Table of Contents

What is Commingled Fund?

Commingled funds feature assets taken from multiple accounts that are combined together. The major benefit of the commingled fund is that it prevents the cost of handling and running the individual asset accounts separately. Commonly known as the pooled funds, commingled funds are not usually made available to people. These funds are rather featured in the common types of retirement plans, insurance policies, and other such accounts.

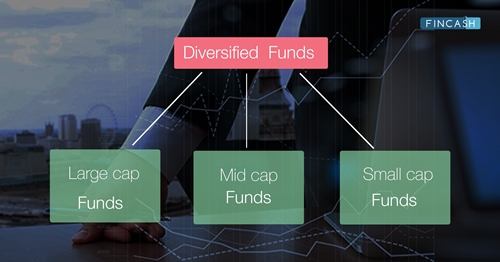

It wouldn’t be wrong to say that commingled funds are quite similar to Mutual Funds. Both funds are handled by multiple fund managers. In addition to that, the funds are mostly invested in stocks, Bonds, and other equities. Commingled funds also promote Portfolio diversification, which makes it possible for the investor to expand their portfolio by Investing in different types of financial instruments.

Understanding the Commingled Funds

One important thing to note here is that the commingled fund is not managed and regulated by SEC (Securities and Exchange Commission). Mutual funds, on the other hand, follow the detailed procedure as issued by the SEC. In order to create the commingled funds, a couple of investors must be willing to group their assets. It is equally important for the investors to have multiple assets available at their disposal to start the commingled funds.

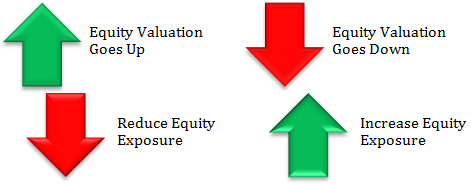

It is important for the investors to get a proper idea of how the commingled funds work before investing in the funds. They must learn more about the objectives of the fund and the liquidity aspects. Note that commingled funds are not made for those with short-term investment goals. If you have any emergency requirements, you can’t rely on the commingled funds to get the issue resolved. Withdrawing money is not going to be easy with the commingled funds. Once you have invested in these funds, you are going to have to wait for a specific number of days before you are able to withdraw your money. You might also experience delays when processing the withdrawal requests.

Talk to our investment specialist

Difference Between Mutual Funds and Commingled Funds

As mentioned earlier, mutual funds and commingled funds work the same way. Both are designed to bring the investor’s assets into a single centralized system. These assets are generated from different investors, clients, and accounts. These funds do not necessarily involve different fund managers. A single manager could Handle the commingled funds, just like how the mutual funds are managed.

The investment decision in the commingled and mutual funds is totally up to the management. What sets the mutual funds apart from the commingled fund is the fact that buying the mutual fund is relatively easier than the commingled fund. There is no need for the investor to have any personal connection with the investors involved in the process. All you have to do is find a broker or a seller who offers mutual funds, read the contract, and sign the deal. There you go! For commingled funds, the investor has to have a personal connection with the organization trading the funds.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.