank account has been pre-validated if you have already submitted the information

- After that, you will be taken to a new page where you can file your ITRs

- Confirm and validate the summary of your returns

- Validate your returns and submit a hard copy to the income tax department

Income Tax Mobile App - Aaykar Setu

The income tax department has made all its services and critical features available on the income tax mobile application named Aaykar Setu to make things easier for consumers. It allows you to file your Taxes on the go. In addition to the ITR form, this mobile app helps you with refund claims and other services. It includes features like finding a tax return preparer near you, tools for calculating taxes, ask it - a chatbot, tax gyaan - a game, and a lot more.

Installation of the Aaykar Setu App

Below are the ways to install the mobile application:

Missed Call

You can give a missed call on +91 7306525252. The income tax department will send an SMS containing the installation link.

The Official Portal

Go to the new income tax portal and click on the 'Taxpayer Services' option. Select the 'Ayakar Setu' mobile app and scan the QR code to download the application.

Play Store and App Store

You can download this mobile app directly from the google play store or the Apple app store by searching for 'Aaykar Setu' in the respective stores' search box. Once downloaded, install it on your mobile phone.

Conclusion

This new e-filing portal offers several benefits intended to make the filing of ITRs as seamless and straightforward as possible. With an easy-to-use interface, you can file taxes from the comfort of your home or from anywhere in the world, demonstrating the progress India has made toward becoming a digital nation.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.