Table of Contents

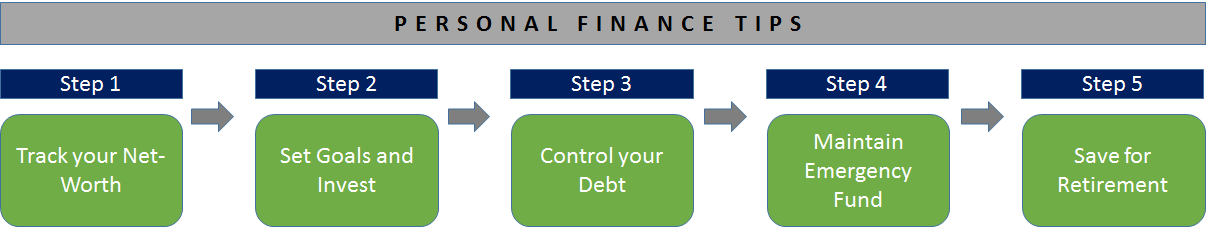

Personal Finance Tips

Want to improve your Personal Finance? Well, then you've landed at the right place! Personal finance is very important for everyone in order to build a healthy financial future and also for greater financial security. So, to start off with, here're have listed down a few important personal finance tips that you need to adopt right now!

Smart Personal Finance Tips

Step1: Track your net worth

A keynote to make personal finance better is by knowing your Net worth (NA). Run through your Current Assets (CA) and liabilities. Calculate your net worth by adding up all your CA and then subtract it with your outstanding debt i.e. Current Liabilities (CL). To illustrate in the form of an equation, it can be summarised as follows:

NA=CA-CL

Step2: Set goals and invest accordingly

Each of us has goals! Be it, buying a house/ car, building commodities, having a big fat wedding, going on a world tour, etc. These are Financial goals that we have to meet in a particular life defined time span (varying Basis each goal). The practical way of meeting these goals is by categorising them into three-time frames such as- short-term, mid-term and long-term goals. So, evaluate your goals along with their respective time frames.

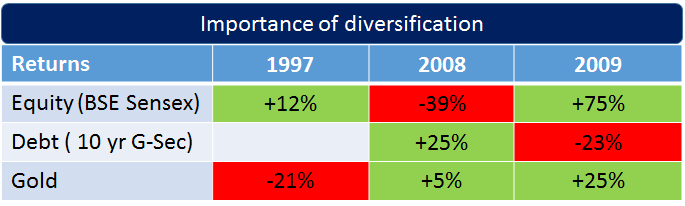

Investing is an important part of financial goals. The main idea behind investing is to generate a regular Income or returns in a specified period of time. Moreover, investing is a means of securing your assets or achieving desired returns. To name a few investment options they are as follows - Mutual Funds, shares, Bonds, hedge fund, ETFs, etc. So, to improve your personal finance, plan your investment avenues and invest smartly.

Step3: Control your debt

To build strong personal finance, start controlling your debt! Most of us go into debt and carry huge liabilities. Many people sometimes go overboard by swiping their credit cards for their lifestyles. Dependency on credit cards is not a good financial habit. So, if you've outstanding balances on your credit card, pay it off at the earliest and start making a healthy Financial plan.

Step4: Maintain an emergency fund

A little share from your Earnings should go here, i.e. on building an emergency fund. It’s a primary step to avoid any further financial problems in life. Emergencies could come up when you're jobless, unexpected health issues/ accidents, etc. So, start building your emergency funds and be financially secure even at your lows.

Talk to our investment specialist

Step5: Save for your Retirement

To build your personal finance strong, start saving for your retirement. Many people still don’t give much importance to their retirement plan. But, don’t you need a safe and secure life after you retire? We all need it! So, start saving for it right from an early age.

Having a perfect retired life comes with proper planning and execution. ‘Right planning and right investment’, is what matters the most. However, every person has a different lifestyle and requirements. That is why, you should first draw a personalised plan in accordance with your requirements, lifestyle, at what age you want to retire and your annual earnings.

Evaluate your monthly expenses, this will give you an idea about your spending in terms of both important and unnecessary things. This will also draw you to a line where you can figure out how much you can save every month.

Now you exactly know how to improve your personal finance! Start working on these above-mentioned points and maintain a healthy personal financial life!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.