Table of Contents

What is Net Investment?

Net investment is referred to as the amount that a firm spends over and above the Depreciation to either maintain the existing assets or acquire new ones. The requirement for net investment varies from company to company. For instance, if a firm is selling services and is generating its entire business from the workforce, it might not need enough investment to grow as its substantial cost will be salaries. On the contrary, a company generating a huge business from intellectual property or Manufacturing might have to continue Investing in assets to achieve maintainable growth.

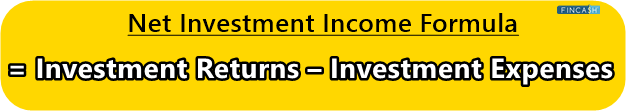

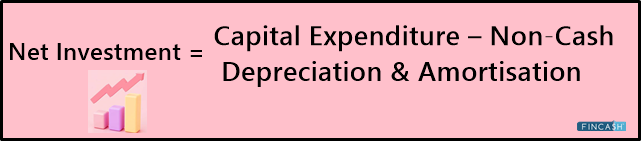

Net Investment Formula

The formula to calculate net investment is:

Net Investment = Capital Expenditure – Non-Cash Depreciation & Amortisation

Here,

- Capital Expenditure is referred to the gross amount that is spent on maintaining the existing assets and acquiring the new assets

- Non-cash depreciation and amortisation are known as the expenditure as displayed on the Income statement

Net Investment Example

Let’s understand this concept with an example of net investment. Let’s suppose a company, ABC Corporations, has spent Rs. 100,000 in capital expenditure in one year. Its depreciation expenditure on the income statement is Rs. 50,000. Now, to calculate the net investment:

Rs. 100,000 – Rs. 50,000 = Rs. 50,000

In this case, the net investment would be Rs. 50,000.

Importance of Net Investment

Any company would have to invest in assets to maintain growth and avoid going obsolete in the future. What will happen if the company continues to use its assets and doesn’t invest in anything new? The older asses will become inefficient, outdated and will break down easily. With this, the sales and production of the company will be hampered, which will lead to:

- Demand exhaustion

- Customer dissatisfaction

- Product returns

- End of the company

To avoid such situations, the management keeps investing in both new and existing assets for the company. By investing in existing assets, the firm gets to retain the level of profits and sales, while new assets bring the ability to keep pace with new technologies and create a diverse stream of revenue and profits.

Talk to our investment specialist

Difference Between Net Investment and Gross Investment

Gross investment is referred to as the capital investment of a company without deducting the depreciation. It tells you about the absolute investment that the firm has made in its assets in a specific year. Although the number is valuable in itself, it is helpful in analysing after netting it to comprehend whether the company is only investing in retaining the current business or also putting money in the future.

Net investment, on the other hand, talks about the replacement rate of the assets of a company. If positive, net investment helps the firm in staying put in the business. It also provides a fair idea to investors and analysts in understanding the seriousness of the company towards its shareholders and business. All in all, it tells you whether the business is capital intensive or not.

Wrapping Up

Undoubtedly, the world of business is dynamic and continues to change rapidly. Products that are in demand today may not exist tomorrow if they are not nurtured properly. Thus, management cannot neglect the investments in the betterment of existing business and creating more products to increase revenue sources.

Being a business owner, you must approach investment strategically. If your company is investing only as much as depreciating, it can create problems. But, this might not be true for every business. Some models don’t need a lot of investment and can survive for a long time by merely maintaining their brand value. These businesses generally run on less capital expense requirements and can launch newer products with less investment in research and development. Thus, make sure you understand the strategic need for net investment in your business to evaluate the future prospects of your firm.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.