Net Worth

What is Net Worth?

Net worth is the amount by which assets exceed liabilities. In simple words, it is the value of everything you own, minus all your debts. Net worth refers to the total value of an individual or company expressed as total assets less total liabilities. In the corporate world, net worth is also called shareholders' equity or Book Value.

A consistent increase in net worth indicates a good financial health. It means that assets are growing faster than debts. Conversely, when liabilities grow faster than assets, net worth decreases, this is an indication to financial hussle.

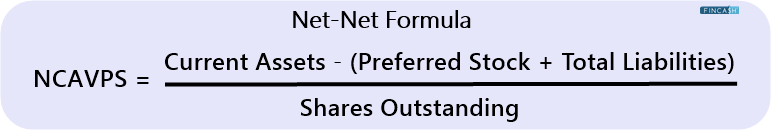

Net Worth Formula

This step will finally determine your current NW. Calculate it by using this formula-

NW=CA-CL

Calculating Net Worth

For illustration purpose, here's a calculation of net worth-

| Current Assets (CA) | INR |

|---|---|

| Car | 5,00,000 |

| Furniture | 50,000 |

| Jewelery | 80,000 |

| Total Assets | 6,30,000 |

| Current Liabilities (CL) | INR |

| Credit out standing | 30,000 |

| personal loan standing | 1,00,000 |

| Total Liabilities | 1,30,000 |

| Net Worth | 5,00,000 |

Talk to our investment specialist

List of Assets

A few general examples of assets are:

- The money in your investment accounts

- The Market value of your home.

- The market value of your vehicles.

- The amount in your savings accounts, including CDs

- Notable items of value such as furniture, artwork, fine jewelry, etc.

List of Liabilities

Examples of liabilities include:

- Car loans

- Mortgages

- credit cards

- Student loans

- Outstanding medical bills

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.