Table of Contents

Overview of Financial Risk Management

Financial Risk management refers to the process through which businesses spot possible financial hazards, analyze them, and devise preventative measures and strategies to mitigate or eliminate them. It is required in non-banking financial organizations, banks, and businesses.

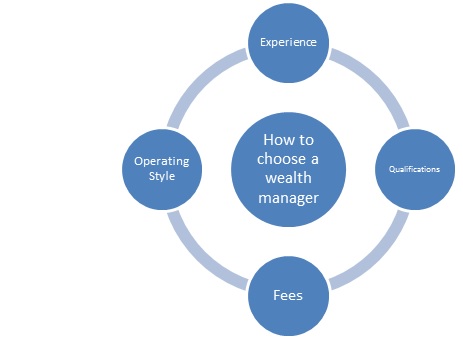

A Financial Risk Manager (FRM) is a trained professional with knowledge of the Market, credit, investment, and strategic risk and methods for managing them effectively. With their particular skill set and expertise, FRMs are critical members of any organization.

A Brief Understanding of FRMs

An FRM detects dangers to an organization's assets, earning capacity, or success. FRMs operate in various industries, including financial services, loan organizations, banking, trading, and marketing. Many focus on areas such as market or credit risk.

Risk is assessed by analyzing financial markets and the global environment to forecast trends and changes. A FIRM's responsibility also includes developing methods to mitigate the potential risks' effects.

Role of an Financial Risk Manager

Here are the critical roles of an FRM:

1. Creating a comprehensive process for risk management

A financial risk manager's most significant duty is to design a complete risk management process, processes, and policies for an organization. They also devise and implement risk management techniques.

Talk to our investment specialist

2. Identifying, assessing, and analyzing risks

The FRM identifies and analyses potential financial threats to the company. They create a clear and comprehensive process for risk identification, assessment, and analysis for this goal. The evaluation and analysis should also be able to show the scope and severity of risks and predict the organization's costs. For assessment, the FRM may choose to construct software/computer programs or apply statistical methodologies.

3. Risk evaluation and budget management

Based on the organization's risk management policies, specific guidelines for lowering or averting risks or easing the impact created by them, as well as legal authorities' guidelines regarding insurance, legal requirements, costs, environmental regulations, and so on, will have to be followed. It will also be necessary to assess and consider the organization's previous risk management practices. All of this is handled by the FRM.

4. Establish risk appetite

The FRM is in charge of determining the level of risk that the organization is prepared and willing to take; this is known as risk appetite.

5. Contingencies and preventive measures

The FRM implements sound contingency plans and precautionary measures based on internal and external risk assessments and evaluations (global, local, and national). They establish business continuity plans, and obtain insurance plans, put together health and safety measures, and prepare business continuity plans with the goal of reducing business risk.

6. Reporting risk and record-keeping

Based on the demands of various stakeholders, the FRM creates tailored feedback on different areas of hazards, such as evaluation of depth and degree, nature, likely effects, costs, insurance, budgeting, and so on. Insurance policies, claims, risk experiences, and loss experiences are all kept on record.

7. Examination

As financial risk experts, FRMs are crucial in reviewing legal papers, policies, contracts, new programs, and activities, etc. They look at these to determine the extent of the losses and the insurance and other financial ramifications.

8. Development of proposal

Their talents in projecting trends and hazards involved and appropriately incorporating them in the bid assist in the formulation of recommendations.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.