Table of Contents

What is Unsecured Debt?

In the complex world of Personal Finance, the concept of unsecured debt poses a significant threat to individuals in India. Unlike secured debt, which relies on Collateral, unsecured debt stands independently, making it imperative for anyone navigating the financial landscape to comprehend its nuances.

This article aims to clarify unsecured debt, shedding light on its forms, considerations, and the pivotal role it plays.

What is Unsecured Debt?

At its core, unsecured debt encompasses loans or credit that lacks collateral. This absence of tangible assets backing the debt distinguishes it from secured loans, marking a crucial element in the borrowing landscape. Unsecured debt relies predominantly on the borrower's creditworthiness, financial history, and the trust lenders place in their ability to repay.

Example of Unsecured Debt in India

Let's understand it further with an example. Suppose Mr M, a private lender specialising in unsecured loans, encounters a new borrower, Ms E, seeking a Rs. 2,00,000 loan. Since it is an unsecured loan, Ms E isn't obligated to offer specific assets as collateral. Mr M imposes a higher interest rate than collateralised loans to mitigate the risk.

In the next six months, Ms E's payments turn infrequent. Faced with this situation, Mr M has several options. While suing Ms E for repayment is an option, Mr M deems it impractical due to the absence of pledged collateral. Alternatively, he opts to enlist a collection agency to pursue repayment on his behalf, compensating the agency with a percentage of the recovered amount. Collection agencies typically operate on a possibility fee Basis, with rates varying between 7.5% and 50%.

Types of Unsecured Debt

Here is the list of unsecured debt types you can find for yourself:

Personal Loans

A universal presence in the financial realm, personal loans offer individuals a versatile means of addressing various monetary needs. Whether it be funding a medical emergency, covering educational expenses, or consolidating debts, personal loans provide a financial lifeline without the necessity of collateral.

Credit Cards

credit cards have become an essential part of normal transactions. Functioning as a revolving line of credit, individuals can make purchases and payments, essentially borrowing money from the card issuer. However, the convenience comes with a warning – interest accrues on unpaid balances, emphasising the need for disciplined financial management.

Medical Loans

With the escalating healthcare costs, medical loans have become vital to unsecured debt. These loans cater specifically to medical expenses, ensuring individuals can access necessary treatments without pledging collateral.

Talk to our investment specialist

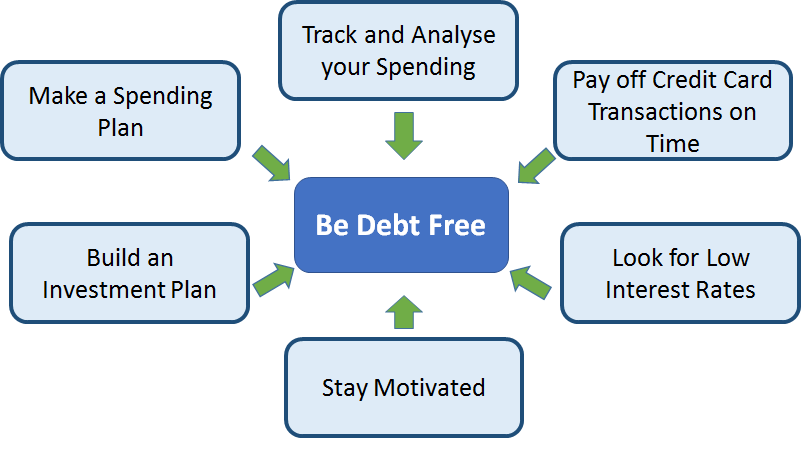

Considerations for Unsecured Debt

Before you think of taking an unsecured debt, the following are some considerations that you must keep in mind:

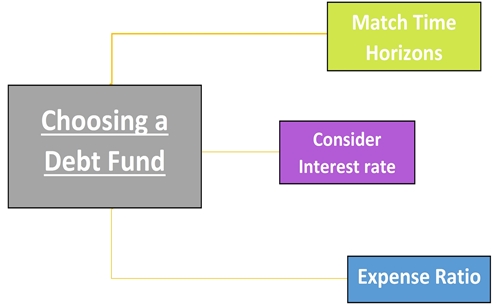

Interest Rates

Unsecured loans often bear higher interest rates than their secured counterparts. As such, prospective borrowers must meticulously scrutinise and compare interest rates from various lenders. A thorough understanding of the interest implications is crucial for responsible financial decision-making.

Credit Score

The Credit Score is the currency of trust in unsecured debt. Lenders depend on on credit scores to assess an individual's creditworthiness. A healthy credit score opens doors to favourable terms and conditions, making it imperative for borrowers to nurture and protect their credit history.

Loan Repayment Terms

Understanding the repayment terms is vital to avoid financial pitfalls. Borrowers must know the loan tenure, monthly instalments, and any prepayment penalties associated with the unsecured loan. A clear comprehension of these terms allows for effective financial planning.

Financial Planning

Individuals should conduct a comprehensive economic evaluation before embracing unsecured debt. This involves scrutinising the necessity of the loan, devising a robust repayment plan, and ensuring that the monthly repayments align with the overall budget. A proactive approach to financial planning mitigates the risks associated with unsecured debt.

Emergency Fund

An often-overlooked yet essential aspect of financial planning is creating and maintaining an emergency fund. This fund reduces the reliance on unsecured debt to meet unexpected expenses. A well-funded emergency fund fosters financial resilience.

Conclusion

Unsecured debt is not merely a Financial Instrument; it's a pivotal player in shaping the economic decisions of individuals. The accessibility and flexibility it provides can be a boon, but it demands a prudent approach and a keen understanding of its intricacies. Responsible borrowing, meticulous financial planning, and a commitment to maintaining a positive credit history are the cornerstones of navigating unsecured debt successfully. By embracing these principles, individuals can harness the benefits of unsecured debt while safeguarding their financial well-being in the dynamic landscape of personal finance.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.