Tax Relief Under Section 89(1)- How to File Form 10E?

Did you receive any advance salary? If yes, then you might be worried about the tax implications regarding the same? To cater to all your questions and queries regarding Section 89(1), here’s an article that gives detailed information about arrears of salary, total taxable amount and so on.

Section 89(1)

Tax is calculated on your total Income earned or received in the current year. If your total income includes any past dues paid in the current year, then you may be worried about paying higher Taxes on arrears. To save you from taxes, the IT Department has enabled the relief under section 89(1).

How to Compute Tax Relief under Section 89(1)?

You need to follow certain steps to compute relief under section 89(1):

- The taxpayer should ascertain the tax payable on his total income, including arrears received a year

- The assessee should find out the tax payable on his total income excluding arrears

- Now, subtract the figures you got in the total income, including arrears from the total income excluding arrears

- Find out the taxable amount on the total income including, arrears receiving year

- Find out the taxable amount on the total income excluding, arrears receiving year

- Now, you have to subtract the figures obtained on the total income including, arrears receiving year from the total income excluding arrears receiving year

Note: If the amount of relief is excess from step 3 over step 6 then there will be no relief if the amount step 6 amount is more than step 3.

Compensation of Termination of Employement

If the employee receives a payment from the employer or former employer at or in combination with the termination of employment, then the tax relief will be available in the below-mentioned conditions:

- Compensation is received after the continuous services not less than 3 years

- The unexpired part of the term of employment should not be less than 3 years

Talk to our investment specialist

What is Form 10E?

form 10e has made to give relief to the taxpayers under Section 89(1). As per Section 89(1), tax relief is provided by recalculating tax for both the years. It is calculated on the year arrears received and the year arrears pertained.

If you do not file Form 10E and claim the relief under section 89(1), then the tax officer can send a tax notice from the income tax Department for not filing the Form 10E.

How to File Form 10E?

The IT Department has made obligatory for the taxpayers to file Form 10E if they want a relief under section 89(1). The government employee in a company, local authority, co-operative society, institution, university, is entitled to file the tax relief under section 89(1).

In the case of the other employees, the application has to be given to the tax officer instead of the employer.

The following steps to file a Form 10E under section 89(1)

- Visit incometaxindiaefiling. gov.in login with the user id and password, if you don't have one then create it

- Click on the tab ‘e-file' and select ‘Prepare & Submit Form' from the drop-down menu

- Now, choose ‘Form 10E’ from the drop-down menu

- Fill the relevant assessment year and press continue

- Now you will see the instructions to e-file Form 10E will become available

- Click on the blue tabs and fill the details asked on the screen

- Once you complete filling the details, click submit

If you are is not able to complete the process at one go, then you can save the information filled by clicking on the ‘Save Draft’. You can anytime, in the future, complete the process.

Conclusion

Tax relief is only allowed if the Tax Liability of the taxpayer increases. In case there is no increase in the liability, then you will not get the tax relief under section 89(1). Just make sure to give correct details and file a Form 10E.

FAQs

1. What is section 89(1)?

A: Section 89(1) was introduced to prevent the taxpayer from paying more taxes due to salary arrears. Say, for instance, if you have received an advance on your salary. Or if there were some arrears left in your salary, which has been cleared in the current year. In such a scenario, you might have to pay more tax in the current financial year as your gross income will increase. However, under this section, you can file for form 10E and claim tax relief.

2. What is for 10E?

A: Form 10E helps you recalculate the tax as per the rules of section 89(1). It helps you compute the salary that you earned the previous year and the Tax that you paid against the income that you have earned in the current financial year.

3. How can you calculate the arrears on your salary?

A: The additional salary you have received will be recorded as 'arrears' and provided by your employer.

4. How will I calculate the tax payable on the income?

A: You will have to subtract the arrears from the total income inclusive of the arrears. You will have to calculate the tax payable on the income earned minus the arrears.

5. How will I calculate the arrears to help file Form 10E?

A: When you evaluate the form 10E, you will find that calculating the arrears on your salary is necessary to fill the form for tax relief. For that, you will have first to calculate the total tax you have to pay on the income you have earned in the current year, minus the additional salary that you have received. Thus, prior knowledge of your arrears is necessary to simplify the process of filing the form 10E.

6. Can I file 10E online?

A: Yes, you can file form 10E online. For that, you will have to log in to the website of the Income Tax Department of India and click on tax forms. After that, you will have to provide details such as PAN, assessment year, submission mode to proceed with the filling of form 10E.

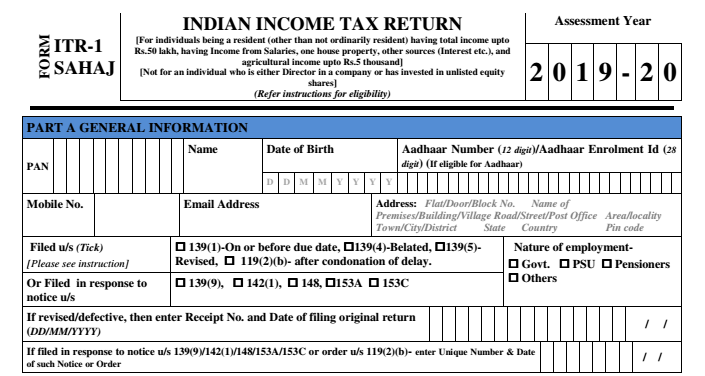

7. Is section 89(1) a part of the IT returns?

A: It is a part of the Income Tax Act, but IT returns are different. You have to file for IT returns if you are a taxpayer, and are looking for tax relief under section 89(1). Also, you will have to fill and submit form 10E before filing IT returns.

8. Is it mandatory to fill form 10E?

A: You should fill the form 10E if you have noticed any arrears in your salary. It is essential not just for your tax relief, but also for ensuring that you pay the taxes you are expected.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like

How To File Itr 1? Know Everything About Itr 1 Or Sahaj Form

E Filing Of Income Tax – A Complete Guide To File Income Tax Return

Section 234f- Penalty And Charges For Filing Late Income Tax Return

Section 234b Of Income Tax Act — Default In Payment Of Advance Tax

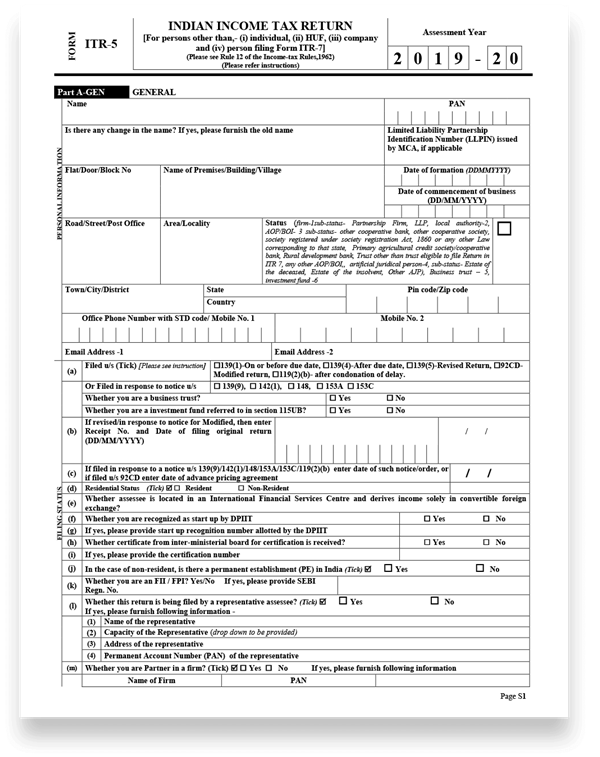

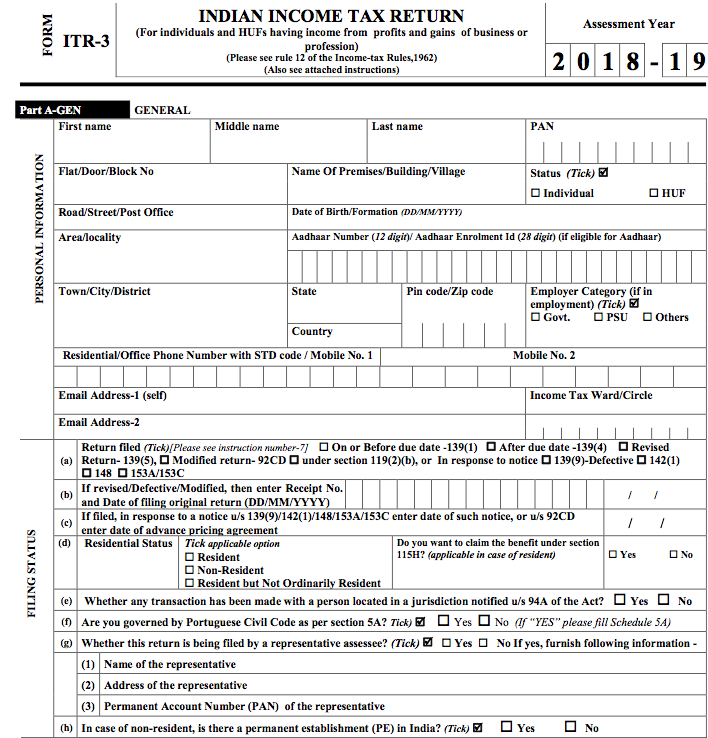

Are You Eligible To File Itr 3? Here's How You Can File Itr 3 Form Online