Table of Contents

- Understanding the PAN

- General Uses of PAN

- What Does the New PAN Card Design Include?

- PAN Card Types in India

- Eligibility for a PAN Application

- PAN Card Form Details

- PAN Card Online Application

- Apply PAN Card Offline

- PAN Card Application Cost

- Documents Required to Apply for a PAN Card Form

- Making Changes/ Corrections in PAN Card

- Applying for a Duplicate Passport

- Check PAN Status Online

- List of PAN Card Offices Across India In 2021

- What If You Don't Have a PAN Card?

- Linking of Aadhaar with PAN

- Frequently Asked Questions (FAQs)

- 1. Where can I get the PAN application form from?

- 2. Can I write the application on a plain piece of paper for the PAN application?

- 3. In the case of a married/ divorced/ widowed female, is it necessary to write the father's name in the application form?

- 4. Do I have to mention my telephone number or email ID in the PAN application form?

- 5. What is the application fee if I submit form 49A for the PAN application?

- 6. Where should I submit the PAN application if applying offline?

- 7. Is it essential to attach two photographs with the PAN application form?

- 8. What should I do to change my photograph from my PAN card?

A Detailed Guide to PAN Card in India

A Permanent Account Number (PAN) is a form of documentation that helps identify the country's taxpayers. The PAN number carries ten-digit alphanumeric characters. The identification system of PAN is a computerized one, and it assigns the unique ID to every taxpayer of India.

This system uses the PAN number of each Individual as a primary key for data storage and records all the tax-related details of people. Because this information is shared across the country, no two people can have the same PAN. When any person is allotted a PAN number, the income tax Department (ITD) also issues a PAN Card. PAN Card is a tangible card that contains your PAN number, as well as your name, date of birth (DoB), and a picture. Copies of this card can be used to prove your identification or date of birth. Because it is unaffected by changes in address, your PAN card is valid throughout your life.

Understanding the PAN

The combination of alphanumeric characters of PAN is explained below:

The first 3 alphabetic characters are randomly chosen from the English alphabet.

The fourth alphabetic character denotes the taxpayer category of the entity. The following categories are available:

- A – Persons’ Association

- B – Individuals' Body

- C – Company

- F – Firms

- G – Government

- H – Undivided Hindu Family

- L – Local Authority

- J – Artificial Judicial Entity

- P – Individual

- T – Persons' Association for a Trust

The fifth alphabetic character denotes the first alphabet of the individual's surname.

The following four characters are random numbers.

The last character again is an alphabet.## Uses of PAN for Finance

You must quote your PAN while paying the direct Taxes.

Taxpayers are required to input the PAN while paying Income tax.

PAN information is essential while registering any business.

Various other financial transactions also require PAN information, like:

- Selling or buying a property with a value of INR 5 lakh or above.

- Selling or purchasing a vehicle, except for a two-wheeler.

- Payments made to any hotel or restaurant or while travelling abroad, exceeding INR 25,000.

- Depositing more than 50,000 INR in a Bank account, and purchasing Bonds or shares or an insurance policy worth 50,000 INR or above.

- Purchasing Mutual Fund schemes.

- Buying jewellery worth INR 5 lakh or above.

- Remitting money out of the country.

- Transferring funds from Non-Resident External (NRE) to Non-Resident Ordinary (NRO) account.

General Uses of PAN

- A PAN card can be used as a piece of legal identity evidence throughout the country.

- The best approach to maintain track of your tax payments is to use a PAN. Otherwise, if your tax payment is not validated, you may be obliged to pay the tax many times.

- Because each person's PAN is unique, it's nearly hard to use it for tax evasion or other wicked objectives.

- Electricity, telephone, LPG, and internet connections can all be obtained with a PAN card.

Talk to our investment specialist

What Does the New PAN Card Design Include?

For PAN cards issued after January 1, 2017, the Income Tax Department has suggested a new format. The following are the changes made to the new PAN card:

- The new PAN card includes a Quick Response (QR) code that contains the cardholder's information. This QR code can be used to validate data.

- There are new sections for the cardholder's name, father's name, and date of birth.

The placement of the PAN and the cardholder's signature have been modified.

PAN Card Types in India

As PAN cards are issued to different taxpaying entities of the country, they are of various types, as follows:

- For Indian citizens

- For Indian companies

- For foreign citizens

- For foreign companies

On an individual’s PAN card, the photograph, name, father’s name, date of birth, an authenticity hologram, signature, QR Code, a PAN number and the date of PAN issue are included.

On the other hand, a company’s PAN card includes the name of the firm, its date of registration, the PAN number, hologram, QR code, and the date of PAN issuing. There will be no pictures or signatures on this one.

Eligibility for a PAN Application

The following taxpaying entities must have a PAN under section 139A of the Income Tax Act:

- Anyone paying tax or the ones who have to pay it in the future to the Income Tax department. The tax brackets help in determining the same.

- Any individual who, in the particular year of assessment, makes a yearly turnover of more than Rs. 5 lakhs through a business or professional practice

- Importers and exporters who must pay any tax or duty under the Income Tax Act or any other applicable law

- Trusts, charity organizations, and associations of all kinds

Minors, adults, HUFs, partnerships, businesses, bodies of individuals, trusts, and other taxpaying entities should all register for a PAN.

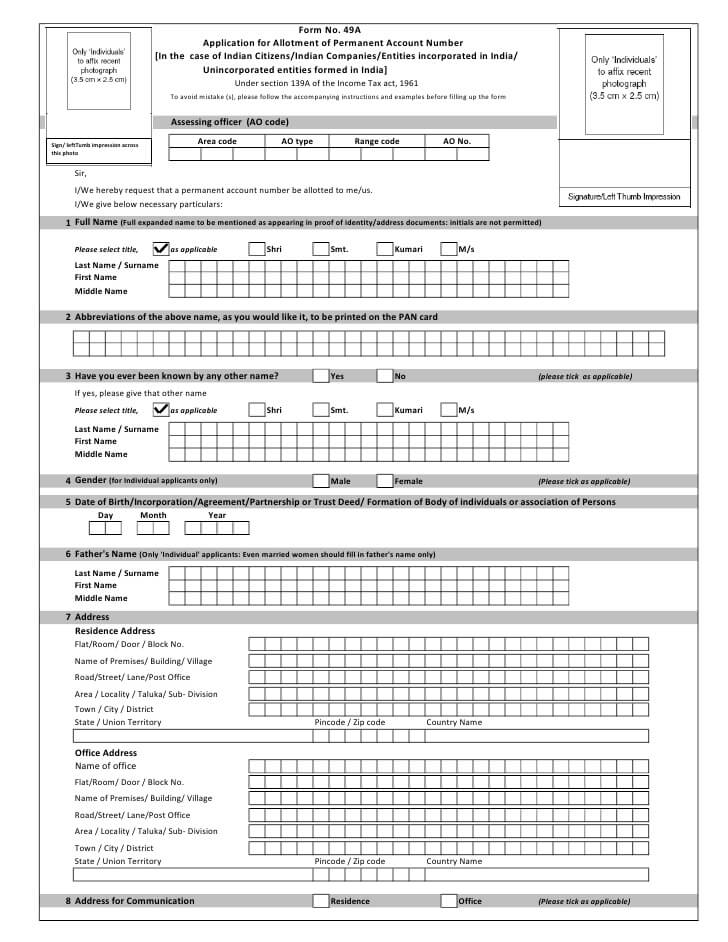

PAN Card Form Details

An application form has to be completed to apply for a PAN card. Form 49A and Form 49AA are the two types of application forms. Both documents are available for download both online and accessing on any device offline.

- Form 49A: To apply for a PAN card, Indian individuals or entities must fill out form 49A. Students and minors can also use this form to apply for a PAN.

- Form 49AA: Form 49AA is the PAN application form for foreigners.

The forms have to be filled out completely and forwarded to the TIN-NSDL's office.

PAN Card Online Application

Either one of the following websites can be used for applying for a PAN card online:

- NSDL

- UTIITSL

You can apply for a new PAN and make changes or corrections to your existing PAN. If you lose your PAN card, you can request a duplicate or have the card reprinted.

For a new PAN online application, follow the given steps:

- PAN form 49A is required for Indian nationals and NRIs (including companies, NGOs, partnership firms, municipal bodies, trusts, and so on).

- PAN card form 49AA is required for foreigners and foreign entities.

- These forms should be sent to the Income Tax PAN Services Unit, along with the appropriate PAN documents.

- You can track your PAN application status using the acknowledgement number provided after you apply for a new or duplicate PAN or request corrections/changes.

- According to the NSDL website, the complete printing and dispatching process takes about two weeks or 14 days.

Apply PAN Card Offline

Follow the steps as mentioned below to apply offline for a PAN card:

- Click on the TIN-NSDL's official website.

- Click on 'PAN' on the main page, under the 'Downloads' section. You'll be redirected to a different page.

- Select 'Form 49A' from the drop-down menu.

- The pdf version of the form will appear on your computer screen. Print the form after downloading it.

- Fill out the form and double-check all of your information for correction.

- Make sure you include all required documentation, including a passport-sized photograph.

- You can pay the registration fee by sending a Demand Draft to NSDL – PAN, payable in Mumbai. You would be required to pay

Rs.115.90.

In an envelope, place the application form and photocopies of your documentation. On the envelope, write 'APPLICATION FOR PAN-N-Acknowledgement Number' and post it to:

Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016

After that, you'll get an application number that you can use to track your PAN card application progress.

PAN Card Application Cost

The following is a breakdown of the cost of applying for a PAN:

- Rs.93 (excluding GST) for an Indian communication address

- Rs.864 for a foreign communication address (excluding GST)

Documents Required to Apply for a PAN Card Form

You have to submit several documents, including Form 49A or 49AA, to apply for a PAN Card. There are two sorts of documentation required for PAN, Proof of Address (POA) and Proof of Identity (POI). Any two of the documents listed below should fit the requirements.

| Who requires the PAN? | List of Documents |

|---|---|

| Individual Applicant | POI/ POA – Passport, Aadhaar, Driving Licence, and Voter ID |

| hindu undivided family | HUF’s affidavit issued by the HUF’s head along with POI/POA |

| Company registered in India | Registration Certificate issued by Registrar of Companies |

| Firms/ Partnership (LLP) | Registration Certificate issued by the Limited Liability Partnerships/ Registrar of Firms and Partnership Deed. |

| Trust | Trust Deed’s copy or a copy of the Registration Certificate Number issued by a Charity Commissioner. |

| Society | Registration Certificate Number from Charity Commissioner or Registrar of Co-operative Society |

| Foreigners | Passport PIO/ OCI card issued by the Indian Government, Bank statement of the residential country along with a Copy of NRE bank statement in India |

Making Changes/ Corrections in PAN Card

If you want to make modifications or corrections to your Pan card online, follow the steps outlined below:

- PAN application can be found on the NSDL website under the heading "Services."

- Scroll down and click on 'Apply' under 'Change/Correction in PAN Data.'

- Select 'Changes/Correction in PAN Data' under 'Application Type'

- Complete the remaining fields and click Submit

- You will be given a token number that you can use to track your progress afterwards

- Proceed to the application form, where you must declare the adjustments or corrections to your PAN Card. Fill in the new information and make an

Rs.93payment before submitting the form - Proof of address, proof of identification, and proof of paperwork proving the modification you wish to make on your PAN card are the documents you will have to mail to the NSDL.

- Your application will be processed, and if the documents you presented are accurate, the modifications will be reflected in your PAN card.

- The new PAN card will be sent to your registered address after the adjustments are made, and you will receive it within 15 days.

Applying for a Duplicate Passport

If you have lost your original PAN card, you can follow the steps outlined below to obtain a duplicate one:

- To apply for a duplicate PAN card, go to the TIN-NSDL or UTIITSL websites.

- If you are an Indian citizen, you must submit Form 49A; if you are a foreigner, you must submit Form 49AA.

- To apply for a duplicate PAN card, make the required payment. Payment can also be made by demand draft.

- Take a printout of the form and mail it to:

Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, Mantri Sterling, 5th Floor, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016

- It might take around 45 days for your duplicate PAN card to arrive.

Check PAN Status Online

After you've filed your application for the PAN card, you can check its status online. The status of your application will indicate whether the card has been granted or is in transit.

- On the TIN-NSDL, you can check the status of your PAN Card application.

- Click on the option stating “Track PAN status”.

- Click on the “Application type” and select the “PAN-New/ Change request” option.

- Enter the acknowledgement number of 15 digits in the available field, enter the captcha code, and then click on the Submit option to get the status of your PAN application.

List of PAN Card Offices Across India In 2021

You can also directly visit the PAN card offices across India to get any of your queries addressed or to submit the application for PAN. Here is a list of all the PAN card offices across the country:

- Chennai

- Bangalore

- Pune

- Delhi

- Mumbai

- Hyderabad

- Kolkata

- Gurgaon

- Patna

- Coimbatore

What If You Don't Have a PAN Card?

If you earn enough to be taxed, not having a PAN card will result in:

A Flat

30% taxon your Earnings and wealth, as determined by the Income Tax Department of India. This regulation applies to people, businesses, and all other taxpaying organizations, including foreign nationals and companies based outside of India.Not being able to buy a car, buy an immovable property worth more than

Rs. 10 lakhs, or create a bank account, to name a few things.Businesses will be unable to conduct a significant portion of their finance and procurement activities.

Linking of Aadhaar with PAN

To complete the process of aadhaar card and PAN card link, follow the given steps:

- Register for the Income Tax e-filing portal

- Your user id will be your PAN.

- Enter your User ID, password, and date of birth to log in

- A pop-up window will appear, and it will request you to link Aadhaar with PAN card. If not, go to the Menu bar and select 'Profile Settings,' then Link Aadhaar.

- Name, date of birth, and gender will already be mentioned in the PAN information

- Compare the PAN information on the screen to the information on your Aadhaar card. Keep in mind that you must get it fixed in both documents if there is a mismatch.

- Enter your Aadhaar number and click the "connect now" button if the details match.

- Your Aadhaar has been successfully linked to your PAN, according to a pop-up notice.

- You can also visit UTIITSL OR NSDL for Aadhaar and PAN Card link.

Frequently Asked Questions (FAQs)

1. Where can I get the PAN application form from?

A. Any NSDL TIN Facilitation Centre (TIN-FC) or PAN centre can provide you with a PAN application form. Applicants can also get the form from some stationery stores. You can also get the form from the NSDL-TIN website.

2. Can I write the application on a plain piece of paper for the PAN application?

A. No, you cannot apply for a PAN card using a handwritten application. Only the format specified by the Central Board of Direct Taxes will be accepted. The following are the relevant forms:

- Form 49A is for Indian citizens only

- Form 49AA is for foreign citizens

3. In the case of a married/ divorced/ widowed female, is it necessary to write the father's name in the application form?

A. Regardless of their marital status, all female candidates should include their father's name on the PAN application form. The name of the husband doesn’t need to be updated on the form.

4. Do I have to mention my telephone number or email ID in the PAN application form?

A. To be reached in the event of a discrepancy, all applicants must submit their email address or phone number on the PAN application form. It is helpful for individuals wishing to receive the PAN via email. If a landline number is provided, the country code and STD code should be included. If a cell phone number is provided, the country code should be included. If an email address is provided, the PAN will be emailed.

5. What is the application fee if I submit form 49A for the PAN application?

A. If you live in India, the PAN card processing charge is Rs.110, which includes Rs.93 (application fee) plus 18% GST. The PAN Card processing fee is Rs.1,020 if your address is outside of India, including Rs.93 (application cost) + Rs.771 (shipping charges) + 18% GST.

6. Where should I submit the PAN application if applying offline?

A. The PAN card application form, once completed and self-attested, can be sent to any PAN centres or TIN-FCs maintained by NSDL e-Gov, together with all necessary papers. If you applied for a PAN Card online, you should print the application form, sign it, and attach a recent photograph. Then email this form, along with any supporting documentation, to the following address:

Income Tax PAN Services Unit (Managed by NSDL e-Governance Infrastructure Limited) 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune - 411 016

7. Is it essential to attach two photographs with the PAN application form?

A. Yes, if you are a single applicant, you must attach two latest colour images with a white background. The photographs should be 3.5 cm by 2.5 cm in size. Clipping or stapling the photos to the form is not recommended. The applicant must sign across the photo such that one part of the signature appears on the photo and the remainder appears on the form. The clarity and quality of the photograph you attach to the application form will determine the image clarity on the PAN Card.

8. What should I do to change my photograph from my PAN card?

A. If the photo on your PAN card is blurry, you can have it replaced with one that is of higher quality and clarity. This service is accessible as part of requests for "Correction of PAN Card." This is similar to requesting a name change or a date of the birth change. You can fill out the 'PAN card modification request form' on the website. The necessary documents have to be mailed to the address listed on the form.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like