Table of Contents

Unemployment Insurance: Why Do You Need One?

Unemployment insurance is a job loss cover that provides temporary financial support to the people who face involuntary termination from their job due to company closure, provided that the company has at least 20 employees. The insured can make an unemployment claim only under genuine circumstances and not due to their own fault. These circumstances can be company’s closure due to the violation of laws, poor financial health, closure of the divisional office, acquisition and merger of the firm etc. Insurance for the unemployed is a new addition to the insurance Industry and is still not available as an individual cover. It can be bought only as an add-on cover with Critical illness insurance and/or Personal Accident policy. To avail unemployment benefits, one can consider various plans offered by the general Insurance companies in India. But first, let’s understand what are the unemployment insurance benefits in detail.

Unemployment Insurance Benefit

Typically, the unemployment insurance cover in a policy has an initial waiting period of 30-90 days before the cover becomes effective. It provides coverage only upto a limited period of time, which is decided initially during the time of purchase. Though the period of Insurance Coverage varies from 1-5 years, the unemployment claim can only be made once during the policy term. Moreover, there are certain exclusions under the insurance policy for unemployed. Take a look!

Unemployment Insurance Exclusions

An unemployment insurance does not provide financial support under certain circumstances. Some of those are listed below.

- Unemployment or job loss caused due to voluntary resignation

- Unemployment of a self-employed person

- Unemployment during the period of probation

- Job loss because of suspension or termination due to poor performance or unlawful activity

- Unemployment due to pre-existing illnesses

Unemployment Insurance Plans or Jobs Loss Covers in India

As mentioned earlier, insurance for unemployment is not a stand-alone policy and is available with certain insurance plans. Plans Offering unemployment insurance as an add-on benefit include-

- ICICI Lombard Secure Mind

- Royal Sundaram Safe Loan Shield

- HDFC Ergo Home Suraksha Plus

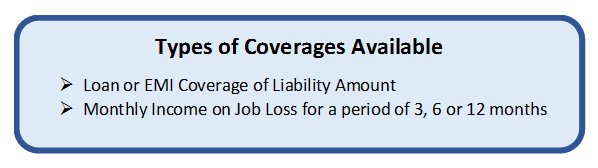

Types of Coverages Available Under Insurance for Unemployed

How to Apply for Unemployment Benefits?

Now that you know the unemployment insurance plans available in the insurance industry you can easily Call the insurance company and ask for the application process. They will guide you to fulfil the process of choosing the policy and finally buying one. But, before you consult the insurance company, there are certain things to keep in mind.

- Understand all the unemployment insurance policies well before you choose one

- Know do you fall under the category of unemployed as per the policy

- Ask as many questions as you wish to

- Understand different ways to apply for unemployment policies

- Fill the unemployment form carefully when making a claim

Talk to our investment specialist

Unemployment Form Claim

The form to avail unemployment benefits (also known as an unemployment form) or get the Insurance Claim is easily available online. One can reach out to the insurance company and the follow the claims process.

File for Unemployment Online

With the advancing technology, various insurance companies offer unemployment insurance online as well. So, you can easily secure your future in just a click.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.