Table of Contents

Financial Risk

Debt is a common way to express financial risk in the Investing Industry. cash flow includes expenses and payments, forms the lifeblood of a business. Certain financial risks have the potential to cause unexpected losses, making it difficult or impossible to Handle a company's financial commitments.

These risks include customers who Fail to pay you, influential shifting Market circumstances, and management errors or technology faults that affect Income. For deep understanding, in this article, you’ll find everything related to financial risks.

What is Financial Risk?

To understand financial risk, let’s know the meaning of two terms used: Financial and Risk. The financial term implies finances. Risk can be defined as the likelihood of anything bad happening, potential resulting in a loss of some kind.

Financial risk is the term used to define the potential risk involved in doing business or investment. Governments can be unable to regulate monetary policy, resulting in bond defaults or other financial problems. Corporations are likewise exposed to the risk of defaulting on the debt they take on, but they can also fail in an endeavour that places a significant financial strain on the company.

Talk to our investment specialist

Types of Financial Risk

Managing financial risk is a top priority for every company. Market movements can include a wide Range of factors, which can lead to financial risk. These risks affect the cash flow & how money is handled in the business. There are four major types of risk that can be included in this list:

Market Risk - It is the possibility of losing money as a result of events affecting a whole market or Asset Class. Market risk is categorised into two types: directional risk and non-directional risk. Directional risk is created by changes in stock prices, interest rates, and other factors. Non-directional risk, on the other hand, might be associated with Volatility.

Operational Risk - These risks arise as a result of a company's lack of internal controls, technology failures, mismanagement, human mistake, or a lack of staff training. Operational Risk is divided into two categories: fraud risk and model risk. Fraud risk originates from a lack of controls, whereas model risk arises from improper model application.

Credit Risk - It is the risk that comes from extending credit to a client who does not pay. This can disrupt the cash flow and profit of the business.

liquidity Risk - It refers to the inability of a company to meet its future or existing financial obligations on time.

Pros and Cons of Financial Risk

Understanding financial risk can help one make better, more informed business or investment decisions. The degree of financial risk associated with a security or asset is used to determine or establish the value of that investment. Here are positives and negatives to take into consideration.

Pros

- Assist in company valuation

- Possible analysis through tool identification

- More informed decisions

Cons

- Might be difficult to overcome

- Impact on different sectors

- Arises out of unusual forces

Tools to Manage Financial Risk

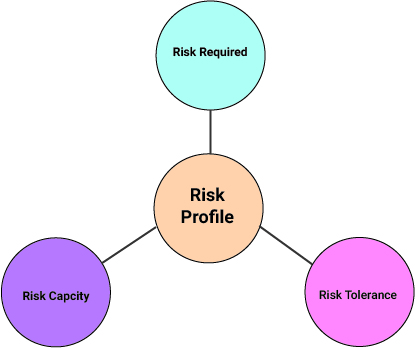

Individuals, businesses, and governments can use a variety of tools to assess how much financial risk they are willing to take on. fundamental analysis, Technical Analysis, and quantitative analysis are the most common techniques used by investment experts to assess long-term investment risks or the stock market as a whole.

- Quantitative analysis is a method of evaluating a company's past performance using particular financial ratio computations.

- Technical analysis is a statistical technique for evaluating securities that look at historical returns, transaction volume, share prices, and other performance data.

- Fundamental analysis is a way of determining a company's intrinsic worth by examining all elements of the Underlying business, including the firm's assets and profits.

Four Ways to Manage Financial Risk

Overspending-related financial concerns might be an impediment to your company's ability to meet its financial commitments. It is your Obligation to reduce financial risks in order to maintain a healthy cash flow. Listed below are the ways to manage the financial risk.

1. Maintain Savings Account

Consider putting a portion of your income into a Savings Account. While your savings account may not earn you much in the long term, it is still one of the safest places to keep your money. Furthermore, your savings account can assist you in transferring funds online, allowing for a faster and more comfortable financial transaction procedure.

2. Invest Wisely

Before you decide to invest in something, be sure you have adequate knowledge. In this case, speaking with your Accountant can be extremely beneficial since they can provide you with good advice on how to optimise your profits.

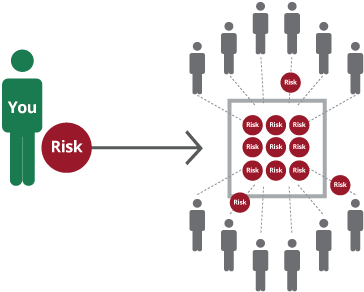

3. Diversification

Diversification is critical for reducing financial risks since its primary goal is to distribute your assets over a variety of financial instruments. It allows you to have a variety of investing progressions based on where you put your money.

4. Hire Management Accountant

Managing your cash flow and making sound business financial decisions can be difficult; it is preferable to use an accountant. An experienced and reliable accountants can give you proper assistance with many aspects of your business finances, such as debt repayment or rounding up investment returns.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.