Table of Contents

What is the Annual Percentage Rate (APR)?

The Annual Percentage Rate defines the total interest the investor gets and the borrower pays. APR shows the total Income an investor earns through interest over the entire term of their investment and the total amount the borrower is charged over the entire duration of the loan. Note that the annual percentage rate will also show the fees and any additional payment that’s associated with the given transaction, except for the interest compounded.

Banks and moneylenders have to show the annual percentage rate to the borrower and investor to give them a better idea of the total interest they will incur and earn over a specific period. Based on this information, the person can compare the rates and make an informed decision.

Understanding the Annual Percentage Rate

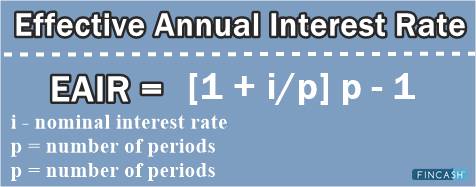

In simple terms, the annual percentage could be defined as the interest rate. It is used to calculate the total amount a borrower will pay until they re-pay the loan in full. The APY is calculated from the monthly interest payments you will incur over the term of the loan. For investors, APR tells the total interest they will earn from the investment over the term of their investment. However, it does not include the compounding interest.

According to the TILA (Truth in Lending Act), it is mandatory for the lenders, banks, and financial institutions to show the annual percentage rate to the borrowers. Now, the credit card companies can show the interest rate to their customers every month, but they are also supposed to specify the APR in the contract.

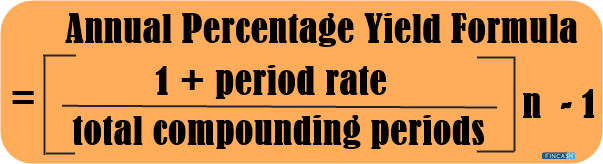

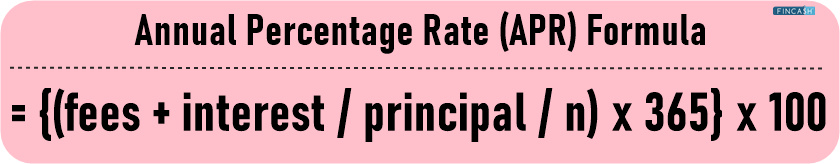

Annual Percentage Rate (APR) Formula

The formula for calculating the APR is as follows:

APR = {(fees + interest / principal / n) x 365} x 100

Note that APR in the United States has a different meaning and formula for calculation than the same in other countries. In the US, it is calculated by multiplying the total compounding periods in the 12 months by the Periodic Interest Rate. In Europe, transparency and consumer rights are taken into account when calculating the annual percentage rate.

Talk to our investment specialist

Different Types of APRs

Now, the APR varies depending on your transaction. For example, each credit card comes with a specific annual percentage rate that the borrower is supposed to pay on the principal amount. The companies may offer the zero APR as an introductory offer to new customers just to get them to sign up for the card, but the customers will have to pay the APR once the introductory period ends. Note that a credit company could charge a separate APR for cash balances, transfers, and purchases. Banks and financial institutions can charge the annual percentage rate to those who delay their payments or breach any condition of the contract.

The APR a borrower has to pay depends mainly on their credit scores and history. For example, banks charge a lower APR to those with a good Credit Score.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.