Table of Contents

CVL KRA - CDSL Ventures Limited

CVL KRA is one of the KYC registration agencies (KRA) in the country.

CVLKRAoffers KYC and KYC related services for all the fund houses, stockbrokers and other agencies that are compliant with SEBI. Know Your Customer – KYC – is a one-time process to authenticate the identity of the investor and this process is compulsory for all financial institutions.

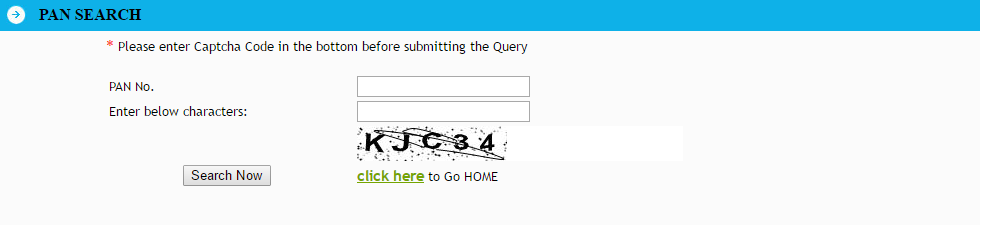

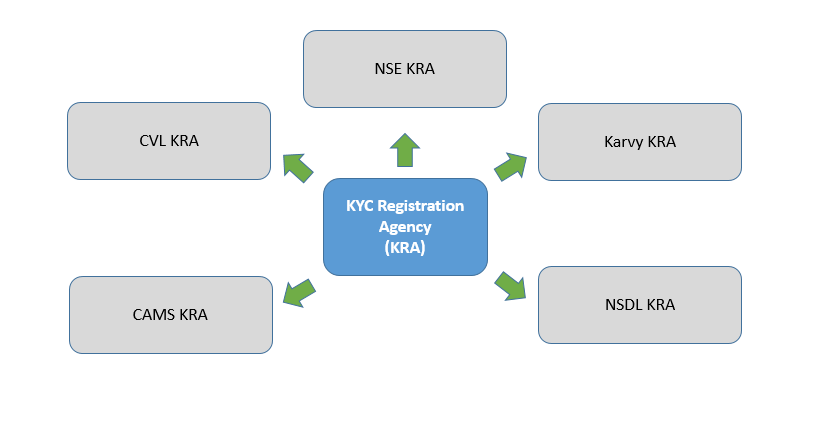

Previously each financial institution like banks, different Asset Management Companies, etc. had different KYC verification processes. SEBI then introduced the KYC registration agency (KRA) to bring uniformity in the registration process. As mentioned above CVLKRA is one such KRA among the five KRAs that provide such services. Here you can check your KYC Status, download the KYC Form and undergo KYC KRA verification. CAMSKRA, NSE KRA, Karvy KRA and NSDL KRA are the other KRAs in the country.

SEBI GUIDELINES FOR KRA

Earlier, the investors could easily complete their KYC process by simply opening an account with any of the SEBI intermediaries and submitting relevant documents. Later, this process caused very high duplication of KYC records as the customer had to undergo the process of KYC with each entity separately. Therefore, in order to bring uniformity in the KYC process and eliminate such duplications, SEBI introduced the concept of KRA (KYC Registration Agency). Now, there are 5 KYC Registration Agencies(KRAs) in India. These include:

- CVL KRA

- CAMS KRA

- Karvy KRA

- NSDL KRA

- NSE KRA

As per the SEBI guidelines of 2011, the investors who wish to invest in Mutual Funds or become KYC complaint have to register with any one of the above-mentioned agencies. Once the customers are registered or are KYC compliant, they can start Investing in Mutual Funds.

What Is CVL KRA?

CDSL Ventures Limited - CVL - is a completely owned subsidiary of the central depository Services of India (CDSL). CDSL is the second securities Depository in India (the first being NSDL). CVL relies on its expertise in the securities Market domain and maintaining the data confidentiality. CVLKRA was the first central-KYC (cKYC) Registration Agency for the securities market. CVL KRA keeps the records of the investor in a centralised manner on behalf of the securities market intermediaries that are compliant with SEBI.

CVL was earlier administered by the Mutual Fund Industry to Handle record keeping and customer profiling. Additionally, it also performed KYC verification for the Mutual Fund investors.

| Name | CDSL Ventures Limited |

|---|---|

| Parent | CDSL, Depository |

| SEBI REG NO | IN/KRA/001/2011 |

| Registration Date | Decemver 28, 2011 |

| Registration Valid Till | Decemver 27, 2016 |

| Registraiton Office | P J Towers, 17th Floor, Dalal Street, Fort, Mumbai 400001 |

| Contact Person | Sanjeev Kale |

| Phone | 022-61216969 |

| Fax | 022-22723199 |

| sanjeev.cvl[AT]cdslindia.com | |

| Website | www.cvlindia.com |

CVL KRA Registration Process

There are various steps under the KYC registration process. From the approach of the entity to the storage of documents by KRA, each step is explained in detail below.

1. By Approaching an Intermediary/POS

You can complete your KYC by approaching an intermediary like fincash.com for completetion of KYC.

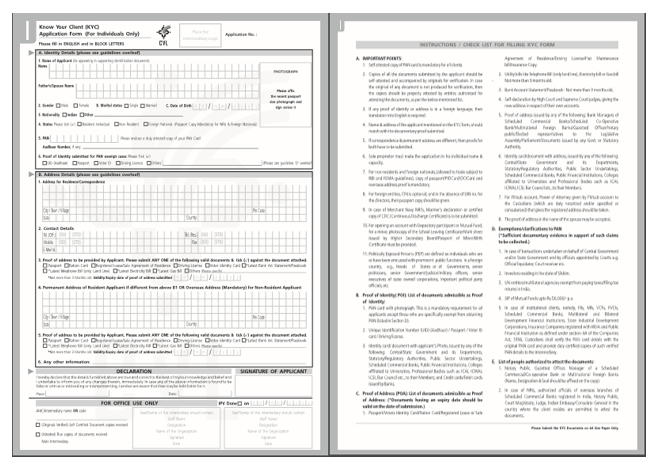

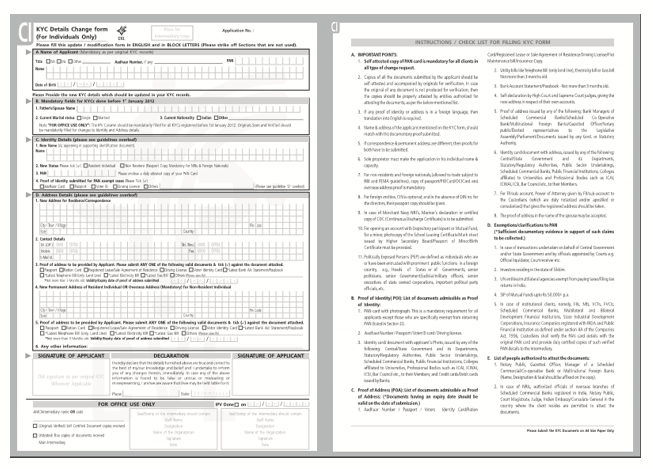

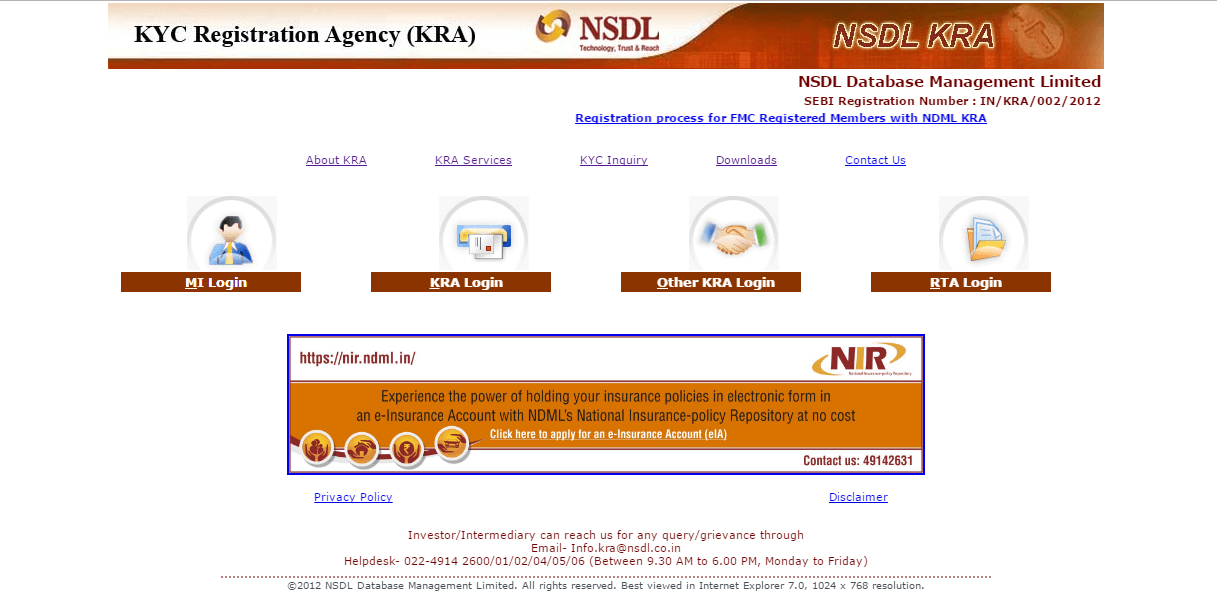

KYC Form

If the investor wants to be KYC compliant by going to CVLKRA or an intermediary, they have to fill the mandated KYC registration form.

KYC Documents

Along with the KYC form, the client needs to submit the self-certified document of the Proof of Address (POA) and the Proof of Identity (POI) in case of individual registration. However, for a non-individuals, various other documents as stated by SEBI need to be submitted. Clients can easily download the KYC form from the CVL KRA website or obtain it from their intermediaries.

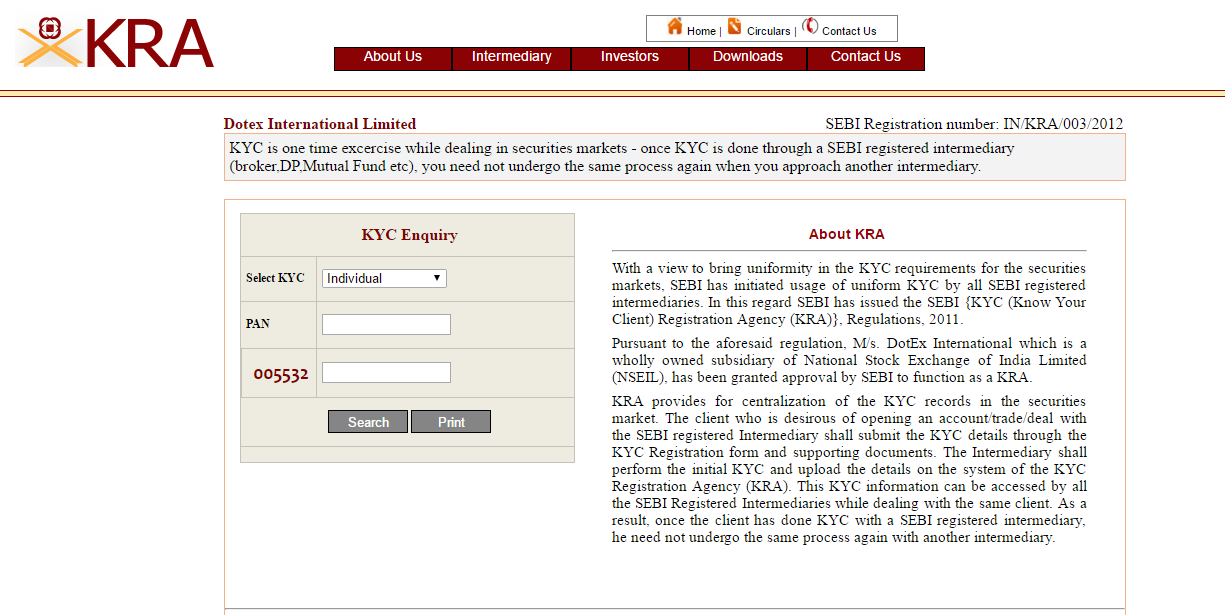

KYC Inquiry or KYC Verification

- After the documents are submitted, the intermediary checks if the details mentioned on the KYC form are similar to the proofs and declarations submitted or not. If there is any mismatch in details, the intermediary will update the same in the KRA system and then will submit the supporting KYC documents after obtaining the same from the customer.

- The distributor or the intermediary will also conduct an IPV (In-Person Verification) for further verification of the client details. They fix their stamp on the documents to certify the verification process is complete. However, if the IPV details are already available in the KYC system, the intermediary might not conduct an IPV.

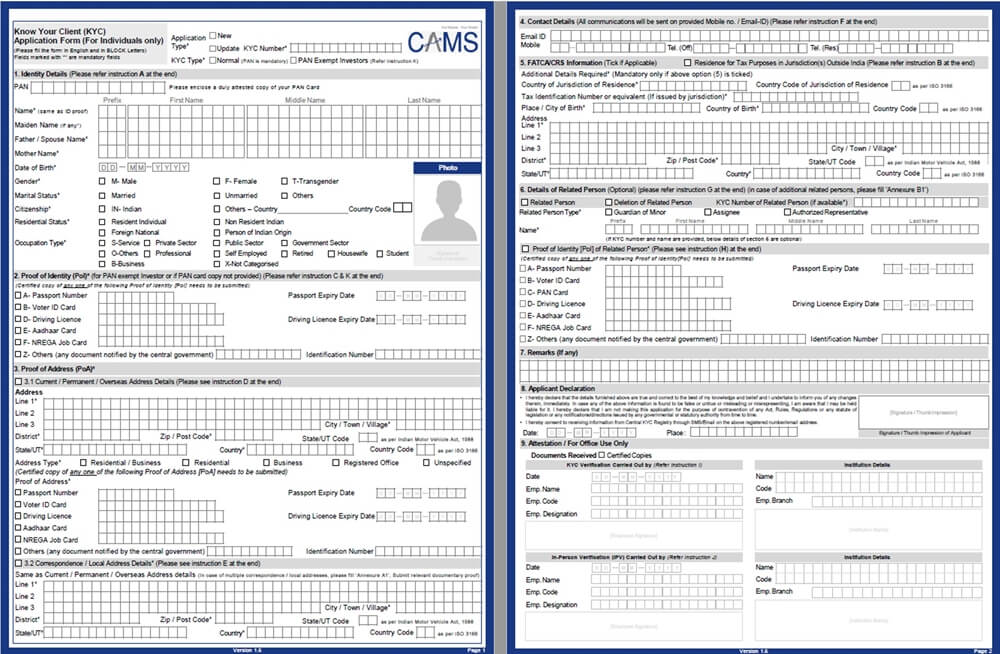

- Additionally, the investors can check their CVLKRA PAN status on CVL KRA website - www. cvlkra.com by inputting their PAN and getting the current KYC status

2. Updating of Documents

Once the final verification of KYC verification is done, the intermediary will update the KYC data in 2 ways-

- New KYC Online

- KYC Bulk Upload

The intermediary can upload files in the file formats mentioned on the CVL KRA website - www.cvlindia.com.

3. Submission of Scanned Image

As per the amendment to the KRA Regulations by SEBI, the intermediary is supposed to upload only the scanned images of the documents to the KRA website. Therefore, CVL introduced an option to upload scanned documents on their website. This image upload Facility by the CVL KRA is for uploading both new and existing client’s images.

4. Scanning of KYC Documents

Finally, all the KYC documents are scanned and stored by the CVL KRA on the behalf of the intermediary that will be available in the “SCAN_STORE” option on the website. The same would be indicated on the bill as well for easy identification.

Talk to our investment specialist

How Does CVL KRA Work?

CVLKRA uses the best technology and security measures to process, protect and retrieve the KYC documents. To work as a top KRA, it implements constant regulatory changes and carries out other required compliances. For a PAN based registration with CVL KRA, you need a correctly filled KYC form with your signature, additionally, you also need other documents such as a proof of identity and address proof. Subsequently, for the In-person verification (IPV) and verification of original documents, ones needs to be present in person. Other than the PAN Card based process, KYC registration has become easier with eKYC or Aadhaar based KYC. EKYC gives you permission to invest up to INR 50,000 per Mutual Fund per year. This process is very quick and easy where one needs to enter their Aadhaar or UIDAI number and then confirm the OTP (one-time password) which is received on the registered mobile number. To invest more than INR 50,000 in an AMC, you need to complete the PAN-based KYC verification process or the biometric Aadhaar based KYC process.

CVL KRA KYC Form

- CVLKRA INDIVIDUAL KYC FORM- Download Now!

- CVLKRA NON-INDIVIDUAL KYC FORM- Download Now!

You can download the KYC form from the CVL KRA website. There are different KYC forms available for download such as:

- cKYC application form (to complete cKYC registration)

- KYC application form (to verify regular KYC)

- Intermediary registration form (for those who want to do KYC process through CVL KRA)

- CVL KRA Modification form (for individuals who are KRA complied and want to change their details like address etc.)

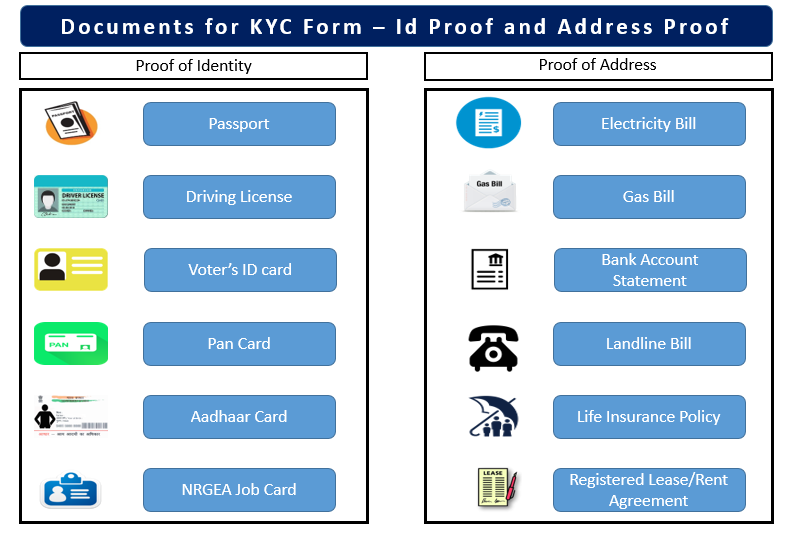

CVL KRA KYC Registration Documents

Apart from filling the KYC form, to complete KYC registration, the entity needs to get certain documents verified along with the KYC form. These documents are essentially the proof of identity and proof of address. The list of acceptable documents for proof of identity and proof of address are given below.

CVLKRA KYC Registration Documents

CVLKRA KYC Registration Documents

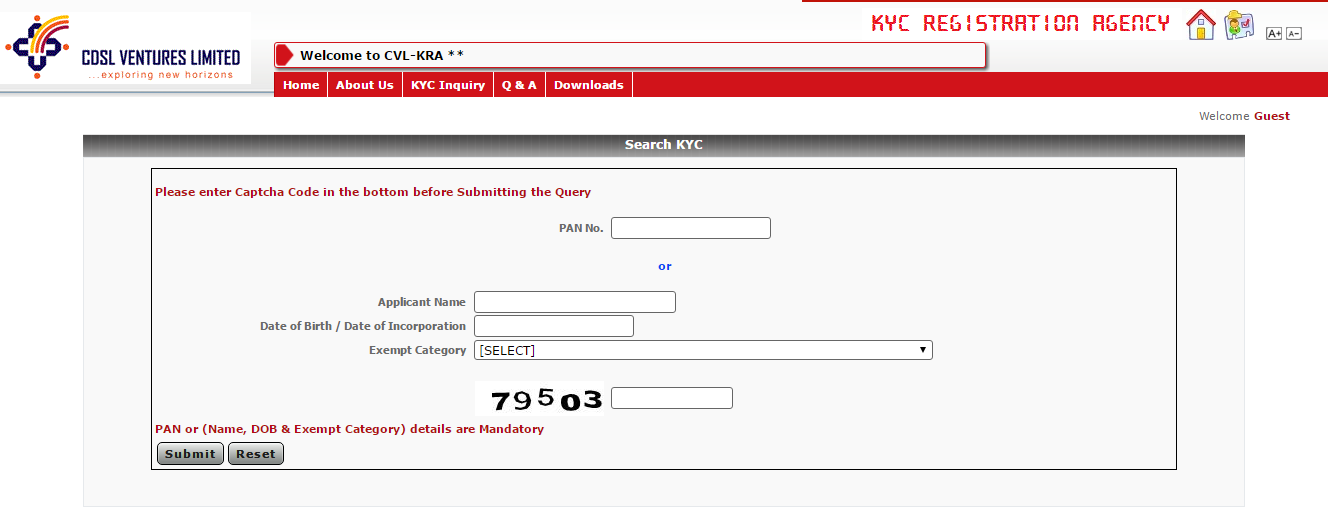

How to Check KYC Status?

You can check your KYC status by going to the CVL KRA website and clicking on “ Inquiry on KYC”. To get the current status of the Aadhaar based KYC registration (eKYC) you need to enter your Aadhaar card number. Similarly, for PAN-based registration, you can repeat the same process and put your PAN number.

CVL KRA - KYC Status Inquiry

CVL KRA - KYC Status Inquiry

The investors can also check their KYC status by visiting any of the other KRA’s website and submitting their PAN number there.

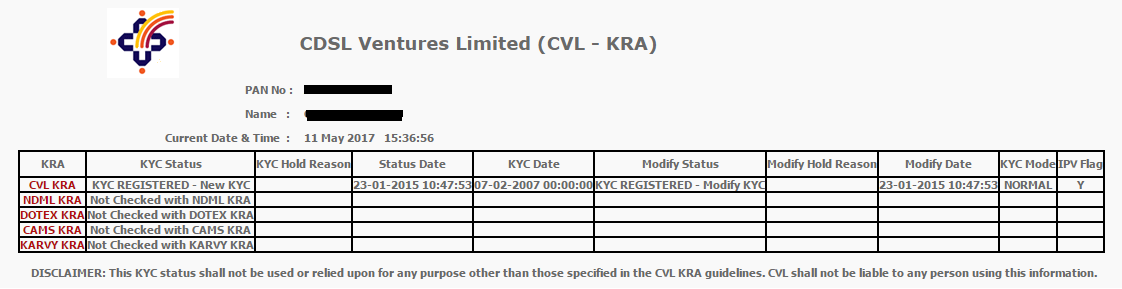

What does the KYC Status Mean?

KYC Registered: Your records are verified and is successfully registered with the KRA.

KYC Under Process: Your KYC documents are being accepted by the KRA and it is under process.

KYC On Hold: Your KYC process is on hold due to the discrepancy in the KYC documents. The documents/details that are incorrect need to be re-submitted.

KYC Rejected: Your KYC has been rejected by the KRA after verification of PAN details and other KYC documents. This means that you need to submit a fresh KYC form with relevant documents.

Not Available: Your KYC record is not available in any KRAs.

Aforementioned 5 KYC statuses can also reflect as Incomplete/Existing/Old KYC. Under such a status, you may need to submit fresh KYC documents to update your KYC records.

How to Change CVL KRA KYC Details?

Download the KYC Form to Change details here- Download KYC Change Form

KYC (Know Your Customer) is a one-time process when dealing in the securities market. Once the KYC is completed through any of the SEBI registered intermediaries, the investor does not need to undergo another registration while approaching any other intermediary. In case of any change in the KYC details, investors can simply submit the change request form in addition to the supporting documents to any of the intermediaries, with whom they transact. CVL KRA will then download and update the corrected details to all the intermediaries which have registered their KYC.

CVL KRA Online Services

CVLKRA provides the following online services to its customers:

- Track your KYC status

- Download KYC and other forms

- Frequently Asked Questions (FAQ)

FAQS

What is KYC?

KYC (or Know Your Customer) is a term generally used for the client’s identification process. To “know” the clients better SEBI (Securities and Exchange Board of India) has mentioned certain essentials related to the KYC norms for the financial institutions and intermediaries including Mutual Funds. KYC forms are compulsory for all financial institutions and intermediaries. Any client investing in Mutual Funds has to fill the KYC form to get KYC registered or compliant.

What is KYC Form?

KYC form is a registration form which needs to be filled before anyone invests in Mutual Funds. The KYC form is easily available on the Mutual Fund website or even with any of the respective KRAs. One must read all the instructions properly before filling the form.

Is it Mandatory to fil the KYC Form? Is there any Exemption?

Yes, it is mandatory for all investors who wish to invest in Mutual Fund schemes to fill the KYC form irrespective of the amount they need to invest. There is no exemption available for any individual or non-individual.

When does KYC Form gets Cancelled?

In case the KYC form is short of any required or mandatory information, then the further process is likely to get cancelled. Investors need to ensure that they do the necessary rectifications to ensure that they get KYC registered or compliant.

Is there any special requirement for an NRI to get KYC Compliant?

Yes, in addition to the other documents a certified true copy of the passport, the overseas address and permanent address are required. Also, if any of the documents that are towards POI (Proof of Identity) are in a foreign language, they have to be translated into English before submission.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Very helpful

Nice sevice

Very good and useful, thanks much.

Informative page.