Gold Investment: An Overview

Gold Investing or holding gold is something that has been done for centuries. In the olden times, gold used to the currency across the world. Furthermore, gold investment has proved as a solid long-term investment and a valuable addition to one’s Portfolio, especially in a bear market. Since ages, the conventional way was to buy physical gold in the form of ornaments or coins. But with time, gold investment has evolved in many other forms such as Gold Mutual Funds and Gold ETFs.

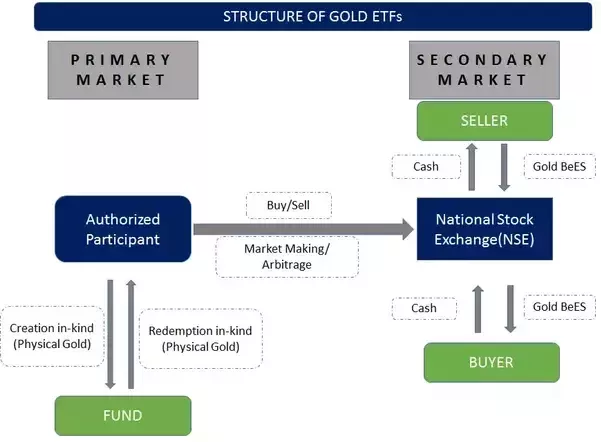

Gold Mutual Funds don’t Buy Gold directly but invests in stocks of companies engaged in gold mining and production. Gold ETFs (Exchange Traded Funds) is an instrument that is based on gold price or invests in gold bullion. It is traded on major stock exchanges and Gold ETFs track the gold bullion performance.

Investing in Gold: Know When to Invest

Investing in Gold is considered to be one of the best hedges for inflation (property also). So when inflation is expected to go up, one would see interest rates rise in an economy and this would be a good time to invest in gold, whether is physical gold or gold ETF. Gold prices are measured in something called a troy ounce(~31.103 gm) and this price is given in US dollars.

To get the Indian price of gold, one needs to use the prevailing exchange rate (USD-INR) and get the price in Indian Rupees. Hence the price of gold in India is a function of 2 factors, i.e. price of gold internationally and the current USD-INR exchange rate. So when there is an expectation that the US Dollar will gain against the Rupee then the price of gold will increase (due to currency). Thus, investors can plan to make a gold investment under such market scenarios.

How to Buy Gold?

Investors can buy physical gold through gold bars or coins; they can buy products backed by physical gold (e.g. Gold ETF), which offer direct exposure to the gold price. They can also buy other gold-linked products, which may not include ownership of gold but are directly related to the gold price.

Also, with the advent of the gold ETFs, it has now become even easier for investors to buy gold. Investors can buy gold ETFs online and keep the units in their Demat account. An investor can purchase and sell gold ETFs on the stock exchange. Gold ETFs are units in lieu of physical gold, which may be in dematerialised form or paper form.

Different gold-related investment products have different risk metrics, return profiles and liquidity. Thus, before investing in gold related options, one should have a thorough knowledge about the risks and returns that come with each investing instrument.

Talk to our investment specialist

Advantages of Gold Investment

Some of the important benefits of investing in a gold are:

Liquidity

Gold investment offers investors the chance to trade it during emergencies or when they need cash. As it is fairly liquid in nature, it ensures that it is easy to sell. Different instruments offer differing levels of liquidity, Gold ETFs may be the most liquid of all options.

Hedge Against Inflation

Gold acts as a hedge against inflation. Gold's value rises when inflation rises. During the inflationary time, gold is a more stable investment than cash.

Offers Diversification

Gold investment can act as a safety net against market Volatility. Gold investment or gold as an asset class has a low correlation with the equity or stock markets. So when the equity markets are down, your gold investment may outperform.

Valuable Asset

Gold has managed to maintain its value over time for many years. It is known as a stable investment with very steady returns. One does not expect to make very high returns in long periods by investing in gold but moderate returns can be expected. In certain short periods, superlative returns can also be made.

Fund Selection Methodology used to find 5 funds

How to Invest in Gold?

There are many different ways to invest in gold:

- Invest Via Gold ETF- A Gold ETF (Exchange Traded Fund) is an instrument that is based on gold price or invests in gold bullion. A gold ETF specialises in investing in a range of gold securities. Such diversification can somewhat minimise your risk.

Some of the best performing underlying gold ETFs to invest are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Gold Fund Growth ₹45.076

↑ 0.18 ₹1,266 24.3 54.3 78.8 38 25 72 Invesco India Gold Fund Growth ₹43.3213

↑ 0.21 ₹341 24.6 53.1 75.8 37.4 24.5 69.6 SBI Gold Fund Growth ₹45.3894

↑ 0.13 ₹10,775 24.7 54.7 78.6 38.1 25.1 71.5 Nippon India Gold Savings Fund Growth ₹59.2746

↑ 0.17 ₹5,301 24.4 54.3 78.1 37.8 24.8 71.2 ICICI Prudential Regular Gold Savings Fund Growth ₹48.0641

↑ 0.20 ₹4,482 24.8 54.8 78.8 38 24.9 72 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Gold Fund Invesco India Gold Fund SBI Gold Fund Nippon India Gold Savings Fund ICICI Prudential Regular Gold Savings Fund Point 1 Bottom quartile AUM (₹1,266 Cr). Bottom quartile AUM (₹341 Cr). Highest AUM (₹10,775 Cr). Upper mid AUM (₹5,301 Cr). Lower mid AUM (₹4,482 Cr). Point 2 Established history (13+ yrs). Oldest track record among peers (14 yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 24.99% (upper mid). 5Y return: 24.54% (bottom quartile). 5Y return: 25.07% (top quartile). 5Y return: 24.77% (bottom quartile). 5Y return: 24.91% (lower mid). Point 6 3Y return: 37.98% (upper mid). 3Y return: 37.44% (bottom quartile). 3Y return: 38.12% (top quartile). 3Y return: 37.79% (bottom quartile). 3Y return: 37.97% (lower mid). Point 7 1Y return: 78.78% (upper mid). 1Y return: 75.84% (bottom quartile). 1Y return: 78.57% (lower mid). 1Y return: 78.09% (bottom quartile). 1Y return: 78.79% (top quartile). Point 8 1M return: 13.50% (top quartile). 1M return: 13.42% (bottom quartile). 1M return: 13.49% (upper mid). 1M return: 13.21% (bottom quartile). 1M return: 13.49% (lower mid). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 4.49 (top quartile). Sharpe: 4.43 (lower mid). Sharpe: 4.38 (bottom quartile). Sharpe: 4.46 (upper mid). Sharpe: 4.33 (bottom quartile). Aditya Birla Sun Life Gold Fund

Invesco India Gold Fund

SBI Gold Fund

Nippon India Gold Savings Fund

ICICI Prudential Regular Gold Savings Fund

Buy Gold Directly- You can buy gold directly in the form of coin or bullion. You will then hold onto physical quantities of gold, which can be sold later.

Buy Shares in a Gold Company- One can purchase stock in a company that produces gold. This is indirect exposure since the asset class would be equity, but a company involved in gold and would benefit with gold price movements.

How to Invest in Gold Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

So, long-term investments in gold either in the form of Gold ETFs, Gold Mutual Funds, E-Gold, or physical gold will definitely be a valuable addition to one's portfolio.

FAQs

1. Is it essential to invest in gold?

A: Gold has been proved to be an excellent investment option. It has produced good returns as it is considered one of the best methods to diversify one's portfolio of investment. Moreover, gold has never diminishing value, which means if you invest in gold, you can be assured that it will produce excellent returns.

2. How can I buy gold?

A: You can purchase gold in the formed metal or even in the form of Bonds. If you purchase gold in its metallic form, you can purchase coins, biscuits, bars, and jewelry. If you want to purchase gold bonds, you can purchase Exchange Traded Fund or ETFs and stocks in a company trading in gold.

3. Is gold a good investment option?

A: Gold is an excellent investment option, especially if you are looking to diversify your investment portfolio. Gold is also an ideal option if you are looking to secure your investments. You can be assured that you will never run at a loss.

4. What is the Gold ETF?

A: ETF is Exchange Traded Funds, which are a financial instrument that uses gold as the underlying asset. It can be traded in the stock market. With an ETF, you can are purchasing gold but in the form of de-materialized form. The trading is regulated by The Securities and Exchange Board of India.

5. Does gold offer liquidity?

A: Gold offers excellent liquidity, whether it is in the form of jewelry or ETF. You can quickly sell gold and get money in exchange.

6. Does gold offer diversification to your investment portfolio?

A: Yes, gold produces excellent returns, and hence, it can be used as an excellent diversification to your investment portfolio. If you invest in a gold ETF, you can trade it in the stock market like your other shares. However, with your ETFs, you can be assured of returns.

7. What are sovereign gold bonds?

A: Sovereign Gold Bonds or SGBs are issued by the Reserve Bank of India (RBI) as government securities. The SGBs are issued against denominations of gold. The SGBs act as substitutes for real gold. On maturity, you can redeem the bond for the gold amount's cash value on the SGB.

8. Is it necessary to have a DEMAT account to invest in gold?

A: Yes, you need a DEMAT account. These are like stocks and shares, and hence you need a DEMAT account to purchase SGBs.

9. Will the fluctuating price of gold affect investment?

A: Yes, the gold price will affect the investment. When gold prices increase, you can expect a nearly 10% per annum increase in your portfolio value. However, if you are purchasing gold, be it in the form of ETF or SGB, the fluctuating gold price means you will have to pay more to purchase the bond. Thus, the fluctuating gold price will affect your overall investment portfolio.

10. Does gold reduce in value?

A: Gold value decreases, similar to other investments, but it will never fall below the value of the amount you purchased. In other words, the price of gold will never fall so much that you will not get any returns on investment. Thus, even if the price of gold fluctuates, it will never fall below your purchase value.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.