Table of Contents

Section 80CCC of Income Tax Act

Pension is a security that provides peace to both young and old alike. People look for jobs that provide pension or start saving up for their retirement. This is to provide themselves with a sense of security in much uncertainty that exists in the changing world.

Section 80CCC of the income tax Act deals with a Deduction on pension funds. It provides deductions up to Rs. 1.5 lakhs per annum for an individual’s contributions toward specific pension funds.

What is Section 80CCC?

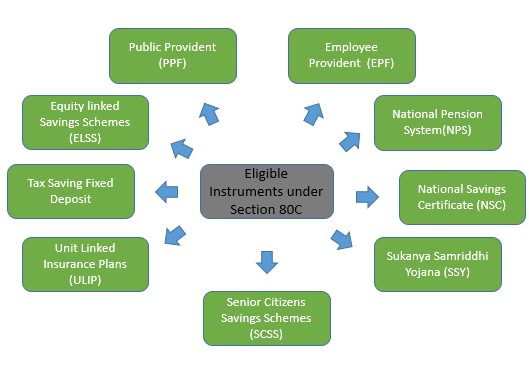

It is an exemption limit that includes money spent on the purchase of fresh payments toward renewal or contribution of an existing policy. The main condition of getting this exemption is that the policy for which the money has been spent should be giving a pension or periodical annuity. Section 80C and Section 80CCD(1) along with Section 80CCC are read together and the total exemption limit is up to Rs. 1.5 lakhs.

Under Section 80CCC you can claim a deduction for investments on specific pension funds. They include:

- Funds specified Under Section 10 (23AAB) of Income Tax Act

- Annuity Plans of Life Insurance Corporation of India (LIC)

Conditions Under Section 80CCC

Mentioned below are the terms and conditions under Section 80CCC:

- Section 80CCC benefits are available to those persons who have paid the amount for renewal or purchase of a Life Insurance policy from their Taxable Income

- Any amount that is received from the policy as the monthly pension is taxable as per prevailing rates

- On surrender of the policy, the amount will still be subject to taxation

- Rebates that were available on investment before April 2006 are not allowed under Section 88

- Amount deposited before April 2006 is not eligible for deduction

Talk to our investment specialist

Eligibility Criteria Under Section 80CCC

In order to claim the benefit under this section, you must meet the following criteria:

1. Individual

You have to be an individual to be able to claim benefit under this section. Even Non-resident Individuals (NRI) can avail the aforementioned benefits.

2. Taxable Income

Your income must be taxable in order to gain this benefit. If you have an income below the basic exemption limit, you cannot claim this deduction.

3. Specific Pension Funds

You can claim this benefit only if you invest money in specified pension funds during a financial year.

4. Investment

The investment you make should be solely out of your taxable income. If done otherwise, you will not be eligible to claim the benefit.

5. Hindu Undivided Family (HUF)

A hindu undivided family (HUF) or firms cannot claim a Tax Rebate under this section.

Note: After you have invested funds under Section 80CCC, you will be required to report the same at the time of filing your Income Tax Return to get a tax benefit. This will be available on the amount invested and not on interest or bonus accrued.

Benefits Under Section 80CCC

You will be eligible for following tax benefits under Section 80CCC:

1. Deduction Amount

One of the biggest benefits under this section is that you get a complete deduction up to Rs. 1.5 lakhs.

2. Amount Received

The pension or withdrawal amount received is completely taxable in the hands of the receiver.

3. Interest or Bonus

The interest or bonus amount received will also be taxable in the hands of the receiver.

Note that no tax benefit as mentioned under Section 80CCC is allowed if you have already been a beneficiary under Section 80C. The deduction under Section 80C, 80CCC and 80CCD(1) cannot exceed Rs. 1.5 lakhs.

What is Section 10(23AAB)?

Section 10(23AAB) has provisions that are linked with Section 80CCC. It is related to the income that is earned from a fund set up by a recognised insurer including Life insurance Corporation of India (LIC). The fund should have been up before August 1996 as a pension scheme. Note that the contribution made to the policy should be with the intention of earning pension income in the future.

Important Points to Remember Under Section 80CCC

Here are a few points to remember under this section:

1. Deduction Limit

The deduction limits under Section 80CCC are clubbed together with Section 80C and Section 80CCDD(1) and the total deduction limit is determined.

2. Premium Paid

Remember that the deductions are applied to the premium paid for the preceding year of assessment. If you pay the premium for 2-3 years together, the deduction can be claimed for the amount that pertains to the preceding year only.

3. Available Deduction

The maximum deduction that is available to attain is Rs. 1.5 lakhs.

4. Insurance Providers

The provisions under this section are available to insurance providers who offer annuity or pension plans. The insurer could be both public or private sector entity.

Difference Between Section 80C and Section 80CCC

The main point of difference between Section 80C and Section 80CCC is mentioned below:

| Section 80C | Section 80CCC |

|---|---|

| According to Section 80C deduction can be claimed by an individual or Hindu Undivided Families (HUFs). When an investment is made or money is spent on specified avenues up to Rs 1.5 lakh, this investment/expenditure can be claimed as a deduction from gross total income before calculating tax payable on it in a financial year. | Section 80CCC is an exemption limit that includes money spent on the purchase of fresh payments toward renewal or contribution of an existing policy. It is related to pensions and periodical annuity |

Conclusion

You can save much toward your taxation liability under Section 80CCC. Keep a record of the transaction for the premium you pay toward the policy in order to avail this exemption.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like