Table of Contents

Difference Between Form 16 and Form 16A

The concept of 'Tax Collected at Source' (TCS) and 'Tax Deducted at Source' (TDS) are specifically meant to collect the revenue at the source where Income is being generated. This is one of the significant ways of ensuring that the deducted tax is collected at a greater and wider base. This is also considered a convenient way of collecting tax.

So, in regards to TDS and TCS, Form 16 and Form 16A are used. But, are you aware of how and why they are used? If not, let’s find out the difference between form 16 and form 16a in this post.

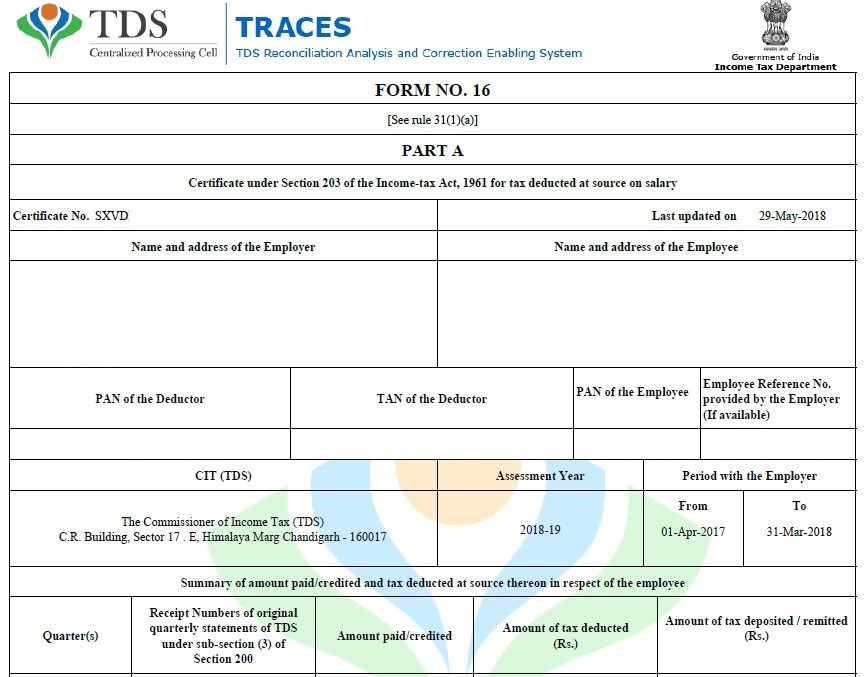

What is Form 16?

Form 16 is meant to provide details of Taxes that your employer paid on your behalf as per the part of your salary. Basically, employers have been given a right to submit taxes to the government on your income in case the amount is more than the exemptible limit.

Also, this means that if your salary comes under the taxable limits as per the income tax law for that specific year, your employer may not provide Form 16.

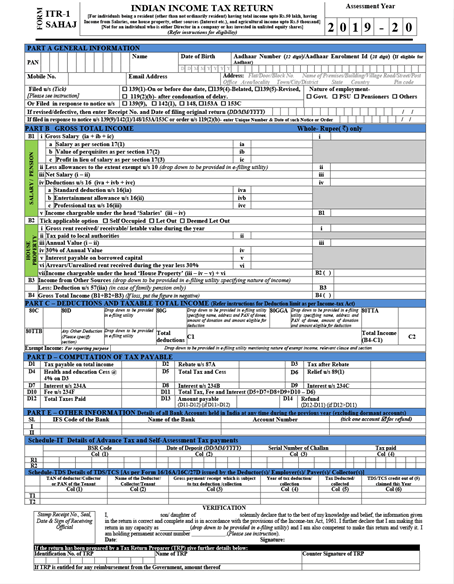

Coming to the form, this one is divided into two different parts – Part and Part B, wherein, part A comprises details of employer and employee and the part B carries breakup of the deductions, salary paid and more. All of this information is vital when it comes to filing the ITR.

As per the Financial Year 2019, the form has got a new format, which is going to be issued by your employer before 10th July. If you had switched jobs in that financial year, you will get Form 16s instead of Form 16.

Talk to our investment specialist

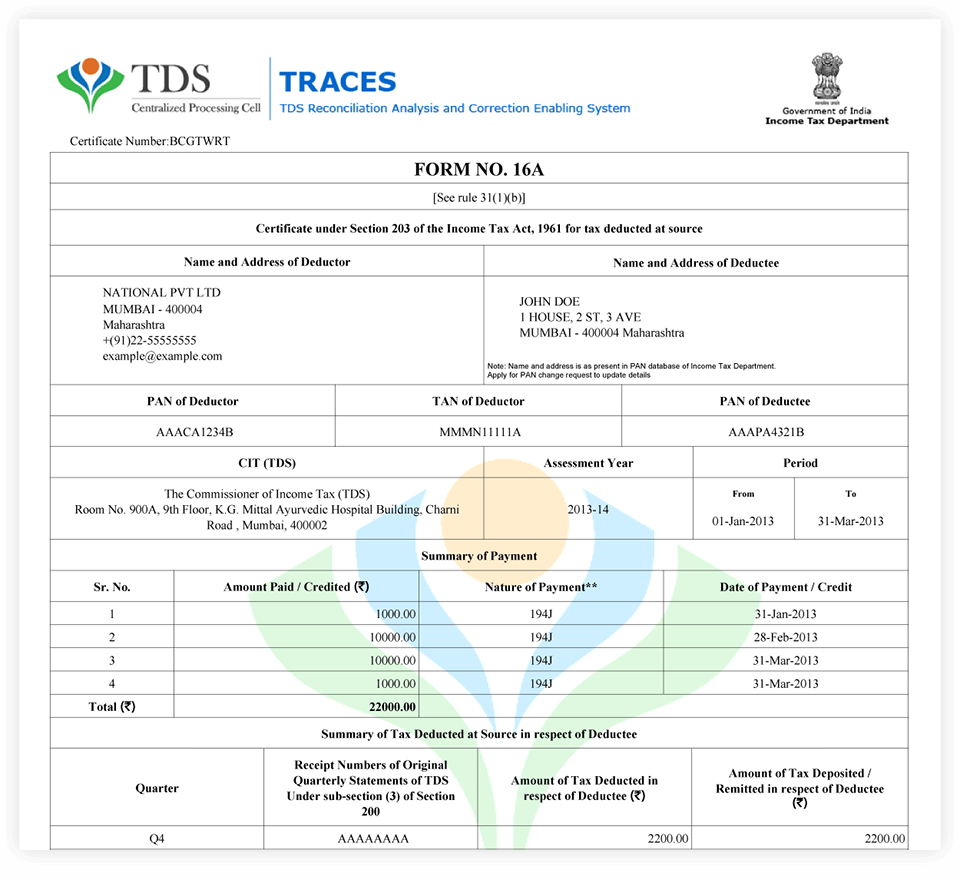

What is Form 16A?

Form 16A is considered as a TDS certification in a situation if you have earned any income apart from your salary in a financial year. For instance, the Bank can issue a Form 16A if you have earned anything in the form of interest on your deposits.

If you have worked as a freelancer and Earned Income from different clients, your clients shall issue a Form 16A if they have deducted TDS on your payment. Note that this form can be issued by any institution that has deducted and deposited taxes on your behalf.

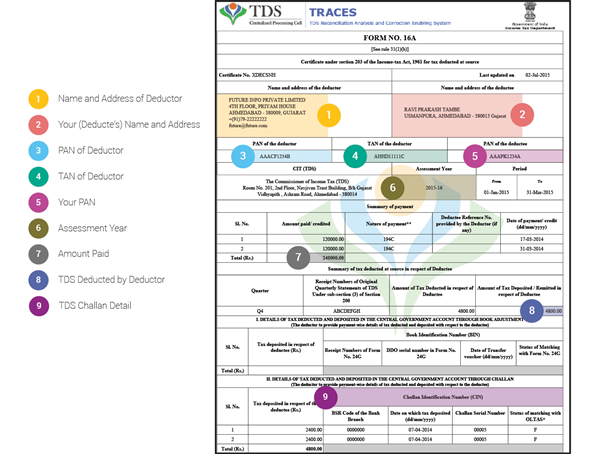

The form comprises certain a set of details, such as name and address of the deductee and deductor, TAN, PAN, challan details, and more. Also, the form has space to add details on the income that you earned and the TDS that was deposited subsequently. On top of that, the form 16a download process is not that difficult either.

A Comprehensive Comparison of Form 16 and Form 16A

To further clear out your doubts, here is a detailed comparison of both the forms:

| Comparison Criteria | Form 16 | Form 16A |

|---|---|---|

| Income source | Salary | Any additional income apart from salary |

| Income Limit | A regular salary of more than Rs. 2,50,000 | The minimum limit varies based on the income source |

| Issuer | Employer | Any institution or person who deducts TDS on the total amount |

| Receiver | Salaried person | Non-salaried people |

| Time of Issue | Annually | Quarterly |

| The Governing Law | Section 203 of the Income Tax Act for TDS on income chargeable under Salaries head | Section 203 of the Income Tax Act for TDS on income apart from the salary |

Conclusion

Deposited tax deducted on the source is an essential part of the entire tax submission process. So, if you are a salaried person or working as a freelancer, understanding which form should you be filling is quite necessary.

Now that you have understood the difference between Form 16 and 16a, don’t forget to ask the required certificate from your employer or any other associate who deducts TDS on your income.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.