What is Net Investment Income?

Net Investment Income (NII) is an income received from investment assets, such as loans, Mutual Funds, stocks, Bonds, and more investments. The individual Tax Rate on NII depends on whether the income is Capital gains, dividends, or an interest amount.

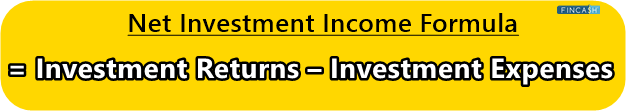

Here is the net investment income formula:

Net Investment Income = Investment Returns – Investment Expenses

Diving Deeper into Net Investment Income (NII)

When, being an investor, you sell assets from your portfolios, the profits from this transaction results in either a loss or a realised gain. These realised gains could be:

- Capital gains from selling stocks

- Interest income from Fixed Income products

- Dividends paid to shareholders of a firm

- Rental income from property

- Specific annuity payments

- Royalty payments And more.

The net investment income is the difference between any realised gains and fees or trade commissions. This income can be either negative or positive, depending upon whether the asset was sold for a loss or a Capital Gain. For instance, suppose you have sold 100 shares of Apple and 50 shares of Netflix for Rs. 175/share and Rs. 170/share. You also accrued coupon payments for the year on your corporate bonds in the total of Rs. 2650 and the rental income of Rs. 16,600. Now, your net investment will be calculated as:

| Calculating Net Investment | Result |

|---|---|

| Capital gains from Apple (Sale Price 175 – Cost 140) x 100 | Rs. 3500 |

| Capital Loss from Netflix (Sale Price 170 – Cost 200) x 50 | Rs. 1500 |

| Brokerage Commissions | Rs. 35 |

| Interest Income | Rs. 2650 |

| Rental Income | Rs. 16600 |

| Tax Preparation Fees | Rs. 160 |

| Net Investment Income | Rs. 21,055 |

Talk to our investment specialist

Components of Net Investment Income

Jotted down below are useful components of net investment income:

Investment Returns

When calculating the net investment income on a Portfolio, you should first calculate your total returns from the assets in that portfolio. The total investment returns can comprise:

Capital Gains These are the profits that come from the sale of bonds, stocks, and other similar assets

Interest These payments come from holding certificates of deposit, savings accounts, holding bonds and other paths of money lending

Dividends They are payments that are distributed among the stocks’ shareholders and can be in the form of shares or cash

Other Under this category, additional returns are included, such as the ones generated from rents, royalties, annuities, and more

Investment Expenses

Once you have calculated returns, the investment-related expenses will have to be cross-checked and subtracted from investment returns. The result that you will get is investment income. Basically, investment expenditure includes:

Transaction Fees It includes annuity withdrawal charges, mutual fund load charges, brokerage commissions, and more

Margin Interest These are the interest charges incurred against Margin Account loans to sell or purchase security

Ongoing Fees The ongoing fees comprise investment advisor fees, registered account fees, annual investment fund administration charges, and more

Other Under this category, financial planner fees, tax filing fees and extra fees that are directly related to Investing are included

Net Investment Income Tax Implications

Net investment income can be evaluated for:

- Individuals

- Trusts

- Estates

- Corporations

It is used for the purpose of tax reporting as well. Every nation has imposed different tax laws for every entity with net investment income.

Investment Income vs Earned Income

Investment income is generated through investment portfolios. On the other hand, Earned Income is referred to the wages received during employment. Earned income can be received from:

- Contract work

- Self-employment

- Full-time work

This income is subject to higher tax rates in comparison to investment income in most countries.

Final Words

Investment companies or the ones with primary business dealing with investing and management of securities generally express net investment income on the Basis of a per-share. To do so, the operating expenses of a company get deducted from the total investment income, and it is then divided by the number of outstanding shares. For investors, NII is a crucial figure as it helps comprehend the capital amount available for dividend payments.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.