Table of Contents

What is an automatic stabilizer?

An automatic stabilizer is the fiscal policy type, designed for offsetting the fluctuations in the overall economic activities of the nation via normal operations without any added and timely authorizations by either the policymakers or the government.

The top-rated and highly popular stabilizers are the graduated corporate or the personal Income Taxes and transfer systems, including the welfare and Unemployment Insurance services. They are named so because they stabilize the economic cycles and are triggered without any added actions from the government.

Fiscal Policies and Automatic Stabilizers

Whenever any Economy enters Recession, the authorities can utilize an automatic stabilizer to get higher finances deficits. This aspect of the fiscal policies acts as a vital tool for Keynesian Economics, which uses government taxes and spending for supporting the overall demand of the economy in case of downturns.

By charging lesser money from the households and private businesses in taxes and Offering more payments and Tax Refund, the fiscal policy encourages people to increase consumption or keep it constant (without any decrease). It also encourages people to expand the investment expenditures. Therefore, the main goal of a fiscal policy in such cases is to prevent the economic setbacks from getting deeper.

Role of Progressive Taxation in Stabilizing the Economic Cycles

Automatic stabilizers acquire a fiscal policy that is counter cyclic by their typical actions and functions. During the rapid growths and higher income levels, like in an economic boom, the stabilizers take money out from the economy. For example, if there is a rise in incomes, then the taxes will also increase. However, with a fall in the income, the tax bracket changes for the taxpayers, and the income share to be paid as taxes gradually decreases. Therefore, the tax bracket assigned to every individual is directly associated with their income level.

Talk to our investment specialist

Role of Unemployment Insurance in Stabilizing the Economic Cycles

Similarly, when there is a boom in the economy, the unemployment rate is also lower. This means that there are lower numbers of people who file claims to get unemployment benefits. This gradually decreases the transfer payment that the government makes as the unemployment insurance’s part. And when any individual gets unemployed, they must file a claim and then receive the transfer payments.

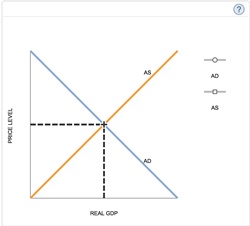

The Impact of Automatic Stabilizers in the Collective Demand

During economic booms, the automatic stabilizers let the government cool off the expansions and combat inflations. However, in case of income falls, these stabilizers put the money back in the system. Therefore, the stabilizers cushioned the economy from lowered economic shocks. The expenditures by customers help to get added to the government revenue, which further helps with funding the stabilizers at times of recession. Thus, it ensures that the consumption patterns of the people stay constant and the economy does not fall into a demand crisis.

If any economy also witnesses the demand crisis, the recession might even turn into a depression. Thus, the automatic stabilizers mainly aim at increasing the demand or maintain the demand level for the said economy. These are often used collectively with other policy measures requiring authorization. The automatic stabilizers are thus only considered as the first defence link during economic downturns.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.