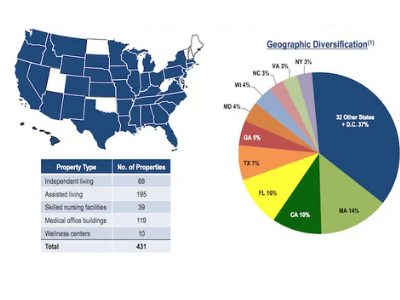

Geographical Diversification

What is Geographical Diversification?

Geographical diversification is a practice of diversifying an investment Portfolio across different geographic regions to reduce the overall risk and enhance returns. This method can be used by private investors as well as companies to limit and manage the risk. Usually, firms manage to lower their risk exposure to political and economic changes by locating particular departments in different parts of the world.

The geographical diversification significantly reduces the level of Volatility and exposure to external factors.

Risk Spreading by Diversifying

The basic principle supports the Asset Allocation that involves spreading money and risk across several structured products in a portfolio. A diversified portfolio should usually include some broad investment categories. The allocation is based on the following factors:

- Investors investment goals

- Risk-appetite for investment

- The time horizon for accessing investments

Talk to our investment specialist

A diversified portfolio has four main asset classes that are considered as follows:

- Stocks & Shares or equities

- Fixed income or Bonds

- money market or cash equivalents

- Property or other tangible assets

There are no right or wrong asset allotments, you need to ascertain those that are right based on your personal needs and Financial goals.

One of the basic building blocks of a solid portfolio is investment diversification. Ensure that as an investor you do not put all eggs in one basket.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.