What are Diversified Funds (Multi Cap Funds)?

In the game of Investing, where returns are essentially important, somehow risk-adjusted returns is what eventually counts. And to strengthen the risk-adjusted returns if one has a long-term view, diversified equities can prove to be beneficial. Diversified funds have historically proven to come out as a winner in most market conditions given long holding periods. They invest across all spectrums of capitalization, within permitted risk levels. But are these funds for you? Let’s find out.

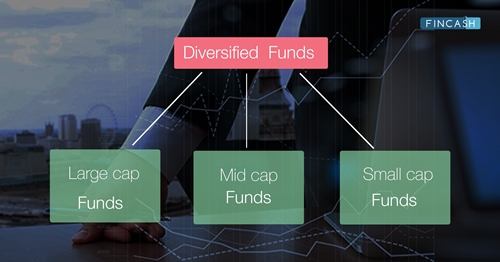

Diversified Equity Funds, also known as Multi-cap or Flexi cap funds, invest in stocks of companies across market capitalization i.e.,-large cap, mid and small cap stocks. In other words, they have the flexibility to adapt their portfolios according to the market. They typically invest anywhere between 40-60% in large cap stocks, 10-40% in mid-cap stocks and about 10% in small-cap stocks. Sometimes, the exposure to small-caps may be very small or none at all.

Diversified funds do not have any limitations on market caps from an investment point of view. They don’t follow a sectoral approach, instead adopting a growth or Value investing strategy, buying stocks whose price are relatively lower to their historical performance, book value, earnings, cash flow potential and dividend yields.

These funds balance out the risk and reduce the Volatility that usually comes with stock investments by investing across market capitalizations and sectors. Larger companies (large caps) tend to perform better during tough market times than the smaller companies, and they can provide investors with better investment returns. Mid-cap stocks can stabilize Portfolio returns with higher growth potential than the large cap stocks and less risky than the small cap stocks. However, irrespective of the market caps, all stock investments carry a certain level of risk, and investors should closely monitor their investments as business conditions can change daily. Given that the underlying investment is equity, there is a risk of loss of capital that can occur in the short term.

Nevertheless, diversified funds have exceptionally performed well over past 5 years, especially after elections, returning 23% p.a. and 21% p.a. for the last 3-5 years, respectively.

Talk to our investment specialist

Why to Invest in Diversified Funds?

As diversified funds or multi-cap funds invest across market caps, they have several benefits compared to funds focused on any one particular market cap. Some of these are discussed below:

The foremost advantage of diversified funds is that it reduces the need to keep a track on multiple funds in the portfolio distinctly. As the monies are invested across market capitalization, the need to maintain separate Large cap funds, mid and Small cap funds is eliminated.

During bull market phases, diversified funds tend to outperform large caps (in the long term) by capturing some of the upside offered by small and mid-cap funds. In the bull market rallies, the large-cap valuations (P/E multiples) run up faster to a point where they appear stretched, in such scenario mid-cap stocks tend to outperform.

Since, diversified funds have all three large cap, mid cap and small cap companies in their portfolio, they have potential to deliver good performance on a consistent basis.

In the bear market phases, small and mid-cap stocks tend to suffer sharp declines and liquidity issues. Also, consequently, they face liquidity constraints when redemption pressures increase during phases of bear markets, especially when investors are exiting investments. On the other hand, diversified funds don’t face liquidity problems as much—as large cap stocks comprise a sustainable portion of the portfolio.

Diversified funds are suitable for investors who start with just one fund and still want to invest across market caps. Also, investors who are not sure of their risk tolerance levels can take advantage of diversified funds.

Fund managers of diversified funds invest in companies of all sizes i.e. large, mid, small cap, based on their long-term growth potential. They also change their portfolio allocations between different sectors from time to time, to maximize fund the performance within defined investment objectives. Investing in diversified or multi-cap funds helps to prevent the tendency of investors to switch between large cap funds and mid-cap/small-cap funds based on short-term performance.

Risk in Diversified Funds

Diversified funds may suffer massively if the moves are extreme, during falls of the markets, diversified funds are affected from than large caps. This is due to the fact that during most declines, the fall in small & mid-caps is much higher. This can lead to higher volatility of returns, causing these funds to have a higher standard deviation, which is one of the important parameters to measure a fund's risk. Larger the standard deviation, higher will be the level of risk.

Who Should Invest in Diversified Mutual Funds?

An investor who has a moderate-risk appetite and who wishes to have an exposure in equities can park their funds in diversified funds. Also, investors who are not well-versed with the technique of Asset Allocation in respect to investments can also put a part of their funds here.

Investors incline towards investing in these funds as it holds a mix of stocks across market capitalizations. Any high degree of volatility shown by either small cap or mid cap funds can be balanced by the stability provided by large-cap equity funds. However, the returns from such diversified funds are vastly dependent on the fund manager’s knowledge and intelligence as to how he is able to include stocks as per the market conditions. In this situation, there is a probability of fund manager going wrong in his allocation strategy. That is why it is advisable for investors to study the record of the fund manager before investing in diversified funds.

Taxation on Diversified Equity Funds

The short-term and long-term Capital Gains offered by Mutual Funds are taxed at different rates.

| Fund Type | Short-Term Capital Gains | Long-Term Capital Gains |

|---|---|---|

| Equity funds | 15% + cess + surcharge | Up to Rs. 1 lakh a year is tax-exempt. Any gains above Rs. 1 lakh are taxed at 10% + cess + surcharge |

Fund Selection Methodology used to find 10 funds

Best Diversified Funds to Invest in 2026 - 2027

Top performing diversified funds in India are as follows-

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Equity Fund Growth ₹2,072.88

↓ -16.31 ₹96,295 0.3 5.3 15.4 22.3 20.6 11.4 Nippon India Multi Cap Fund Growth ₹297.613

↓ -2.74 ₹50,352 -2.1 -0.2 14.1 21.9 22.1 4.1 Motilal Oswal Multicap 35 Fund Growth ₹58.0221

↓ -0.98 ₹13,862 -6.9 -3.9 4.2 21.9 12.8 -5.6 Aditya Birla Sun Life Manufacturing Equity Fund Growth ₹33.71

↓ -0.45 ₹1,099 0.6 7.7 17.1 21.2 15.1 3.5 Mahindra Badhat Yojana Growth ₹35.8179

↓ -0.44 ₹6,133 -1.4 3.1 14.3 21.2 18.6 3.4 ICICI Prudential Multicap Fund Growth ₹805.38

↓ -10.49 ₹16,263 -0.5 2.8 11.2 20.4 17.1 5.7 JM Multicap Fund Growth ₹94.3849

↓ -1.27 ₹5,463 -3.9 -1.4 1.3 20 16.9 -6.8 Bandhan Focused Equity Fund Growth ₹87.2

↓ -0.85 ₹2,059 -3.1 0 8.5 19.3 12.5 -1.6 Edelweiss Multi Cap Fund Growth ₹39.145

↓ -0.61 ₹3,127 -0.6 4.9 13.6 19.1 15.4 5.4 Franklin India Equity Fund Growth ₹1,642.56

↓ -20.62 ₹19,972 -1.7 1.8 9.9 18.7 15.9 3.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 10 Funds showcased

Commentary HDFC Equity Fund Nippon India Multi Cap Fund Motilal Oswal Multicap 35 Fund Aditya Birla Sun Life Manufacturing Equity Fund Mahindra Badhat Yojana ICICI Prudential Multicap Fund JM Multicap Fund Bandhan Focused Equity Fund Edelweiss Multi Cap Fund Franklin India Equity Fund Point 1 Highest AUM (₹96,295 Cr). Top quartile AUM (₹50,352 Cr). Upper mid AUM (₹13,862 Cr). Bottom quartile AUM (₹1,099 Cr). Lower mid AUM (₹6,133 Cr). Upper mid AUM (₹16,263 Cr). Lower mid AUM (₹5,463 Cr). Bottom quartile AUM (₹2,059 Cr). Bottom quartile AUM (₹3,127 Cr). Upper mid AUM (₹19,972 Cr). Point 2 Oldest track record among peers (31 yrs). Established history (20+ yrs). Established history (11+ yrs). Established history (11+ yrs). Established history (8+ yrs). Established history (31+ yrs). Established history (17+ yrs). Established history (19+ yrs). Established history (11+ yrs). Established history (31+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (lower mid). Top rated. Not Rated. Not Rated. Rating: 3★ (upper mid). Rating: 4★ (top quartile). Rating: 4★ (upper mid). Not Rated. Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 20.56% (top quartile). 5Y return: 22.08% (top quartile). 5Y return: 12.81% (bottom quartile). 5Y return: 15.11% (bottom quartile). 5Y return: 18.59% (upper mid). 5Y return: 17.06% (upper mid). 5Y return: 16.94% (upper mid). 5Y return: 12.55% (bottom quartile). 5Y return: 15.40% (lower mid). 5Y return: 15.87% (lower mid). Point 6 3Y return: 22.29% (top quartile). 3Y return: 21.93% (top quartile). 3Y return: 21.89% (upper mid). 3Y return: 21.21% (upper mid). 3Y return: 21.19% (upper mid). 3Y return: 20.35% (lower mid). 3Y return: 20.00% (lower mid). 3Y return: 19.26% (bottom quartile). 3Y return: 19.06% (bottom quartile). 3Y return: 18.69% (bottom quartile). Point 7 1Y return: 15.42% (top quartile). 1Y return: 14.12% (upper mid). 1Y return: 4.17% (bottom quartile). 1Y return: 17.09% (top quartile). 1Y return: 14.31% (upper mid). 1Y return: 11.20% (lower mid). 1Y return: 1.30% (bottom quartile). 1Y return: 8.54% (bottom quartile). 1Y return: 13.64% (upper mid). 1Y return: 9.86% (lower mid). Point 8 Alpha: 3.70 (top quartile). Alpha: -1.30 (upper mid). Alpha: -12.91 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -1.73 (upper mid). Alpha: 0.06 (top quartile). Alpha: -14.34 (bottom quartile). Alpha: -8.83 (bottom quartile). Alpha: -2.22 (lower mid). Alpha: -4.14 (lower mid). Point 9 Sharpe: 0.53 (top quartile). Sharpe: -0.05 (upper mid). Sharpe: -0.51 (bottom quartile). Sharpe: -0.05 (upper mid). Sharpe: -0.07 (lower mid). Sharpe: 0.03 (top quartile). Sharpe: -0.73 (bottom quartile). Sharpe: -0.40 (bottom quartile). Sharpe: 0.03 (upper mid). Sharpe: -0.13 (lower mid). Point 10 Information ratio: 1.24 (top quartile). Information ratio: 0.64 (upper mid). Information ratio: 0.54 (upper mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.17 (bottom quartile). Information ratio: 0.27 (bottom quartile). Information ratio: 0.59 (upper mid). Information ratio: 0.35 (lower mid). Information ratio: 0.91 (top quartile). Information ratio: 0.51 (lower mid). HDFC Equity Fund

Nippon India Multi Cap Fund

Motilal Oswal Multicap 35 Fund

Aditya Birla Sun Life Manufacturing Equity Fund

Mahindra Badhat Yojana

ICICI Prudential Multicap Fund

JM Multicap Fund

Bandhan Focused Equity Fund

Edelweiss Multi Cap Fund

Franklin India Equity Fund

Aims at providing capital appreciation through investments predominantly in equity oriented securities Below is the key information for HDFC Equity Fund Returns up to 1 year are on (Erstwhile Reliance Equity Opportunities Fund) The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term growth opportunities by investing in a portfolio constituted of equity securities & equity related securities and the secondary objective is to generate consistent returns by investing in debt and money market securities. Research Highlights for Nippon India Multi Cap Fund Below is the key information for Nippon India Multi Cap Fund Returns up to 1 year are on (Erstwhile Motilal Oswal MOSt Focused Multicap 35 Fund) The investment objective of the Scheme is to achieve long term capital appreciation by primarily investing in a maximum of 35 equity & equity related instruments across sectors and market-capitalization levels.However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Research Highlights for Motilal Oswal Multicap 35 Fund Below is the key information for Motilal Oswal Multicap 35 Fund Returns up to 1 year are on The primary investment objective of the Schemes is to generate long-term capital appreciation to unit holders from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in Manufacturing activity. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved. Research Highlights for Aditya Birla Sun Life Manufacturing Equity Fund Below is the key information for Aditya Birla Sun Life Manufacturing Equity Fund Returns up to 1 year are on The investment objective of the Scheme is to provide medium to long term capital appreciation through appropriate diversification and taking low risk on business quality. The diversified portfolio would predominantly consist of equity and equity related securities including derivatives. However, there can be no assurance that the investment objective of the Scheme will be achieved. Research Highlights for Mahindra Badhat Yojana Below is the key information for Mahindra Badhat Yojana Returns up to 1 year are on To generate capital appreciation through investments in equity and equity related securities in core sectors and associated feeder industries. Research Highlights for ICICI Prudential Multicap Fund Below is the key information for ICICI Prudential Multicap Fund Returns up to 1 year are on (Erstwhile JM Multi Strategy Fund) The investment objective of the Scheme is to provide capital appreciation by investing in equity and equity related securities using a combination of strategies. Research Highlights for JM Multicap Fund Below is the key information for JM Multicap Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate capital appreciation and/or provide income distribution from a portfolio of predominantly equity and equity related instruments. There is no assurance or guarantee that the objectives of the scheme will be realized. Research Highlights for Bandhan Focused Equity Fund Below is the key information for Bandhan Focused Equity Fund Returns up to 1 year are on (Erstwhile Edelweiss Economic Resurgence Fund ) The investment objective of the Scheme is to generate long-term capital appreciation from a diversi?ed portfolio that predominantly invests in equity and equity-related securities of companies across various market capitalisation.

However, there can be no assurance that the investment objective of the Scheme will be realised. Research Highlights for Edelweiss Multi Cap Fund Below is the key information for Edelweiss Multi Cap Fund Returns up to 1 year are on (Erstwhile Franklin India Prima Plus) The investment objective of Prima Plus is to provide growth of capital plus regular dividend through a diversified portfolio of equities, fixed income securities and money market instruments. Research Highlights for Franklin India Equity Fund Below is the key information for Franklin India Equity Fund Returns up to 1 year are on 1. HDFC Equity Fund

HDFC Equity Fund

Growth Launch Date 1 Jan 95 NAV (13 Feb 26) ₹2,072.88 ↓ -16.31 (-0.78 %) Net Assets (Cr) ₹96,295 on 31 Dec 25 Category Equity - Multi Cap AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.44 Sharpe Ratio 0.53 Information Ratio 1.24 Alpha Ratio 3.7 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,188 31 Jan 23 ₹15,801 31 Jan 24 ₹21,419 31 Jan 25 ₹25,237 31 Jan 26 ₹28,444 Returns for HDFC Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 0% 3 Month 0.3% 6 Month 5.3% 1 Year 15.4% 3 Year 22.3% 5 Year 20.6% 10 Year 15 Year Since launch 18.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.4% 2023 23.5% 2022 30.6% 2021 18.3% 2020 36.2% 2019 6.4% 2018 6.8% 2017 -3.5% 2016 36.9% 2015 7.3% Fund Manager information for HDFC Equity Fund

Name Since Tenure Chirag Setalvad 8 Dec 25 0.07 Yr. Dhruv Muchhal 22 Jun 23 2.53 Yr. Data below for HDFC Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 38.96% Consumer Cyclical 15.22% Health Care 7.46% Technology 5.6% Basic Materials 5.25% Industrials 4.76% Utility 2.5% Communication Services 2.47% Real Estate 2.36% Energy 1.37% Consumer Defensive 0.86% Asset Allocation

Asset Class Value Cash 12.66% Equity 86.81% Debt 0.53% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | 5321749% ₹8,595 Cr 64,000,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 13 | HDFCBANK8% ₹8,128 Cr 82,000,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 17 | 5322157% ₹6,855 Cr 54,000,000 State Bank of India (Financial Services)

Equity, Since 31 Jan 03 | SBIN4% ₹4,322 Cr 44,000,000 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 31 Mar 21 | SBILIFE4% ₹4,070 Cr 20,000,000 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Oct 23 | KOTAKBANK4% ₹4,006 Cr 18,200,000 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Dec 23 | MARUTI3% ₹3,339 Cr 2,000,000 Cipla Ltd (Healthcare)

Equity, Since 30 Sep 12 | 5000873% ₹3,174 Cr 21,000,000 HCL Technologies Ltd (Technology)

Equity, Since 30 Sep 20 | HCLTECH3% ₹2,922 Cr 18,000,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 30 Sep 23 | 5328983% ₹2,408 Cr 91,000,000 2. Nippon India Multi Cap Fund

Nippon India Multi Cap Fund

Growth Launch Date 28 Mar 05 NAV (13 Feb 26) ₹297.613 ↓ -2.74 (-0.91 %) Net Assets (Cr) ₹50,352 on 31 Dec 25 Category Equity - Multi Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 1.57 Sharpe Ratio -0.06 Information Ratio 0.64 Alpha Ratio -1.3 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,272 31 Jan 23 ₹16,812 31 Jan 24 ₹24,235 31 Jan 25 ₹27,905 31 Jan 26 ₹29,655 Returns for Nippon India Multi Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 1.7% 3 Month -2.1% 6 Month -0.2% 1 Year 14.1% 3 Year 21.9% 5 Year 22.1% 10 Year 15 Year Since launch 17.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 4.1% 2023 25.8% 2022 38.1% 2021 14.1% 2020 48.9% 2019 0% 2018 2.2% 2017 -2.2% 2016 40.9% 2015 -6.7% Fund Manager information for Nippon India Multi Cap Fund

Name Since Tenure Sailesh Raj Bhan 31 Mar 05 20.77 Yr. Ashutosh Bhargava 1 Sep 21 4.34 Yr. Kinjal Desai 25 May 18 7.61 Yr. Lokesh Maru 5 Sep 25 0.32 Yr. Divya Sharma 5 Sep 25 0.32 Yr. Data below for Nippon India Multi Cap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Consumer Cyclical 23.93% Financial Services 23.31% Industrials 16.17% Health Care 9.48% Basic Materials 5.74% Utility 5.65% Consumer Defensive 5.53% Technology 5.19% Energy 2.52% Communication Services 1.44% Asset Allocation

Asset Class Value Cash 1.03% Equity 98.97% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 10 | HDFCBANK5% ₹2,733 Cr 27,569,796

↑ 500,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jan 15 | 5322154% ₹1,795 Cr 14,140,351 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | 5321743% ₹1,478 Cr 11,009,000

↑ 2,500,000 Infosys Ltd (Technology)

Equity, Since 30 Apr 09 | INFY3% ₹1,444 Cr 8,939,713

↓ -243,518 GE Vernova T&D India Ltd (Industrials)

Equity, Since 31 May 12 | 5222753% ₹1,377 Cr 4,395,615

↓ -401,443 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 20 | RELIANCE3% ₹1,267 Cr 8,068,975

↓ -1,500,000 Max Financial Services Ltd (Financial Services)

Equity, Since 31 Mar 12 | 5002712% ₹1,203 Cr 7,196,331

↓ -84,778 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 10 | LT2% ₹1,014 Cr 2,482,390 NTPC Ltd (Utilities)

Equity, Since 30 Jun 23 | 5325552% ₹981 Cr 29,762,573 ITC Ltd (Consumer Defensive)

Equity, Since 31 May 25 | ITC2% ₹927 Cr 23,013,819 3. Motilal Oswal Multicap 35 Fund

Motilal Oswal Multicap 35 Fund

Growth Launch Date 28 Apr 14 NAV (13 Feb 26) ₹58.0221 ↓ -0.98 (-1.67 %) Net Assets (Cr) ₹13,862 on 31 Dec 25 Category Equity - Multi Cap AMC Motilal Oswal Asset Management Co. Ltd Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.77 Sharpe Ratio -0.51 Information Ratio 0.54 Alpha Ratio -12.91 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,508 31 Jan 23 ₹10,830 31 Jan 24 ₹15,405 31 Jan 25 ₹19,292 31 Jan 26 ₹19,595 Returns for Motilal Oswal Multicap 35 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month -3.8% 3 Month -6.9% 6 Month -3.9% 1 Year 4.2% 3 Year 21.9% 5 Year 12.8% 10 Year 15 Year Since launch 16.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 -5.6% 2023 45.7% 2022 31% 2021 -3% 2020 15.3% 2019 10.3% 2018 7.9% 2017 -7.8% 2016 43.1% 2015 8.5% Fund Manager information for Motilal Oswal Multicap 35 Fund

Name Since Tenure Ajay Khandelwal 1 Oct 24 1.25 Yr. Niket Shah 1 Jul 22 3.51 Yr. Rakesh Shetty 22 Nov 22 3.11 Yr. Atul Mehra 1 Oct 24 1.25 Yr. Sunil Sawant 1 Jul 24 1.5 Yr. Data below for Motilal Oswal Multicap 35 Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Technology 22.19% Industrials 15.89% Consumer Cyclical 13.34% Financial Services 12.91% Communication Services 9.44% Energy 2.24% Consumer Defensive 0.27% Asset Allocation

Asset Class Value Cash 23.73% Equity 76.27% Top Securities Holdings / Portfolio

Name Holding Value Quantity Persistent Systems Ltd (Technology)

Equity, Since 31 Mar 23 | PERSISTENT10% ₹1,411 Cr 2,249,513

↓ -487 Coforge Ltd (Technology)

Equity, Since 31 May 23 | COFORGE9% ₹1,247 Cr 7,500,000 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | KALYANKJIL7% ₹974 Cr 20,075,900

↓ -3,424,100 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 Mar 23 | CHOLAFIN7% ₹933 Cr 5,480,348

↓ -397,148 Polycab India Ltd (Industrials)

Equity, Since 31 Jan 24 | POLYCAB7% ₹905 Cr 1,188,311

↓ -275,250 ICICI Bank Ltd (Financial Services)

Equity, Since 28 Feb 21 | 5321746% ₹853 Cr 6,353,221

↑ 3,853,721 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 31 Jan 25 | 5000936% ₹770 Cr 11,879,369

↓ -120,631 Eternal Ltd (Consumer Cyclical)

Equity, Since 31 May 25 | 5433206% ₹765 Cr 27,525,000

↓ -12,500,000 Bharti Airtel Ltd (Partly Paid Rs.1.25) (Communication Services)

Equity, Since 30 Apr 24 | 8901575% ₹676 Cr 4,000,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Nov 25 | BHARTIARTL5% ₹632 Cr 3,000,000 4. Aditya Birla Sun Life Manufacturing Equity Fund

Aditya Birla Sun Life Manufacturing Equity Fund

Growth Launch Date 31 Jan 15 NAV (13 Feb 26) ₹33.71 ↓ -0.45 (-1.32 %) Net Assets (Cr) ₹1,099 on 31 Dec 25 Category Equity - Multi Cap AMC Birla Sun Life Asset Management Co Ltd Rating Risk High Expense Ratio 2.26 Sharpe Ratio -0.05 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,371 31 Jan 23 ₹12,161 31 Jan 24 ₹16,902 31 Jan 25 ₹19,203 31 Jan 26 ₹20,465 Returns for Aditya Birla Sun Life Manufacturing Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 3% 3 Month 0.6% 6 Month 7.7% 1 Year 17.1% 3 Year 21.2% 5 Year 15.1% 10 Year 15 Year Since launch 11.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.5% 2023 25% 2022 32.5% 2021 -1.4% 2020 22.1% 2019 26.3% 2018 -4% 2017 -12.9% 2016 41.7% 2015 9.2% Fund Manager information for Aditya Birla Sun Life Manufacturing Equity Fund

Name Since Tenure Harish Krishnan 3 Nov 23 2.16 Yr. Data below for Aditya Birla Sun Life Manufacturing Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Consumer Cyclical 30.39% Industrials 24.36% Basic Materials 21.24% Health Care 11.48% Energy 5.24% Consumer Defensive 4.26% Technology 1.76% Utility 0.69% Asset Allocation

Asset Class Value Cash 0.59% Equity 99.41% Top Securities Holdings / Portfolio

Name Holding Value Quantity Hindalco Industries Ltd (Basic Materials)

Equity, Since 31 Mar 17 | HINDALCO5% ₹59 Cr 663,789

↓ -24,242 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 19 | RELIANCE5% ₹58 Cr 366,616

↓ -12,944 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 28 Feb 15 | MARUTI5% ₹54 Cr 32,584 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Nov 22 | M&M5% ₹54 Cr 144,570

↓ -5,430 Cummins India Ltd (Industrials)

Equity, Since 28 Feb 15 | 5004803% ₹38 Cr 85,582

↓ -4,418 Tata Steel Ltd (Basic Materials)

Equity, Since 30 Jun 16 | TATASTEEL3% ₹34 Cr 1,902,669 Vedanta Ltd (Basic Materials)

Equity, Since 31 Jul 24 | 5002953% ₹33 Cr 550,000 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 30 Nov 22 | SUNPHARMA3% ₹33 Cr 190,238 United Breweries Ltd (Consumer Defensive)

Equity, Since 31 May 16 | UBL2% ₹27 Cr 167,179 Bharat Electronics Ltd (Industrials)

Equity, Since 28 Feb 15 | BEL2% ₹27 Cr 678,274 5. Mahindra Badhat Yojana

Mahindra Badhat Yojana

Growth Launch Date 11 May 17 NAV (13 Feb 26) ₹35.8179 ↓ -0.44 (-1.22 %) Net Assets (Cr) ₹6,133 on 31 Dec 25 Category Equity - Multi Cap AMC Mahindra Asset Management Company Pvt. Ltd. Rating Risk Moderately High Expense Ratio 1.83 Sharpe Ratio -0.07 Information Ratio 0.17 Alpha Ratio -1.73 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,333 31 Jan 23 ₹14,823 31 Jan 24 ₹22,200 31 Jan 25 ₹23,708 31 Jan 26 ₹25,983 Returns for Mahindra Badhat Yojana

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month -0.1% 3 Month -1.4% 6 Month 3.1% 1 Year 14.3% 3 Year 21.2% 5 Year 18.6% 10 Year 15 Year Since launch 15.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.4% 2023 23.4% 2022 34.2% 2021 1.6% 2020 50.8% 2019 16.6% 2018 13.8% 2017 -9.9% 2016 2015 Fund Manager information for Mahindra Badhat Yojana

Name Since Tenure Manish Lodha 21 Dec 20 5.03 Yr. Fatema Pacha 16 Oct 20 5.21 Yr. Vishal Jajoo 3 Nov 25 0.16 Yr. Data below for Mahindra Badhat Yojana as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 30.94% Industrials 17.41% Health Care 14.11% Consumer Cyclical 12.25% Basic Materials 8.23% Technology 7.15% Communication Services 4.08% Energy 2.11% Utility 1.05% Real Estate 1.03% Asset Allocation

Asset Class Value Cash 1.64% Equity 98.36% Top Securities Holdings / Portfolio

Name Holding Value Quantity Glenmark Pharmaceuticals Ltd (Healthcare)

Equity, Since 30 Jun 25 | 5322963% ₹201 Cr 989,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 24 | 5321743% ₹188 Cr 1,403,000 Indus Towers Ltd Ordinary Shares (Communication Services)

Equity, Since 31 Jan 25 | 5348163% ₹188 Cr 4,490,000 Divi's Laboratories Ltd (Healthcare)

Equity, Since 30 Apr 23 | DIVISLAB3% ₹182 Cr 285,000 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Nov 25 | SHRIRAMFIN3% ₹154 Cr 1,547,000

↑ 140,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 28 Feb 25 | 5325382% ₹147 Cr 125,000 Polycab India Ltd (Industrials)

Equity, Since 31 Jul 25 | POLYCAB2% ₹147 Cr 193,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 25 | 5322152% ₹133 Cr 1,050,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 24 | RELIANCE2% ₹130 Cr 825,000 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 30 Nov 25 | MCX2% ₹126 Cr 113,000

↑ 28,000 6. ICICI Prudential Multicap Fund

ICICI Prudential Multicap Fund

Growth Launch Date 1 Oct 94 NAV (13 Feb 26) ₹805.38 ↓ -10.49 (-1.29 %) Net Assets (Cr) ₹16,263 on 31 Dec 25 Category Equity - Multi Cap AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.75 Sharpe Ratio 0.03 Information Ratio 0.27 Alpha Ratio 0.06 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-18 Months (1%),18 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,691 31 Jan 23 ₹14,069 31 Jan 24 ₹20,002 31 Jan 25 ₹22,856 31 Jan 26 ₹23,998 Returns for ICICI Prudential Multicap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 1.9% 3 Month -0.5% 6 Month 2.8% 1 Year 11.2% 3 Year 20.4% 5 Year 17.1% 10 Year 15 Year Since launch 15% Historical performance (Yearly) on absolute basis

Year Returns 2024 5.7% 2023 20.7% 2022 35.4% 2021 4.7% 2020 36.4% 2019 9.2% 2018 6% 2017 0.2% 2016 28% 2015 10.1% Fund Manager information for ICICI Prudential Multicap Fund

Name Since Tenure Lalit Kumar 29 Sep 25 0.26 Yr. Sharmila D’mello 31 Jul 22 3.42 Yr. Data below for ICICI Prudential Multicap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 25.4% Industrials 20.71% Financial Services 16.42% Consumer Cyclical 15.49% Communication Services 6.04% Real Estate 5.74% Health Care 3.95% Technology 1.63% Consumer Defensive 1.61% Energy 0.5% Utility 0.15% Asset Allocation

Asset Class Value Cash 2.36% Equity 97.64% Top Securities Holdings / Portfolio

Name Holding Value Quantity Vedanta Ltd (Basic Materials)

Equity, Since 31 Aug 25 | 5002954% ₹686 Cr 11,352,245

↑ 1,000,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL4% ₹657 Cr 3,119,041 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Aug 25 | 5325383% ₹434 Cr 368,008 Jindal Steel Ltd (Basic Materials)

Equity, Since 31 Aug 25 | 5322862% ₹400 Cr 3,800,436

↑ 770,764 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 23 | 5322152% ₹396 Cr 3,122,359 BSE Ltd (Financial Services)

Equity, Since 31 Aug 25 | BSE2% ₹367 Cr 1,393,998

↑ 73,274 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Aug 25 | INDIGO2% ₹361 Cr 712,741

↑ 150,000 PB Fintech Ltd (Financial Services)

Equity, Since 31 Aug 25 | 5433902% ₹291 Cr 1,593,271 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Aug 25 | HAL2% ₹283 Cr 645,553 JSW Steel Ltd (Basic Materials)

Equity, Since 31 Aug 25 | JSWSTEEL2% ₹262 Cr 2,252,423

↑ 654,899 7. JM Multicap Fund

JM Multicap Fund

Growth Launch Date 23 Sep 08 NAV (13 Feb 26) ₹94.3849 ↓ -1.27 (-1.33 %) Net Assets (Cr) ₹5,463 on 31 Dec 25 Category Equity - Multi Cap AMC JM Financial Asset Management Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.84 Sharpe Ratio -0.74 Information Ratio 0.59 Alpha Ratio -14.34 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,550 31 Jan 23 ₹14,170 31 Jan 24 ₹21,354 31 Jan 25 ₹25,168 31 Jan 26 ₹24,349 Returns for JM Multicap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month -0.4% 3 Month -3.9% 6 Month -1.4% 1 Year 1.3% 3 Year 20% 5 Year 16.9% 10 Year 15 Year Since launch 13.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 -6.8% 2023 33.3% 2022 40% 2021 7.8% 2020 32.9% 2019 11.4% 2018 16.6% 2017 -5.4% 2016 39.5% 2015 10.5% Fund Manager information for JM Multicap Fund

Name Since Tenure Satish Ramanathan 20 Aug 21 4.37 Yr. Asit Bhandarkar 1 Oct 24 1.25 Yr. Ruchi Fozdar 4 Oct 24 1.24 Yr. Deepak Gupta 11 Apr 25 0.73 Yr. Data below for JM Multicap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 28.59% Consumer Cyclical 15.59% Technology 14.42% Industrials 10.5% Health Care 8.74% Basic Materials 6.35% Consumer Defensive 5.14% Energy 4.31% Communication Services 4.21% Real Estate 0.31% Asset Allocation

Asset Class Value Cash 1.82% Equity 98.17% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 25 | RELIANCE4% ₹236 Cr 1,500,000

↓ -467,880 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 10 | LT4% ₹234 Cr 573,383

↓ -158,976 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 24 | BHARTIARTL4% ₹230 Cr 1,092,200

↓ -240,000 Godfrey Phillips India Ltd (Consumer Defensive)

Equity, Since 28 Feb 25 | GODFRYPHLP4% ₹219 Cr 794,101 Tech Mahindra Ltd (Technology)

Equity, Since 31 Jul 24 | 5327554% ₹206 Cr 1,294,184

↓ -546,724 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Nov 23 | HDFCBANK3% ₹178 Cr 1,800,000

↓ -200,000 State Bank of India (Financial Services)

Equity, Since 30 Nov 20 | SBIN3% ₹177 Cr 1,802,196

↓ -1,202,804 Infosys Ltd (Technology)

Equity, Since 31 Aug 25 | INFY3% ₹166 Cr 1,024,796

↓ -12,461 One97 Communications Ltd (Technology)

Equity, Since 31 May 25 | 5433963% ₹163 Cr 1,251,745 Dr Reddy's Laboratories Ltd (Healthcare)

Equity, Since 31 Oct 25 | DRREDDY3% ₹149 Cr 1,171,532

↑ 205,000 8. Bandhan Focused Equity Fund

Bandhan Focused Equity Fund

Growth Launch Date 16 Mar 06 NAV (13 Feb 26) ₹87.2 ↓ -0.85 (-0.97 %) Net Assets (Cr) ₹2,059 on 31 Dec 25 Category Equity - Multi Cap AMC IDFC Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 2.1 Sharpe Ratio -0.4 Information Ratio 0.35 Alpha Ratio -8.83 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,429 31 Jan 23 ₹11,501 31 Jan 24 ₹15,910 31 Jan 25 ₹18,750 31 Jan 26 ₹19,365 Returns for Bandhan Focused Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 0.7% 3 Month -3.1% 6 Month 0% 1 Year 8.5% 3 Year 19.3% 5 Year 12.5% 10 Year 15 Year Since launch 11.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 -1.6% 2023 30.3% 2022 31.3% 2021 -5% 2020 24.6% 2019 14.9% 2018 8.9% 2017 -12.7% 2016 54.4% 2015 1.8% Fund Manager information for Bandhan Focused Equity Fund

Name Since Tenure Manish Gunwani 2 Dec 24 1.08 Yr. Kirthi Jain 2 Dec 24 1.08 Yr. Ritika Behera 7 Oct 23 2.24 Yr. Gaurav Satra 7 Jun 24 1.57 Yr. Rahul Agarwal 2 Dec 24 1.08 Yr. Data below for Bandhan Focused Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 33.99% Consumer Defensive 16.65% Health Care 15.47% Technology 8.42% Real Estate 6.88% Consumer Cyclical 4.35% Industrials 3.79% Energy 2.72% Basic Materials 2.68% Communication Services 2.35% Utility 1.99% Asset Allocation

Asset Class Value Cash 0.71% Equity 99.29% Top Securities Holdings / Portfolio

Name Holding Value Quantity Power Finance Corp Ltd (Financial Services)

Equity, Since 31 Mar 25 | 5328108% ₹164 Cr 4,612,723

↑ 270,000 LT Foods Ltd (Consumer Defensive)

Equity, Since 30 Jun 25 | 5327837% ₹154 Cr 3,943,991

↑ 180,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 25 | SBIN6% ₹131 Cr 1,331,166 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 19 | HDFCBANK6% ₹129 Cr 1,302,728 Jubilant Pharmova Ltd (Healthcare)

Equity, Since 31 Jul 25 | JUBLPHARMA5% ₹103 Cr 955,222

↑ 100,308 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | 5321745% ₹95 Cr 710,586 Glenmark Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Dec 24 | 5322964% ₹90 Cr 442,894 Prestige Estates Projects Ltd (Real Estate)

Equity, Since 31 Jan 25 | PRESTIGE4% ₹84 Cr 524,887 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 24 | LT4% ₹78 Cr 191,166 Cholamandalam Financial Holdings Ltd (Financial Services)

Equity, Since 31 May 25 | CHOLAHLDNG4% ₹77 Cr 425,719

↑ 3,300 9. Edelweiss Multi Cap Fund

Edelweiss Multi Cap Fund

Growth Launch Date 3 Feb 15 NAV (13 Feb 26) ₹39.145 ↓ -0.61 (-1.54 %) Net Assets (Cr) ₹3,127 on 31 Dec 25 Category Equity - Multi Cap AMC Edelweiss Asset Management Limited Rating Risk High Expense Ratio 1.98 Sharpe Ratio 0.03 Information Ratio 0.91 Alpha Ratio -2.22 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,560 31 Jan 23 ₹13,488 31 Jan 24 ₹18,190 31 Jan 25 ₹20,985 31 Jan 26 ₹23,027 Returns for Edelweiss Multi Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month -0.6% 3 Month -0.6% 6 Month 4.9% 1 Year 13.6% 3 Year 19.1% 5 Year 15.4% 10 Year 15 Year Since launch 13.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 5.4% 2023 25.4% 2022 29.3% 2021 0.7% 2020 34.7% 2019 14.4% 2018 8.4% 2017 -4.9% 2016 47.4% 2015 0.4% Fund Manager information for Edelweiss Multi Cap Fund

Name Since Tenure Ashwani Agarwalla 15 Jun 22 3.55 Yr. Trideep Bhattacharya 1 Oct 21 4.25 Yr. Raj Koradia 1 Aug 24 1.42 Yr. Data below for Edelweiss Multi Cap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 33.24% Consumer Cyclical 12.58% Technology 10.18% Industrials 9.99% Basic Materials 7.41% Health Care 6.61% Consumer Defensive 6.2% Energy 5% Communication Services 2.53% Utility 2.33% Real Estate 1.38% Asset Allocation

Asset Class Value Cash 2.12% Equity 97.86% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 15 | HDFCBANK7% ₹217 Cr 2,190,827

↑ 6,251 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 17 | RELIANCE3% ₹107 Cr 683,249

↑ 3,977 ICICI Bank Ltd (Financial Services)

Equity, Since 28 Feb 15 | 5321743% ₹101 Cr 751,468 Larsen & Toubro Ltd (Industrials)

Equity, Since 28 Feb 15 | LT3% ₹99 Cr 241,612

↑ 1,532 State Bank of India (Financial Services)

Equity, Since 31 Aug 18 | SBIN3% ₹91 Cr 926,234

↑ 6,417 Infosys Ltd (Technology)

Equity, Since 30 Apr 18 | INFY3% ₹86 Cr 532,965

↓ -46,952 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 19 | BHARTIARTL3% ₹79 Cr 375,230

↑ 2,945 NTPC Ltd (Utilities)

Equity, Since 31 Oct 22 | 5325552% ₹73 Cr 2,209,438

↑ 19,134 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Sep 22 | M&M2% ₹64 Cr 173,883

↑ 1,712 Tata Steel Ltd (Basic Materials)

Equity, Since 31 May 25 | TATASTEEL2% ₹63 Cr 3,492,787

↑ 36,668 10. Franklin India Equity Fund

Franklin India Equity Fund

Growth Launch Date 29 Sep 94 NAV (13 Feb 26) ₹1,642.56 ↓ -20.62 (-1.24 %) Net Assets (Cr) ₹19,972 on 31 Dec 25 Category Equity - Multi Cap AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.72 Sharpe Ratio -0.13 Information Ratio 0.51 Alpha Ratio -4.14 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,795 31 Jan 23 ₹13,884 31 Jan 24 ₹19,158 31 Jan 25 ₹21,647 31 Jan 26 ₹22,960 Returns for Franklin India Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 0% 3 Month -1.7% 6 Month 1.8% 1 Year 9.9% 3 Year 18.7% 5 Year 15.9% 10 Year 15 Year Since launch 17.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.3% 2023 21.8% 2022 30.8% 2021 5.3% 2020 40.3% 2019 16% 2018 3.3% 2017 -4.4% 2016 30.6% 2015 5% Fund Manager information for Franklin India Equity Fund

Name Since Tenure R. Janakiraman 1 Feb 11 14.93 Yr. Sandeep Manam 18 Oct 21 4.21 Yr. Rajasa Kakulavarapu 1 Dec 23 2.09 Yr. Data below for Franklin India Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 28.59% Industrials 13.99% Consumer Cyclical 9.76% Technology 8.34% Health Care 6.68% Consumer Defensive 5.66% Basic Materials 5.51% Utility 4.87% Energy 4.75% Communication Services 4.57% Real Estate 1.46% Asset Allocation

Asset Class Value Cash 5.81% Equity 94.19% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 11 | HDFCBANK8% ₹1,672 Cr 16,869,284 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jan 10 | 5321746% ₹1,194 Cr 8,891,035 Bharti Airtel Ltd (Communication Services)

Equity, Since 28 Feb 06 | BHARTIARTL5% ₹912 Cr 4,333,252 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Aug 13 | LT4% ₹871 Cr 2,131,779 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 14 | 5322154% ₹858 Cr 6,761,448 Infosys Ltd (Technology)

Equity, Since 29 Feb 12 | INFY4% ₹729 Cr 4,515,580

↓ -111,420 Reliance Industries Ltd (Energy)

Equity, Since 31 May 22 | RELIANCE4% ₹706 Cr 4,493,052 State Bank of India (Financial Services)

Equity, Since 31 Aug 15 | SBIN3% ₹610 Cr 6,206,362 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Jun 24 | M&M3% ₹598 Cr 1,612,271 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | KOTAKBANK3% ₹588 Cr 2,672,494

Conclusion

When making a long-term investment, investors are advised to take into account their risk appetite. Investors who wish to invest in equity funds should smartly allocate funds to their portfolio. However, there are no hard and fast rules, investors should see the level of risk they can take and then decide the funds to invest. Investors could thoroughly study these funds and invest according to their investment objectives by adding the Best diversified funds to their portfolio.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for HDFC Equity Fund