Table of Contents

Net-Net Meaning

Benjamin Graham, an Economist, created the value investment strategy known as "net-net," which values a company's stock purely on its Net Current Assets Per Share (NCAVPS). By taking cash and Cash Equivalents at Face Value, lowering accounts receivable for doubtful accounts, and liquidating inventories to their lowest possible value, net-net Investing concentrates on current assets.

Total liabilities are subtracted from the existing assets that have been modified to determine net-net value. A double net Lease, a commercial rental arrangement where the tenant is accountable for Real Estate Taxes and insurance premiums, should not be mistaken for a net-Net Lease.

Net-Net Price and Investing

Graham employed this approach when net-net was more widely regarded as a model for valuing companies, and financial information was less easily accessible. When a corporation is deemed a net-net, its current assets and liabilities are the only ones taken into consideration, and no other tangible assets or long-term obligations are considered.

Analysts can now easily access the complete set of financial statements, ratios, and other benchmarks for a company, thanks to advancements in economic data collection. In essence, because a net-existing net's assets were worth more than its Market price, investing in one was a safe bet in the short run. In a net-net, the potential for long-term growth and any value from long-term assets are accessible to the investor. In the short term, the market will typically reevaluate net-net equities and set a price more in line with their Underlying value. Net-net stocks, however, may present issues in the long run.

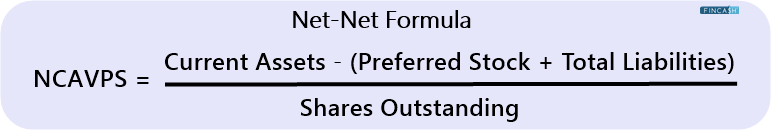

Net-Net Formula

Here is the formula for NCAVPS:

NCAVPS = Current Assets - (Preferred Stock + Total Liabilities) / Shares Outstanding

Graham contends that investors will gain significantly from holding shares in businesses whose share prices are no higher than 67% of their NCAV. In reality, a State University of New York analysis revealed that between 1970 and 1983, an investor might have generated an Average Return of 29.4% by investing in companies that met Graham's criteria and holding them for an entire year.

Graham clarified, however, that not all stocks selected using the NCAVPS formula would produce high returns and that, while employing this technique, investors should diversify their holdings. Graham advised investing in at least 30 stocks.

Talk to our investment specialist

Criticisms Related to Net-Net Stocks

Simply said, management teams rarely opt to entirely liquidate the company at the first indication of crisis, which is why net-net stocks may not be a fantastic long-term investment. A net-net stock could close the short-term gap between current assets and market cap. On the other hand, a bad management team or a bad business plan can quickly damage a Balance Sheet in the long run.

Because the market has already identified long-term problems that would negatively impact a stock, a net-net stock may find itself in that situation. As an illustration, the growth of Amazon.com has, over time, forced several shops into net-net positions, and some investors have benefited in the near term. Long-term, nevertheless, many of those same stocks have failed or been bought at a loss.

Small investors may succeed using the net-net method, which involves looking for businesses with a market value below their net-net working Capital (NNWC), which is calculated as follows:

Cash and short-term investments + 75% of accounts receivable + 50% of inventory - Total liabilities

Day traders are interested in net-net companies, which would explain why their valuation has increased month over month.

Conclusion

Accounts receivable and inventory are instances of current assets employed in the net-net approach, and current assets can be converted to cash within a year. A company decreases inventory levels and Receivables by selling inventory and receiving consumer payments. According to the net-net concept, a business's actual value is its capacity to generate cash. Current obligations like accounts payable are subtracted from existing assets to determine net current assets. This study excludes long-term assets and liabilities, which only consider the cash that the company can produce during the next 12 months.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.