Table of Contents

Deposit Multiplier Meaning

The Deposit Multiplier is equal to the maximum amount of money that a Bank can create for all the reserved units. It is generally a percentage of the amount deposited at any bank.

The requirement of a deposit multiplier is critical for maintaining the essential money supply of any Economy. Furthermore, reliance on deposit multiplier is termed the fractional reserve banking system and is common to various banks across the world.

Brief on Deposit Multiplier

Deposit multiplier is also referred to as deposit expansion multiplier or simple deposit multiplier. This is the money amount that every bank must keep on hand in all their reserves. It is essential to help them function on a daily Basis while eradicating the risks of depleting their supplies to satisfy the customers’ withdrawal requests. Like the Reserve bank of India, all the central banks have the right to establish a minimum amount that the banks must hold.

These are called the reserve requirement or the required reserve, and it is the amount that the bank has available for lending to the customers. The banks must maintain this minimum amount in the accounts deposited at the central bank. It is necessary to ensure that it has enough cash to meet all the withdrawal requests from its depositors.

Talk to our investment specialist

Formula of Deposit Multiplier

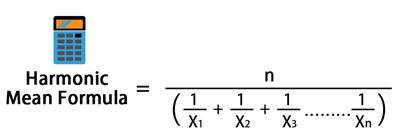

Here is the formula to calculate the deposit multiplier of a bank:

Deposit multiplier = 1/ Required Reserve Ratio

Deposit Multiplier and required reserves are inversely related; therefore, if the required reserve is 40%, the deposit multiplier ratio will be 60%. This ratio is referred to as the number of chequable deposits of a bank.

Chequable Deposits

Chequable deposits are the bank accounts against which the cheques can be written to make the withdrawals easily possible. These accounts are often considered liquid assets as they ensure easier access for the consumers. Examples of chequable deposits are interest-bearing accounts, money market accounts, and deposit accounts.

Money Multipliers

The amount that the banks generate in combination with every amount of reserves is called the money multiplier. For example, there is a country with a central bank imposing 15% of the reserve requirements. The reserve ratio would be 1/15, which means that for every Re. 1 deposit in the bank, 0.85 Rs can be loaned out. Therefore, if a bank has Rs. 200 million of deposits, it can loan Rs. 170 million. Thus, it might also raise the money supplies from Rs. 200 million to Rs. 370 million.

The money multipliers provide details about the growth rate of money supplies from any bank’s lending. If the reserve ratio is higher, it means that a lesser number of deposits are available to lend, and thus the production leads to a lower money multiplier.

Money Multiplier = Change in the total supplied money / Change in the overall monetary base

Real-world Money Multipliers

It is the process in which a bank loans money and results in higher cash circulation in the economy. The money supply gets multiplied. In reality, each bank has a unique multiplier based on its excessive reserves. They can be expressed for every bank, every community, or an overall economy. For determining the real-world multiplier, you must have a brief understanding of the existing monetary base.

The monetary base might be the required reserve rate multiplied by the deposit amount in any given banking system for a simple money multiplier. However, a solid monetary base must add excessive reserves from every bank and the currency under circulation. The inverse of this total gives the value of the real-world money multiplier.

Deposit Multiplier vs Money Multiplier

There is a massive confusion between a deposit multiplier and a money multiplier. Even though the terms seem to have a closer relationship, they are not interchangeable and have differences. The money multiplier acts to reflect a change in the money supply of a nation, resulting from the loan of Capital beyond the reserves of a bank. You can consider a money multiplier as the creation of money at its maximum potential using the multiplied effects of the overall bank lending.

The deposit multiplier ensures the basis for the money multiplier, but the former one is lesser. That is mainly because of excess savings, reserves, and the conversion to cash by the customers. If the banks loan out every available penny beyond their reserved requirements, and if the borrower spends every penny of the borrowed amount from the banks, the deposit multiplier would eventually have the same meaning as the money multiplier. However, the banks do not lend out every Rupee available, and not all the borrowers spend the whole of the borrowed amount.

The borrowers might save some of the cash in any savings or other accounts. This leads to the reduced amount of money creation and the reflecting money multiplier.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.