Fincash » U.S. Federal Reserve System » Checking vs. Savings Accounts

Table of Contents

Checking vs. Savings Accounts: Making the Right Choice for Your Financial Future

When it comes to managing your finances, understanding the differences between checking and savings accounts is crucial. Both account types serve distinct purposes and come with their own set of features, benefits, and limitations. In this comprehensive guide, we will delve into the key aspects of checking and savings accounts, helping you make an informed decision that aligns with your Financial goals.

Understanding Checking Accounts

What is a Checking Account?

A checking account is a type of Bank account designed for day-to-day financial transactions. It offers easy access to your money for activities like paying bills, making purchases, and withdrawing cash. Checking accounts are typically used for managing Income and expenses, providing a convenient way to Handle your everyday financial needs.

Key Features of Checking Accounts

Ease of Access: Checking accounts offer unlimited transactions, allowing you to write checks, use a Debit Card, and make electronic transfers without restrictions.

Direct Deposit: Employers can directly deposit your paycheck into your checking account, ensuring timely access to your funds.

Bill Payment: Many banks provide online bill payment services, making it simple to manage and pay your bills on time.

Overdraft Protection: Some checking accounts offer overdraft protection, which can prevent declined transactions and associated fees.

Benefits of Checking Accounts

Convenience: With features like debit cards and mobile banking, checking accounts provide easy access to your money whenever you need it.

No Transaction Limits: Unlike savings accounts, checking accounts do not limit the number of withdrawals or transfers you can make.

Automated Payments: You can set up automated payments for bills, rent, and other recurring expenses, ensuring you never miss a payment.

Drawbacks of Checking Accounts

Low or No Interest: Most checking accounts offer little to no interest on your balance, meaning your money doesn’t grow over time.

Fees: Some checking accounts come with monthly maintenance fees, overdraft fees, and ATM fees, which can add up if not managed properly.

Talk to our investment specialist

Understanding Savings Accounts

What is a Savings Account?

A Savings Account is a type of bank account that allows you to save money while earning interest on your deposits. Savings accounts are designed for longer-term financial goals, Offering a safe place to store your funds while they grow over time.

Key Features of Savings Accounts

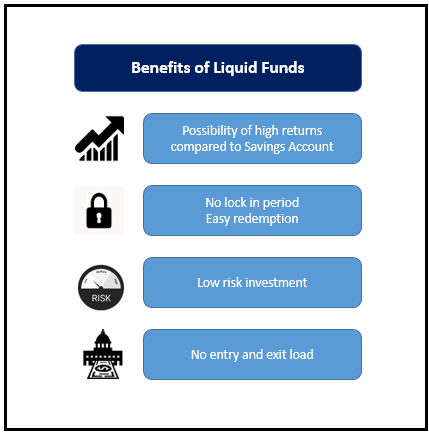

Interest Earnings: Savings accounts typically offer higher interest rates compared to checking accounts, helping your money grow.

Limited Transactions: Federal regulations limit the number of withdrawals or transfers from savings accounts to six per month.

Security: Savings accounts are insured by the FDIC (Federal Deposit insurance Corporation) up to $250,000 per depositor, providing peace of mind that your money is safe.

Benefits of Savings Accounts

Interest Accumulation: The primary benefit of a savings account is the ability to earn interest on your deposits, helping you grow your savings over time.

Encourages Saving: With limited access to your funds, savings accounts help encourage saving and prevent impulsive spending.

Financial Security: Savings accounts offer a secure place to store your emergency fund or save for future expenses, such as a down payment on a house or a vacation.

Drawbacks of Savings Accounts

Limited Access: The restrictions on withdrawals and transfers can be inconvenient if you need frequent access to your funds.

Lower Interest Rates: While savings accounts do offer interest, the rates are generally lower compared to other investment options, such as certificates of deposit (CDs) or stocks.

Potential Fees: Some savings accounts may charge fees if your balance falls below a certain threshold or if you exceed the transaction limit.

Checking vs. Savings Accounts: Which One Should You Choose?

Consider Your Financial Goals

When deciding between a checking and a savings account, it’s important to consider your financial goals and how you plan to use the account. If you need an account for everyday transactions, such as paying bills and making purchases, a checking account is the better option. On the other hand, if you’re looking to save money and earn interest over time, a savings account is the way to go.

Emergency Fund

Having an emergency fund is essential for financial security. A savings account is ideal for this purpose, as it keeps your money separate from your daily spending and allows it to grow with interest. Make sure your emergency fund covers at least three to six months’ worth of living expenses.

Budgeting and Saving

For effective budgeting, it can be helpful to have both a checking and a savings account. Use your checking account for regular expenses and your savings account for setting aside money for future goals. This separation can help you manage your finances more effectively and avoid overspending.

Avoiding Fees

To avoid unnecessary fees, choose accounts that offer low or no fees, or that provide easy ways to waive them. Many banks offer free checking accounts with direct deposit or maintaining a minimum balance. Similarly, some savings accounts waive fees if you meet certain balance requirements.

Maximizing Interest Earnings

If earning interest is a priority, compare the interest rates offered by different savings accounts. Online banks often offer higher interest rates compared to traditional brick-and-mortar banks. Additionally, consider high-yield savings accounts for better returns on your savings.

Accessibility Needs

If you need frequent access to your funds, a checking account is more suitable. However, if you’re disciplined about saving and can limit your withdrawals, a savings account will help you grow your money while keeping it accessible for emergencies.

Conclusion

Choosing between a checking and a savings account depends on your financial needs and goals. While checking accounts offer convenience and ease of access for daily transactions, savings accounts provide a secure way to grow your money over time. For most people, having both types of accounts is beneficial, allowing you to manage your everyday expenses while saving for the future. By understanding the features, benefits, and limitations of each account type, you can make an informed decision that supports your financial well-being. Whether you’re looking to save for a specific goal, build an emergency fund, or simply manage your daily finances, the right combination of checking and savings accounts can help you achieve your financial objectives.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.