Marginal Cost of Production

What is the Marginal Cost of Production?

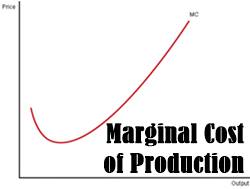

The marginal cost of production is defined as the changes in the total cost that occurs when you manufacture another unit. In order to obtain the marginal cost of production, you are supposed to divide the total changes in the cost of production by the total production units. The main reason why people calculate the marginal cost is that it helps them determine the time when the company can reach Economies of Scale.

The company can earn a profit when the cost of production for an extra unit is comparatively lower than the per-unit price of the same commodity. It is quite common for manufacturers to calculate the cost of production of another unit of the same commodity. This is done to determine the expenses on the additional unit as well as the Income from that unit.

Fixed and Variable Costs

For example, if an organization decides to build a new factory to increase the level of production, then the cost you pay to establish this factory will be considered the marginal cost.

The marginal cost usually differs with the quantity of the goods manufactured. As mentioned above, the primary purpose of calculating the marginal cost of production is to bring the production level up to the Marginal Revenue. In other words, this calculation helps companies maximize their profits to a level where the marginal cost of the product is equal to the marginal revenue. If the production goes beyond this level, then this cost will be higher than the revenues you generate from the production.

It is important to note that the cost of production includes both variable and fixed costs. The latter remains stable even if there is fluctuation in the production quantities. Variable cost, on the other hand, changes with the fluctuation in the output levels. The variable cost of the product will be higher as you produce more units of this product.

Talk to our investment specialist

Example

Let’s understand the concept with an example. Suppose you work in a company that produces hats. Each new unit of the hat needs plastic and fabric worth INR 50. The factory you work at pays INR 50,000 as the Fixed Cost every month. Here, the plastic and fabric will be the variable cost as it will change with the level of production. The rental payment for equipment, building, and other plants will be the fixed cost that is spread out across different units of hats. The more hats you produce, the higher the variable cost will be. That’s because you will need more plastic and fabric for additional units.

If the factory fails to produce the additional units of hats with the current equipment and machinery, then you are going to need to add the extra cost of machinery to the marginal cost of production. Suppose you managed to produce up to 1499 units of a product and needed new machinery of INR 5,00,000 for the 1500th unit, you are going to need to add this cost to the marginal cost of production.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.