BYJU’s: The Rise and Fall of an Edtech Giant

Byju’s has been the subject of heightened interest in recent months, leading us to delve deeper into the current concerns surrounding the company.

Let’s have a look at the quick rise and fall of this edutech giant and what lessons it has for newcomers in the Industry.

Byju’s: How it Started?

Byju’s, established in 2011 by Byju Raveendran and Divya Gokulnath, revolutionised EdTech and the way students should learn through its innovative and engaging programs. With a presence in 120 countries and a staggering enrollment of over 150 million learners, Byju’s offered comprehensive learning solutions ranging from K-12 education to competitive exam preparation and professional upskilling. Initially, they started with offline coaching classes but later introduced an app that revolutionised the way education was delivered. The app provided video lessons and interactive quizzes, gaining immense popularity among students and parents who recognised its high-quality and effectiveness.

The success of Byju’s caught the attention of investors, who showed great confidence in the company by injecting substantial amounts of Capital. Additionally, Byju’s embarked on an acquisition spree, acquiring other edtech startups such as WhiteHat Jr and Aakash Educational Services. These acquisitions were aimed at expanding the company’s offerings and widening its reach within the education sector. By 2020, during the peak Covid-19, online education bloomed, which helped Byju’s achieve an extraordinary milestone. It became the most valuable edtech startup globally with an astonishing valuation of $22 billion. However, things started changing for the company in no time. The moment the Covid scenario stopped and schools reopened, Byju’s started facing challenges that contradicted its seemingly positive image.

Byju’s Soft Scam: Harsh Selling Practices

The re-opening of schools and other educational institutes impacted Byju’s revenue significantly. In an attempt to keep up with the image it created and the revenue mark it had hit, the company strayed from its mission of delivering high-quality education and instead shifted its focus to selling hardware devices like laptops and tablets to students and parents. This shift was accompanied by the use of aggressive and unethical sales tactics. For instance, according to an article in a newspaper, there were reports of one parent complaining about receiving comments like, “Your daughter will end up poor like you” and “You should be ashamed for trying to stop her from succeeding in life” when they declined to purchase Byju’s products and services due to affordability issues.

There are also allegations that Byju’s pressures its teachers to promote its products. Byju’s claims that its offerings are unique and provide a competitive edge to students. However, if they are selling the same content to everyone, it raises doubts about the distinctiveness of their products. Another tactic employed by Byju’s is targeting parents directly, highlighting their children’s underperformance and emphasising how Byju’s can help them achieve academic success. This strategy appears to be successful in capturing the attention of typical Indian parents. Furthermore, Byju’s resorted to aggressive Accounting practices to inflate its revenue and valuation. The company engaged in questionable practices such as selling its Receivables to third parties and counting them as Income.

Talk to our investment specialist

The Money Troubles at Byju’s

The company faced serious accusations from lenders who claimed Byju’s had concealed a significant amount of $500 million by transferring it out of the business account, which marked the beginning of their troubles. In response to this shocking revelation, lenders abruptly withdrew from the process of restructuring the outstanding loans, totaling a substantial $1.2 billion. To compound matters, Byju’s encountered another financial setback when a $40 million interest payment became due on the debt that lenders were attempting to negotiate, further exacerbating the situation. Failure to make this payment in full would result in the largest unrated loan Default by a startup in history, and unfortunately, Byju’s made history by defaulting on the payment. Furthermore, Byju’s faced delays in submitting crucial financial statements, adding to the growing concerns. These documents are vital for assessing the company’s financial stability and helping lenders evaluate credit risk. The delay drew criticism and intensified Byju’s financial difficulties.

In a surprising twist, Byju’s took a proactive stance and filed a lawsuit against its lenders, alleging harassment during the loan recovery process. The resolution of this court dispute remains uncertain, further complicating an already critical situation.

Resignation of Byju’s Board Members and Auditors

Byju’s long-standing auditor, Deloitte Haskins & Sells, unexpectedly tendered their resignation. Deloitte had been working with Byju’s since 2016 and had been reappointed for a five-year contract starting from April 1, 2020. The resignation was prompted by significant delays in the release of the financial results for the year ending on March 31, 2022. Deloitte has emphasised the need to present these statements to shareholders at the Annual General Meeting (AGM) by September 30, 2022, in accordance with the 2013 Companies Act. Following Deloitte’s departure, the financial matters of Think and Learn Pvt. Ltd., the Parent Company of Byju’s, are now being seen by a new auditor, BDO.

Concurrently, there have been changes in the board of directors of the parent company. The following three directors have chosen to resign from their positions:

- GV Ravishankar of Peak XV Partners

- Vivian Wu of the Chan Zuckerberg Initiative

- Russell Dreisenstock of Prosus

These changes in the composition of the board indicate a shift that may influence the trajectory and decision-making processes of the organisation.

Currently, Byju’s is undergoing a board reconstitution initiative, aiming to appoint independent directors who can bring valuable insights and guidance. Additionally, the company is exploring the establishment of a board of advisors composed of experienced individuals who can provide valuable guidance to founders. During a recent executive board meeting with shareholders, Raveendran openly acknowledged the mistakes made by the company but emphasised his commitment to course corrections and learning from those missteps.

How has the Game Changed for Byju’s in the Last Two Years?

As per the annual financial statement that Byju’s submitted to the Registrar of Companies (RoC) for the Fiscal Year ending in March 2021, there were some concerning figures for the public to ponder.

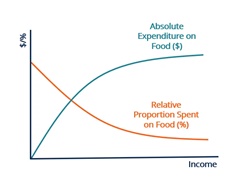

In a year when edtech companies thrived due to the pandemic-induced shift to online learning, Byju’s operating income for FY21 stood at Rs. 2280 crores, a mere 4% increase from the previous fiscal year’s Rs. 2189 crores (FY20). However, during this period, the company’s losses surged by a staggering 14.9 times to reach Rs. 4564 crores. In FY21, sales of edtech products, such as laptops, tablets, SD cards, and tech-enabled devices, accounted for 81% of Byju’s total income, but revenue from this vertical decreased by 9.5% to Rs. 1848.7 crores.

In FY21, streaming and course fees contributed Rs. 429 crores to the company’s revenue. Advertising and promotions constituted the largest chunk of the company’s expenses, accounting for 32% of overall costs, and this expenditure grew by 2.5 times to reach Rs. 2251 crores in FY21. The second-largest cost for Byju’s in FY21 was employee perks, which saw a significant surge of 4.6 times to reach Rs. 1943 crores. This includes the cost of Employee Stock Ownership Plans (ESOPs), amounting to Rs. 476 crores and funded through equity.

While legal and professional fees increased by 16% to Rs. 667 crores in FY21, there was also a Rs. 128 crores increase in sponsorship costs. Byju’s acquisition activities in FY21 also incurred compliance costs. Overall, the company’s total costs for FY21 grew by 2.4 times to reach Rs. 7027 crores. With significant expenditures reflected in its financial statements, Byju’s witnessed a substantial increase in losses, amounting to 14.9 times higher at Rs. 4564 crores in FY21.

Byju Raveendran is no Longer a Billionare

Byju Raveendran, who joined the billionaire’s club three years ago, has dropped out of his exclusive ranking due to a series of missteps. Prosus, based in the Netherlands (formerly known as Nasperas), recently revealed that it had marked down its 9.6% stakes in Byju’s to $493 million. This markdown signifies a significant devaluation of Raveendran’s company, which is now valued at $5.1 billion, a substantial 77% discount from its peak valuation of $22 billion last year. As a result, Raveendran’s 18% stakes at Byju’s is currently valued under $1 billion. However, considering the loans he took last year to invest in the company, his personal Net worth is estimated to be around $475 million. This marks a considerable decline from Raveendran’s net worth of $1.8 billion in 2020, when he debuted on Forbes’ World Billionaires list and his firm was valued at $10 billion. Within two years, his fortune had doubled to $3.6 billion before experiencing a downturn.

The rapid pace of growth took its toll on Byju’s. Analysts suggest that the company expanded too quickly, lacking proper checks and balances. For example, Byju’s operated without a Chief Financial Officer (CF) from December 2021 to April 2023. In an attempt to reassure nervous investors, Raveendran participated in the company’s funding round in March 2022, Investing $400 million at the $22 billion valuation. However, despite the announcement of funding rounds with great fanfare, the actual funding did not materialise as investors like Sumeru Ventures and Vitruvian Partners backed out.

The Layoff by Byju’s

In an unconventional approach to alleviate pressure, Byju’s embarked on a weight loss journey by reducing a significant portion of its workers. The news of these layoff has likely reached many ears. Since the onset of the funding winter in 2022, it has been reported that Byju’s has laid off 5% of its employee workforce (almost 2500 of them) by giving an excuse of restructuring the inside operations of the firm.

Byju’s made the decision to remove approximately 500 - 1000 additional positions in the third round of layoffs this year, bringing a total number of job cuts to 4000 for the year. These layoffs affected various departments, including sales, marketing, non-sales teams, and senior management. Additionally, the impact extended to Byju’s acquisitions, with employees of Whitehat Jr requested to resign voluntarily, indicating the spread of these measures within the company and its subsidiaries.

Lionel Messi: The Global Byju’s Ambassador

While financial constraints can be a legitimate Factor behind layoffs, it becomes concerning when a company allocates substantial amounts, estimated to be around $5-7 million per year, to secure Lionel Messi as the brand ambassador for its social impact division, Education for All. Moreover, it is astonishing to consider an additional expenditure of $30-40 million on FIFA World Cup sponsorship. These figures raise questions about why such extravagant expenses are being made when the company is unable to sustain its workforce. It prompts us to question what Byju’s true priorities are. As the dust settles on these conflicting actions, it becomes crucial to reflect on the balance between making financial choices and upholding moral obligations. This serves as a powerful reminder that business decisions should align with the well-being and values of both the company and its stakeholders. It calls for a careful evaluation of how financial resources are allocated and the ethical implications of those choices.

Wrapping Up

Reportedly, Byju’s has vacated a 5.58 lakh square feet property in Kalyani Tech Park, as well as two floors at Prestige Tech Park at Bangalore. This move is believed to result in a monthly rent savings of approximately Rs. 3 crores, highlighting the significant financial strain the edtech company is currently facing. The once-promising trajectory of Byju’s has taken a sharp downturn, leading to the edtech giant’s downfall. The challenges faced by Byj’s served as a cautionary tale, highlighting the importance of sustainable growth, prudent financial management, and maintaining investor trust. As the company restructures its board and seeks to navigate through these turbulent times, the future of Byju’s remains uncertain. However, lessons can be learned from its downfall to pave the way for a more resilient and sustainable edtech landscape.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.