Table of Contents

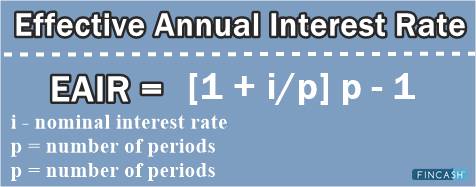

Effective Annual Interest Rate (EAIR)

What is an Effective Annual Interest Rate?

Also known as the annual equivalent rate or the effective rate, the effective annual interest rate is the real return that one gets on an interest-paying investment, such as a Savings Account. The return is acquired when the compounding effects, over the period of time, are taken into account.

It also helps to reveal the real percentage rate that is owed on the interest on a debt, like a credit card, loan, etc.

Effective Annual Interest Rate Formula

The Effective Annual Interest Rate Formula is:

Effective Annual Interest Rate = [1 + (nominal interest rate / number of periods)] number of periods - 1

Talk to our investment specialist

Understanding Effective Annual Interest Rate

A loan, a savings account, or a Bank Certificate of Deposit could be advertised with nominal interest rate and effective annual interest rate. While the nominal interest rate doesn’t reflect the impacts of compounding interest or the fees that come along with the financial products; the effective annual interest rate is regarded as the real return.

That is the reason why the effective annual interest rate is an essential financial concept that should be understood. You can only compare a variety of offers adequately if you know the effective annual interest rates of them.

Example of Effective Annual Interest Rate

Let’s take an effective annual interest rate example here. Suppose there are two different offers. One, an Investment Y is paying 10% interest and is compounded on a monthly Basis. Second, Investment Z is paying 10.1% and is compounded on a semi-annually basis.

So, which one would be better?

In both these scenarios, the advertised interest rate will be the nominal interest rate. And, the effective annual interest rate can be calculated by adjusting the nominal interest rate for the compounding period number that the product will experience within a specific time.

In this situation, the period will be 1 year. Thus, by putting the aforementioned formula:

For Investment Y: 10.47% = (1 + (10% / 12)) ^ 12 – 1

For Investment Z: 10.36% = (1 + (10.1% / 2)) ^ 2 - 1

With this result, it can be stated that Investment Z has a higher stated nominal interest rate; however, the effective annual interest rate will be lower than that of Investment Y. The reason behind this is that Investment Z compounds lesser times over the period of 1 year than Investment Y.

Thus, if the investor is ready to put Rs. 5,000,000 into any of these investments, one wrong decision would cost him more than Rs. 5800 each year.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.