Home Contents and Home Building Insurance

Wondering what is home contents and home building insurance? Well, a Home insurance policy in India has two main types- one covers the contents of the house, while the other covers the building. So, let us study about them in a detailed manner.

Home Contents Insurance

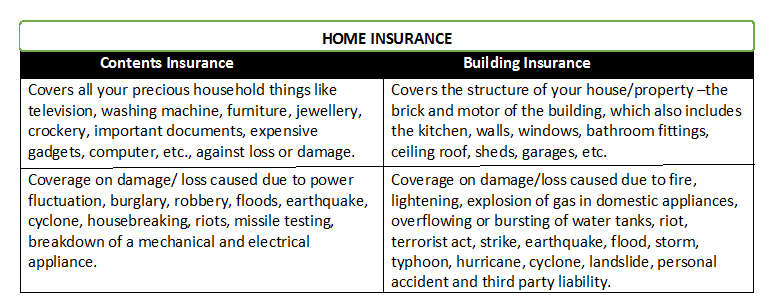

The home contents insurance policy covers all your precious household things like television, washing machine, furniture, jewellery, crockery, important documents, expensive gadgets, computer, etc., against loss or damage. This policy covers your household contents only when they are kept inside the house or building, but jewellery is covered against snatching (when only worn). Usually, contents insurance policy comes along with the home insurance policy, though at times it may be sold separately. Home contents insurance is important for tenant, Landlord and property owners.

If you are selling the property during the policy, you can either cancel the policy or can also do an endorsement by changing the address of the insured.

Home Contents Coverage

Some of the common covers given by insurers for contents insurance are below:

- Damage/loss caused due to power fluctuation, burglary, robbery.

- Damage/loss caused due to man-made or natural calamities, such as flood, earthquake, cyclone, housebreaking, riots, missile testing, etc.

- Damage/loss caused due to the breakdown of a mechanical and electrical appliance.

Tips to Compare Home Contents Insurance

Before you get an insurance cover, make sure you compare the features across insurers.

Understand the covers that you need for your house contents. This will reduce your premium if you don’t require additional covers.

At times you may get both home insurance and contents insurance in one policy, in case you don’t get in one, buy both policies from the same insurer. This will give you a better deal.

Home Building Insurance

The home building insurance policy safeguards against man-made and natural calamities like fire, storm, flood, lightning, explosion & implosion, overflow of tanks, landslides, riots, strikes, etc. This policy may also cover damages caused due to terrorism. Home building insurance is a type of home insurance that covers the structure of your house/property –the brick and mortar of the building, which also includes the kitchen, walls, windows, bathroom fittings, ceiling roof, sheds, garages, etc.

Insuring the building or building structure is important since it protects you against unpredictable losses or damages. When it comes to buying the home building policy, it is suggested that you should read the terms and conditions of the policy carefully because every home insurance company has different policy coverage.

Home Building Coverage

Some of the common covers given by insurers for building insurance are below:

- Damage/loss caused due to fire, lightning, explosion of gas in domestic appliances.

- Damage/loss caused due to overflowing or bursting of water tanks.

- Damage/loss caused due to riot, terrorist act, strike.

- Damage caused due to earthquake, flood, storm, typhoon, hurricane, cyclone, landslide.

- Damage/loss caused due to Personal Accident and third party liability.

Building Insurance Quote

The main factors affecting the cost of your home building insurance policy premium will be the structure of your house, location, quality of material used for construction, type of property and how old the house is.

Talk to our investment specialist

Conclusion

Home insurance is a good long-term investment that a person can make to protect his/her property.Also, now with a detailed insight into the home contents and home building insurance, one can take a step forward in getting the same and insuring your home against all possible kinds of man-made/natural calamities.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.