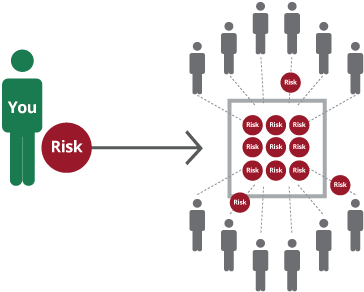

What is Risk Pooling?

insurance is a way to transfer your risks to the capital market in order to survive any unplanned financial losses. In Insurance Terms, risk pooling is the sharing of common financial risks evenly among a large number of people. So, the Capital Markets or here, Insurance companies, take that risk from you in exchange for a regular payment called premium. The company believes the premium is enough to cover the risk. An interesting thing to note here is that you are not the only one getting insured. There are many people that try and seek the same kind of insurance covers. This group of people is called the Insurance pool. The possibility of all the clients needing the insurance claim is almost improbable. Thus, if and when any such event(of claim) occurs for a couple of individuals, risk pooling allows the Insurance company to settle their claim.

History of Risk Pooling

The insurance industry basically runs on the concept of risk pooling. The earliest references to insurance policies and risk pooling can be found some 5000 years back. Traders and merchants pooled their resources and shared the common risk of damage or loss of goods. That covered the merchants from sudden damage or loss of goods by relatively paying less amount for the recovery.

Talk to our investment specialist

Benefits of Risk Pooling

The benefits of risk pooling in insurance include:

Spreading risk: By pooling the risks of many policyholders, the financial impact of individual losses is distributed among the entire pool. This reduces the burden on individual policyholders and provides them with financial protection in case of unexpected events.

Stability and predictability: The larger the pool, the more predictable the losses become. Insurance companies can rely on historical data and actuarial models to estimate the expected claims and set premiums accordingly. This stability allows insurers to operate more efficiently and provide coverage at reasonable rates.

Affordability: Risk pooling makes insurance more affordable for individual policyholders. The premium each policyholder pays is typically smaller than the potential losses they might face, making insurance accessible to a broader population.

Risk diversification: Risk pooling enables insurers to diversify their risk portfolios across different policyholders, geographical areas, and types of coverage. This diversification helps insurers manage their overall risk exposure and maintain financial stability.

It's important to note that risk pooling does not eliminate risk entirely. Instead, it spreads the risk and provides a mechanism for sharing the financial consequences of unpredictable events among a larger group of policyholders.

Modern Day Insurance

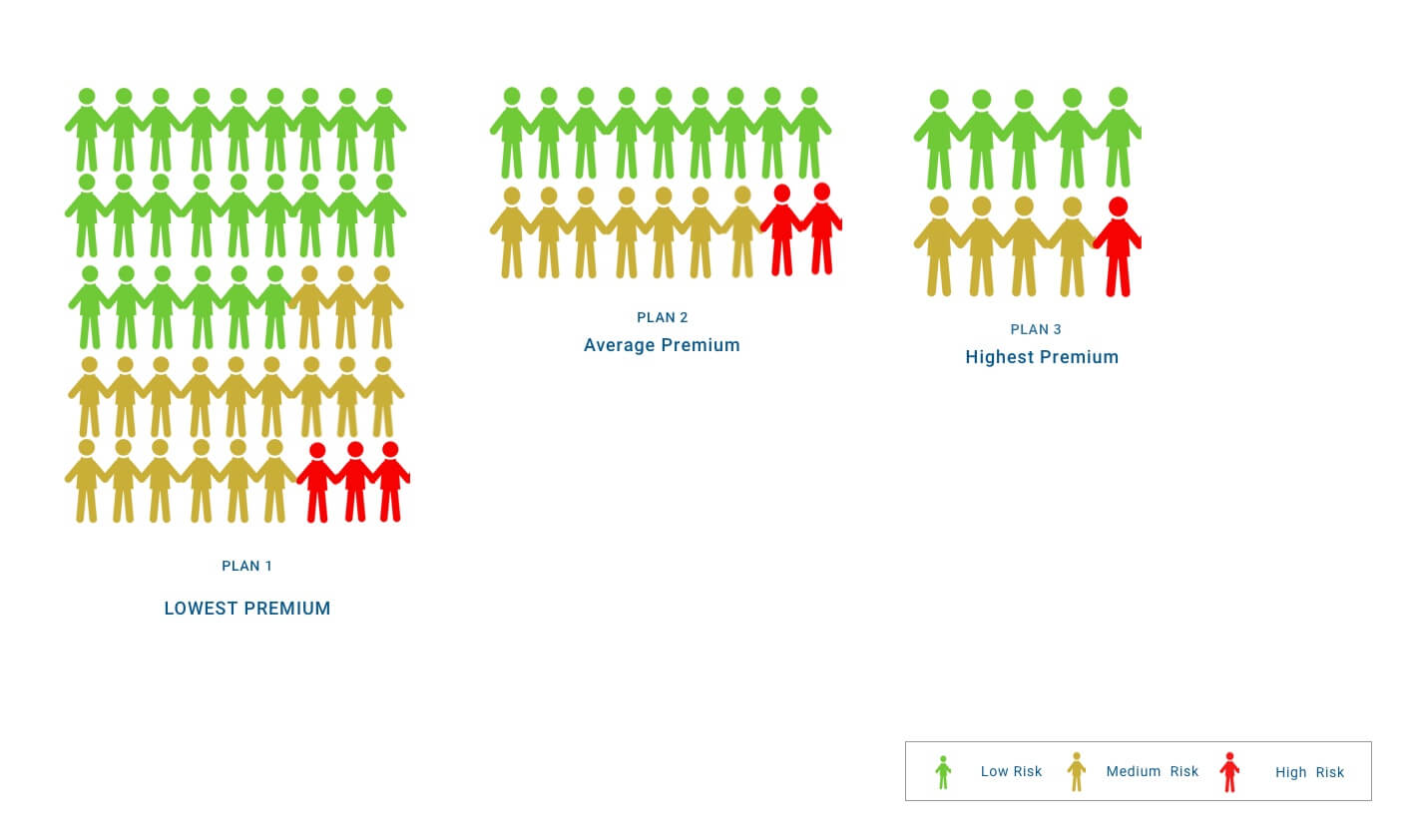

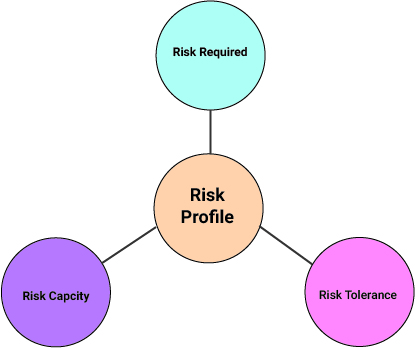

The insurance industry has now grown into a major business which plays a significant role in shaping the economy. More and more people are seeking to transfer their risks to the companies as a part of the Insurance pool. Different types of Insurance cover different aspects of life and living, but the basic principle of risk pooling remains the same. Actuaries - professionals in finance - work for the Insurance companies and calculate the probability and severity of the risk. Accordingly, they calculate the cost of pooling one's risk with that of others through the Insurance company.

While calculating, some limits are put to covering a certain entity even if it is at high-risk. For eg., A company will not cover a terminally ill person even if they are ready to pay a high amount as a premium. Insurance companies use the actuarial data to calculate the risk of an individual considering their profile and demographic group. So, as the risk related to the individual increases, the cost of insurance also increases. Thus, Life Insurance for old people with health problems will be more costly than young people (without health problems).

Insurable Risk vs Uninsurable Risk

Every negative economic incident cannot be insured. To have effective risk pooling, the risk considered should be unforeseen and spread out. And in the case, if such a negative incident is predicted, then that incident becomes a certainty, not a risk - and you can't give insurance to cover certainty. Also, on the flip side, it is foolish to cover a frequent risk. The insurance company will only pass on the cost of the occurred incident to the insurance pool along with the expenses and profits. So, everyone in the insurance pool is filing a claim then that leaves the pool with less or no resources to cover the basic risk and also empty the reserves to pay for themselves.

Reinsurance

Now we know that an Insurance company works on the concept of risk pooling and then aims to cover the individuals who may need the relevant coverage. There is a concept of reinsurance comes in picture when multiple insurance companies pool their risks by buying insurance policies from other companies. This is done in order to limit the total loss the primary insurance company would bear in case of a disaster. By such risk pooling, a primary insurance company can insure clients whose coverage would be too large for that single company to bear. Thus, when reinsurance occurs, the claim amount paid by the insured is generally shared by all the insurance companies involved in the pool. Even the reinsurance companies transfer their risks to higher companies. These re-reinsuring companies are called retro-insurers.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Very interested