Table of Contents

Educate Yourself With These Tax Full Forms

“Make sure you comply with the ITR filing guidelines for this AY!”

Need help understanding what this sentence tries to convey? Don’t worry; you are not alone. So many people do not know the A-B-C of taxation when almost everyone has to pay Taxes in one way or another.

When you have a Chartered Accountant (CA) who manages all income tax payment compliances, things take a smoother turn. However, this ignorance can cost a person heavily. The importance of knowing and understanding tax must be considered. Having basic tax knowledge is necessary for a taxpayer. Thus, this article will help you understand the most common full forms of taxation.

Why Should you Understand the Basics of Tax?

Being a responsible citizen of the country, paying taxes is an Obligation. But why is it important to understand why and what tax is to be paid? These points might help in making this clearer:

- Firstly, you pay taxes out of your hard-earned money. So, it is evident that you must know where this money is used by the government

- Secondly, if you know the technicalities of tax, especially Income tax, you will be able to do better Tax Planning. You can even save tax by staying within the legal provisions

- Lastly, being fully dependent on your CA and being unaware of the tax to be paid can dupe you

Tax Abbreviations Everyone Must Know

There are innumerable abbreviations one can come across when it comes to taxes. While it would be difficult to know and understand each one of them, the below-mentioned are some basic tax full forms to know.

- AIR: Annual Information Return

This refers to the information about the financial transactions an assessee carries out during a year. This has to be submitted only by specified persons (specified in the Income Tax Act, 1961)

- AJP: Artificial Juridical Person

An artificial juridical person can be a company (either government, public or private), an NGO, a government agency, or an international organisation that is recognised as a person by the law. An AJP has many rights similar to those enjoyed by a natural person

- AOP: Association Of Persons

An AOP is a group of persons who are together to achieve a specific objective. Here, a person may mean an artificial or a natural person. Companies, NGOs, individuals, etc., anyone can be a part of an AOP

- AY: Assessment Year

This is the year in which the previous year’s income is assessed, and tax is calculated on it. The returns are filed this year as well as tax is paid this year

Talk to our investment specialist

- BOI: Body Of Individuals

A group of individuals (only natural persons) who come together for a particular objective is called a Body of Individuals

- CCIT: Chief Commissioner of Income Tax

It comes under the Union Ministry of Finance. CCIT is responsible for every tax-related activity of the central government

- CBDT: Central Board of Direct Taxes

This is a statutory body formed under the Central Board of Revenue Act of 1963. CBDT is responsible for levying and collecting direct taxes

- CGST: Central Goods and Services Tax

CGST is the tax levied by the central government on intra-state transactions of goods and services

- CGT: Capital Gains Tax

This is the tax levied on the sale of capital assets

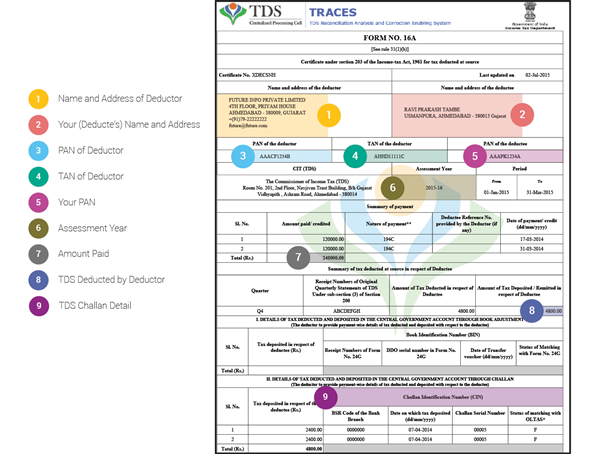

- CIN: Challan Identification Number

This is a 7-digit number that is allotted to tax payers for the payment of regular assessment tax, self-assessment tax, Advance Tax, and tax on distributed profits or distributed income

- DDT: Dividend Distribution Tax

The tax a company has to pay on the dividends declared is called DDT. This is 15% of the gross dividend in the case of domestic companies

- DGIT: Director General of Income Tax

This is the attached office of the CBDT, i.e. Central Board of Direct Taxes

- DTAA: Double Taxation Avoidance Agreement

Often when a taxpayer resides in one country and earns income from another country, they are in a dilemma of paying taxes to both countries. To avoid such conflicts, countries come into a Double Taxation Avoidance Agreement

- EBN: E-Way Bill Number

This is the bill number of the transaction of goods exceeding Rs.50,000. This bill is generated electronically

- FATCA: Foreign Account Tax Compliance

A country comes into an agreement with the US government required to identify the US accounts of various financial institutions

- FBT: Fringe Benefits Tax

This tax is levied on the fringe benefits (like health insurance, workers’ compensation, etc.) given to an employee by the employer

- FORM RFP: Refund Form

This form is related to GST refunds

- FY: Financial Year

A financial year is 12 months, starting on the 1st of April of a year and ending on the 31st of March of the next year. It is different from a calendar year

- GSP: GST Suvidha Provider

A GST Suvidha Provider is an authorised entity which helps taxpayers in compliance with GST requirements

- GST: Goods and Services Tax

This is the tax levied on all goods and services, from manufacturer to consumer

- GSTIN: Goods and Services Tax Identification Number

Every business entity has a unique 15-digit number after they register themselves under GST

- GSTN: Goods and Services Tax Network

This is a non-profit and non-government organisation that manages the web portal and the entire GST information technology system

- GSTR: Goods and Services Tax Return

This is the monthly/quarterly return to be filed by each taxpayer. There are different GSTRs for different taxpayers

- GST REG: GST Registration

This is the registration portal for GST payers

- GTR: Gross Tax Return

GTR is the gross income before paying taxes

- HP: House Property

According to the Income Tax Act 1961, a house property is any building, Flat, shop, etc., owned by the assessee

- HRA: House Rent Allowance

This is the amount given by the employer to an employee to compensate them for payment of rent of the house the employee resides in

A HUF is a Hindu family comprising lineal descendants from the same ancestor, including their wives and unmarried daughters. A HUF is usually involved in a business. It is treated as a separate entity by the law

- IGST: Integrated Goods and Services Tax

IGST is the tax levied on inter-state transactions of goods and services. This is collected by the central government and distributed to the state governments

- IRS: Indian Revenue Services

The officers of the IRS are concerned with proper levying and collection of taxes

- IT: Income Tax

The tax levied on the income of an assessee, which can be an individual, company, HUF, LLP, partnership, AOP, or BOI

- ITA: Interactive Tax Assistant

This is a tool developed by the IRS to assist in tax-related queries of individuals in specific circumstances

- ITAT: Income Tax Appellate Tribunal

It's a quasi-judicial body dealing with matters relating to indirect taxes

- ITC: Input Tax Credit

Input Tax Credit is used to reduce the GST liability by an enterprise. It is the amount of tax the entity pays in purchasing its raw material

- ITDREIN: Income Tax Department Reporting Entity Identification Number

This is a unique 16-digit number issued to the entities reporting under Section 285BA of the Income Tax Act, 1961

- ITR: Income Tax Return

This is the return required to be filed by all taxpayers annually to comply with the tax-paying legal requirements

- ITR-V: Income Tax Return Verification

Every ITR needs to be verified, or else it is not valid

- JSON: JavaScript Object Notation

After filling in all the information relating to all incomes of an assessee, a JSON file is generated by the computer

- LLP: Limited Liability Partnership

This is an entity that is similar to a partnership, but the partners have limited liability. It takes the best features of a partnership and a limited liability company

- MAT: Minimum Alternative Tax

Some companies do not pay taxes by utilising the provisions for tax exemptions and deductions even when they earn good profits. Such companies are brought under the tax net, and MAT is levied on their profits

- NCLT: National Company Law Tribunal

This is a quasi-judicial body that settles conflicts related to companies. This body was formed in place of the Company Law Board

- NRI: Non-Resident Indian

An individual who resides in India for less than 182 days in a year or has been in India for less than 60 days in that year and less than 365 days in the four years preceding that year

- PAN: Permanent Account Number

This is a unique 10-character alphanumeric number allotted by the Income Tax Department

- POA: Power Of Attorney

When a person writes a letter giving authority to a person to represent or act on their behalf in business, private affairs, or any legal matter, it is called a power of attorney

- PY: Previous Year

The year whose income is assessed for paying taxes is called the previous year

- RFA: Rent-Free Accommodation

When an employer provides accommodation to the employees either free of rent or with minimal rent, it is called rent-free accommodation

- RCM: Reverse Charge Mechanism

In some cases, the receiver is liable to pay a reverse charge on the goods and services supplied by the supplier

- ROC: Registrar Of Companies

ROC is an office that comes under the Ministry of Corporate Affairs dealing with companies on the ground level. All companies are required to file their annual returns and other relevant information with the ROC

- SGST: State Goods and Service Tax

SGST is the tax levied by the state government on intra-state transactions of goods and services

The tax levied on the sale and purchase of securities

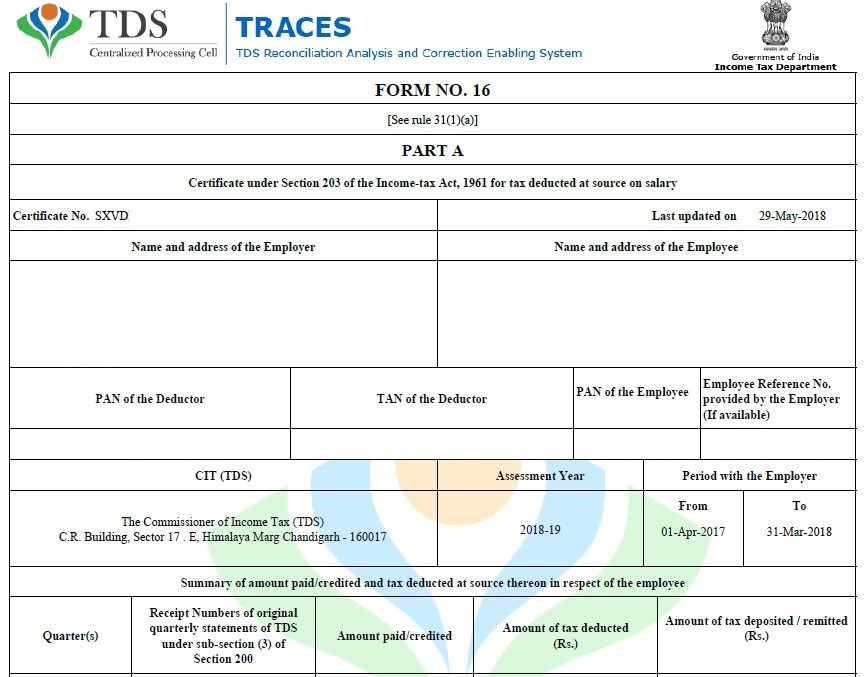

- TAN: Tax Deduction and Collection Account Number

This is a unique Alpha-numeric 10-digit number issued by the Income Tax Department to taxpayers who require to collect or deduct tax

- TCS: Tax Collected at Source

This is the tax amount collected by a seller at the time of sale exceeding the amount already deposited with the government as tax

- TDS: Tax Deducted at Source

The tax collected at the source of income is called TDS

- UTGST: Union Territory Goods and Service Tax

This tax is levied by the Union Territories on the intra-Union Territory supply of goods and services

Conclusion

Spending money always has to be a very wise decision. While going on vacations, you choose destinations that are worth the money. Then where does this ‘careful spender’ go when it comes to paying taxes? Being a little more aware of taxes will not harm you. So, from now on, be careful that you know which tax you are paying by educating yourself well.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.