Table of Contents

ELSS बनाम टैक्स सेविंग FD

इक्विटी लिंक्ड सेविंग्स स्कीम (ईएलएसएस)

ईएलएसएस सिर्फ यहीम्यूचुअल फंड 80सी कटौती के लिए पात्र। यह एक डायवर्सिफाइड इक्विटी म्यूचुअल फंड है जो रुपये तक की टैक्स कटौती की पेशकश करता है। 1.5 लाख सालाना के तहतधारा 80सी काआयकर अधिनियम (आईटी अधिनियम 1961)।

फरवरी 2018 के बजट की शुरुआत से पहले, इसके रिटर्न पूरी तरह से कर-मुक्त थे। हालांकि, अब यह 10% लंबी अवधि के अधीन हैराजधानी लाभ कर यदि आपकापूंजीगत लाभ रुपये से अधिक एक साल बाद 1 लाख। 10% कर कटौती के बाद भी, ELSS में अन्य कर-बचत साधनों की तुलना में बेहतर रिटर्न देने की क्षमता है। ईएलएसएस निवेश के लाभ सीमित नहीं हैंकरों बचाया।कंपाउंडिंग की शक्ति यह सुनिश्चित करता है कि यदि आप 5 वर्षों के लिए निवेश करते हैं तो आपका निवेश दोगुना हो जाता है (टैक्स-बचत का कार्यकालएफडी) इसे जोड़ने के लिए, न्यूनतम लॉक-इन अवधि केवल 3 वर्ष है।

टैक्स सेविंग फिक्स्ड डिपॉजिट

निवेश बैंकों के पास सावधि जमा में पैसा व्यक्तियों और एचयूएफ को कर का दावा करने की अनुमति देता हैकटौती रुपये तक 1,50,000 एक वित्तीय वर्ष में। इन जमाओं में 5 साल की लॉक-इन अवधि होती है। हालाँकि, आप इस जमा राशि को समय से पहले नहीं निकाल सकते। लेकिन आप अपनी FD पर प्रतिस्पर्धी दरों पर ऋण प्राप्त कर सकते हैं। हालांकि, इन जमाओं पर अर्जित ब्याज व्यक्ति की कर योग्य सीमांत दर (कर ब्रैकेट के अनुसार) है।

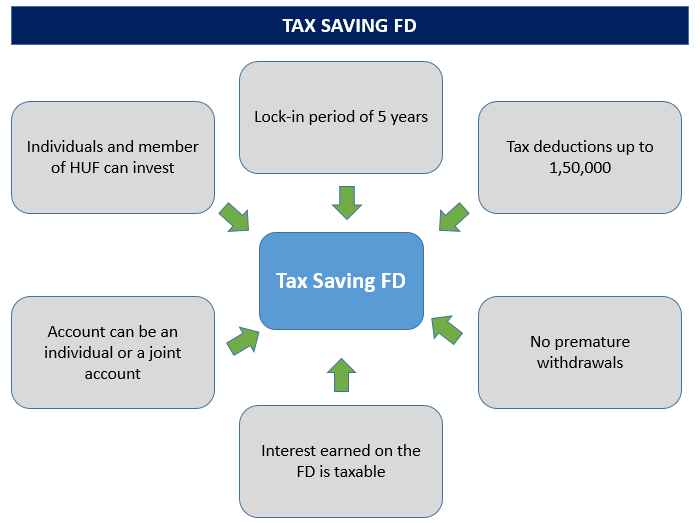

टैक्स सेवर FD की मुख्य विशेषताएं

आइए नजर डालते हैं इसके मुख्य आकर्षणों परकर बचाने वाला एफडी -

- केवल व्यक्ति और के सदस्यहिन्दू अविभाजित परिवार (HUF) में निवेश कर सकते हैंटैक्स सेविंग FD योजना

- टैक्स सेवर FD की न्यूनतम निवेश राशि अलग-अलग होती हैबैंक बैंक के लिए

- टैक्स सेविंग FD की लॉक-इन अवधि पांच साल है

- आप रुपये तक कर कटौती प्राप्त कर सकते हैं। 1,50,000

- समय से पहले निकासी का कोई प्रावधान नहीं है

- आप इन टैक्स सेवर FD पर लोन के लिए अप्लाई नहीं कर सकते हैं

- इन टैक्स सेवर एफडी में निवेश किसी भी निजी या सार्वजनिक क्षेत्र के बैंक (सहकारी और ग्रामीण बैंकों को छोड़कर) में किया जा सकता है।

- में किया गया निवेशडाक बंगला पांच साल से अधिक की अवधि के लिए सावधि जमा भी कर बचत FD के रूप में योग्य है

- आप पोस्ट ऑफिस FD को एक पोस्ट ऑफिस से दूसरे पोस्ट ऑफिस में ट्रांसफर कर सकते हैं

- इस प्रकार की FD से अर्जित ब्याज कर योग्य है और स्रोत से काट लिया जाएगा

- टैक्स बचत जमा खाता व्यक्तिगत और संयुक्त रूप से भी खोला जा सकता है।

- संयुक्त खाते के मामले में, संयुक्त खाते के पहले धारक को कर लाभ मिलेगा

Talk to our investment specialist

ईएलएसएस बनाम एफडी - तुलना

विभिन्न मानकों पर ईएलएसएस और टैक्स सेविंग एफडी के बीच अंतर का एक त्वरित अवलोकन यहां दिया गया है:

| पैरामीटर | एफडी | ईएलएसएस |

|---|---|---|

| कार्यकाल | 5 साल का लॉक-इन | 3 साल का लॉक-इन |

| रिटर्न | 7.00 - 8.00% (वार्षिक रूप से संयोजित) | कोई सुनिश्चित लाभांश / इसके रूप में वापसी नहींमंडी आम तौर पर लगभग 16 - 17% प्रति वर्ष जुड़ा हुआ है |

| न्यूनतम। निवेश | रु. 1000 | रु. 500 |

| मैक्स। निवेश | कोई ऊपरी सीमा नहीं | कोई ऊपरी सीमा नहीं |

| 80c . के तहत कटौती के लिए पात्र राशि | रु. 1.5 लाख | रु. 1.5 लाख |

| ब्याज/वापसी के लिए कराधान | ब्याज कर योग्य | रुपये तक का लाभ 1 लाख कर मुक्त हैं। रुपये से अधिक के लाभ पर 10% की दर से कर लागू होता है। 1 लाख |

| सुरक्षा/रेटिंग | सुरक्षित | थोड़ा जोखिम भरा |

| लिक्विडिटी | आप 5 साल से पहले टैक्स सेविंग FD नहीं निकाल सकते हैं | आप 3 साल बाद ईएलएसएस से बाहर निकल सकते हैं या निकाल सकते हैं। |

| ऑनलाइन विकल्प | सभी बैंक ऑनलाइन ऑफ़र नहीं करते हैंसुविधा FD खोलने के लिए | एक ईएलएसएस ऑनलाइन शुरू कर सकते हैं - एकमुश्त या . के रूप मेंसिप |

शीर्ष ईएलएसएस म्युचुअल फंड वित्त वर्ष 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Motilal Oswal Long Term Equity Fund Growth ₹45.8314

↑ 0.29 ₹3,405 -10 -16.6 9 21.3 25.6 47.7 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 9.7 15.1 16.9 20.8 10 DSP BlackRock Tax Saver Fund Growth ₹133.473

↑ 1.68 ₹14,981 2.5 -4.7 16.1 17.8 26.9 23.9 Franklin India Taxshield Growth ₹1,402.25

↑ 19.66 ₹5,986 0.5 -6.3 10.3 17.2 26.6 22.4 JM Tax Gain Fund Growth ₹45.0852

↑ 0.41 ₹167 -3.7 -11.6 9.5 17 26 29 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

* नीचे उन फंडों की सूची दी गई है जिनका एयूएम 100 - 15000 करोड़ के बीच है और फंड की आयु 3 वर्ष से अधिक है। 3 साल के प्रदर्शन के आधार पर। (Erstwhile Motilal Oswal MOSt Focused Long Term Fund) The investment objective of the Scheme is to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related instruments. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Motilal Oswal Long Term Equity Fund is a Equity - ELSS fund was launched on 21 Jan 15. It is a fund with Moderately High risk and has given a Below is the key information for Motilal Oswal Long Term Equity Fund Returns up to 1 year are on The Scheme will seek to invest predominantly in a diversified portfolio of equity and equity related instruments with the objective to provide investors with opportunities for capital appreciation and income along with the benefit of income-tax deduction(under section 80C of the Income-tax Act, 1961) on their investments. Investments in this scheme would be subject to a statutory lock-in of 3 years from the date of allotment to be eligible for income-tax benefits under Section 80C. There can be no assurance that the investment objective under the scheme will be realized. IDBI Equity Advantage Fund is a Equity - ELSS fund was launched on 10 Sep 13. It is a fund with Moderately High risk and has given a Below is the key information for IDBI Equity Advantage Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek to generate medium to long-term capital appreciation from a diversified portfolio that is substantially constituted of equity and equity related securities of corporates, and to enable investors to avail of a deduction from total income, as permitted under the Income Tax Act, 1961 from time to time. DSP BlackRock Tax Saver Fund is a Equity - ELSS fund was launched on 18 Jan 07. It is a fund with Moderately High risk and has given a Below is the key information for DSP BlackRock Tax Saver Fund Returns up to 1 year are on The primary objective for Franklin IndiaTaxshield is to provide medium to long term growth of capital along with income tax rebate Franklin India Taxshield is a Equity - ELSS fund was launched on 10 Apr 99. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Taxshield Returns up to 1 year are on The investment objective is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities and to enable investors a deduction from total income, as permitted under the Income Tax Act, 1961 from time to time. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns. JM Tax Gain Fund is a Equity - ELSS fund was launched on 31 Mar 08. It is a fund with Moderately High risk and has given a Below is the key information for JM Tax Gain Fund Returns up to 1 year are on 1. Motilal Oswal Long Term Equity Fund

CAGR/Annualized return of 16% since its launch. Return for 2024 was 47.7% , 2023 was 37% and 2022 was 1.8% . Motilal Oswal Long Term Equity Fund

Growth Launch Date 21 Jan 15 NAV (17 Apr 25) ₹45.8314 ↑ 0.29 (0.64 %) Net Assets (Cr) ₹3,405 on 28 Feb 25 Category Equity - ELSS AMC Motilal Oswal Asset Management Co. Ltd Rating Risk Moderately High Expense Ratio 0.74 Sharpe Ratio -0.05 Information Ratio 0.52 Alpha Ratio 6.88 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,396 31 Mar 22 ₹18,690 31 Mar 23 ₹19,798 31 Mar 24 ₹30,510 31 Mar 25 ₹33,744 Returns for Motilal Oswal Long Term Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 8% 3 Month -10% 6 Month -16.6% 1 Year 9% 3 Year 21.3% 5 Year 25.6% 10 Year 15 Year Since launch 16% Historical performance (Yearly) on absolute basis

Year Returns 2023 47.7% 2022 37% 2021 1.8% 2020 32.1% 2019 8.8% 2018 13.2% 2017 -8.7% 2016 44% 2015 12.5% 2014 Fund Manager information for Motilal Oswal Long Term Equity Fund

Name Since Tenure Ajay Khandelwal 11 Dec 23 1.22 Yr. Rakesh Shetty 22 Nov 22 2.27 Yr. Atul Mehra 1 Oct 24 0.41 Yr. Data below for Motilal Oswal Long Term Equity Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 30.18% Consumer Cyclical 22.76% Financial Services 17.97% Technology 12.09% Real Estate 6.8% Basic Materials 6.36% Health Care 2.01% Asset Allocation

Asset Class Value Cash 1.83% Equity 98.17% Top Securities Holdings / Portfolio

Name Holding Value Quantity Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | 5433206% ₹220 Cr 9,923,692 Trent Ltd (Consumer Cyclical)

Equity, Since 31 Aug 22 | 5002516% ₹206 Cr 425,260 Gujarat Fluorochemicals Ltd Ordinary Shares (Basic Materials)

Equity, Since 28 Feb 23 | FLUOROCHEM4% ₹147 Cr 408,886 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | KALYANKJIL4% ₹145 Cr 3,134,622 Amber Enterprises India Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Mar 24 | AMBER4% ₹132 Cr 235,044 Coforge Ltd (Technology)

Equity, Since 31 Jul 24 | COFORGE4% ₹124 Cr 168,355 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Jun 23 | KAYNES4% ₹123 Cr 297,751 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 18 | ICICIBANK4% ₹120 Cr 995,689 Suzlon Energy Ltd (Industrials)

Equity, Since 31 Jan 24 | SUZLON4% ₹120 Cr 24,068,813 Inox Wind Ltd (Industrials)

Equity, Since 31 Dec 23 | INOXWIND4% ₹119 Cr 7,946,960 2. IDBI Equity Advantage Fund

CAGR/Annualized return of 16% since its launch. Ranked 21 in ELSS category. . IDBI Equity Advantage Fund

Growth Launch Date 10 Sep 13 NAV (28 Jul 23) ₹43.39 ↑ 0.04 (0.09 %) Net Assets (Cr) ₹485 on 30 Jun 23 Category Equity - ELSS AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.39 Sharpe Ratio 1.21 Information Ratio -1.13 Alpha Ratio 1.78 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,407 31 Mar 22 ₹17,362 31 Mar 23 ₹17,326 Returns for IDBI Equity Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 3.1% 3 Month 9.7% 6 Month 15.1% 1 Year 16.9% 3 Year 20.8% 5 Year 10% 10 Year 15 Year Since launch 16% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for IDBI Equity Advantage Fund

Name Since Tenure Data below for IDBI Equity Advantage Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. DSP BlackRock Tax Saver Fund

CAGR/Annualized return of 15.3% since its launch. Ranked 12 in ELSS category. Return for 2024 was 23.9% , 2023 was 30% and 2022 was 4.5% . DSP BlackRock Tax Saver Fund

Growth Launch Date 18 Jan 07 NAV (17 Apr 25) ₹133.473 ↑ 1.68 (1.28 %) Net Assets (Cr) ₹14,981 on 28 Feb 25 Category Equity - ELSS AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.78 Sharpe Ratio 0.07 Information Ratio 1.01 Alpha Ratio 6.92 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,754 31 Mar 22 ₹21,728 31 Mar 23 ₹21,760 31 Mar 24 ₹30,533 31 Mar 25 ₹35,611 Returns for DSP BlackRock Tax Saver Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 7.4% 3 Month 2.5% 6 Month -4.7% 1 Year 16.1% 3 Year 17.8% 5 Year 26.9% 10 Year 15 Year Since launch 15.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 23.9% 2022 30% 2021 4.5% 2020 35.1% 2019 15% 2018 14.8% 2017 -7.6% 2016 36.3% 2015 11.3% 2014 4.4% Fund Manager information for DSP BlackRock Tax Saver Fund

Name Since Tenure Rohit Singhania 16 Jul 15 9.63 Yr. Data below for DSP BlackRock Tax Saver Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 35.97% Health Care 10.11% Consumer Cyclical 9.45% Basic Materials 9.1% Technology 6.84% Industrials 6.8% Consumer Defensive 5.04% Communication Services 4.6% Utility 3.77% Energy 3.63% Asset Allocation

Asset Class Value Cash 4.68% Equity 95.32% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK9% ₹1,277 Cr 7,369,356 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 16 | ICICIBANK6% ₹917 Cr 7,618,202

↓ -318,386 Axis Bank Ltd (Financial Services)

Equity, Since 30 Nov 18 | 5322155% ₹746 Cr 7,344,442

↑ 544,928 State Bank of India (Financial Services)

Equity, Since 30 Jun 20 | SBIN4% ₹579 Cr 8,404,741 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Oct 22 | KOTAKBANK3% ₹520 Cr 2,734,913 Infosys Ltd (Technology)

Equity, Since 31 Mar 12 | INFY3% ₹450 Cr 2,666,937

↓ -693,080 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jul 19 | BHARTIARTL3% ₹395 Cr 2,517,085 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 24 | LT3% ₹377 Cr 1,192,711 HCL Technologies Ltd (Technology)

Equity, Since 31 Mar 21 | HCLTECH2% ₹358 Cr 2,270,114 Cipla Ltd (Healthcare)

Equity, Since 30 Apr 23 | 5000872% ₹339 Cr 2,410,446 4. Franklin India Taxshield

CAGR/Annualized return of 20.9% since its launch. Ranked 28 in ELSS category. Return for 2024 was 22.4% , 2023 was 31.2% and 2022 was 5.4% . Franklin India Taxshield

Growth Launch Date 10 Apr 99 NAV (17 Apr 25) ₹1,402.25 ↑ 19.66 (1.42 %) Net Assets (Cr) ₹5,986 on 28 Feb 25 Category Equity - ELSS AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆ Risk Moderately High Expense Ratio 1.83 Sharpe Ratio -0.19 Information Ratio 1.13 Alpha Ratio 2.84 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,793 31 Mar 22 ₹21,613 31 Mar 23 ₹22,171 31 Mar 24 ₹32,145 31 Mar 25 ₹35,012 Returns for Franklin India Taxshield

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 6.9% 3 Month 0.5% 6 Month -6.3% 1 Year 10.3% 3 Year 17.2% 5 Year 26.6% 10 Year 15 Year Since launch 20.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 22.4% 2022 31.2% 2021 5.4% 2020 36.7% 2019 9.8% 2018 5.1% 2017 -3% 2016 29.1% 2015 4.7% 2014 4% Fund Manager information for Franklin India Taxshield

Name Since Tenure R. Janakiraman 2 May 16 8.84 Yr. Rajasa Kakulavarapu 1 Dec 23 1.25 Yr. Data below for Franklin India Taxshield as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 30.86% Consumer Cyclical 13.13% Technology 10.95% Industrials 9.83% Health Care 6.41% Communication Services 5.59% Consumer Defensive 5.31% Basic Materials 4.65% Utility 4.03% Energy 3.03% Real Estate 1.63% Asset Allocation

Asset Class Value Cash 3.86% Equity 96.14% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 07 | HDFCBANK9% ₹565 Cr 3,260,417 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK9% ₹547 Cr 4,546,914 Infosys Ltd (Technology)

Equity, Since 29 Feb 12 | INFY5% ₹325 Cr 1,922,741 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 07 | BHARTIARTL5% ₹308 Cr 1,963,637

↓ -250,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 19 | LT5% ₹280 Cr 883,853 HCL Technologies Ltd (Technology)

Equity, Since 31 Oct 21 | HCLTECH4% ₹230 Cr 1,462,587 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 14 | 5322154% ₹229 Cr 2,252,948 Zomato Ltd (Consumer Cyclical)

Equity, Since 30 Nov 21 | 5433203% ₹167 Cr 7,500,000 United Spirits Ltd (Consumer Defensive)

Equity, Since 31 Oct 18 | UNITDSPR3% ₹164 Cr 1,276,457

↓ -298,543 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Nov 17 | KOTAKBANK3% ₹161 Cr 843,530 5. JM Tax Gain Fund

CAGR/Annualized return of 9.2% since its launch. Ranked 18 in ELSS category. Return for 2024 was 29% , 2023 was 30.9% and 2022 was 0.5% . JM Tax Gain Fund

Growth Launch Date 31 Mar 08 NAV (17 Apr 25) ₹45.0852 ↑ 0.41 (0.92 %) Net Assets (Cr) ₹167 on 28 Feb 25 Category Equity - ELSS AMC JM Financial Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.4 Sharpe Ratio -0.09 Information Ratio 0.45 Alpha Ratio 5.72 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,396 31 Mar 22 ₹21,099 31 Mar 23 ₹20,935 31 Mar 24 ₹30,269 31 Mar 25 ₹33,442 Returns for JM Tax Gain Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 5.6% 3 Month -3.7% 6 Month -11.6% 1 Year 9.5% 3 Year 17% 5 Year 26% 10 Year 15 Year Since launch 9.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 29% 2022 30.9% 2021 0.5% 2020 32.2% 2019 18.3% 2018 14.9% 2017 -4.6% 2016 42.6% 2015 5.2% 2014 -0.6% Fund Manager information for JM Tax Gain Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 0.41 Yr. Asit Bhandarkar 31 Dec 21 3.17 Yr. Chaitanya Choksi 18 Jul 14 10.63 Yr. Ruchi Fozdar 4 Oct 24 0.41 Yr. Data below for JM Tax Gain Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 24.93% Consumer Cyclical 16.94% Basic Materials 12.3% Technology 11.78% Industrials 9.75% Health Care 9.45% Consumer Defensive 4.67% Communication Services 2.88% Utility 1.21% Asset Allocation

Asset Class Value Cash 4.75% Equity 95.25% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | ICICIBANK6% ₹9 Cr 77,975

↑ 20,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 11 | HDFCBANK6% ₹9 Cr 54,131 Infosys Ltd (Technology)

Equity, Since 31 Aug 18 | INFY5% ₹8 Cr 45,965

↓ -2,500 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Jan 25 | 5329784% ₹7 Cr 35,500

↑ 3,000 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | MARUTI3% ₹6 Cr 4,706 Bajaj Auto Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | 5329773% ₹5 Cr 6,550 State Bank of India (Financial Services)

Equity, Since 31 Aug 20 | SBIN3% ₹5 Cr 72,900 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 24 | BHARTIARTL3% ₹5 Cr 30,700 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 10 | LT3% ₹5 Cr 14,447 CreditAccess Grameen Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 24 | CREDITACC2% ₹4 Cr 43,600

क्या आपको ईएलएसएस या टैक्स सेविंग एफडी में निवेश करना चाहिए?

नए निवेश उपक्रमों में आने से पहले लोग बहुत सी बातों पर विचार करते हैं। आयु, निवेश क्षितिज औरजोखिम उठाने का माद्दा कुछ महत्वपूर्ण कारक हैं। जो लोग धन वृद्धि और कर लाभ के दोहरे लाभ चाहते हैं वे ईएलएसएस पसंद करते हैं। उदाहरण के लिए, लंबे निवेश क्षितिज और उच्च जोखिम क्षमता वाले नए निवेशक ईएलएसएस को एक समझदार विकल्प मानते हैं। पास के लोगनिवृत्ति टैक्स सेविंग FD में निवेश कर सकते हैं क्योंकि इनमें कम जोखिम और लंबी अवधि (कम से कम 5 साल या उससे अधिक) पर रिटर्न की गारंटी होती है।

ईएलएसएस ऑनलाइन में निवेश कैसे करें?

Fincash.com पर आजीवन मुफ्त निवेश खाता खोलें।

अपना पंजीकरण और केवाईसी प्रक्रिया पूरी करें

Upload Documents (PAN, Aadhaar, etc.). और, आप निवेश करने के लिए तैयार हैं!

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।