+91-22-48913909

+91-22-48913909

Table of Contents

New Fund Offer (NFO) Mutual Fund in India

NFO or New Fund Offer mutual fund is a new scheme launched by an Asset Management Company (AMC). These funds can either be open-ended or close-ended. Fund houses introduce new mutual fund schemes to augment their Assets Under Management (AUM).

NFO Mutual Funds are launched when the financial markets are performing well as individuals sense an opportunity of earning additional Income and invest in various financial avenues like mutual funds, equity shares, and Bonds. Taking advantage of this situation, AMCs introduce new mutual fund schemes.

So let us go through the various aspects of NFO Mutual Fund like what is an NFO mutual fund, the difference between NFO and IPO, reasons for why not to invest in an NFO mutual fund, and other related aspects.

What is NFO Mutual Fund?

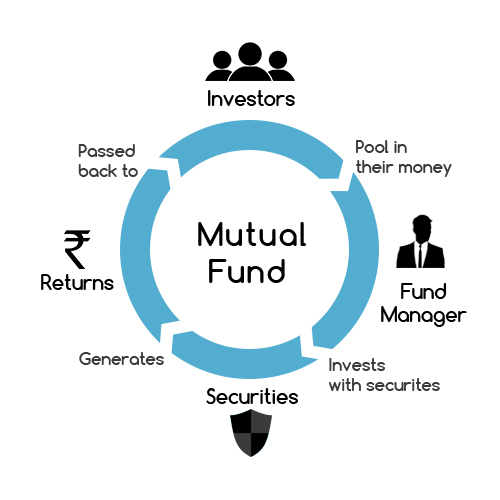

As mentioned earlier, New Fund Offers are mutual fund schemes collecting maiden subscription from the public. These new fund offers are launched by the AMC after considering the modalities and financial viability. AMCs introduce new fund offers for a group of individuals having the same set of requirements. For instance, assume a fund house has different categories of equity mutual funds like large cap Equity Funds, small cap equity funds, and mid-cap equity funds. However, after conducting a Market research, it is found that there are a group of individuals interested in a specific type of mutual fund that contains shares of large cap and small cap companies. In order to cater to such individuals, the AMC would introduce a new fund scheme, termed as NFO Mutual Fund.

The NFO mutual fund is launched to target a specific segment of customers and the subsequent need that exists.

Talk to our investment specialist

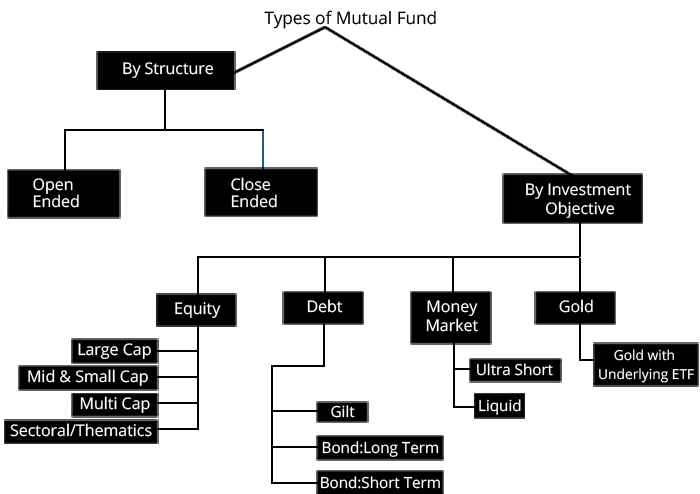

Types of Mutual Fund NFOs

1. Open-ended Funds

It is the most common form of investment in MFs. As the name goes, open-ended funds are always open for investment without any lock-in period. Investors can make Redemption as and when they feel. The number of units of the respective fund keeps fluctuating with the demand. An investor can procure units of MFs before its Net Asset Value (NAV) has been determined, which allows gaining long-term profits. The investor has to pay NAV for obtaining each unit of the respective fund when it starts operating.

In an open-ended fund, you can invest in lump-sum as well as through Systematic Investment plan (SIP). So the advantage of Investing in a SIP is that you can start with as low as Rs. 500 or Rs. 1000.

2. Close-ended Funds

Unlike open-ended funds, NFO investors will not be able to exit the funds until the maturity period, which usually comes with 3-5 years. An investor can subscribe to close-ended schemes only during the NFO period and redeem the units after the lock-in period of the scheme.

The units of a close-ended fund are available for purchase only during the New Fund Offer. Once the NFO period is over, fresh units of the fund will not be available for purchase. This means that you can invest only during the time of the Initial Fund Offer (IPO).

Generally, the minimum investment amount for investing in close-ended NFO starts from Rs. 5,000.

Benefits of Investing in NFOs

Following are the various advantages of investing in New Fund Offers:

1. High Rewards

As there can be a significant difference between the NFO price and the Net Asset Value. This difference can sometimes be highly rewarding.

2. Disciplined Investing

For keeping a disciplined investment, closed-fund NFO is a good option. Usually, people invest and end up redeeming shortly without making enough profits. With a lock-in feature in close-ended schemes, investors remain invested, thus increasing the chances of higher profits.

3. Rupee Cost Averaging

Through SIPs in open-ended funds, you can take benefit of rupee cost averaging of the unit price.

How to Invest in NFOs?

Investing in Mutual Fund NFOs is possible during the subscription period of 15 days. Earlier this period used to be 45 days. Investors depending on the choice given by the fund house can invest a lumpsum or even do a SIP.

Following are the options for investing:

1. Online Trading Account

You can invest in NFOs through an online Trading Account, where you can purchase and sell the NFO units. You can even track the Net Asset Value of the fund.

2. Through Broker

It is a basic way to invest in Mutual Funds, but, ensure you approach an authorised broker. The broker will do all the investment formalities regarding the application in the NFO. Nowadays, many brokers offer doorstep services for your convenience.

Note: Ensure you are investing in an NFO only after doing a thorough analysis and research.

Why not to Invest in NFOs?

Often, investors are confused on whether to invest in an NFO mutual fund. So let us look at the aspects on why not to invest in NFO mutual funds.

No Proven Track Record

NFO mutual funds being new, do not have a past performance record to determine their future performance. However, this becomes easy in case of an existing fund whose past data is already available.

Mutual Fund Charges

Newly launched mutual fund schemes in most cases have an initial expense and also marketing expenses, these are covered via the fund running expenses or the Management Fee. Resultantly, it can impact the performance of the fund as the effective return for the investors reduces. In contrast, in the existing fund, the mutual fund charges are generally lower.

Limited Diversification

NFO mutual funds in most situations are sector specific or category specific. Hence, they have limited scope of diversification and are not able to enjoy the benefits of diversification. Individuals should always consider the investment benefits properly before investing in any newly launched fund to minimize the losses.

Not Cheaper as Compared to Peer Funds

One of the biggest misnomers when it comes to investing in NFO mutual funds is that they are cheaper as compared to their peer funds. The performance of any mutual fund depends on the value of the Underlying assets it holds. Thus, better the performance of the underlying assets, higher the NAV.

The rationale behind investing in an NFO mutual fund is the uniqueness of the scheme. Individuals can invest in a new scheme if it is distinct from the existing ones. For instance, assume a fund house launches a mutual fund scheme which will invest its corpus in international commodity markets. If such schemes are not available, then individuals invest in this scheme for its uniqueness.

In addition, individuals invest in NFO mutual funds considering the reputation of the fund house and the fund manager managing the underlying fund.

NFO Mutual Fund Vs IPO

Though the concepts of NFOs and IPOs (Initial Public Offer) for a company seem to be identical, however, they differ from each other. IPO means a company raising shares (direct equity) from the public for the first time. The company while Going Public needs to submit all its credentials like past performance, future growth prospects and other factors through their prospects. In IPO, individuals get shares of the company against their money paid.

On the other hand, NFO is an investment in a new mutual fund scheme which in turn invests the money in stocks and bonds based on a specific strategy. During the subscription period of the NFO mutual fund, the mutual fund does not hold any investment, there is no Portfolio. Here, the scheme allots units to its investors at 10 rupees per unit. The NFO mutual fund invests the money collected in various financial instruments in-line with its objectives. Based on the performance of these underlying portfolio, the Net Asset Value (NAV) of the mutual fund tends to increase or decrease.

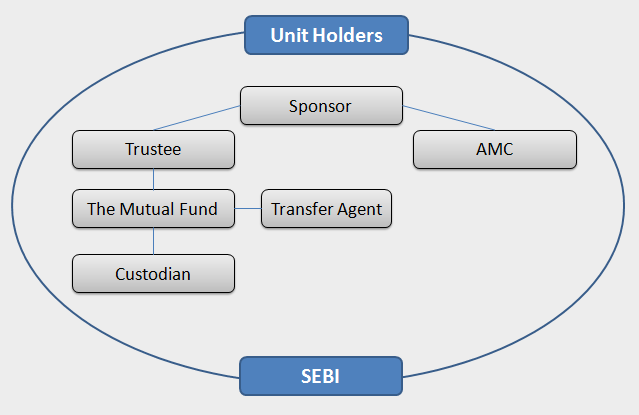

Before launching an NFO mutual fund, the AMC has to complete all the formalities and seek approvals from the concerned governing bodies like Securities and Exchange Board of India so that the process becomes smooth.In a nutshell, it can be concluded that any individual planning to invest in any NFO mutual fund schemes needs to go through the offer documents carefully. Individuals should also ensure whether by investing in the NFO mutual fund they will be able to achieve their objectives, the portfolio of assets that the mutual fund scheme will be holding, and other related aspects.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.