Table of Contents

Tangible Net Worth

What is Tangible Net Worth?

Tangible Net worth refers to the net worth of a company where intangible assets are excluded during the calculation. Intangible assets included trademarks, intellectual property, patents, etc.

This is used to examine and determine a company’s physical asset net worth without including assumptions and estimations regarding the valuation of intangible assets. Lenders use this to determine the borrower’s actual net worth and also examine the creditworthiness of the borrower.

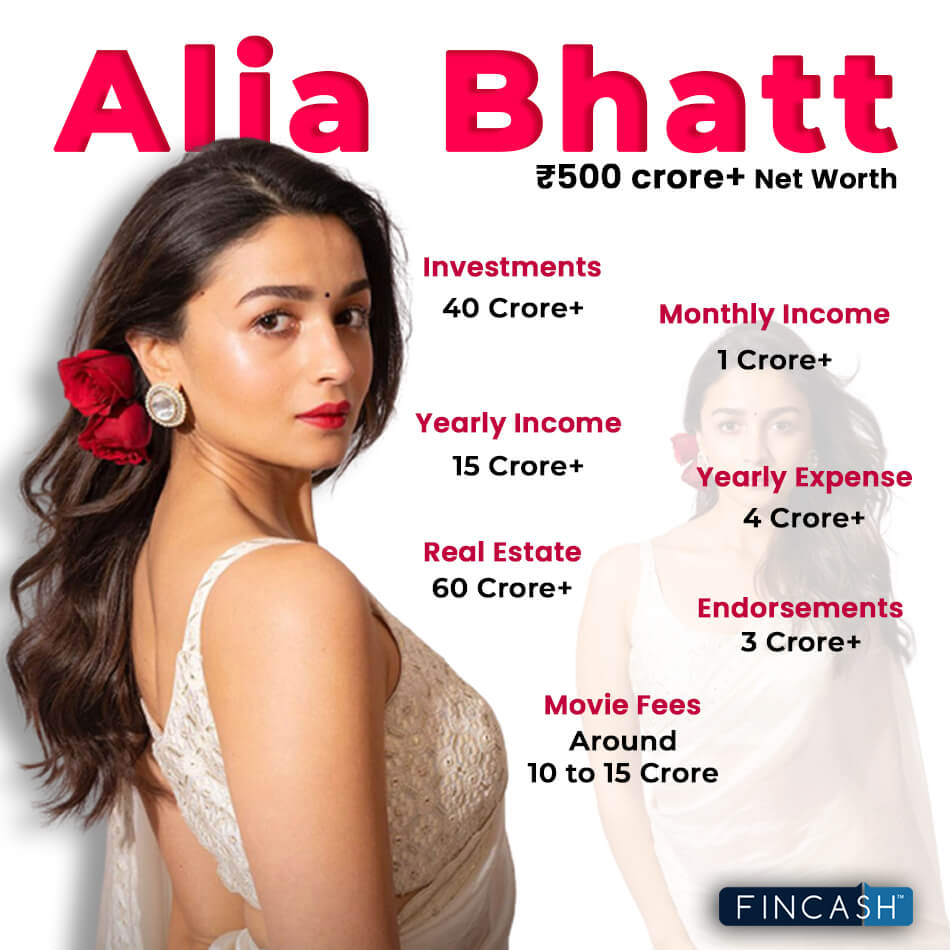

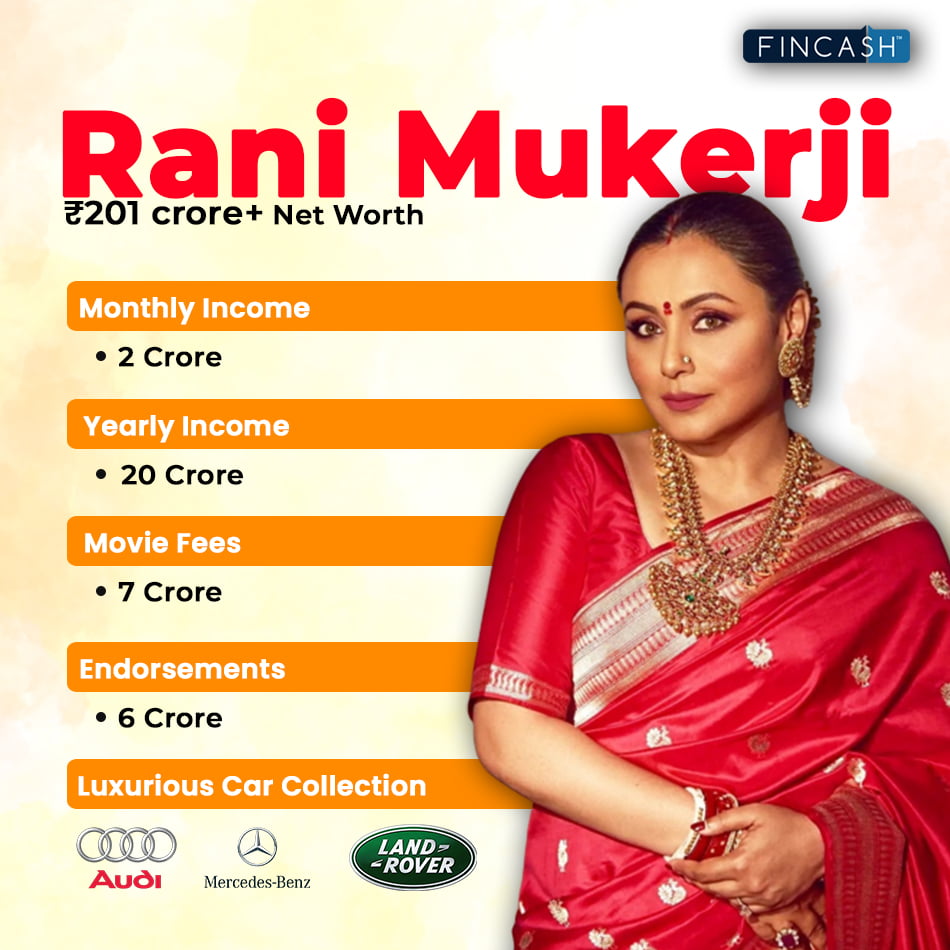

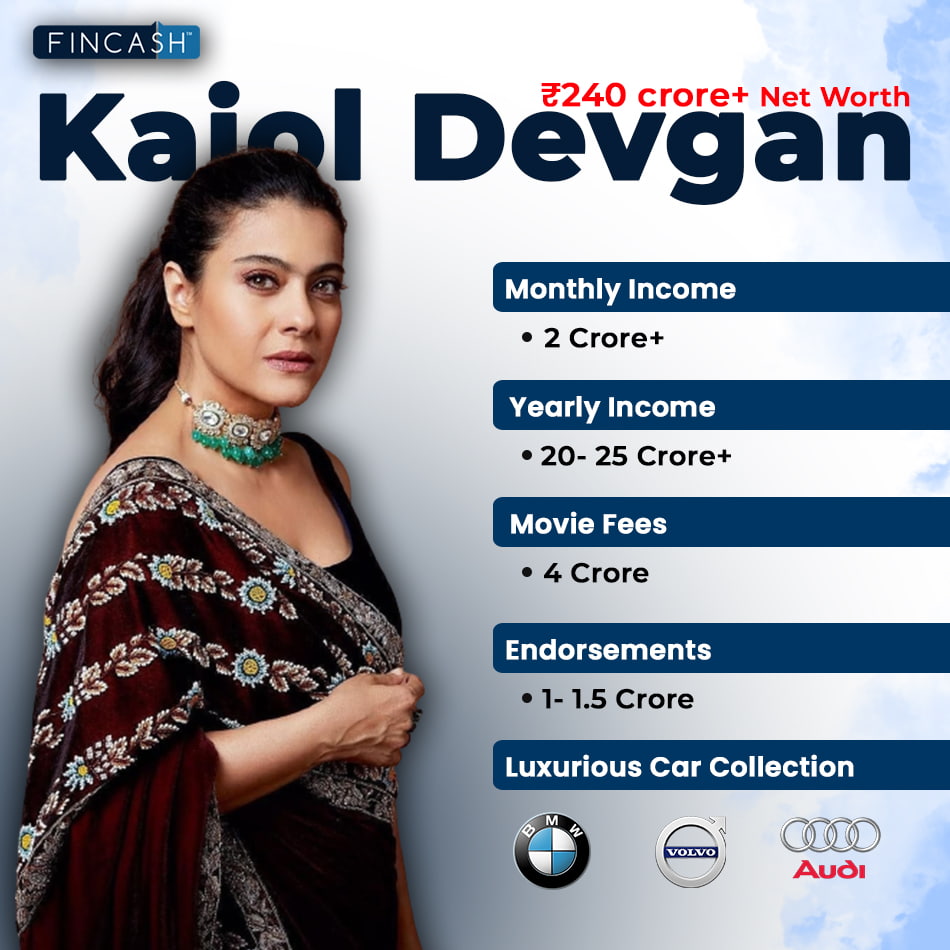

Some of the physical assets included to calculate tangible net worth are mentioned below:

- Accounts Receivables

- Real Estate

- Investments

- Equipment

- Building

- Inventory

- Cash

Negative Tangible Book Value refers to the net worth of the company tied up in brands, goodwill and the ability to make money. This leaves nothing for the company to borrow against.

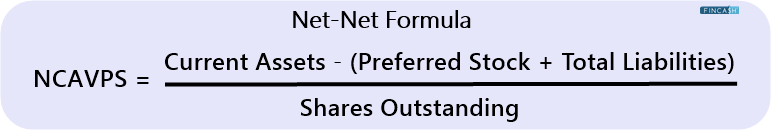

Tangible Net Worth Formula

You can calculate the tangible net worth by locating the company’s total assets, liabilities and intangible assets as listed on the Balance Sheet. Subtract total liabilities from total assets. Furthermore, subtract the result of the previous calculation with intangible assets.

The formula is mentioned below:

Tangible Net Worth = Total Assets – Total Liabilities – Total Intangible Assets

Remember that tangible net worth can also be used on individuals. The same formula can be used.

Talk to our investment specialist

Subordinated Debt

Subordinated Debt can be a complication during the net worth calculation of tangible assets. This debt is in the situation of Default or liquidation and can be repaid only months after all debt obligations to senior debt holders have been dealt with. For example, secondary mortgage in real estate is subordinated debt.

Tangible Net Worth and Debt Covenants

Tangible Net Worth is important when it comes to debt covenants. This is crucial for lending parties since they assess the net worth of a company without involving assumptions with the valuation of intangible assets.

This shows the lender the ability of the borrowing party to settle debts. If a lender of a financial institution places this measure as a condition in a loan agreement, it will mean that the borrower will be part of the agreement only until the net worth of the borrower is up to the minimum percentage mentioned by the lender during agreement. This is also an example of a debt covenant.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.