Table of Contents

The 7-5-3-1 Equity SIP Rule: A Complete Guide for Smart Investors

Introduction: A Conversation Between Two Friends

"Yaar, I started a SIP 6 months back and it’s still showing red! Wasn’t it supposed to make money?"

That’s what Rohan told his friend Aakash over chai on a Sunday morning. Aakash, an avid mutual fund investor, smiled and said - "Bro, Investing is like planting a tree. You won’t see fruits in a month or two. But give it time, sunlight, and consistency—and it’ll give you shade and mangoes for years."

He then pulled out a napkin and scribbled:

- 1 year = 1% return

- 3 years = 7%

- 5 years = 10%

- 7+ years = 12%

This, he said, was the 7-5-3-1 Rule of SIPs.

This story isn’t unique. Many new investors start their SIPs expecting fast returns. But the equity Market doesn’t reward urgency—it rewards patience.

So, let’s dive into what this rule really means and how it can change the way you invest.

What is the 7-5-3-1 Equity SIP Rule?

The 7-5-3-1 rule is a simple thumb rule that helps you estimate potential returns from Equity Mutual Funds based on the investment horizon.

- 7 years – Expect ~12% CAGR

- 5 years – Expect ~10% CAGR

- 3 years – Expect ~7% CAGR

- 1 year – Expect ~1% or even negative

This rule is not a guarantee, but a practical way to align your return expectations with investment duration. It’s based on historical patterns seen in Indian equity markets.

Talk to our investment specialist

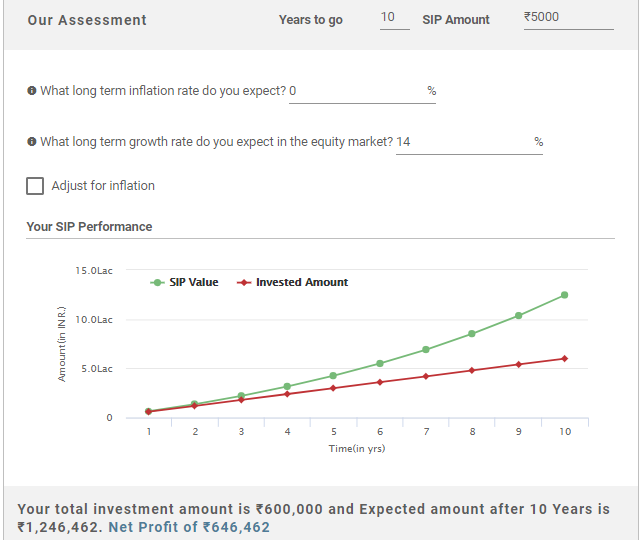

7 5 3 1 Equity SIP Rule Calculator

There’s no special calculator required. Just use any sip calculator and adjust the expected returns (CAGR) based on your investment horizon:

- 1 year – 1%

- 3 years – 7%

- 5 years – 10%

- 7+ years – 12%

👉 You can use our custom SIP calculator here: SIP Calculator Tool

7-5-3-1 Rule Mutual Fund: How It Applies

This rule is most relevant to equity Mutual Funds, especially Diversified Funds like Flexi-cap, large-cap, and Index Funds (e.g., Nifty 50 or Sensex-based funds). Equity mutual funds tend to deliver better returns over long durations, but they can be volatile in the short term.

Here’s how you apply the rule based on your Financial goals:

7 years or more: For long-term goals such as retirement, child’s higher education, or wealth creation. Equity SIPs work best here because they give your investments time to recover from short-term market dips and benefit from compounding.

5 years: Suitable for medium-term goals like buying a car, home renovation, or starting a business. While there's still some risk, five years is usually long enough to ride out Volatility.

3 years: Good for conservative equity investing, but expectations should be lower. Opt for balanced advantage or Hybrid Fund if you're unsure.

1 year: Avoid equity SIPs for short-term needs. Markets are unpredictable over 12 months, and you could end up with negative or negligible returns. Stick to debt or Liquid Funds.

7-5-3-1 Rule in SIP: Real World Usage

Let’s say you invest ₹10,000/month in a SIP:

After 1 year, your investment might barely break even or show a 1% return. This is because short-term market movements can drastically affect returns, and there’s not enough time for compounding to work in your favour.

After 3 years, your total invested amount starts compounding moderately. Historical data suggests around 7% CAGR. It’s decent for medium-term goals, though you may still see some volatility.

After 5 years, your investment gets a more stable ground, and returns tend to average around 10% CAGR. This is when the compounding becomes more meaningful and consistent.

After 7 years or more, the compounding effect kicks in strongly. Market volatility gets ironed out, and long-term returns typically align with the average growth rate of Indian equity markets — around 12% CAGR or more.

This rule teaches patience and discipline. It reminds investors that equity SIPs are not short-term money machines—they’re long-term wealth creators.

How to Use the 7-5-3-1 Rule for Smart Investing?

The 7-5-3-1 rule isn’t just about knowing what returns to expect—it’s about using that insight to make better investment decisions.

Here’s how smart investors apply it:

1. Match Duration with Expectations

Don’t invest in equity SIPs for short-term goals. Expecting 10–12% returns in 1–3 years is unrealistic. Use the rule to set realistic goals. The longer you stay invested, the better your chances of wealth creation.

2. Plan Goals Backward

Planning to buy a home in 5 years? Use the 5-year rule and project 10% CAGR. Retirement in 15–20 years? The 7-year+ rule gives you a benchmark of 12% CAGR to estimate the corpus you'll need.

3. Avoid Panic During Market Drops

Knowing that 1-year equity SIP returns might be Flat or negative helps you stay calm when markets fall. The rule teaches you to look at the bigger picture, not daily market noise.

4. Adjust SIPs with Changing Goals

Review your financial goals every year. If your timeline changes, adjust your investments accordingly. For instance, if a 5-year goal becomes a 3-year one, you may want to reduce equity exposure.

5. Use It to Educate Others

Whether you’re a financial advisor, content creator, or simply an informed investor, the 7-5-3-1 rule is a great way to communicate investing wisdom in simple terms.

Conclusion: Patience Rewards, Planning Wins

The 7-5-3-1 equity SIP rule is more than just a thumb rule — it’s a mindset. In a world that often seeks quick returns, this rule is a gentle reminder that wealth creation takes time, consistency, and smart planning.

By aligning your investment horizon with realistic return expectations, you:

✅ Make smarter financial decisions ✅ Avoid emotional reactions to market swings ✅ Stay committed to your long-term goals ✅ Harness the true Power of Compounding

So, whether you're investing for 3 years or 30 — let this rule be your compass.

💡 Remember: SIPs work best not when timed perfectly, but when given enough time.

By Rohini Hiremath

By Rohini Hiremath

Rohini Hiremath works as a Content Head at Fincash.com. Her passion is to deliver financial knowledge to the masses in simple language. She has a strong background in start-ups and diverse content. Rohini is also an SEO expert, coach and motivating team head!

You can connect with her at rohini.hiremath@fincash.com

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.