+91-22-48913909

+91-22-48913909

Table of Contents

- एकमुश्त म्युचुअल फंड निवेश के लिए टिप्स

- सर्वश्रेष्ठ म्युचुअल फंड में ऑनलाइन निवेश कैसे करें?

- बेस्ट लम्पसम इक्विटी म्यूचुअल फंड 2022 - 2023

- बेस्ट लम्पसम डेट फंड 2022 - 2023

- बेस्ट लम्पसम हाइब्रिड फंड 2022 - 2023

- शीर्ष 5 एकमुश्त बैलेंस्ड म्यूचुअल फंड

- शीर्ष 5 एकमुश्त आक्रामक हाइब्रिड फंड

- शीर्ष 5 एकमुश्त कंजर्वेटिव हाइब्रिड फंड

- शीर्ष 5 एकमुश्त आर्बिट्राज फंड

- शीर्ष 5 एकमुश्त गतिशील आवंटन निधि

- शीर्ष 5 एकमुश्त मल्टी एसेट एलोकेशन फंड

- शीर्ष 5 एकमुश्त इक्विटी बचत निधि

- शीर्ष 5 एकमुश्त समाधान उन्मुख योजनाएं

- 1 महीने के प्रदर्शन पर सर्वश्रेष्ठ एकमुश्त म्युचुअल फंड

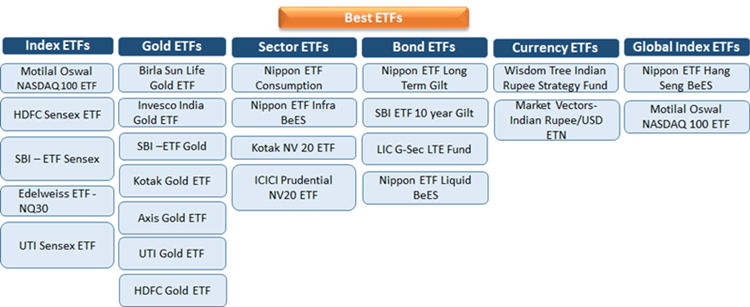

Top 4 Equity - Sectoral Funds

5 सर्वश्रेष्ठ प्रदर्शन करने वाला एकमुश्त निवेश 2022 - 2023

भारत में म्यूचुअल फंड योजनाएं पिछले कुछ वर्षों में बढ़ी हैं। नतीजतन,सर्वश्रेष्ठ प्रदर्शन करने वाले म्युचुअल फंड मेंमंडी बदलते रहो। म्यूचुअल फंड स्कीम को जज करने के लिए विभिन्न रेटिंग सिस्टम हैं, जैसे क्रिसिल, मॉर्निंग स्टार, आईसीआरए, आदि।

ये सिस्टम रिटर्न, जैसे गुणात्मक और मात्रात्मक कारकों के आधार पर म्यूचुअल फंड का मूल्यांकन करते हैं।मानक विचलन, फंड की उम्र, आदि। इन सभी कारकों का योग सर्वश्रेष्ठ प्रदर्शन करने वाली रेटिंग की ओर जाता हैम्यूचुअल फंड्स भारत में।

एकमुश्त म्युचुअल फंड निवेश के लिए टिप्स

सबसे अच्छा प्रदर्शन करने वाले म्यूचुअल फंड में निवेश करने का एक सही तरीका इसके गुणात्मक और मात्रात्मक दोनों उपायों को देखना है, जैसे:

योजना संपत्ति का आकार

निवेशकों को हमेशा ऐसे फंड में जाना चाहिए जो न तो बहुत बड़ा हो और न ही बहुत छोटा हो। जबकि फंड के आकार के बीच कोई सटीक परिभाषा और संबंध नहीं है, यह कहा जाता है कि बहुत छोटा और बहुत बड़ा, दोनों ही फंड के प्रदर्शन में बाधा डाल सकते हैं। किसी भी योजना में कम परिसंपत्ति प्रबंधन (एयूएम) बहुत जोखिम भरा होता है क्योंकि आप नहीं जानते कि निवेशक कौन हैं और किसी विशेष योजना में उनका कितना निवेश है। इस प्रकार, एक फंड चुनते समय, उसी के लिए जाने की सलाह दी जाती है जिसका एयूएम लगभग श्रेणी के समान है।

फंड आयु

सबसे अच्छा प्रदर्शन करने वाले म्यूचुअल फंड में निवेश करने के लिए, निवेशकों को समय की अवधि के लिए फंड के प्रदर्शन का उचित मूल्यांकन करना चाहिए। साथ ही, ऐसी योजना के लिए जाने का सुझाव दिया जाता है जो 4-5 वर्षों में लगातार रिटर्न दे रही हो।

सर्वश्रेष्ठ म्युचुअल फंड में ऑनलाइन निवेश कैसे करें?

Fincash.com पर आजीवन मुफ्त निवेश खाता खोलें।

अपना पंजीकरण और केवाईसी प्रक्रिया पूरी करें

Upload Documents (PAN, Aadhaar, etc.). और, आप निवेश करने के लिए तैयार हैं!

बेस्ट लम्पसम इक्विटी म्यूचुअल फंड 2022 - 2023

नीचे से शीर्ष रैंक वाले फंड हैंइक्विटी लार्ज-, मिड-, स्मॉल-, मल्टी-कैप फंड जैसी श्रेणी,ईएलएसएस और क्षेत्रीय निधि।

शीर्ष 5 एकमुश्त लार्ज कैप इक्विटी म्यूचुअल फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) IDBI India Top 100 Equity Fund Growth ₹44.16

↑ 0.05 ₹655 5,000 9.2 12.5 15.4 21.9 12.6 Nippon India Large Cap Fund Growth ₹83.4739

↓ -0.46 ₹34,212 5,000 -3.6 -10 6.8 18.7 28.2 18.2 DSP BlackRock TOP 100 Equity Growth ₹448.063

↓ -0.84 ₹4,519 1,000 -0.8 -7.6 14.7 17.9 23.5 20.5 ICICI Prudential Bluechip Fund Growth ₹102.92

↓ -0.27 ₹60,177 5,000 -1.4 -9.6 7 16.8 26.5 16.9 HDFC Top 100 Fund Growth ₹1,078.07

↓ -1.50 ₹33,913 5,000 -1.8 -11.2 5 16.2 25.9 11.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23

Talk to our investment specialist

शीर्ष 5 एकमुश्त मिड कैप इक्विटी म्यूचुअल फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Motilal Oswal Midcap 30 Fund Growth ₹92.6273

↓ -0.65 ₹23,704 5,000 -16.7 -13.9 16.9 28.3 36.7 57.1 Edelweiss Mid Cap Fund Growth ₹89.859

↓ -0.20 ₹7,729 5,000 -10.5 -12.4 17.6 22.9 35.1 38.9 SBI Magnum Mid Cap Fund Growth ₹219.238

↓ -0.49 ₹19,392 5,000 -6.1 -12 8.5 18 33.2 20.3 PGIM India Midcap Opportunities Fund Growth ₹58.12

↓ -0.35 ₹9,600 5,000 -8.9 -13.4 8 12 32.3 21 ICICI Prudential MidCap Fund Growth ₹259.2

↓ -0.47 ₹5,394 5,000 -9.2 -14.6 7.8 18.6 32.1 27 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त स्मॉल कैप म्यूचुअल फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) L&T Emerging Businesses Fund Growth ₹72.5753

↓ -0.24 ₹13,334 5,000 -18.1 -19 4.3 17.8 37.3 28.5 HDFC Small Cap Fund Growth ₹121.314

↓ -0.31 ₹28,120 5,000 -12.7 -14.5 3.1 19.8 36.2 20.4 Kotak Small Cap Fund Growth ₹236.304

↑ 0.38 ₹14,407 5,000 -14.4 -18.2 8.7 14 35.3 25.5 Franklin India Smaller Companies Fund Growth ₹151.651

↓ -0.10 ₹11,257 5,000 -15.6 -18.5 2.9 20.3 35.1 23.2 DSP BlackRock Small Cap Fund Growth ₹170.423

↓ -0.05 ₹13,277 1,000 -15.3 -16.2 9 16.1 34.4 25.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

टॉप 5 एकमुश्त डायवर्सिफाइड/मल्टी कैप इक्विटी म्यूचुअल फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) IDBI Diversified Equity Fund Growth ₹37.99

↑ 0.14 ₹382 5,000 10.2 13.2 13.5 22.7 12 HDFC Equity Fund Growth ₹1,846.33

↓ -3.02 ₹64,124 5,000 -1.1 -6.5 15 22.6 32.5 23.5 Nippon India Multi Cap Fund Growth ₹269.266

↓ -0.94 ₹35,353 5,000 -6.9 -12.8 10.1 22 32.9 25.8 Motilal Oswal Multicap 35 Fund Growth ₹57.0575

↓ -0.27 ₹11,172 5,000 -10 -10 18.4 21.9 23.7 45.7 JM Multicap Fund Growth ₹91.0394

↓ -0.27 ₹4,899 5,000 -12.5 -17 7.3 21.7 28.2 33.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23

टॉप 5 एकमुश्त (ईएलएसएस) इक्विटी लिंक्ड सेविंग स्कीम

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Magnum Tax Gain Fund Growth ₹408.767

↓ -1.26 ₹25,724 500 -4.2 -11 10.2 23.9 31.7 27.7 Motilal Oswal Long Term Equity Fund Growth ₹45.6879

↓ -0.14 ₹3,405 500 -17.8 -16.6 10.6 23 27.4 47.7 HDFC Tax Saver Fund Growth ₹1,306.64

↓ -3.42 ₹14,671 500 -1.7 -8.7 12.5 21.8 30.1 21.3 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 500 9.7 15.1 16.9 20.8 10 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 500 1.2 15.4 35.5 20.6 17.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त सेक्टर इक्विटी म्यूचुअल फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI PSU Fund Growth ₹29.9015

↓ -0.05 ₹4,149 5,000 -2.6 -12.2 6 31.4 32.3 23.5 HDFC Infrastructure Fund Growth ₹43.275

↓ -0.11 ₹2,105 5,000 -7.4 -13.9 4.9 29.9 36.8 23 Invesco India PSU Equity Fund Growth ₹57.52

↓ -0.09 ₹1,047 5,000 -4.9 -14.5 4.6 29.7 31.4 25.6 ICICI Prudential Infrastructure Fund Growth ₹178.42

↓ -0.23 ₹6,886 5,000 -4.3 -12 8.1 29.5 40.9 27.4 Nippon India Power and Infra Fund Growth ₹318.077

↓ -0.65 ₹6,125 5,000 -8.5 -17 2.8 29.4 37.8 26.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

बेस्ट लम्पसम डेट फंड 2022 - 2023

लिक्विड, अल्ट्रा शॉर्ट, शॉर्ट टर्म, गिल्ट, क्रेडिट रिस्क और कॉरपोरेट जैसे डेट कैटेगरी के टॉप रैंक वाले फंड नीचे दिए गए हैंडेट फंड.

शीर्ष 5 एकमुश्त अल्ट्रा शॉर्ट टर्म डेट म्यूचुअल फंड

अत्यंतशॉर्ट टर्म फंड्स कम जोखिम वाले स्थिर रिटर्न के साथ 6-12 महीने की अवधि के लिए अच्छे निवेश हैं क्योंकि वे 6-12 महीने की परिपक्वता अवधि वाले शॉर्ट टर्म डेट इंस्ट्रूमेंट्स में कॉर्पस निवेश करते हैं।

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Savings Fund Growth ₹537.018

↑ 0.58 ₹14,988 1,000 2 3.9 7.8 6.9 7.9 7.84% 5M 19D 7M 20D SBI Magnum Ultra Short Duration Fund Growth ₹5,862.4

↑ 6.87 ₹11,987 5,000 1.9 3.7 7.4 6.6 7.4 7.53% 5M 5D 8M 8D ICICI Prudential Ultra Short Term Fund Growth ₹27.161

↑ 0.03 ₹13,017 5,000 1.9 3.7 7.4 6.6 7.5 7.74% 5M 1D 7M 6D Invesco India Ultra Short Term Fund Growth ₹2,647.5

↑ 3.52 ₹1,337 5,000 2 3.7 7.3 6.4 7.5 7.5% 5M 13D 5M 29D Nippon India Ultra Short Duration Fund Growth ₹3,954.3

↑ 3.92 ₹7,545 100 1.9 3.6 7.2 6.4 7.2 7.73% 5M 4D 7M 1D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त शॉर्ट टर्म डेट म्यूचुअल फंड

शॉर्ट टर्म फंड 1-2 साल की अवधि के लिए कम जोखिम वाले स्थिर रिटर्न के साथ अच्छा निवेश है क्योंकि वे 1 - 3 साल के बीच की परिपक्वता वाले डेट इंस्ट्रूमेंट्स में निवेश करते हैं।

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sundaram Short Term Debt Fund Growth ₹36.3802

↑ 0.01 ₹362 5,000 0.8 11.4 12.8 5.3 4.52% 1Y 2M 13D 1Y 7M 3D HDFC Short Term Debt Fund Growth ₹31.2939

↑ 0.04 ₹14,391 5,000 2.3 3.9 8.4 6.8 8.3 2.96% 2Y 9M 18D 4Y 23D IDFC Bond Fund Short Term Plan Growth ₹55.86

↑ 0.08 ₹9,570 5,000 2.4 3.9 8.3 6.4 7.8 7.38% 2Y 10M 17D 3Y 8M 16D Axis Short Term Fund Growth ₹30.1851

↑ 0.03 ₹8,825 5,000 2.4 4.1 8.3 6.6 8 7.57% 2Y 9M 14D 3Y 7M 10D Nippon India Short Term Fund Growth ₹51.5572

↑ 0.06 ₹6,340 5,000 2.3 4 8.3 6.4 8 7.65% 2Y 9M 3Y 7M 13D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 31 Dec 21

शीर्ष 5 एकमुश्त लिक्विड म्युचुअल फंड

लिक्विड फंड कम जोखिम वाले स्थिर रिटर्न के साथ एक दिन से लेकर 90 दिनों की अवधि के लिए अच्छे निवेश हैं क्योंकि वे इसमें कॉर्पस निवेश करते हैंमुद्रा बाजार एक सप्ताह से लेकर 3 महीने तक की परिपक्वता अवधि वाले ऋण लिखत।

Fund NAV Net Assets (Cr) Min Investment 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Liquid Fund Growth ₹2,858.32

↑ 3.17 ₹42,867 500 0.6 1.9 3.6 7.3 7.4 7.17% 1M 9D 1M 9D DSP BlackRock Liquidity Fund Growth ₹3,665.21

↑ 3.70 ₹22,387 1,000 0.6 1.8 3.6 7.3 7.4 0.12% 1M 10D 1M 17D Canara Robeco Liquid Growth ₹3,089.59

↑ 3.28 ₹5,294 5,000 0.6 1.9 3.6 7.3 7.4 7.03% 29D 1M 1D Invesco India Liquid Fund Growth ₹3,528.49

↑ 3.76 ₹14,276 5,000 0.6 1.8 3.6 7.3 7.4 7.12% 1M 14D 1M 14D Edelweiss Liquid Fund Growth ₹3,282.88

↑ 3.54 ₹7,270 5,000 0.6 1.8 3.6 7.3 7.3 7.17% 1M 18D 1M 18D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त गिल्ट म्युचुअल फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity SBI Magnum Gilt Fund Growth ₹65.3085

↑ 0.21 ₹11,257 5,000 3.1 3.5 8.9 7.8 8.9 7.11% 9Y 11M 1D 23Y 10M 28D ICICI Prudential Gilt Fund Growth ₹100.774

↑ 0.20 ₹6,356 5,000 2.9 4.2 8.7 7.8 8.2 7.05% 5Y 3M 22D 13Y 4M 28D DSP BlackRock Government Securities Fund Growth ₹94.939

↑ 0.36 ₹1,699 1,000 3.1 3.4 9.1 7.6 10.1 7.09% 11Y 2M 12D 28Y 11M 16D Invesco India Gilt Fund Growth ₹2,810.46

↑ 8.71 ₹1,220 5,000 3.1 3.1 8.7 7.4 10 7.15% 10Y 11M 5D 29Y 3M 22D Axis Gilt Fund Growth ₹25.2594

↑ 0.08 ₹912 5,000 3.2 3.9 9.7 7.4 10 7.11% 9Y 9M 14D 22Y 9M Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त कॉर्पोरेट बॉन्ड म्यूचुअल फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity ICICI Prudential Corporate Bond Fund Growth ₹29.1692

↑ 0.04 ₹29,290 5,000 2.3 4.1 8.3 7.3 8 7.63% 2Y 7M 28D 4Y 8M 8D Nippon India Prime Debt Fund Growth ₹58.6005

↑ 0.09 ₹6,498 1,000 2.5 4 8.6 7.1 8.4 7.44% 3Y 10M 6D 5Y 2M 26D Aditya Birla Sun Life Corporate Bond Fund Growth ₹110.57

↑ 0.19 ₹25,293 1,000 2.5 4 8.7 7.1 8.5 7.48% 3Y 9M 14D 5Y 8M 19D HDFC Corporate Bond Fund Growth ₹31.8491

↑ 0.05 ₹32,191 5,000 2.4 3.9 8.6 6.9 8.6 4.03% 3Y 9M 19D 5Y 11M 12D Kotak Corporate Bond Fund Standard Growth ₹3,686.67

↑ 4.69 ₹14,449 5,000 2.4 3.9 8.5 6.7 8.3 7.41% 2Y 9M 29D 4Y 2M 8D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त क्रेडिट जोखिम म्युचुअल फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity BOI AXA Credit Risk Fund Growth ₹11.9635

↑ 0.01 ₹114 5,000 1.3 2.8 4.9 37.3 6 7% 5M 19D 6M 25D DSP BlackRock Credit Risk Fund Growth ₹48.2485

↑ 0.05 ₹192 1,000 15.1 17 21.6 15.9 7.8 7.96% 2Y 2M 12D 3Y 29D Franklin India Credit Risk Fund Growth ₹25.3348

↑ 0.04 ₹104 5,000 2.9 5 7.5 11 0% Aditya Birla Sun Life Credit Risk Fund Growth ₹21.7121

↑ 0.03 ₹964 1,000 5.9 10.3 16.1 10.2 11.9 8.24% 2Y 2M 12D 3Y 5M 8D Invesco India Credit Risk Fund Growth ₹1,890.7

↑ 2.44 ₹140 5,000 4.3 5.6 9.6 8.3 7.3 7.58% 3Y 2M 16D 4Y 5M 8D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

बेस्ट लम्पसम हाइब्रिड फंड 2022 - 2023

अंतर श्रेणियों से शीर्ष रैंक वाले फंड नीचे दिए गए हैं जैसे। आक्रामक, रूढ़िवादी, मध्यस्थता, गतिशील आवंटन, बहु संपत्ति, इक्विटी बचत और समाधान उन्मुख

हाइब्रिडयोजनाएं

शीर्ष 5 एकमुश्त बैलेंस्ड म्यूचुअल फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Balanced Advantage Fund Growth ₹490.303

↓ -0.86 ₹90,375 5,000 -1.9 -5.2 8.6 19.8 27 16.7 JM Equity Hybrid Fund Growth ₹113.269

↓ -0.30 ₹729 5,000 -8.8 -12.4 7 19.5 27.8 27 ICICI Prudential Multi-Asset Fund Growth ₹719.348

↑ 2.40 ₹52,257 5,000 3.5 -1.5 13.9 18.6 28.1 16.1 ICICI Prudential Equity and Debt Fund Growth ₹368.69

↓ -0.51 ₹38,507 5,000 1.2 -6 9.4 17.8 28.5 17.2 UTI Multi Asset Fund Growth ₹69.9721

↓ -0.08 ₹4,979 5,000 -2.2 -6.4 8.6 16.9 19.1 20.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त आक्रामक हाइब्रिड फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) JM Equity Hybrid Fund Growth ₹113.269

↓ -0.30 ₹729 5,000 -8.8 -12.4 7 19.5 27.8 27 ICICI Prudential Equity and Debt Fund Growth ₹368.69

↓ -0.51 ₹38,507 5,000 1.2 -6 9.4 17.8 28.5 17.2 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹34.82

↓ -0.08 ₹974 5,000 -10.6 -11.2 6.6 16.3 28 25.8 Sundaram Equity Hybrid Fund Growth ₹135.137

↑ 0.78 ₹1,954 5,000 0.5 10.5 27.1 16 14.2 UTI Hybrid Equity Fund Growth ₹380.385

↓ -0.96 ₹5,633 1,000 -3.9 -8.2 10.7 15.8 24.4 19.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त कंजर्वेटिव हाइब्रिड फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Balanced Advantage Fund Growth ₹490.303

↓ -0.86 ₹90,375 5,000 -1.9 -5.2 8.6 19.8 27 16.7 JM Equity Hybrid Fund Growth ₹113.269

↓ -0.30 ₹729 5,000 -8.8 -12.4 7 19.5 27.8 27 ICICI Prudential Multi-Asset Fund Growth ₹719.348

↑ 2.40 ₹52,257 5,000 3.5 -1.5 13.9 18.6 28.1 16.1 ICICI Prudential Equity and Debt Fund Growth ₹368.69

↓ -0.51 ₹38,507 5,000 1.2 -6 9.4 17.8 28.5 17.2 UTI Multi Asset Fund Growth ₹69.9721

↓ -0.08 ₹4,979 5,000 -2.2 -6.4 8.6 16.9 19.1 20.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त आर्बिट्राज फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Equity Arbitrage Fund Growth ₹36.8798

↑ 0.08 ₹58,923 5,000 1.9 3.8 7.5 6.9 5.7 7.8 UTI Arbitrage Fund Growth ₹34.471

↑ 0.07 ₹6,415 5,000 1.9 3.7 7.5 6.7 5.5 7.7 HDFC Arbitrage Fund Growth ₹30.158

↑ 0.06 ₹18,054 100,000 1.8 3.7 7.4 6.7 5.4 7.7 Invesco India Arbitrage Fund Growth ₹31.4101

↑ 0.07 ₹19,341 5,000 1.9 3.7 7.4 7 5.6 7.6 ICICI Prudential Equity Arbitrage Fund Growth ₹33.7547

↑ 0.07 ₹25,880 5,000 1.9 3.7 7.4 6.7 5.5 7.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त गतिशील आवंटन निधि

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Balanced Advantage Fund Growth ₹490.303

↓ -0.86 ₹90,375 5,000 -1.9 -5.2 8.6 19.8 27 16.7 BOI AXA Equity Debt Rebalancer Fund Growth ₹23.5248

↓ -0.08 ₹125 5,000 -2.2 -9 0.1 13.1 12.4 6.4 Axis Dynamic Equity Fund Growth ₹20.12

↓ -0.02 ₹2,625 5,000 -0.9 -4.1 11.2 13 14.3 17.5 ICICI Prudential Balanced Advantage Fund Growth ₹69.36

↓ -0.09 ₹58,717 5,000 -0.1 -3.5 7.6 12.1 17.8 12.3 Invesco India Dynamic Equity Fund Growth ₹50.96

↓ -0.15 ₹919 5,000 -4.5 -5.5 7.2 12.1 15.3 15.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त मल्टी एसेट एलोकेशन फंड

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Multi-Asset Fund Growth ₹719.348

↑ 2.40 ₹52,257 5,000 3.5 -1.5 13.9 18.6 28.1 16.1 UTI Multi Asset Fund Growth ₹69.9721

↓ -0.08 ₹4,979 5,000 -2.2 -6.4 8.6 16.9 19.1 20.7 Edelweiss Multi Asset Allocation Fund Growth ₹59.69

↑ 0.01 ₹2,290 5,000 -2.8 -7.4 10.4 16.2 22.9 20.2 SBI Multi Asset Allocation Fund Growth ₹55.2053

↓ -0.01 ₹7,351 5,000 -0.3 -3.2 10.5 13.9 16.5 12.8 HDFC Multi-Asset Fund Growth ₹67.425

↑ 0.04 ₹3,837 5,000 0.7 -2.7 10 12.9 19.7 13.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Mar 25

शीर्ष 5 एकमुश्त इक्विटी बचत निधि

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Principal Equity Savings Fund Growth ₹67.4743

↑ 0.04 ₹1,033 5,000 -0.4 -2.2 8.8 10.7 15.1 12.6 L&T Equity Savings Fund Growth ₹31.1821

↑ 0.02 ₹619 5,000 -8.1 -5.5 9 10.5 15 24 Kotak Equity Savings Fund Growth ₹24.9082

↓ -0.02 ₹7,897 5,000 -1.5 -3.2 6.1 10.4 13.2 11.7 Edelweiss Equity Savings Fund Growth ₹24.1591

↑ 0.04 ₹569 5,000 0 0.2 9.5 10.2 11.9 13.4 DSP BlackRock Equity Savings Fund Growth ₹21.216

↑ 0.01 ₹2,476 1,000 1.1 0.2 10.8 10 13.8 12.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

शीर्ष 5 एकमुश्त समाधान उन्मुख योजनाएं

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Retirement Savings Fund - Equity Plan Growth ₹47.106

↓ -0.16 ₹5,571 5,000 -4.6 -10.9 7.2 18.8 30 18 ICICI Prudential Child Care Plan (Gift) Growth ₹298.93

↓ -1.08 ₹1,183 5,000 -3.2 -9.2 7.5 15.8 21.7 16.9 HDFC Retirement Savings Fund - Hybrid - Equity Plan Growth ₹36.439

↓ -0.04 ₹1,485 5,000 -3.2 -7.9 7.1 14.4 21.5 14 Tata Retirement Savings Fund - Progressive Growth ₹59.5114

↑ 0.10 ₹1,803 5,000 -10 -13.9 7.7 13.6 20.4 21.7 Tata Retirement Savings Fund-Moderate Growth ₹59.2572

↑ 0.15 ₹1,908 5,000 -7.7 -10.3 8.8 12.8 18.8 19.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25

1 महीने के प्रदर्शन पर सर्वश्रेष्ठ एकमुश्त म्युचुअल फंड

To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Invesco India PSU Equity Fund is a Equity - Sectoral fund was launched on 18 Nov 09. It is a fund with High risk and has given a Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on The Scheme seeks to provide long term capital appreciation by investing in a portfolio that is predominantly constituted of equity and equity related instruments of infrastructure companies. However, there can be no assurance that the investment objective of the Scheme will be achieved. Invesco India Infrastructure Fund is a Equity - Sectoral fund was launched on 21 Nov 07. It is a fund with High risk and has given a Below is the key information for Invesco India Infrastructure Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. SBI PSU Fund is a Equity - Sectoral fund was launched on 7 Jul 10. It is a fund with High risk and has given a Below is the key information for SBI PSU Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on 1. Invesco India PSU Equity Fund

CAGR/Annualized return of 12.1% since its launch. Ranked 33 in Sectoral category. Return for 2024 was 25.6% , 2023 was 54.5% and 2022 was 20.5% . Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (28 Mar 25) ₹57.52 ↓ -0.09 (-0.16 %) Net Assets (Cr) ₹1,047 on 28 Feb 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.39 Sharpe Ratio -0.67 Information Ratio -0.53 Alpha Ratio 0.52 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹11,266 28 Feb 22 ₹13,191 28 Feb 23 ₹15,226 29 Feb 24 ₹28,692 28 Feb 25 ₹25,610 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 16.6% 3 Month -4.9% 6 Month -14.5% 1 Year 4.6% 3 Year 29.7% 5 Year 31.4% 10 Year 15 Year Since launch 12.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 25.6% 2023 54.5% 2022 20.5% 2021 31.1% 2020 6.1% 2019 10.1% 2018 -16.9% 2017 24.3% 2016 17.9% 2015 2.5% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Dhimant Kothari 19 May 20 4.79 Yr. Data below for Invesco India PSU Equity Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 30.21% Utility 24.02% Financial Services 19.87% Energy 18% Basic Materials 6.08% Asset Allocation

Asset Class Value Cash 1.83% Equity 98.17% Top Securities Holdings / Portfolio

Name Holding Value Quantity Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹114 Cr 3,894,619

↓ -443,636 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 28 Feb 22 | 5328989% ₹109 Cr 3,599,413 State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN8% ₹97 Cr 1,251,543 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | 5005477% ₹90 Cr 3,445,961 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Aug 24 | 5003126% ₹75 Cr 2,868,783

↑ 1,206,383 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN6% ₹68 Cr 5,911,723

↑ 521,208 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL5% ₹60 Cr 153,175

↑ 17,924 BEML Ltd (Industrials)

Equity, Since 31 Aug 23 | 5000485% ₹59 Cr 152,998 Hindustan Petroleum Corp Ltd (Energy)

Equity, Since 30 Nov 23 | HINDPETRO5% ₹56 Cr 1,564,169 National Aluminium Co Ltd (Basic Materials)

Equity, Since 31 Aug 24 | 5322344% ₹53 Cr 2,604,332 2. Invesco India Infrastructure Fund

CAGR/Annualized return of 10.6% since its launch. Ranked 24 in Sectoral category. Return for 2024 was 33.2% , 2023 was 51.1% and 2022 was 2.3% . Invesco India Infrastructure Fund

Growth Launch Date 21 Nov 07 NAV (28 Mar 25) ₹57.21 ↑ 0.06 (0.10 %) Net Assets (Cr) ₹1,255 on 28 Feb 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.34 Sharpe Ratio -0.37 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹12,627 28 Feb 22 ₹16,217 28 Feb 23 ₹17,572 29 Feb 24 ₹29,218 28 Feb 25 ₹27,836 Returns for Invesco India Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 13.2% 3 Month -12.2% 6 Month -16.9% 1 Year 4.6% 3 Year 24.1% 5 Year 33.9% 10 Year 15 Year Since launch 10.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 33.2% 2023 51.1% 2022 2.3% 2021 55.4% 2020 16.2% 2019 6.1% 2018 -15.8% 2017 48.1% 2016 0.8% 2015 -2.6% Fund Manager information for Invesco India Infrastructure Fund

Name Since Tenure Amit Nigam 3 Sep 20 4.49 Yr. Data below for Invesco India Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 55.97% Consumer Cyclical 8.55% Utility 8.11% Basic Materials 6.3% Technology 6.02% Communication Services 4.1% Health Care 3.46% Financial Services 1.98% Energy 1.95% Real Estate 1.64% Asset Allocation

Asset Class Value Cash 1.91% Equity 98.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT5% ₹78 Cr 218,263 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 30 Apr 22 | 5328984% ₹63 Cr 2,097,430

↓ -221,454 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Aug 21 | BHARTIARTL4% ₹61 Cr 377,580

↑ 276,336 Jyoti CNC Automation Ltd (Industrials)

Equity, Since 31 Jan 24 | JYOTICNC3% ₹49 Cr 452,265 PTC Industries Ltd (Industrials)

Equity, Since 30 Sep 24 | 5390063% ₹48 Cr 33,576

↑ 23 Dixon Technologies (India) Ltd (Technology)

Equity, Since 30 Sep 22 | DIXON3% ₹47 Cr 31,418

↑ 6,425 KEI Industries Ltd (Industrials)

Equity, Since 30 Sep 19 | KEI3% ₹44 Cr 108,188 Hitachi Energy India Ltd Ordinary Shares (Technology)

Equity, Since 30 Nov 24 | POWERINDIA3% ₹43 Cr 33,412

↑ 12,727 Indian Railway Catering And Tourism Corp Ltd (Industrials)

Equity, Since 30 Apr 24 | IRCTC3% ₹41 Cr 492,595 BEML Ltd (Industrials)

Equity, Since 31 May 23 | 5000483% ₹40 Cr 105,205

↓ -13,825 3. SBI PSU Fund

CAGR/Annualized return of 7.7% since its launch. Ranked 31 in Sectoral category. Return for 2024 was 23.5% , 2023 was 54% and 2022 was 29% . SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (28 Mar 25) ₹29.9015 ↓ -0.05 (-0.16 %) Net Assets (Cr) ₹4,149 on 28 Feb 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 2.3 Sharpe Ratio -0.57 Information Ratio -0.1 Alpha Ratio 3.02 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹11,312 28 Feb 22 ₹13,400 28 Feb 23 ₹15,401 29 Feb 24 ₹29,693 28 Feb 25 ₹27,741 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 12.8% 3 Month -2.6% 6 Month -12.2% 1 Year 6% 3 Year 31.4% 5 Year 32.3% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 23.5% 2023 54% 2022 29% 2021 32.4% 2020 -10% 2019 6% 2018 -23.8% 2017 21.9% 2016 16.2% 2015 -11.1% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 0.75 Yr. Data below for SBI PSU Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 35.72% Utility 24.32% Energy 17.09% Industrials 11.13% Basic Materials 6.29% Asset Allocation

Asset Class Value Cash 5.35% Equity 94.54% Debt 0.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN15% ₹663 Cr 8,577,500 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | 5321559% ₹431 Cr 24,350,000

↑ 2,400,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | 5328989% ₹428 Cr 14,185,554

↑ 900,000 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL8% ₹374 Cr 12,775,000

↑ 800,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | 5005476% ₹253 Cr 9,700,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | 5263714% ₹184 Cr 27,900,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | 5325554% ₹176 Cr 5,443,244 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | 5321344% ₹166 Cr 7,800,000 General Insurance Corp of India (Financial Services)

Equity, Since 31 May 24 | 5407553% ₹148 Cr 3,600,000 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹139 Cr 3,300,000 4. IDFC Infrastructure Fund

CAGR/Annualized return of 11.5% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (28 Mar 25) ₹45.942 ↓ -0.12 (-0.26 %) Net Assets (Cr) ₹1,400 on 28 Feb 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio -0.3 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 29 Feb 20 ₹10,000 28 Feb 21 ₹14,023 28 Feb 22 ₹17,580 28 Feb 23 ₹18,995 29 Feb 24 ₹32,794 28 Feb 25 ₹31,727 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 12.7% 3 Month -11.2% 6 Month -18% 1 Year 6.3% 3 Year 27.2% 5 Year 38% 10 Year 15 Year Since launch 11.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 39.3% 2023 50.3% 2022 1.7% 2021 64.8% 2020 6.3% 2019 -5.3% 2018 -25.9% 2017 58.7% 2016 10.7% 2015 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.1 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 56.44% Utility 12.75% Basic Materials 8.95% Communication Services 4.63% Energy 3.49% Financial Services 3.1% Consumer Cyclical 2.89% Technology 2.42% Health Care 1.83% Asset Allocation

Asset Class Value Cash 3.5% Equity 96.5% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹82 Cr 443,385 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹61 Cr 171,447 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE3% ₹57 Cr 452,706 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325383% ₹54 Cr 46,976 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA3% ₹53 Cr 4,797,143 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹48 Cr 434,979 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹47 Cr 12,400,122 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL3% ₹47 Cr 289,163 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹43 Cr 512,915

↑ 37,553 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Oct 19 | BEL3% ₹42 Cr 1,431,700

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।

Best kumaun sun

Comprehensive list of funds from all categories.