Table of Contents

Average Annual Return (AAR)

When presenting historical returns of a fund, like the three, five, or ten-year average returns, the Average Annual Rate (AAR) is used in the percentage form. The average yearly return is reported before the Operating Expense ratio for the fund. Additionally, it excludes sales fees (if any) and brokerage commissions on Portfolio transactions. AAR, in its most basic form, gauges how much money a Mutual Fund made or lost over a specific time frame. As part of their Investment plan, investors thinking about making a mutual fund investment frequently research the AAR and compare it to other closely related funds.

Components of Average Annual Return on Stocks

The share price growth, Capital gains, and dividends are the three factors that make up an equity mutual fund's AAR:

Increase in Share Price

Unrealised profits or losses in the Underlying equities held in a portfolio cause share prices to increase. The AAR of the fund that keeps a position in an issue change proportionally when the share price of the stock changes over a year. To achieve the fund's performance goals, fund managers can add or remove assets from the fund or alter the proportions of each holding.

Capital Gains Distributions

A mutual fund pays Capital Gains distributions when it generates revenue or sells assets from which a growth portfolio manager makes a profit. The option of receiving payouts in cash or reinvesting in the fund is given to shareholders. The realised portion of the AAR consists of capital gains. The distribution results in a taxable Income for shareholders because it lowers the share price by the amount paid out. Even though a fund's AAR is negative, it might distribute taxable money.

Dividends

Quarterly dividend payments from corporate profits affect a mutual fund's AAR and lower the portfolio's Net Asset Value (NAV). The portfolio's dividend income can be reinvested or taken as cash, much as capital gains. Individual and corporate shareholders often receive dividend payments from large-cap stock funds with good Earnings. The AAR for a mutual fund's Dividend Yield is made up of these quarterly distributions.

Talk to our investment specialist

Annual Average Return Formula

Here is the formula for AAR:

AAR = (Return during the A Period + Return during the B Period + Return during the C Period + ... Return during the X Period) / Number of Periods Average Annual Return Example

To understand average annual return better, let's take an example. Suppose a fund has recorded the following annual returns:

| Year | Return Percentage |

|---|---|

| 2000 | 20% |

| 2001 | 25% |

| 2002 | 22% |

| 2002 | 1% |

You can now determine the AAR for the years 2000 to 2003 using this data and the formula above:

- AAR = (1% + 22% + 25% + 20%) / 4

- = 17%

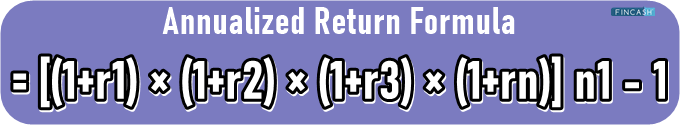

Annualised Return

An investment's geometric average yearly return over a specified period is the annualised Total Return. Its formula calculates how much a shareholder would make over time if the annual return were compounded.

Average Annual Return vs. CAGR

An annualised return, which is an extrapolated return for the entire year, can be considered a standard return calculated as a percentage every year. CAGR displays the yearly growth rate of your investments on average. The initial value, ending value, and time duration of an investment are the only three major inputs needed to calculate CAGR. As CAGR considers the idea that the investment is multiplied over time, it is preferable to average returns.

Conclusion

AAR can help you spot trends to some extent. Additionally, a single or a small number of unusually high or low data points, or "outliers," can skew the average and produce false conclusions. As a result, when assessing changing returns, most analysts choose to utilise the CAGR.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.