+91-22-48913909

+91-22-48913909

Table of Contents

Best Retirement Mutual Funds 2025 – 2026

Retirement planning is an essential part of our life. Not many people start their retirement planning at an early age, but it is important as it takes a longer time to build the retirement corpus. Ideally, one should start planning their retirement right from their 20’s because it gives enough time to save.

And also, the longer you keep your money invested, the higher would be the returns in the equity Market. So, let’s understand how one can attain their retirement goals by investing in Mutual Funds, along with the best retirement Mutual Funds to invest.

Talk to our investment specialist

Why Mutual Funds for Retirement Planning?

Mutual funds are considered to be a smart tool for planning, Financial goals like retirement, a child’s education, purchase of a house/car, world tour, etc. Mutual funds are particularly designed to suit the different investment needs of people. Investors can pick funds from a wide Range of mutual fund schemes like equity, debt, and hybrid funds. The Security and Exchange Board of India (SEBI) has recently introduced a separate category called as ‘Solution Oriented Schemes’ that majorly includes retirement and child’s investment scheme.

The SEBI has given a separate category for these plans so that investors can easily plan their retirement in a disciplined manner. These solutions oriented retirement schemes come with a fixed tenure of 5 years or till the retirement. This is a good way to keep investors invested for a longer duration in order to attain their retirement investment goals. Investors who are keen to invest in this scheme, here are some of the schemes you can consider Investing in.

Best Retirement Mutual Fund- Solution Oriented Schemes

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Sub Cat. Tata Retirement Savings Fund-Moderate Growth ₹60.2971

↑ 0.50 ₹1,908 -3.3 -6.7 8.9 12.6 17.4 19.5 Retirement Fund Tata Retirement Savings Fund - Progressive Growth ₹60.5601

↑ 0.55 ₹1,803 -5.5 -9.5 7.4 13.1 18.6 21.7 Retirement Fund Tata Retirement Savings Fund - Conservative Growth ₹30.7715

↑ 0.11 ₹169 0.7 -0.6 7.3 7.6 8.7 9.9 Retirement Fund HDFC Retirement Savings Fund - Equity Plan Growth ₹47.969

↑ 0.64 ₹5,571 0.5 -5.9 8.9 17.7 28.5 18 Retirement Fund HDFC Retirement Savings Fund - Hybrid - Debt Plan Growth ₹21.2069

↑ 0.09 ₹155 2.2 1.1 8.4 9.1 9.6 9.9 Retirement Fund Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

Best Retirement Mutual Fund- As per Risk Appetite

Investors who want to invest in equity, debt or Balanced Fund, can invest in these funds as per risk appetite.

Best Retirement Mutual Funds for Aggressive Investors

These funds are Equity Funds that invest in the stocks of companies. Equity funds are considered to be a good option for a long-term investment and for those who are ready to take a high-risk in mutual funds. Ideally, investors who fall in the age bracket of 25-40 years and are willing to invest for at least 10-15 years can invest in these schemes.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Sub Cat. ICICI Prudential Banking and Financial Services Fund Growth ₹128.07

↑ 2.49 ₹8,843 9.5 4.1 18.3 15 23.5 11.6 Sectoral Motilal Oswal Multicap 35 Fund Growth ₹56.3349

↑ 0.62 ₹11,172 -3.7 -9.9 15.6 19.6 21.8 45.7 Multi Cap Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹58.51

↑ 1.20 ₹3,011 10.9 3.3 15 15.3 24 8.7 Sectoral Sundaram Rural and Consumption Fund Growth ₹93.3766

↑ 1.12 ₹1,398 -0.3 -7.8 14.3 17.7 21.9 20.1 Sectoral Mirae Asset India Equity Fund Growth ₹106.324

↑ 1.65 ₹35,533 1.9 -3.9 10.4 10.8 20.2 12.7 Multi Cap Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

Best Retirement Mutual Funds for Moderate Investors

These funds are suitable for investors who fall in the age bracket of 41-50 years and are willing to invest for at least 5-10 years more. These are hybrid funds, i.e., a mix of debt and equity funds. These are a good option for investors who want to earn long-term returns via equity, as well as regular Income via debt securities.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Sub Cat. Aditya Birla Sun Life Regular Savings Fund Growth ₹65.1082

↑ 0.27 ₹1,374 2.7 2.1 10.6 8.2 12.2 10.5 Hybrid Debt ICICI Prudential MIP 25 Growth ₹73.6523

↑ 0.28 ₹3,086 2.2 2.4 9.9 9.6 10.8 11.4 Hybrid Debt SBI Debt Hybrid Fund Growth ₹70.7157

↑ 0.27 ₹9,580 2.3 0.7 9.5 9.8 12.4 11 Hybrid Debt Principal Hybrid Equity Fund Growth ₹154.881

↑ 1.80 ₹5,236 1.4 -3.9 9.3 11.8 18.6 17.1 Hybrid Equity Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

Best Retirement Mutual Funds for Conservative Investors

Investors who are above 50 years of age would prefer investing in the conservative scheme, i.e., funds which carry a low level of risk. These are debt scheme that offers stable returns.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Sub Cat. Aditya Birla Sun Life Corporate Bond Fund Growth ₹111.856

↑ 0.13 ₹25,293 3.3 4.8 9.9 7.6 7.3 8.5 Corporate Bond Aditya Birla Sun Life Savings Fund Growth ₹540.322

↑ 0.27 ₹14,988 2.2 4.1 7.9 7 6.3 7.9 Ultrashort Bond HDFC Corporate Bond Fund Growth ₹32.2227

↑ 0.04 ₹32,191 3.2 4.7 9.7 7.5 7.1 8.6 Corporate Bond PGIM India Short Maturity Fund Growth ₹39.3202

↓ 0.00 ₹28 1.2 3.1 6.1 4.2 4 Short term Bond PGIM India Low Duration Fund Growth ₹26.0337

↑ 0.01 ₹104 1.5 3.3 6.3 4.5 1.3 Low Duration Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

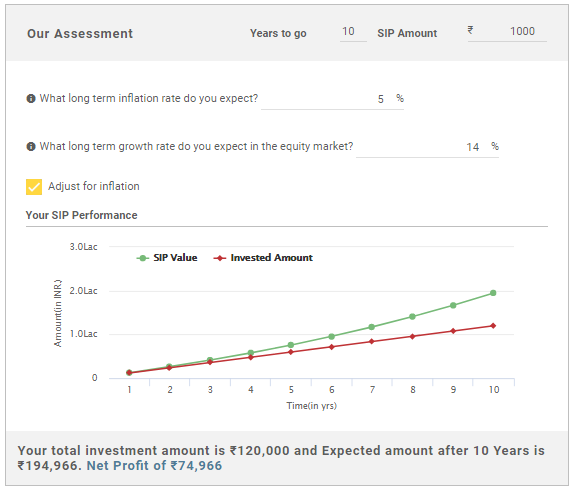

SIP Investing for Retirement Planning

A Systematic Investment plan (SIP) can be the key to your happy retirement life. Ideally, when you plan to invest for a long-term, SIP is considered to be the most efficient way. SIP is a process of wealth creation where a small amount of money is invested over regular intervals of time i.e., monthly /quarterly. And this investment is invested in the stock market generates returns over time. The amount required for starting a SIP is as low as INR 500, thus making SIP’s a great tool for smart investments, where one can start investing a small amount from a young age.

The two major benefits of SIPs are— Power of Compounding and rupee cost averaging. Rupee cost averaging helps an individual to average out the cost of an asset purchase. In a systematic investing, the purchase of units is done over a long period and these are spread out equally over monthly intervals (usually). Due to the investment being spread out over time, the investment is made into the stock market at different price points giving the investor the benefit of averaging cost.

In the case of compound interest, the interest amount is added to the principal, and interest is calculated on the new principal (old principal plus gains). This process continues every time. Since the mutual funds in the SIP are in instalments, they are compounded, which adds more to the initially invested sum.

How to Invest in Retirement Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.