Table of Contents

What is Electronic Filing?

Electronic filing is the method through which the relevant tax authority has pre-approved tax returns on the internet, utilizing tax preparation software. The advantages of e-filing have increased in recent years with the popularity of this fiscal preparation approach.

At any convenient moment, after the taxation agency starts taking returns, the taxpayer can file a Tax Return from home. Overpayment reimbursement is received quickly as compared to paper filings.

More about Electronic Filing

E-filing saves time and money from the tax agency as data is directly delivered to the agency's computers, minimizing key mistakes and input errors dramatically. If the individual and family Income for the tax year 2020 is 5 lakh INR or less, the taxpayer will not be required to pay any extra Taxes, but if it is higher than that, the person must pay the calculated tax for the income.

The taxpayer can submit the return with any tax preparation program containing e-filing capabilities or recruit tax workers using similar software. A key benefit associated with e-filing is that within 48 hours, the tax filer receives a notification of confirmation or refusal. You get the confirmation when there is evidence of document submission and their registration in the system.

On the contrary, you may have to face rejection in case your return is not accepted by the income tax department. The notice of refusal will also contain information on what has to be corrected for acceptability. If you have done e-filing before but are refused, the grace period for revising and resubmitting your return is five days. Then, you have to send a revised return on paper.

Talk to our investment specialist

Benefits Associated with E-Filing

Here are the benefits associated with ITR e-filing:

- In addition to the advantages of timely filing of Income Tax Returns, ITR e-filing is also handy.

- Due to unwanted delays in filing the return, you can avoid the sanctions imposed while utilizing the Facility of e-filing.

- When you file your ITR post at the end of the year, you are liable to pay the maximum INR '10,000' penalty; this can be avoided by utilizing e-filing.

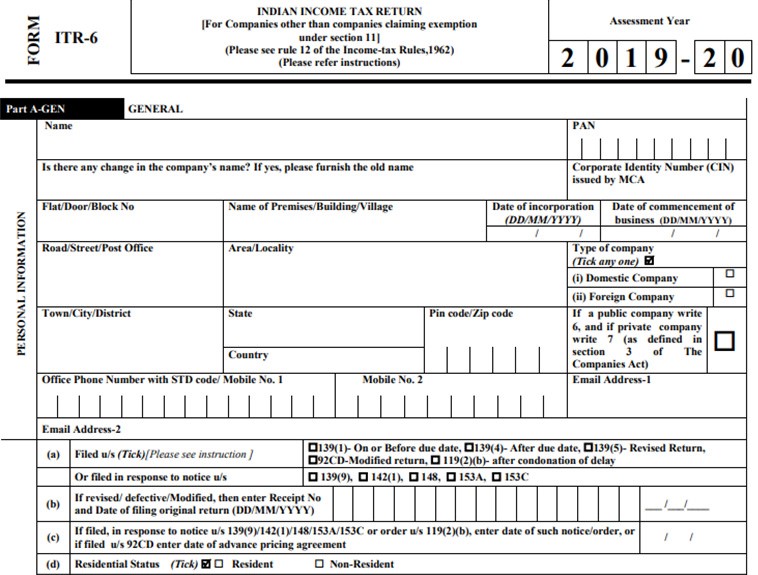

Required E-filing Documents

It is suggested to keep these documents useful for the following purposes during the online completion of the ITR form:

- PAN

- Aadhaar

- Details of Bank account

- Salary slips

- Rental receipts for house rent allowance claims

- Form 16

- Interest certificates received from deposit and savings accounts

- Details of Home Loan and insurance

- Details of investments applicable for deductions

- Other income proofs

3 Ways to E-File IT Forms

There are three fundamental ways of electronically filing income tax forms.

Digital Signing Certificate (DSC) can be used to file your e-file. A DSC helps in signing the documents electronically, as it is a digital equivalent to certificates in physical or paper form.

You can e-file even without a DSC. In this situation, a one-page document is generated as 'Return–Validation Revenue Tax' or ITR-V. If the information on Aadhar is not updated on the income tax site, the form should be printed, submitted, and signed by post to the Central Processing Centre (CPC).

You may use the Aadhar number or can email the revenue tax return through a bank if you don’t have a DSC. The ITR-V must not be sent to the CPC in this circumstance.

E-filing Portal Registration

Here are all the steps that you must follow for registering for e-filing.

- Register yourself at the website of the income tax department.

- Keep all the documents handy, including the PAN, tax Deduction account number, and the membership with ICAI (for chartered accountants).

- Create your account after providing all the required details.

- Submit the request.

- You will receive an activation link after successful registration on your email and phone number. Click on the link and provide the received PIN to activate your account.

- Login to your account using the ID, password, DOB, and captcha code, and then apply for e-filing.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.