Table of Contents

- What is Section 154 of Income Tax?

- Features of Section 154

- Section 154: Errors that can be Rectified

- Applying for Rectification Under 154 of Income Tax Act

- Steps to take if you Receive Section 154 Notice

- Conclusion

- FAQs

- 1. What is the importance of section 154?

- 2. What are the amendments that come under the purview of sec 154?

- 3. Who can apply for rectification under section 154?

- 4. Can the tax authority send a notice under section 154?

- 5. Can I file for rectification online?

- 6. What are the steps that I need to follow to file for rectification?

- 7. Where is the request processed?

- 8. Can the tax authority demand a refund on excess payment?

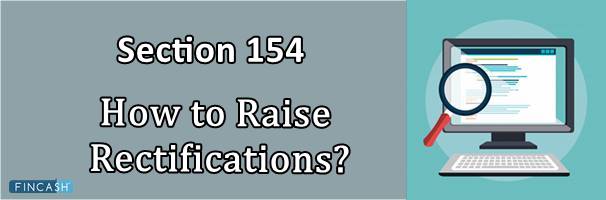

How to Raise Rectifications Under Section 154?

Nobody seems to be working with complete perfection. Unless you are a robot, you will surely experience mistakes as well as discrepancies in your work. And, when it comes to filing Taxes, not just taxpayers, but the income tax department can commit some grave mistakes sometimes.

As they say, “To err is human and to persist the error is diabolical.” Thus, the Income Tax Department (ITD) has come up with a provision to rectify the mistakes that would have occurred during the assessment. All of these rectifications are made under Sec 154 of the Income Tax Act.

What is Section 154 of Income Tax?

Basically, this section of ITA deals with the rectification of any error or mistake that may have occurred in the records of an individual by the income tax department. Apart from that, the section is also meant to Handle amendments of errors in the orders issued by the Assessing Officer.

Under Section 154 of income tax, corrections can be made to orders that were issued under sections 143 (1), 200A (1) and 206CB (1). These notices are generally issued before a case is assessed and the errors are amended in TDS and TCS statements.

Features of Section 154

Some of the primary points of this section are:

The tax authority is liable to send an order either on the Basis of inappropriateness pointed out by the income tax department or their own volition. The order could be a request for extra details, mismatch in tax credit, a mistake in gender, refund mismatch, discrepancy in Advance Tax, and more.

Before any action is taken, the taxpayer shall be notified, especially if the action is about reducing/increasing a refund, increasing the assessee or deductor’s liability, enhancing the assessment, or more. This basically means that if any sort of amendment made under this section leads to an increased tax amount or lower exemption for the assessee, the IT department becomes responsible for sending a written notice before taking any sort of action.

If the action taken under section 144 resulted in reduced taxes or increased exemption, IT Department becomes responsible for providing the refund to the assessee.

In case a refund has already been made and the refund amount gets reduced afterwards, the assessee is responsible for paying back the excess amount to the IT department.

A notice can only be issued up to 4 years after the rectification made in a particular financial year.

If a taxpayer puts an application for rectification under section 154, the IT Department must respond within 6 months of the Receipt of the request.

Talk to our investment specialist

Section 154: Errors that can be Rectified

- Factual error

- An error occurred due to the failure of adherents by the law provisions

- Arithmetic mistakes

- Minor errors

Applying for Rectification Under 154 of Income Tax Act

The online rectification request filing process for Sec 154 of income tax is quite a simple task. However, before you choose to go with it, you must cautiously examine the order against which you want to file. You must make sure that the calculations are appropriate and all of the deductions, as well as the examinations, have been taken into consideration.

It could be possible that your calculations might turn out to be wrong and the corrections made by the Centralized Processing Centre, Bangalore, are correct. To crosscheck this, you can compare your Income Tax Return with Form 26AS. In case you are not sure, you can seek help from a professional Tax consultant.

If you still find mistakes after thoroughly going through the details, you can then apply for the rectification. Keep in mind that these mistakes should not be any sort of omissions or additions in investment declaration or income.

As per the Income Tax Act, the mistake for which you are going to apply the rectification request should not require any investigation or debate.

Steps to take if you Receive Section 154 Notice

Lately, the income tax department seems to be issuing self-generated rectification orders to a majority of taxpayers. However, upon receiving these orders, people are left stumped and feel clueless about what to do next.

If you receive such notice, don’t fret out. Simply follow the below-mentioned steps, and the issue will be sorted out effortlessly:

Crosscheck whether you have received the information regarding the notice via email or in your post.

If you didn’t receive any notification, you could submit a request for resending the intimation. For that:

- Visit this official portal of the IT department

- Log in or sign up to create an account

- On the dashboard, visit the section My Account > Request for intimation u/s 143(1)/154

- Complete the information & click on submit

If you have already received the intimation, check for the reasons behind the difference between the claims raised by you and what the ITD has considered

Visit the ITD portal and check your form 26as

Once done, either accept the rectifications made by the ITD or you can respond with your side of the factual data. If you are not accepting the corrections, you have to mention the reason behind it

Then, sign the notice and send it to the address stated at the top of the notice

Conclusion

In case there are any minor discrepancies, the income tax department can rectify it themselves. However, if you notice anything unusual happening afterwards, you can always raise the complaint by visiting the official portal of the department. Keep in mind that whatever step you take, being 100% sure of accuracy from your end is quite essential.

FAQs

1. What is the importance of section 154?

A: Section 154 of the Income Tax Act of 1961 allows you to rectify errors that you might have made while filing your IT returns. However, the errors you can rectify have to fall under categories such as factual error, an error caused due to failure to adhere to legal provisions, arithmetic error, or other minor errors, such as clerical errors. Any other type of mistake cannot be rectified under this section. The act was introduced to allow the taxpayer to rectify simple mistakes that he or she might have inadvertently made while filing his or her IT returns and preventing the mistakes' perpetuation.

2. What are the amendments that come under the purview of sec 154?

A: All notices and amendments issued under 143(1), 200A(1), and 206CB(1) of the Income Tax Act come under the purview of section 154. These are usually amendments and notices issues regarding TDS and TCS statements.

3. Who can apply for rectification under section 154?

A: As per the rule, individuals who have filed for their IT Returns can rectify an error in their tax filing. However, if you feel you cannot manage the rectification form's intricacies, you can ask your tax consultant to do it on your behalf.

4. Can the tax authority send a notice under section 154?

A: If there is any mismatch or incongruity found by the department in the IT returns than they can send the notice. Say, for instance, dichotomies such as gender mismatch, tax credit error, refund miscalculation, or discrepancy in the advance tax payment can be flagged off by the tax authority, and a notice can be sent to the taxpayer.

5. Can I file for rectification online?

A: Yes, you can file for rectification online. However, you can file for rectification only after filing your IT returns for the given financial year.

6. What are the steps that I need to follow to file for rectification?

A: When you file for rectification, you will have to log-in to the official website of the Income Tax Department of India. After that, you will have to go to e-file, scroll down, and click onto 'Rectification.' When you click on 'Rectification,' you will be prompted to log into your account, which you can do by providing your PAN, Return to be rectified, last communication Reference Number and assessment year.

When you provide these details and click on validate, you will get a drop-down menu from which you will have to select the Rectification Request Type and select a reason for rectification. Once you have provided the necessary details, click on 'OK,' and your request will be sent.

7. Where is the request processed?

A: The request for verification will be processed in CPC Bangalore. After processing of Rectification Request, an order under section 154 will be issued.

8. Can the tax authority demand a refund on excess payment?

A: Yes, suppose on reassessment, the authority identifies that the department has made a refund, but the amount has been reduced. In that case, the tax authority can ask the assessee for a refund.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.