Table of Contents

Defining Ultra-High Net-Worth Individual

To get on the meaning of ultra-high-net-worth individual, let’s first understand the high-net-worth individual's importance. In simple words, a High-Net-Worth Individual (HNWI) is a financial Industry classification that indicates an individual’s or a man’s worth, which is the Liquid asset of Rs. 73million.

On the other hand, the ultra-high Net worth individual is defined as the person or an individual having the investible asset of at least Rs. 2196 million. These individuals are among the world's wealthiest personalities and contribute a huge amount to global wealth.

Explaining Ultra-High Net-Worth Individuals

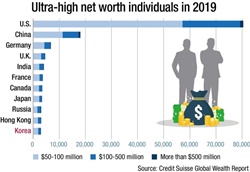

Ultra-net worth is generally considered in terms of a liquid asset over a certain figure mentioned above. The figure can differ according to the situations and the value of standard gold. The population of UHNWI is 0.003% of the entire world’s population, and they contribute approximate 13% of the world’s total wealth.

The UHNW individuals play a very crucial role not only in terms of finance but also in banking, investments, luxury companies, charities, universities, schools and other mandatory things. In terms of philanthropy, they have established many foundations, charitable trusts and support various causes, such as education, environmental crises, poverty, etc. This group of people is very less in population but is continuously growing. According to the reports, this group in India is expected to increase from 43% to 162 by the end of 2025.

As per the report published by Knight Frank, an individual needs $60,000 to join the wealthiest club of 1% in India. Also, as per the prediction of the Wealth Growth, India’s 1% threshold is expected to double in the next five years.

Talk to our investment specialist

Characteristics of UHNW

Until 2013, 65% of the global UHNW population comprised self-made individuals, in contrast to the 19% who had inherited the fortune and the other 16% who had inherited but simultaneously grown the wealth. As per the gender, such proportions change to a great extent. Furthermore, a report mentioned in 2013 spoke about the world’s 12% UHNW population being female. Out of these, merely 33% are self-made in comparison to 70% of the male population. The same report also mentioned that 22% of the self-made population derived the wealth from investment, banking, and finance. And then, 15% of people who inherited wealth are into social organizations and non-profit causes.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.