Table of Contents

What is Hedge Ratio?

The hedge ratio refers to a calculation comparing the value of a hedged position to the overall position's size. A hedge ratio compares the value of acquired or sold futures contracts to the value of the cash commodity being hedged.

Futures contracts are investment vehicles that allow investors to lock in a price for a physical item at a future date.

The open position has been fully hedged if the hedge ratio is 1, or 100 percent. A hedge ratio of 0, or 0%, on the other hand, indicates that the open position has not been hedged in any form. Understanding the hedge ratio is crucial for risk management because it enables you to determine how much movement in your hedging instrument will counteract changes in your asset or debt value.

How Does the Hedge Ratio Work?

Hedge ratios are most typically employed as a risk management tool, as they can assist you in understanding the level of risk that your Financial Assets are exposed to. Furthermore, hedge ratios can help investors and financial analysts make better investment selections because they are suitable for estimating an asset's performance.

Assume you have 10,000 INR in foreign equity and are exposed to currency risk. To safeguard against losses in this position, you could enter into a hedge, which can be formed using several strategies to take an offsetting place to the foreign equity investment.

Your hedging ratio is 0.5 (5,000 / 10,000) if you hedge 5,000 INR of equity with a currency investment. It means that your foreign equity investment is protected from currency risk to the tune of 50%.

Talk to our investment specialist

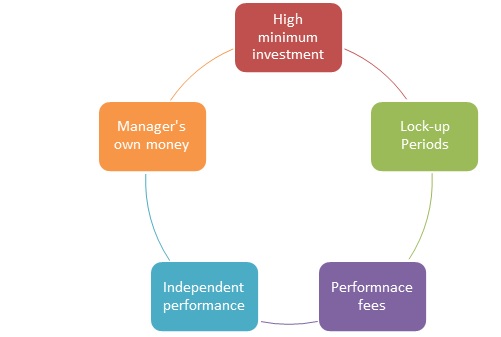

Hedging Strategies

Short Hedges

When a temporary position is taken to hedge futures or a commodity, it is referred to as a short hedge. When an investor predicts a future asset sale or the price of futures is likely to fall, they will typically use a short hedge.

Long Hedges

When a long position is taken to hedge futures or a commodity, it is referred to as a long hedge. When an investor anticipates a future asset purchase or the price of futures is likely to rise, they will typically use a long hedge.

Types of Hedging

Static Hedge

A static hedge is one in which the hedging position or number of hedging contracts is not bought and sold, i.e., is not modified throughout the hedge period, regardless of the price movement of the hedging instrument.

Dynamic Hedge

When an increasing number of hedging contracts are bought and sold throughout the hedge, the hedge ratio is influenced and brought closer to the target hedge ratio.

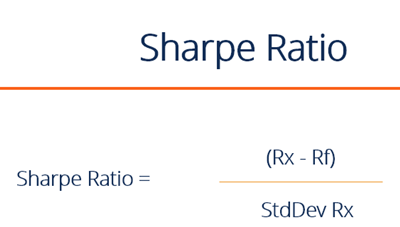

Calculating the Hedge Ratio

Here is the hedge ratio formula:

Hedge Ratio = Hedge Value / Total Position Value

Understanding the Optimal Hedge Ratio Formula

Let's look at the best hedging ratio now that you know a little more about how to calculate it (also known as the minimum-variance hedge ratio). The optimal hedge ratio is a risk management ratio that aids in determining the percentage of a hedging instrument or the portion of your Portfolio that should be hedged. In another way, the hedge ratio informs you of your current position, but the optimal hedge ratio tells you of your desired position.

The following is the best hedging ratio formula:

Optimal Hedge Ratio = ρ x (σs / σf)

Here,

- ρ = Changes in your future price and spot price have this as a correlation coefficient.

- σs = Changes in spot price Standard Deviation (s)

- σf = Changes in futures price standard deviation (f)

Hedge Ratio Applications

In the realms of investment and finance, the hedge ratio has a variety of applications:

Used as a statistical measure: The ratio is a statistical measure used to assess the degree of risk an investor may be exposed to when establishing a position.

Proves as a guideline: It helps investors make informed Investing selections by serving as a guide. It can be used as an investment guideline and can assist in making informed decisions because it indicates the risk exposure for developing a specific position.

Used as a risk mitigation technique: Hedge ratios are an essential risk mitigation tool since they assist in determining the level of risk exposure.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.