Income Funds

What are Income Funds?

An Income fund is a Mutual Fund or an exchange-traded fund (ETF) which focuses on current income, often in the garb of interest or dividend-paying investments. These funds usually possess a variety of government, municipal, and corporate debt obligations. Some other elements involved are money market instruments, preferred stock and stocks paying a dividend. In other words, income fund invests in Bonds and other fixed-income securities.

Note that income funds’ share prices are not fixed in nature. The share prices of these funds fall when the interest rates are rising and rise when the interest is falling. Usually, these funds include bonds of investment grade. There are two most popular high-risk funds that focus mainly on income. They are mentioned below:

a. High-yield bond funds: These funds are primarily invested in corporate junk bonds

b. Bank loan funds: These funds invest in floating-rate loans that are invested by banks or other financial institutions.

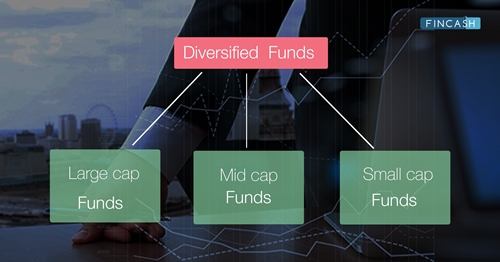

Therefore income funds come in several types and their major point of difference lies in the type of security they invest in order to generate income.

Type of Income Funds

The main type of income funds are mentioned below:

1. Money Market Funds

These funds invest in certificates of deposits (CDs), short-term treasury bills and commercial papers. These funds are specifically designed to be safe investments. They generally have a low share price at odd times, but also offer low yields.

Talk to our investment specialist

2. Equity Income Funds

investor’s get paid in dividends for the stocks they have invested in various companies. The funds that are invested in these stocks which assure regular dividend payments are known as equity income funds. These funds are very popular among retirement-age investors.

3. Bond Funds

Bond funds usually invest in corporate and government bonds. Government bond funds do not carry many risks and can act as safe investments corporate bond funds can carry a little risk.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.