Fincash » Add biller for SIP Transaction Through Net Banking

Table of Contents

- Biller Addition Process for ICICI Bank

- Biller Addition Process for Axis Bank

- Biller Addition Process in HDFC Bank

- Biller Addition Process in State Bank of India (SBI)

- Biller Addition Process in Union Bank of India

- Biller Addition Process in Yes Bank

- Biller Addition Process in Kotak Mahindra Bank

- Biller Addition Process in IDFC Bank

- Biller Addition Process in IndusInd Bank

- Biller Addition Process in Punjab National Bank (PNB)

- Best SIPs to Invest to Earn Better Returns

Top 5 Funds

How to Add Biller for SIP Transactions in Banks for Net Banking?

SIP or Systematic Investment plan is an investment mode wherein; people invest small amounts in Mutual Fund schemes at regular intervals. SIP has many advantages such as rupee cost averaging, the Power of Compounding, disciplined savings habit, and so on. With the advancements in technology, the process of SIP payments has become easy. People just need to add the Unique Registration Number (URN) which they receive after the first payment is done to their Bank accounts through Net Banking so that the SIP payment process gets automated. You will receive the URN number either in your email or else; you can get the same in your by accessing the website of Fincash.com and going to My SIPs section. However, the process of adding biller in case of SIP transactions is different for each bank. So, let us glance the steps for biller addition in case of SIP transactions through Net Banking for various banks.

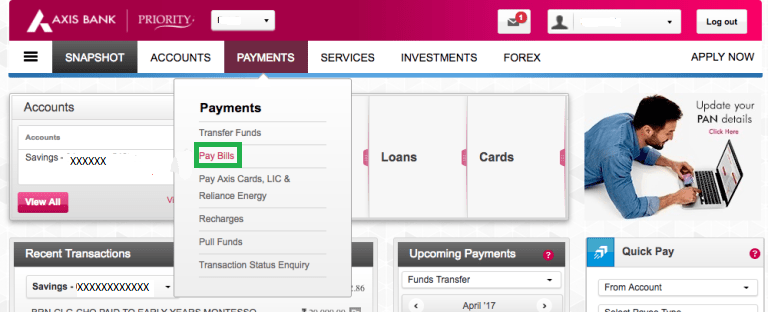

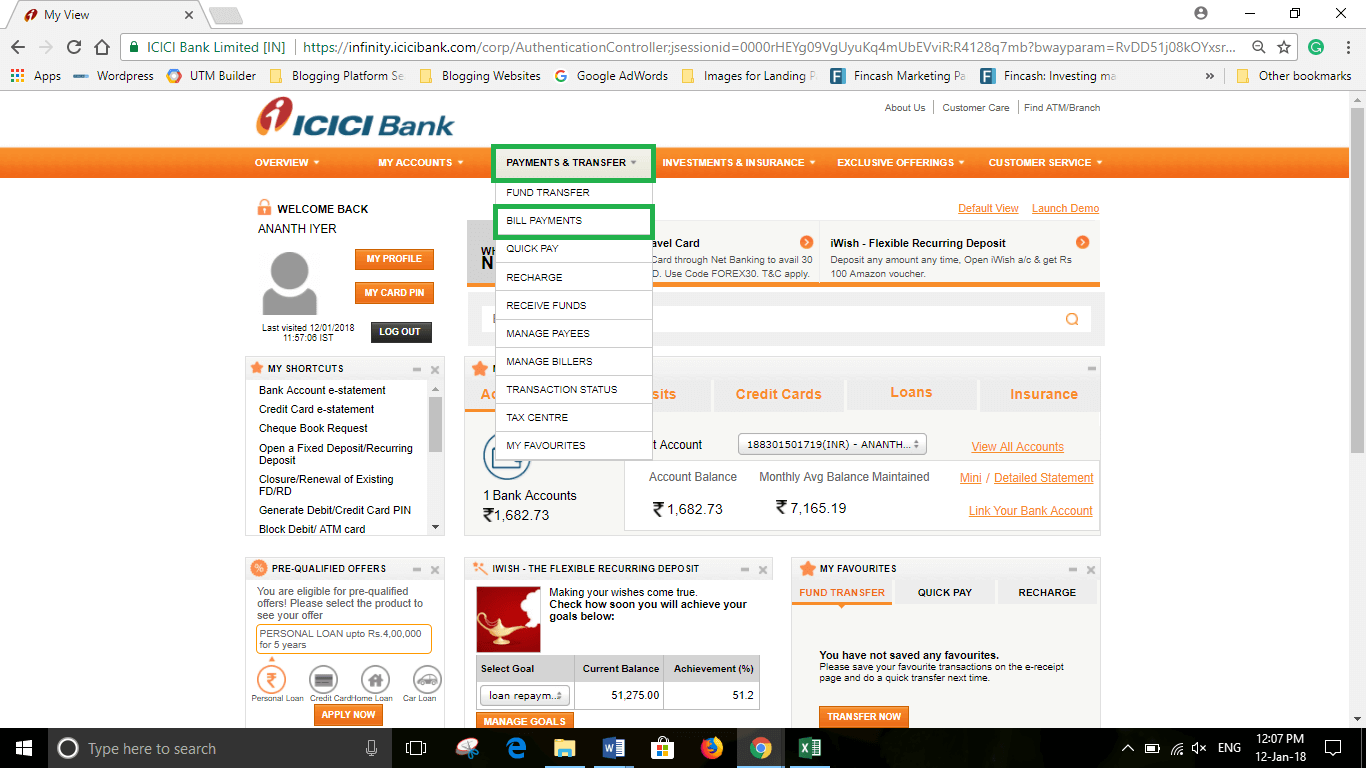

Biller Addition Process for ICICI Bank

In case of biller addition in ICICI Bank, you need to log in to your account and select Payment & Transfer Tab. In this tab, you need to select the Mutual Fund option. Once you select this option, a new screen opens where you need to select the Register option under Pay New Bills section. Then, a new screen will open Mutual Fund Option, and in the scroll below, click on BSE ISIP#. Once you press enter by selecting BSE ISIP#, you need to enter your URN along with other details and select confirm. Once you click on Confirm, the biller gets confirmed and your SIP payment process gets automated.

For understanding the process in detail, the read the article How to Do SIP Through Net Banking on Fincash.com Using ICICI Bank?

Biller Addition Process for Axis Bank

The biller addition process in case of Axis Bank is different as compared to ICICI Bank. Here, once you log in with your credentials, on the Home Screen, you need to click on Payments Tab and select Pay Bills option on it. Once you click on Pay Bills, a new screen opens where you need to click on Add Biller option. After clicking on this option, in the new screen, you will find various options related to various billers like insurance premia, utility payments where you select Mutual Funds. Under Mutual Funds option, you will select BSE Limited option. After you click on this option and move ahead, on the next page, you need to enter your URN and other related details and press enter. Then, in the new screen, you need to confirm the details before proceeding ahead. Onnce you proceed ahead, in the new screen you need to enter the NetSecure Code or One Time Password that you would receive on your mobile number. After entering the OTP once you press enter, your biller is successfully added in Axis Bank for SIP transactions.

For understanding the process in detail, the read the article How to Add Biller for SIP Transactions in Axis Bank?

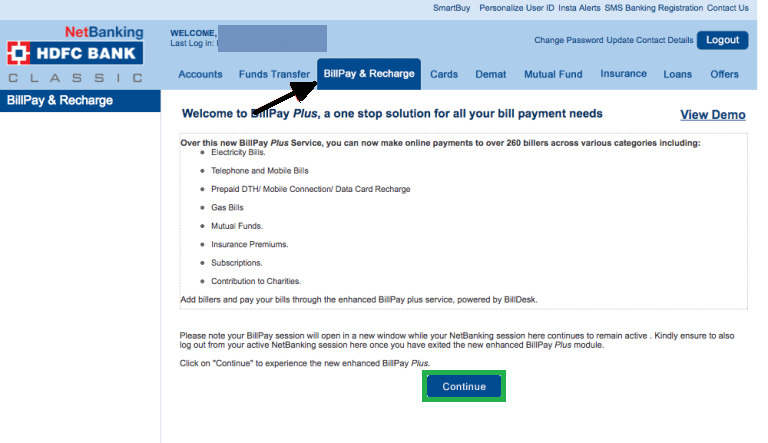

Biller Addition Process in HDFC Bank

In HDFC Bank after you log in, click on BillPay & Recharge tab. Once you click on this tab, a new screen opens wherein; you need to select the Registered New Biller box and select Click here to add option. After selecting this option, again a new screen opens where you will select Mutual Funds and BSE Limited in the drop-down next to Mutual Funds. After selecting on BSE Limited and you click on Continue, on the new screen you will enter your URN and other related details and click Continue. Once, you click on Continue, the biller gets added automatically to your system and enables automated payments of your SIP.

For understanding the process in detail, the read the article How to Add Biller for SIP Transactions in HDFC Bank?

Biller Addition Process in State Bank of India (SBI)

In SBI, once you log in using your credentials, you need to click on the Bill Payments option on the home screen. Once you enter here, you need to click on Manage Biller option on the left side of the screen. After Clicking on Manage Biller, you will select Add tab and select All India Billers under this option. Post selecting the All India Billers option, you will select the BSE Limited option and click on Go. After clicking this option, in the new screen that opens; you need to enter your URN and other related details and click on Submit. Once you click on Submit your biller is added successfully thereby; enabling the SIP payment process to get automated.

For understanding the process in detail, the read the article How to Add Biller for SIP Transactions in SBI?

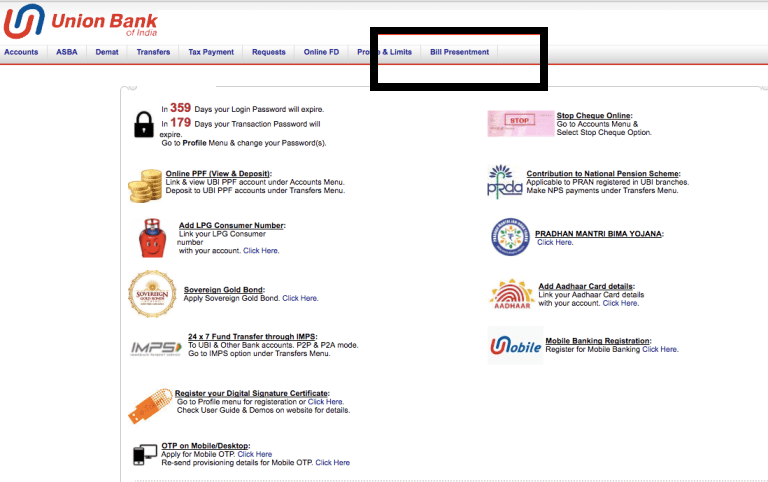

Biller Addition Process in Union Bank of India

For Union Bank of India, the initial process is the same where you log in your accounts using your log in credentials. In your home screen, you need to select Bill Presentment option. After clicking on the Bill Presentment option, select the Add Billers/Instant Pay option under the head My Billers option. In the next step, you need to select Mutual Funds and BSE Limited in the type of payments and move on to the next step. In the next step, you need to add the URN and click on Register. The next page is a Summary page where you can check the details and click on Confirm to successfully register the biller.

For understanding the process in detail, the read the article How to Add Biller for SIP Transactions in Union Bank of India?

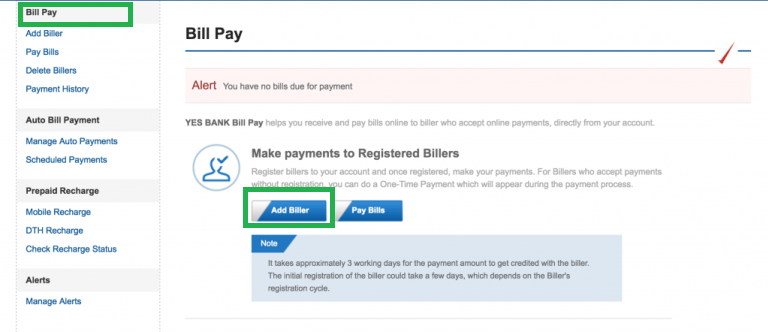

Biller Addition Process in Yes Bank

To add biller in Yes Bank, first log in your account. Once you are on the home screen, you need to click on Bill Pay option. Once you click on Bill Pay option, a new screen opens up, wherein; you need to click on Add Biller option. Once this is done, a new screen opens up wherein on Biller Location you need to click on National and in Biller, you need to click on BSE Limited. After clicking on BSE Limited, a new page opens where you need to enter your URN and fill other relevant components. After this, you need to click on Continue. Then, a new screen opens where you can see the summary of your details entered finally click on Confirm. After this, the biller is successfully registered and the SIP payment process gets automated.

For understanding the process in detail, the read the article How to Add Biller for SIP Transactions in Yes Bank?

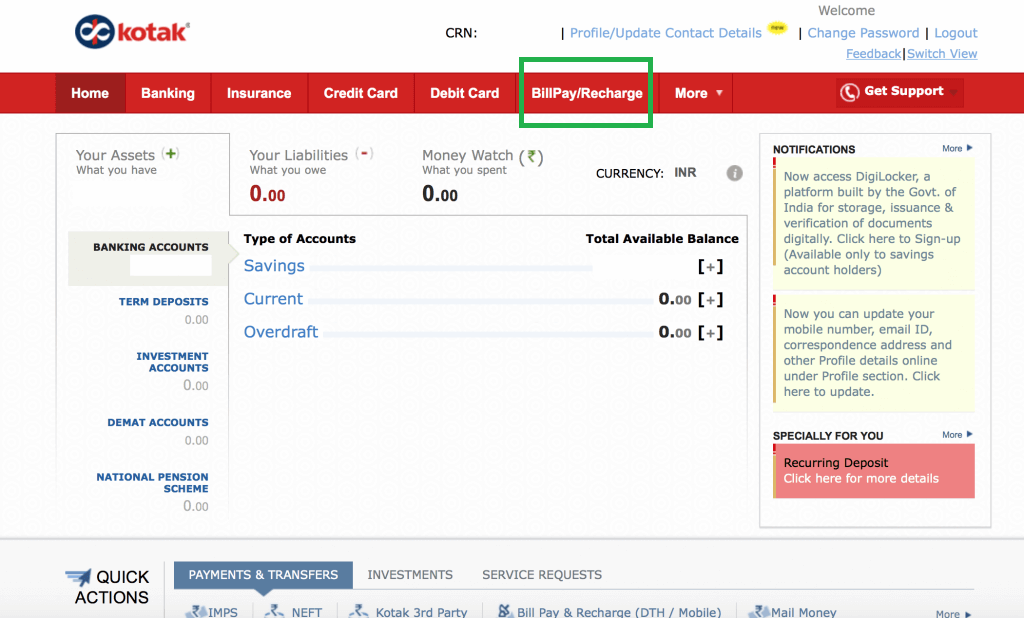

Biller Addition Process in Kotak Mahindra Bank

This process is again simple in which you first log in to the account and in your home screen click on the BillPay/Recharge option. Once you click on this, a new screen opens up which shows a message Click here to add a biller. Once you click on this option, in the new screen select Mutual Funds in the type of biller and BSE Limited in the select company drop-down. After selecting both of them, click on Continue. This action takes you to a new screen where you need to enter the URN along with other details and click on Add Biller. Once you click on Add Biller, the next page shows the summary of your URN details where you need to click on Confirm. Once you click, the biller gets registered thereby; enabling the automated SIP payment process.

For understanding the process in detail, the read the article How to Add Biller for SIP Transactions in Kotak Mahindra Bank?

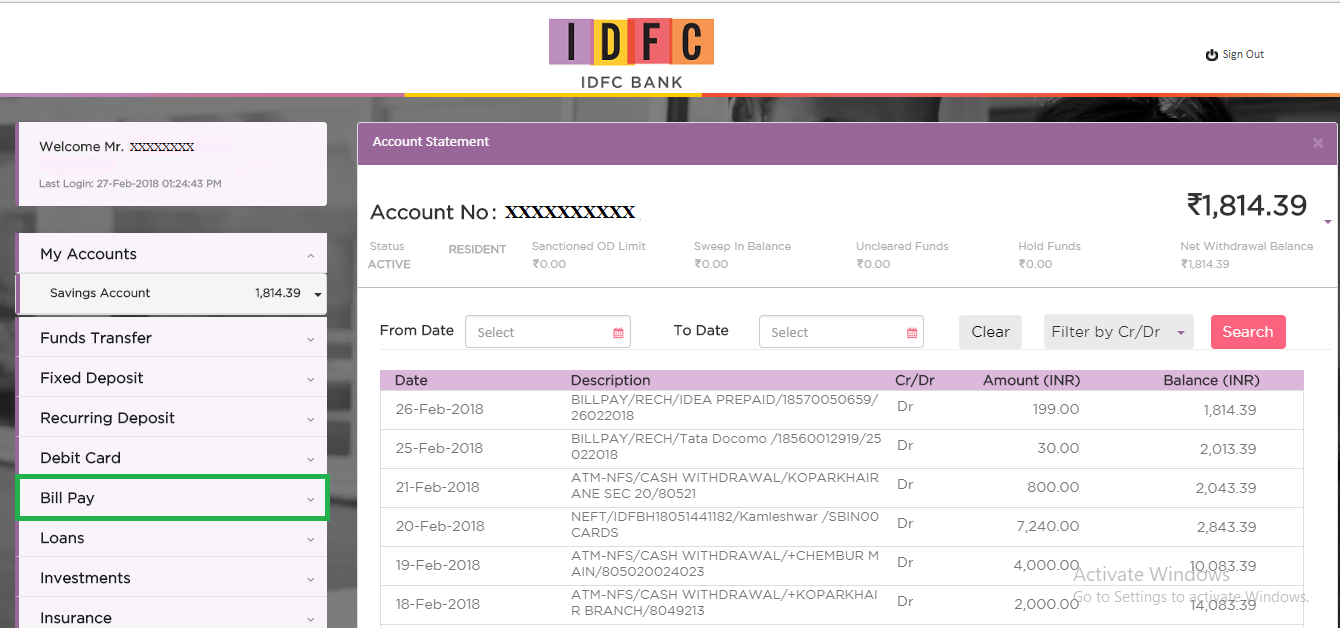

Biller Addition Process in IDFC Bank

The process of adding a biller in IDFC Bank is quiet simple. Here, you first need to log in to the IDFC net banking account and in you home screen, click on the Bill Pay option. Once you click on the Bill Pay option, a drop-down opens which has various options such as View/Pay Bills, Quick Pay, and much more. Out of these options, you need to select the Add Biller option. Once you click on Add Biller, a new window opens up where you need to add Biller Details. In this step you need to add the URN and other details such as Category of Payment, Provider, and click on Set for Auto Pay option. Post you click on Set for Auto Pay, a drop down opens where you need to enter the account from which the payment will be made, start date of SIP and so on. After entering these details you need to click on Add Biller button. After click, a new screen opens where you can see the details you have entered. Also, you can see a box where you need to enter the OTP which you will receive in your registered mobile number. After you enter the OTP and click on Verify; your biller addition process is done and you get a confirmation message. This will help you to ensure that all future SIP payments get automated.

For understanding the process in detail, the read the article How to Add Biller for SIP Transactions in IDFC Bank?

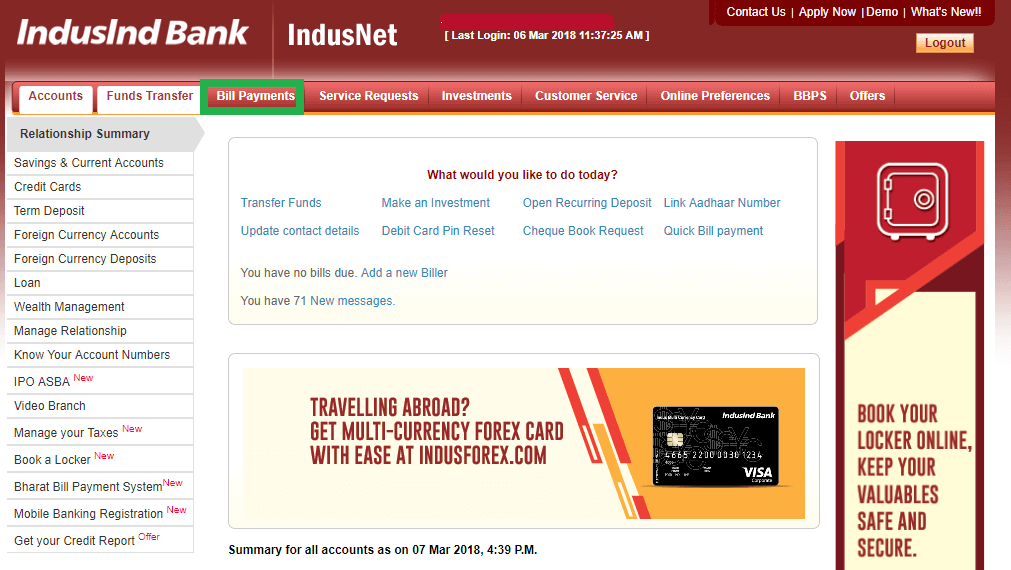

Biller Addition Process in IndusInd Bank

The process of adding a biller in IndusInd Bank is different from other banks. First-of-all, once you log into the bet banking system of IndusInd Bank, you need to click on Bill Payments tab which is on the top of the screen. Once you click on bill payments, a new screen opens in which you need to click on Manage Biller tab which is on the left side of the screen and then click on Add Biller option. Once you click on Add Biller then, you are redirected to a new screen in which there are various bill payment options. Here, you need to click on Mutual Fund option and then select BSE Limited from the drop-down against Mutual Funds. After selecting Go, in the new screen you need to add your URN along with other details and click on Register. After you click on Register a new screen opens where you need to verify the URN details and then click on Confirm. Once you click on Confirm, a new screen opens in which you can see that the Biller addition process is successful. However, the process does not end here. After adding the biller, you need to click on Schdule Payments tab and select Edit Payments option under it. Once you click on Edit Payments, a new screen opens where you can see the Mutual Fund SIP Biller added. Here you need to click on Set button in the Mutual Funds. Once you click on Set, a new AutoPay screen opens up in which you need to enter the payment details such as Click Yes on Pay Entire Bill Amount, select Payment Mode as Net Banking and the Account Number from which you wish to make payments. After entering the details you then need to click on Go button. Then again, you will get a Verification page wherein; you need to verify the details and click on Confirm. Post confirmation, your AutoPay details get activated therby ensuring that your SIP payment is automated.

For understanding the process in detail, the read the article How to Add Biller for SIP Transactions in IndusInd Bank?

Biller Addition Process in Punjab National Bank (PNB)

The process of biller addition in case of SIP transactions in Punjab National Bank (PNB) can be done through mobile banking. Here, first you need to open the PNB application on your mobile. Once you open it, you need to enter your User ID and MPIN and click on Login. Once you click on login and reach your homescreen, then you need to click on the Payments/Recharge section in your home screen. Then, you will be redirected to a new screen, where you need to click on Register Biller. Then again, a new screen opens in which you need to click on Mutual Fund option. Under Mutual Fund option, you can find an array of billers out of which you need to select the BSE Limited option. Once you click on this, a new screen will open. In this new screen, you need to add your URN of the SIP transaction and nickname for the SIP and finally, click on continue. After this, in the new screen, you need to set up the autopay options and finally add the OTP so that the biller for SIP transactions, gets added successfully.

For understanding the process in detail, the read the article How to Add Biller for SIP Transactions in Punjab National Bank?

Thus, from the above steps, we can say that the biller addition process for each bank though is different yet; it's easy.

Best SIPs to Invest to Earn Better Returns

Here are some of the recommend SIPs as per 5 year returns and AUM of more than INR 500 Cr:

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Nippon India Small Cap Fund Growth ₹148.156

↑ 3.53 ₹50,826 100 -11.1 -18.1 0.2 18.3 38.1 26.1 ICICI Prudential Infrastructure Fund Growth ₹173.11

↑ 3.09 ₹6,886 100 -3.3 -11.8 0.4 25.5 38 27.4 IDFC Infrastructure Fund Growth ₹44.791

↑ 1.00 ₹1,400 100 -8.6 -18.3 -1.4 22.3 36 39.3 Nippon India Power and Infra Fund Growth ₹307.974

↑ 6.25 ₹6,125 100 -6.6 -16.5 -3.2 24.9 35.6 26.9 HDFC Infrastructure Fund Growth ₹42.756

↑ 0.81 ₹2,105 300 -3.4 -11.9 -1.1 26 35.5 23 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related instruments of small cap companies and the secondary objective is to generate consistent returns by investing in debt and money market securities. Nippon India Small Cap Fund is a Equity - Small Cap fund was launched on 16 Sep 10. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Small Cap Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. HDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 10 Mar 08. It is a fund with High risk and has given a Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on 1. Nippon India Small Cap Fund

CAGR/Annualized return of 20.3% since its launch. Ranked 6 in Small Cap category. Return for 2024 was 26.1% , 2023 was 48.9% and 2022 was 6.5% . Nippon India Small Cap Fund

Growth Launch Date 16 Sep 10 NAV (11 Apr 25) ₹148.156 ↑ 3.53 (2.44 %) Net Assets (Cr) ₹50,826 on 28 Feb 25 Category Equity - Small Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.55 Sharpe Ratio -0.31 Information Ratio 0.66 Alpha Ratio 3.26 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹21,742 31 Mar 22 ₹31,334 31 Mar 23 ₹33,418 31 Mar 24 ₹51,907 31 Mar 25 ₹55,076 Returns for Nippon India Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 3.3% 3 Month -11.1% 6 Month -18.1% 1 Year 0.2% 3 Year 18.3% 5 Year 38.1% 10 Year 15 Year Since launch 20.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 26.1% 2022 48.9% 2021 6.5% 2020 74.3% 2019 29.2% 2018 -2.5% 2017 -16.7% 2016 63% 2015 5.6% 2014 15.1% Fund Manager information for Nippon India Small Cap Fund

Name Since Tenure Samir Rachh 2 Jan 17 8.16 Yr. Kinjal Desai 25 May 18 6.77 Yr. Data below for Nippon India Small Cap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 22.17% Consumer Cyclical 13.91% Financial Services 13.54% Basic Materials 12.14% Consumer Defensive 8.89% Technology 8.65% Health Care 8.16% Energy 2.03% Utility 1.98% Communication Services 1.54% Real Estate 0.54% Asset Allocation

Asset Class Value Cash 6.04% Equity 93.96% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 22 | HDFCBANK2% ₹1,152 Cr 6,650,000 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 28 Feb 21 | MCX2% ₹924 Cr 1,851,010 Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Oct 12 | KIRLOSBROS1% ₹714 Cr 4,472,130 Dixon Technologies (India) Ltd (Technology)

Equity, Since 30 Nov 18 | DIXON1% ₹655 Cr 470,144 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 28 Feb 17 | 5900031% ₹639 Cr 31,784,062 State Bank of India (Financial Services)

Equity, Since 31 Oct 19 | SBIN1% ₹627 Cr 9,100,000 Tube Investments of India Ltd Ordinary Shares (Industrials)

Equity, Since 30 Apr 18 | TIINDIA1% ₹615 Cr 2,499,222 NLC India Ltd (Utilities)

Equity, Since 31 Oct 22 | NLCINDIA1% ₹563 Cr 27,190,940 Adani Wilmar Ltd (Consumer Defensive)

Equity, Since 31 Jan 25 | 5434581% ₹553 Cr 22,483,343

↑ 183,343 Apar Industries Ltd (Industrials)

Equity, Since 31 Mar 17 | APARINDS1% ₹521 Cr 899,271 2. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.6% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (11 Apr 25) ₹173.11 ↑ 3.09 (1.82 %) Net Assets (Cr) ₹6,886 on 28 Feb 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio -0.25 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,670 31 Mar 22 ₹25,304 31 Mar 23 ₹30,899 31 Mar 24 ₹50,465 31 Mar 25 ₹54,540 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 2.9% 3 Month -3.3% 6 Month -11.8% 1 Year 0.4% 3 Year 25.5% 5 Year 38% 10 Year 15 Year Since launch 15.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% 2014 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.75 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 36.49% Basic Materials 21.39% Financial Services 16.91% Utility 8.65% Energy 7.09% Communication Services 1.63% Consumer Cyclical 0.89% Real Estate 0.35% Asset Allocation

Asset Class Value Cash 5.98% Equity 93.39% Debt 0.62% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹649 Cr 2,052,790

↑ 126,940 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS4% ₹288 Cr 2,695,324 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹268 Cr 98,408

↓ -10,339 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK3% ₹240 Cr 1,990,000 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325553% ₹226 Cr 7,260,775 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹212 Cr 1,225,000 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹210 Cr 12,006,117

↑ 1,500,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹205 Cr 1,709,486

↑ 100,000 Vedanta Ltd (Basic Materials)

Equity, Since 31 Jul 24 | 5002953% ₹194 Cr 4,923,662

↑ 100,000 Cummins India Ltd (Industrials)

Equity, Since 31 May 17 | 5004803% ₹173 Cr 635,000 3. IDFC Infrastructure Fund

CAGR/Annualized return of 11.2% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (11 Apr 25) ₹44.791 ↑ 1.00 (2.29 %) Net Assets (Cr) ₹1,400 on 28 Feb 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio -0.3 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,153 31 Mar 22 ₹24,848 31 Mar 23 ₹27,324 31 Mar 24 ₹47,064 31 Mar 25 ₹50,038 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 4.9% 3 Month -8.6% 6 Month -18.3% 1 Year -1.4% 3 Year 22.3% 5 Year 36% 10 Year 15 Year Since launch 11.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 39.3% 2022 50.3% 2021 1.7% 2020 64.8% 2019 6.3% 2018 -5.3% 2017 -25.9% 2016 58.7% 2015 10.7% 2014 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.1 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 54.7% Utility 13.22% Basic Materials 10.84% Communication Services 4.49% Energy 3.88% Consumer Cyclical 3.46% Financial Services 2.99% Technology 2.07% Health Care 1.9% Asset Allocation

Asset Class Value Cash 2.43% Equity 97.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹71 Cr 443,385 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹58 Cr 183,173

↑ 11,726 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE4% ₹54 Cr 452,706 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL4% ₹52 Cr 330,018

↑ 40,855 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325384% ₹51 Cr 50,452

↑ 3,476 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA3% ₹45 Cr 4,797,143 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹39 Cr 365,137

↓ -69,842 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹39 Cr 12,400,122 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Oct 19 | BEL3% ₹35 Cr 1,431,700 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹35 Cr 512,915 4. Nippon India Power and Infra Fund

CAGR/Annualized return of 17.8% since its launch. Ranked 13 in Sectoral category. Return for 2024 was 26.9% , 2023 was 58% and 2022 was 10.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (11 Apr 25) ₹307.974 ↑ 6.25 (2.07 %) Net Assets (Cr) ₹6,125 on 28 Feb 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.05 Sharpe Ratio -0.55 Information Ratio 1.03 Alpha Ratio 1.38 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,563 31 Mar 22 ₹23,186 31 Mar 23 ₹26,891 31 Mar 24 ₹47,550 31 Mar 25 ₹48,861 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 3.4% 3 Month -6.6% 6 Month -16.5% 1 Year -3.2% 3 Year 24.9% 5 Year 35.6% 10 Year 15 Year Since launch 17.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% 2014 0.3% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 6.77 Yr. Rahul Modi 19 Aug 24 0.53 Yr. Data below for Nippon India Power and Infra Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 40.77% Utility 19.49% Energy 9.09% Basic Materials 9.08% Communication Services 8.44% Real Estate 3.99% Technology 2.14% Health Care 2.08% Consumer Cyclical 1.96% Financial Services 1.78% Asset Allocation

Asset Class Value Cash 1.18% Equity 98.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE8% ₹480 Cr 4,000,000

↑ 250,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325558% ₹480 Cr 15,400,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT8% ₹472 Cr 1,492,001 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL7% ₹408 Cr 2,600,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325384% ₹243 Cr 240,038 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | 5004004% ₹237 Cr 6,975,789

↑ 500,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES3% ₹176 Cr 423,938 Siemens Ltd (Industrials)

Equity, Since 31 May 21 | 5005503% ₹162 Cr 350,000 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 30 Sep 24 | 5000932% ₹151 Cr 2,632,923

↑ 80,000 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Sep 23 | CARBORUNIV2% ₹150 Cr 1,800,000 5. HDFC Infrastructure Fund

CAGR/Annualized return of since its launch. Ranked 26 in Sectoral category. Return for 2024 was 23% , 2023 was 55.4% and 2022 was 19.3% . HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (11 Apr 25) ₹42.756 ↑ 0.81 (1.94 %) Net Assets (Cr) ₹2,105 on 28 Feb 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.31 Sharpe Ratio -0.55 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,356 31 Mar 22 ₹21,727 31 Mar 23 ₹25,279 31 Mar 24 ₹45,346 31 Mar 25 ₹47,548 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 4.9% 3 Month -3.4% 6 Month -11.9% 1 Year -1.1% 3 Year 26% 5 Year 35.5% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2023 23% 2022 55.4% 2021 19.3% 2020 43.2% 2019 -7.5% 2018 -3.4% 2017 -29% 2016 43.3% 2015 -1.9% 2014 -2.5% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Srinivasan Ramamurthy 12 Jan 24 1.13 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 38.42% Financial Services 20.62% Basic Materials 10.93% Utility 7.4% Energy 6.96% Communication Services 3.76% Health Care 1.73% Technology 0.98% Real Estate 0.94% Consumer Cyclical 0.58% Asset Allocation

Asset Class Value Cash 6.48% Equity 92.31% Debt 1.21% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK7% ₹157 Cr 1,300,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK6% ₹121 Cr 700,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT6% ₹120 Cr 380,000

↑ 30,000 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL5% ₹98 Cr 1,450,000

↓ -50,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | 5325553% ₹69 Cr 2,200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹67 Cr 150,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL3% ₹67 Cr 758,285 Coal India Ltd (Energy)

Equity, Since 31 Oct 18 | COALINDIA3% ₹63 Cr 1,700,000 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹60 Cr 500,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹55 Cr 350,000

↓ -50,000

In case of any further queries, you can contact us on 8451864111 on any working day between 9.30am to 6.30 pm or write a mail to us anytime at support@fincash.com or chat with us by logging onto our website www.fincash.com.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

hi, how to add a SIP URN in Fedral Bank aacound... kindly help me out balaji

How to add biller for SIP transaction for Federal bank?